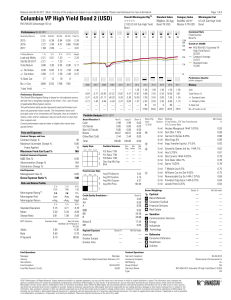

Columbia VP High Yield Bond 2 (USD)

... in the fund. All data presented is based on the most current information available to Morningstar, Inc. Morningstar Investment Management, LLC, a registered investment adviser and wholly owned subsidiary of Morningstar, Inc., provides various institutional investment consulting services, including a ...

... in the fund. All data presented is based on the most current information available to Morningstar, Inc. Morningstar Investment Management, LLC, a registered investment adviser and wholly owned subsidiary of Morningstar, Inc., provides various institutional investment consulting services, including a ...

NBER WORKING PAPER SERIES TAXES, LEVERAGE AND THE NATIONAL RETURN ON OUTBOUND

... one dollar from foreign sources for each dollar of equity iivested in foreign subsidiaries (including reinvested retained earnings). By contrast, there is virtually no foreign source debt in the financing of U.S. firms outside their foreign affiliates. 4Feldstein and Horioka (1980) showed that the s ...

... one dollar from foreign sources for each dollar of equity iivested in foreign subsidiaries (including reinvested retained earnings). By contrast, there is virtually no foreign source debt in the financing of U.S. firms outside their foreign affiliates. 4Feldstein and Horioka (1980) showed that the s ...

can the earning-price ratio explain the cross

... In order to check if there is price-earning ratio effect in the Spanish Stock Market during the period April 1992-March 2000, we form five portfolios based on positive PER, at March 31st, in the same way as we constructed the size portfolios before. The PER numerator for each security is the ratio b ...

... In order to check if there is price-earning ratio effect in the Spanish Stock Market during the period April 1992-March 2000, we form five portfolios based on positive PER, at March 31st, in the same way as we constructed the size portfolios before. The PER numerator for each security is the ratio b ...

TRADING RULE PROFITS AND FOREIGN EXCHANGE MARKET

... What the authors found with the bootstrapped experiment is that the profitability from simple technical models that was documented on data from the 1970's has continued in the 80's. In addition, they found that the profitability of these technical rules is highly significant in comparison to the emp ...

... What the authors found with the bootstrapped experiment is that the profitability from simple technical models that was documented on data from the 1970's has continued in the 80's. In addition, they found that the profitability of these technical rules is highly significant in comparison to the emp ...

Why it pays to be diversified

... only realized investments were used to calculate fund multiples, fee data for the overall fund cannot be overlaid to arrive at net multiples. However, if we suppose an average company holding time of five years and a 2% management fee on invested capital and no carry, the proportion of primary funds ...

... only realized investments were used to calculate fund multiples, fee data for the overall fund cannot be overlaid to arrive at net multiples. However, if we suppose an average company holding time of five years and a 2% management fee on invested capital and no carry, the proportion of primary funds ...

Mutual Funds Investment

... companies collects money from the investors and invests those money in different Stocks, Bonds and other financial securities in a diversified manner. Before investing they carry out thorough research and detailed analysis on the market conditions and market trends of stock and bond prices. These th ...

... companies collects money from the investors and invests those money in different Stocks, Bonds and other financial securities in a diversified manner. Before investing they carry out thorough research and detailed analysis on the market conditions and market trends of stock and bond prices. These th ...

The Case for Funds of Hedge Funds

... is the cost of setting up an equivalent team inhouse. This analysis must inevitably also include all the human resources and management-related ramifications this may have on an organisation. Setting up an in-house team not only entails significant legal and compliance costs and the need to create c ...

... is the cost of setting up an equivalent team inhouse. This analysis must inevitably also include all the human resources and management-related ramifications this may have on an organisation. Setting up an in-house team not only entails significant legal and compliance costs and the need to create c ...

Chapters 11&12

... Diversification of a Portfolio Correlation: →the behavioral relationship between two or more variables (stocks in a portfolio) →a measure of the degree to which returns share common risk. →it is calculated as the covariance of returns divided by the standard deviation of each return Various conditi ...

... Diversification of a Portfolio Correlation: →the behavioral relationship between two or more variables (stocks in a portfolio) →a measure of the degree to which returns share common risk. →it is calculated as the covariance of returns divided by the standard deviation of each return Various conditi ...

30. Earnings Per Share

... For the purpose of calculating diluted earnings per ordinary share, the weighted average number of ordinary shares outstanding is adjusted for the effects of all dilutive potential ordinary shares. The Company has three categories of dilutive potential ordinary shares: share options, performance sha ...

... For the purpose of calculating diluted earnings per ordinary share, the weighted average number of ordinary shares outstanding is adjusted for the effects of all dilutive potential ordinary shares. The Company has three categories of dilutive potential ordinary shares: share options, performance sha ...

