returns on small cap growth stocks, or the lack

... cap growth, can the differences in risk and return be explained by the factor exposures of the different quintiles? Exhibit 8 shows the regression results for the five different quintiles. As expected, there is a clear decrease in the value (HmL) exposure as we go from Q1 to Q5 with Q1 having an HmL ...

... cap growth, can the differences in risk and return be explained by the factor exposures of the different quintiles? Exhibit 8 shows the regression results for the five different quintiles. As expected, there is a clear decrease in the value (HmL) exposure as we go from Q1 to Q5 with Q1 having an HmL ...

Measuring the Benefits of Option Strategies For Portfolio Management

... supports a market equilibrium model that includes skewness. Friend and Westerfield (1980) find less evidence in support of the three-moment model, but Lim (1989) verifies the Kraus and Litzenberger (1976) result. More recently, Harvey and Siddique (1998) find that conditional skewness is priced in ...

... supports a market equilibrium model that includes skewness. Friend and Westerfield (1980) find less evidence in support of the three-moment model, but Lim (1989) verifies the Kraus and Litzenberger (1976) result. More recently, Harvey and Siddique (1998) find that conditional skewness is priced in ...

Sin Stock Returns

... firm is further equated to a bad stock, whose valuation, according to traditional finance theory, should only be determined by its unique properties of risk and return. The further assumption is made that investors in bad stocks of this sort lack character or integrity. This chain reaction starts an ...

... firm is further equated to a bad stock, whose valuation, according to traditional finance theory, should only be determined by its unique properties of risk and return. The further assumption is made that investors in bad stocks of this sort lack character or integrity. This chain reaction starts an ...

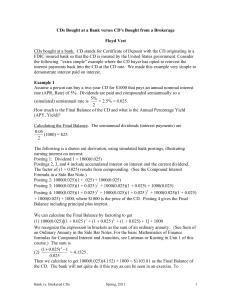

CDs Bought at a Bank verses CD`s Bought from a Brokerage Floyd

... Modified Internal Rate of Return (MIRR). The basic definition of YTM is the same as that of Internal Rate of Return (IRR). IRR has the same problems as YTM. For brokered CDs¸ one problem is the assumption that dividends are reinvested at the CD rate. To compensate, modifications of IRR (YTM) such a ...

... Modified Internal Rate of Return (MIRR). The basic definition of YTM is the same as that of Internal Rate of Return (IRR). IRR has the same problems as YTM. For brokered CDs¸ one problem is the assumption that dividends are reinvested at the CD rate. To compensate, modifications of IRR (YTM) such a ...

share issuance and equity returns in the istanbul stock exchange

... In regression equations (2) and (3), Ri,t+n is the return on stock i for holding periods of n months after year t; ME is the natural logarithm of market equity measured at the end of previous June; BM is the natural logarithm of the ratio of book value of equity to market value of equity measured a ...

... In regression equations (2) and (3), Ri,t+n is the return on stock i for holding periods of n months after year t; ME is the natural logarithm of market equity measured at the end of previous June; BM is the natural logarithm of the ratio of book value of equity to market value of equity measured a ...

9535 Testimony [Dave] - Maryland Public Service Commission

... a fair and enlightened judgment, having regard to all relevant facts. A public utility is entitled to such rates as will permit it to earn a return on the value of the property which it employs for the convenience of the public equal to that generally being made at the same time and in the same gene ...

... a fair and enlightened judgment, having regard to all relevant facts. A public utility is entitled to such rates as will permit it to earn a return on the value of the property which it employs for the convenience of the public equal to that generally being made at the same time and in the same gene ...

chapter 1

... The covariance of BP with the market portfolio (σBP, Market) is the mean of the eight respective covariances between BP and each of the eight stocks in the portfolio. (The covariance of BP with itself is the variance of BP.) Therefore, σBP, Market is equal to the average of the eight covariances in ...

... The covariance of BP with the market portfolio (σBP, Market) is the mean of the eight respective covariances between BP and each of the eight stocks in the portfolio. (The covariance of BP with itself is the variance of BP.) Therefore, σBP, Market is equal to the average of the eight covariances in ...

An Introduction to Asset Pricing Models

... time horizon such as one-month, six months, or one year. – The model will be developed for a single hypothetical period, and its results could be affected by a different assumption. A difference in the time horizon would require investors to derive risk measures and risk-free assets that are consist ...

... time horizon such as one-month, six months, or one year. – The model will be developed for a single hypothetical period, and its results could be affected by a different assumption. A difference in the time horizon would require investors to derive risk measures and risk-free assets that are consist ...

