Wespath`s Hedge Fund Strategy— The Path Not Followed

... While many hedge fund investors believe that superior performance is a benefit of hedge fund investing, such claims depend on the skill of investors in selecting the right hedge funds. Reliable hedge fund data first became available in 1990 and, indeed, reported results for the first 10 years averag ...

... While many hedge fund investors believe that superior performance is a benefit of hedge fund investing, such claims depend on the skill of investors in selecting the right hedge funds. Reliable hedge fund data first became available in 1990 and, indeed, reported results for the first 10 years averag ...

An Indirect Impact of the Price to Book Value to the Stock Returns

... namely: a single return and portfolio return. Single return is the result obtained in the form of return of investment, realized return and expected return. The realize return is a return that has happened, ...

... namely: a single return and portfolio return. Single return is the result obtained in the form of return of investment, realized return and expected return. The realize return is a return that has happened, ...

S2AV: A valuation methodology for insurance companies

... capital to be held) are constant over time as a proportion of risky assets8 then we can express the impact on NPV (distributable profits) as: NPV (Total risky assets at all points in time)@RDR * (Net of tax return in excess of risk free Capital charge for risky assets) 9 If excess returns on risky a ...

... capital to be held) are constant over time as a proportion of risky assets8 then we can express the impact on NPV (distributable profits) as: NPV (Total risky assets at all points in time)@RDR * (Net of tax return in excess of risk free Capital charge for risky assets) 9 If excess returns on risky a ...

The Effect of Capital Controls on Interest Rate Differentials

... —and hence their investment horizon— are contingent on the state of the economy and part of a dynamic optimization process that takes into account entry and exit costs as well as the stochastic process followed by interest rate differentials. In that set-up, an optimal (S,s) rule (as in Dixit, 1989) ...

... —and hence their investment horizon— are contingent on the state of the economy and part of a dynamic optimization process that takes into account entry and exit costs as well as the stochastic process followed by interest rate differentials. In that set-up, an optimal (S,s) rule (as in Dixit, 1989) ...

chapter one - McGraw Hill Higher Education

... Why the surge of interest in shares? Perhaps it is because people recognize that stocks, in the long term, have performed better historically than bonds. In the U.S., stocks have yielded an average annual return of about 12 percent since 1926, compared to 6 percent for corporate bonds, 5.6 percent f ...

... Why the surge of interest in shares? Perhaps it is because people recognize that stocks, in the long term, have performed better historically than bonds. In the U.S., stocks have yielded an average annual return of about 12 percent since 1926, compared to 6 percent for corporate bonds, 5.6 percent f ...

The Predictability of Real Estate Returns and Market

... findings of Gyourko and Keim (1990). They find that returns on real estate investment trusts (REITs) and real estate related companies can predict returns on the Frank Russell Company (FRC) appraisal based return index of unlevered institutional grade properties that most institutional investors use ...

... findings of Gyourko and Keim (1990). They find that returns on real estate investment trusts (REITs) and real estate related companies can predict returns on the Frank Russell Company (FRC) appraisal based return index of unlevered institutional grade properties that most institutional investors use ...

chapter 3 - Erasmus University Thesis Repository

... the bidding firm receive an abnormal return that is statistically insignificant from zero while target shareholders earn a return of more than 7% in the period four days around the announcement date. When we look at the combined gain from M&A, we find a statistically significant return of almost 1,5 ...

... the bidding firm receive an abnormal return that is statistically insignificant from zero while target shareholders earn a return of more than 7% in the period four days around the announcement date. When we look at the combined gain from M&A, we find a statistically significant return of almost 1,5 ...

Cornerstone Investor

... The Cornerstone Placing We have entered into a cornerstone investment agreement with Best Investment Corporation (the Cornerstone Investor) which has agreed to subscribe at the Offer Price for such number of Offer Shares that may be purchased with an aggregate amount of US$50 million. Assuming an Of ...

... The Cornerstone Placing We have entered into a cornerstone investment agreement with Best Investment Corporation (the Cornerstone Investor) which has agreed to subscribe at the Offer Price for such number of Offer Shares that may be purchased with an aggregate amount of US$50 million. Assuming an Of ...