Mutual fund flows: an analysis of the main macroeconomic factors

... Other authors examined whether other variables are related to investment fund flows. Luo (2003) studied the relationship between market volatility and investment fund flows in the USA between 1984 and 1998. This author divided the funds into nineteen categories, based on the investment quality of ea ...

... Other authors examined whether other variables are related to investment fund flows. Luo (2003) studied the relationship between market volatility and investment fund flows in the USA between 1984 and 1998. This author divided the funds into nineteen categories, based on the investment quality of ea ...

Long-Run Stock Returns: Participating in the

... ratio for 1926–2000. On average, the dollar amount of dividends after inflation grew 1.23 percent a year, while the dividend-payout ratio decreased 0.51 percent a year. The dividend-payout ratio was 46.68 percent at the beginning of 1926. It had decreased to 31.78 percent at the end of 2000. The hig ...

... ratio for 1926–2000. On average, the dollar amount of dividends after inflation grew 1.23 percent a year, while the dividend-payout ratio decreased 0.51 percent a year. The dividend-payout ratio was 46.68 percent at the beginning of 1926. It had decreased to 31.78 percent at the end of 2000. The hig ...

Risk Arbitrage and the Prediction of Successful

... Vinberg [1993] studies risk arbitrage in the Swedish stock market during 1987-1992. He examines whether abnormal returns can be earned against the risk free interest rate and the market index. Vinberg finds negative abnormal returns against the market index, and reports insignificant positive abnorm ...

... Vinberg [1993] studies risk arbitrage in the Swedish stock market during 1987-1992. He examines whether abnormal returns can be earned against the risk free interest rate and the market index. Vinberg finds negative abnormal returns against the market index, and reports insignificant positive abnorm ...

Investment Recommendation in P2P Lending: A Portfolio

... model in Section II-B). We can see that the larger the predicted return, the larger the risk. The Pearson correlation coefficient between the risk and return of products is 0.909, indicating a highly positive correlation between each product’s estimated return and risk. This is consistent with the ba ...

... model in Section II-B). We can see that the larger the predicted return, the larger the risk. The Pearson correlation coefficient between the risk and return of products is 0.909, indicating a highly positive correlation between each product’s estimated return and risk. This is consistent with the ba ...

PRIVATE EQUITY FOR THE COMMON MAN

... for exchange listing and they will utilize a continuous offering process. The former describes the L-REIT sample, while the latter identifies the UL-REIT sample. Both groups are subject SEC, NASD and NASAA reporting requirements, as well as compliance with all tax-related REIT restrictions as noted ...

... for exchange listing and they will utilize a continuous offering process. The former describes the L-REIT sample, while the latter identifies the UL-REIT sample. Both groups are subject SEC, NASD and NASAA reporting requirements, as well as compliance with all tax-related REIT restrictions as noted ...

test reasonableness - LifeCycle Returns, Inc.

... Theoretically, both the capitalization and the multi period discount models should return the same value. Often, however, obtaining a reliable estimate of long term growth becomes difficult, if short to intermediate term growth will vary considerably from the long term. Both the multi-period model a ...

... Theoretically, both the capitalization and the multi period discount models should return the same value. Often, however, obtaining a reliable estimate of long term growth becomes difficult, if short to intermediate term growth will vary considerably from the long term. Both the multi-period model a ...

determining the risk free rate for regulated companies

... REV2 = $30m + $50m + $50m(.04) = $82m These revenues imply output prices of $8.40 or $8.20. We now determine the present value of the future cash flows. The revenue received in one year, net of the operating cost then, is known now, and is therefore valued using the current one year spot rate (.06). ...

... REV2 = $30m + $50m + $50m(.04) = $82m These revenues imply output prices of $8.40 or $8.20. We now determine the present value of the future cash flows. The revenue received in one year, net of the operating cost then, is known now, and is therefore valued using the current one year spot rate (.06). ...

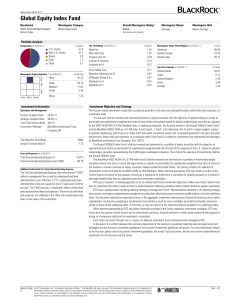

Global Equity Index Fund

... by the MSCI ACWI IMI US $ Net Dividend Index. In seeking its objective, the Account invests in the Russell 3000[rt] Index Fund E and the BlackRock MSCI ACWI ex-U.S. IMI Index Fund E (each, a "Fund", and collectively, the "Funds") in target weights, subject to periodic rebalancing. Each Fund is an "i ...

... by the MSCI ACWI IMI US $ Net Dividend Index. In seeking its objective, the Account invests in the Russell 3000[rt] Index Fund E and the BlackRock MSCI ACWI ex-U.S. IMI Index Fund E (each, a "Fund", and collectively, the "Funds") in target weights, subject to periodic rebalancing. Each Fund is an "i ...