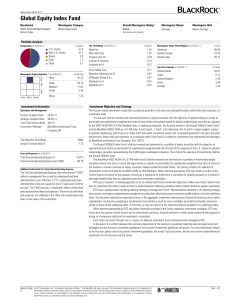

Global Equity Index Fund

... by the MSCI ACWI IMI US $ Net Dividend Index. In seeking its objective, the Account invests in the Russell 3000[rt] Index Fund E and the BlackRock MSCI ACWI ex-U.S. IMI Index Fund E (each, a "Fund", and collectively, the "Funds") in target weights, subject to periodic rebalancing. Each Fund is an "i ...

... by the MSCI ACWI IMI US $ Net Dividend Index. In seeking its objective, the Account invests in the Russell 3000[rt] Index Fund E and the BlackRock MSCI ACWI ex-U.S. IMI Index Fund E (each, a "Fund", and collectively, the "Funds") in target weights, subject to periodic rebalancing. Each Fund is an "i ...

Rising Interest Rates and Timberland Returns

... This paper looks at the potential impact of a rise in interest rates once the Federal Open Market Committee (“FOMC”) determines that employment, inflation, wage growth, and economic growth are headed in the right direction. Since the recession of 2008/2009, the FOMC has kept interest rates near 0% ( ...

... This paper looks at the potential impact of a rise in interest rates once the Federal Open Market Committee (“FOMC”) determines that employment, inflation, wage growth, and economic growth are headed in the right direction. Since the recession of 2008/2009, the FOMC has kept interest rates near 0% ( ...

How to measure returns?

... Given the alternatives, & ATE both A & B are inferior. • Therefore, one question you must always ask regarding risk is “what are the alternatives or benchmarks to compare with?” M-10 ...

... Given the alternatives, & ATE both A & B are inferior. • Therefore, one question you must always ask regarding risk is “what are the alternatives or benchmarks to compare with?” M-10 ...

The buck stops here: Vanguard money market funds Factor

... on the performance of an effectively diversified portfolio. Although this paper focuses on historically rewarded factors, or factor premiums, we reemphasise that investors should be aware of the distinction between rewarded and unrewarded factors. Indeed, factor-based investing is premised on the ab ...

... on the performance of an effectively diversified portfolio. Although this paper focuses on historically rewarded factors, or factor premiums, we reemphasise that investors should be aware of the distinction between rewarded and unrewarded factors. Indeed, factor-based investing is premised on the ab ...

SVP-SV and Rising Interest Rates.indd

... performance of a stable value fund using yield changes as implied by the current forward Treasury yield curve. While this analysis is simplistic in market assumptions, it provides a reasonable scenario of expected changes in market interest rates and how stable value could subsequently perform over ...

... performance of a stable value fund using yield changes as implied by the current forward Treasury yield curve. While this analysis is simplistic in market assumptions, it provides a reasonable scenario of expected changes in market interest rates and how stable value could subsequently perform over ...

Vanguard Materials ETF Summary Prospectus

... sector could be affected by, among other things, commodity prices, government regulation, inflation expectations, resource availability, and economic cycles. Sector risk is expected to be high for the Fund. • Nondiversification risk, which is the chance that the Fund’s performance may be hurt dispro ...

... sector could be affected by, among other things, commodity prices, government regulation, inflation expectations, resource availability, and economic cycles. Sector risk is expected to be high for the Fund. • Nondiversification risk, which is the chance that the Fund’s performance may be hurt dispro ...

Chapter 14—Capital Budgeting TRUE/FALSE 1. Capital budgeting

... from further consideration. ANS: F 25. Managers must often use multiple measures to effectively rank capital projects. ANS: T 26. Reinvestment assumptions are different under each method of ranking capital projects. ANS: T 27. When considering risk, a manager will often use a judgmental method of ri ...

... from further consideration. ANS: F 25. Managers must often use multiple measures to effectively rank capital projects. ANS: T 26. Reinvestment assumptions are different under each method of ranking capital projects. ANS: T 27. When considering risk, a manager will often use a judgmental method of ri ...

Secular Stagnation, Rational Bubbles, and Fiscal

... that bubbly assets provide a useful instrument in this context. Suppose that r is temporarily low due to an investment slump. Then, the young do not want to invest all their savings in capital. Instead, they buy the bubbly asset. This raises the price of this asset. Hence, the elderly, who hold thes ...

... that bubbly assets provide a useful instrument in this context. Suppose that r is temporarily low due to an investment slump. Then, the young do not want to invest all their savings in capital. Instead, they buy the bubbly asset. This raises the price of this asset. Hence, the elderly, who hold thes ...

IFM7 Chapter 3

... be constructed from a given set of stocks. This set is only efficient for part of its combinations. c. An efficient portfolio is that portfolio which provides the highest expected return for any degree of risk. Alternatively, the efficient portfolio is that which provides the lowest degree of risk f ...

... be constructed from a given set of stocks. This set is only efficient for part of its combinations. c. An efficient portfolio is that portfolio which provides the highest expected return for any degree of risk. Alternatively, the efficient portfolio is that which provides the lowest degree of risk f ...

Chapter 12: The Cost of Capital

... Example: You can issue preferred stock for a net price of $42 and the preferred stock pays a ...

... Example: You can issue preferred stock for a net price of $42 and the preferred stock pays a ...

PSG Global Equity Feeder Fund Class A

... and we recommend that you consult with a qualified financial adviser before making investment decisions. For further information on the funds and full disclosure of costs and fees please refer to the Minimum Disclosure Documents on our website. Disclaimer: Collective Investment Schemes in Securities ...

... and we recommend that you consult with a qualified financial adviser before making investment decisions. For further information on the funds and full disclosure of costs and fees please refer to the Minimum Disclosure Documents on our website. Disclaimer: Collective Investment Schemes in Securities ...

An Overview of Return-Based and Asset

... When a restriction is applied to the months where the market return minus the risk free rate is negative, the CAPM provides an alpha of 260 basis points per month and a beta of 0.51, and the Fama and French model gives an alpha of 206 basis points. The most interesting point is the increase in the i ...

... When a restriction is applied to the months where the market return minus the risk free rate is negative, the CAPM provides an alpha of 260 basis points per month and a beta of 0.51, and the Fama and French model gives an alpha of 206 basis points. The most interesting point is the increase in the i ...

Financial Accounting: Assets Question 1 (30 marks) Multiple choice

... recorded at cost, at each financial reporting date the investment is remeasured to fair value, and any gain or loss on remeasurement is recorded in the income statement for that period. l. 4) Purchased accrued interest is not interest revenue to the purchaser. The accrued interest belongs to the pre ...

... recorded at cost, at each financial reporting date the investment is remeasured to fair value, and any gain or loss on remeasurement is recorded in the income statement for that period. l. 4) Purchased accrued interest is not interest revenue to the purchaser. The accrued interest belongs to the pre ...