The Risky Capital of Emerging Markets – A Long-Run

... Epstein and Zin (1989), asset values respond sharply to persistent shocks that are global in nature. Regions that are more sensitive to these shocks represent riskier investments and so must offer higher risk premia as compensation. Additionally, each region is exposed to both common and idiosyncrat ...

... Epstein and Zin (1989), asset values respond sharply to persistent shocks that are global in nature. Regions that are more sensitive to these shocks represent riskier investments and so must offer higher risk premia as compensation. Additionally, each region is exposed to both common and idiosyncrat ...

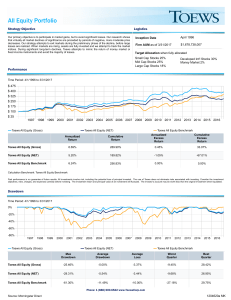

diversified growth funds - Pensions and Lifetime Savings Association

... An investment manager is typically able to utilise a portfolio’s risk budget more efficiently by allocating across asset classes that are less than perfectly correlated. Such a multi-asset approach often helps generate higher returns at lower risk, as can be seen from the chart below, which is based ...

... An investment manager is typically able to utilise a portfolio’s risk budget more efficiently by allocating across asset classes that are less than perfectly correlated. Such a multi-asset approach often helps generate higher returns at lower risk, as can be seen from the chart below, which is based ...

Updating the Discount Rate Used for Benefit-Cost Analysis

... How does society choose how much to consume now versus how much to invest now so it can consume later? Many economists assume that it is many individuals interacting in the market with their decisions to lend or borrow that should determine the social discount rate.6 Of course different individuals ...

... How does society choose how much to consume now versus how much to invest now so it can consume later? Many economists assume that it is many individuals interacting in the market with their decisions to lend or borrow that should determine the social discount rate.6 Of course different individuals ...

Serial Dependence and Portfolio Performance in the Swedish Stock

... good return, but also exhibits a high variance and very high turnover. For weekly data both the variance and the mean return is very high with a slightly better Sharpe ratio than for daily data. In the case with monthly data the model has a very high negative return, which can best be explained by t ...

... good return, but also exhibits a high variance and very high turnover. For weekly data both the variance and the mean return is very high with a slightly better Sharpe ratio than for daily data. In the case with monthly data the model has a very high negative return, which can best be explained by t ...

Predictability of Future Index Returns based on the 52 Week High

... the models while the intercept αp represents the risk adjusted abnormal returns of the portfolios analysed by that model over the estimation period. The t-values corresponding to the regression coefficients are corrected for heteroskedasticity using the White (1980) test. The test to determine wheth ...

... the models while the intercept αp represents the risk adjusted abnormal returns of the portfolios analysed by that model over the estimation period. The t-values corresponding to the regression coefficients are corrected for heteroskedasticity using the White (1980) test. The test to determine wheth ...

The Risk-Free Rate`s Impact on Stock Returns with Representative

... increased their fraction of the stock market activity dramatically. This has resulted in an increased possibility for diversification and access to new markets for households, but not without introducing other problems. Rajan (2005) points out that discretionary investment management creates an agen ...

... increased their fraction of the stock market activity dramatically. This has resulted in an increased possibility for diversification and access to new markets for households, but not without introducing other problems. Rajan (2005) points out that discretionary investment management creates an agen ...

THE CAPITAL ASSET PRICING MODEL`S RISK

... security. Bruner et al. (1998) found wide variation in the choice of risk-free rates for the CAPM. Practitioners strongly prefer long-term bonds; 70% of corporations and financial advisors use Treasury bonds with maturities of ten years or greater, while 10% or less use Treasury bills. By contrast, ...

... security. Bruner et al. (1998) found wide variation in the choice of risk-free rates for the CAPM. Practitioners strongly prefer long-term bonds; 70% of corporations and financial advisors use Treasury bonds with maturities of ten years or greater, while 10% or less use Treasury bills. By contrast, ...