2015 President`s Letter - Constellation Software, Inc.

... and board members. We focus on high performance conglomerates that have demonstrated at least a decade of superior shareholder returns. We started by studying those that have generated superior returns for multiple decades. That narrowed the field a lot, so we are beginning to let some single decade ...

... and board members. We focus on high performance conglomerates that have demonstrated at least a decade of superior shareholder returns. We started by studying those that have generated superior returns for multiple decades. That narrowed the field a lot, so we are beginning to let some single decade ...

fund facts - RBC Global Asset Management

... firm provide to you. Your representative's firm may pay part of the trailing commission to its representatives. RBC GAM pays your representative's firm a trailing commission. The trailing commission is paid out of the management fee. The rate for this series of the fund is 1.00% of the value of your ...

... firm provide to you. Your representative's firm may pay part of the trailing commission to its representatives. RBC GAM pays your representative's firm a trailing commission. The trailing commission is paid out of the management fee. The rate for this series of the fund is 1.00% of the value of your ...

Here - Punter Southall Transaction Services

... increased the recorded liabilities of a typical scheme by around 25% in isolation over this period. Whilst tranche 10 data (covering September 2014 to September 2015) will only become available later during 2017 with tranche 11 data (covering September 2015 to September 2016) not available not until ...

... increased the recorded liabilities of a typical scheme by around 25% in isolation over this period. Whilst tranche 10 data (covering September 2014 to September 2015) will only become available later during 2017 with tranche 11 data (covering September 2015 to September 2016) not available not until ...

The Variability of IPO Initial Returns

... standard errors for cross-sectional models used in corporate finance has become “state-of-the-art,” correctly using WLS or MLE leads to much more reliable inferences for the “mean equation” ...

... standard errors for cross-sectional models used in corporate finance has become “state-of-the-art,” correctly using WLS or MLE leads to much more reliable inferences for the “mean equation” ...

Sample Glossary of Investment-Related Terms for

... International Fund: A fund that invests primarily in the securities of companies located, or with revenues derived from, outside of the United States. Investment Adviser: A person or organization hired by an investment fund or an individual to give professional advice on investments and asset manage ...

... International Fund: A fund that invests primarily in the securities of companies located, or with revenues derived from, outside of the United States. Investment Adviser: A person or organization hired by an investment fund or an individual to give professional advice on investments and asset manage ...

Paper-14: Advanced Financial Management

... The objective of the Financing Public Private Partnerships (PPP) in Infrastructure through Support to India Infrastructure Finance Company Limited (IIFCL) Project is to increase the availability of long-term financing for infrastructure PPP projects. There are two components the project, the first c ...

... The objective of the Financing Public Private Partnerships (PPP) in Infrastructure through Support to India Infrastructure Finance Company Limited (IIFCL) Project is to increase the availability of long-term financing for infrastructure PPP projects. There are two components the project, the first c ...

Janus Research Fund - Proxy

... broker-dealers and institutions. There is the risk that when portfolio securities are lent, the securities may not be returned on a timely basis, and the Fund may experience delays and costs in recovering the security or gaining access to the collateral provided to the Fund to collateralize the loan ...

... broker-dealers and institutions. There is the risk that when portfolio securities are lent, the securities may not be returned on a timely basis, and the Fund may experience delays and costs in recovering the security or gaining access to the collateral provided to the Fund to collateralize the loan ...

Major Currencies And Capitalization

... the regression r2 levels meet the 0.80 standard set forth in FAS 133 as a bona fide hedge. Only the Russell 2000Chilean peso relationship comes close. Finally, the Durbin-Watson statistics for all of the regressions involved are very near zero; we should want these to be near 2.00. This indicates se ...

... the regression r2 levels meet the 0.80 standard set forth in FAS 133 as a bona fide hedge. Only the Russell 2000Chilean peso relationship comes close. Finally, the Durbin-Watson statistics for all of the regressions involved are very near zero; we should want these to be near 2.00. This indicates se ...

Truth in Savings - UVA Community Credit Union

... Accrual of Dividends: Dividends begin to accrue on the day that you deposit items, including non-cash items such as checks, to your account. Dividends will be calculated using the daily balance method, which is an application of a daily periodic rate to the full amount of principal in the account e ...

... Accrual of Dividends: Dividends begin to accrue on the day that you deposit items, including non-cash items such as checks, to your account. Dividends will be calculated using the daily balance method, which is an application of a daily periodic rate to the full amount of principal in the account e ...

![9535 Testimony [Dave] - Maryland Public Service Commission](http://s1.studyres.com/store/data/009524184_1-6690ffe236a26be1dddea21ad3b9b7b9-300x300.png)