THE DREYFUS CORPORATION August 11, 2016 Mr. Dale

... permit insurance companies to report shares of money market funds with stable NAV as bonds instead of as shares of common stock….”(emphasis in the original). While we believe a stable NAV provides several benefits, we do not believe that making shares of a money market fund more ‘bond-like’ is one o ...

... permit insurance companies to report shares of money market funds with stable NAV as bonds instead of as shares of common stock….”(emphasis in the original). While we believe a stable NAV provides several benefits, we do not believe that making shares of a money market fund more ‘bond-like’ is one o ...

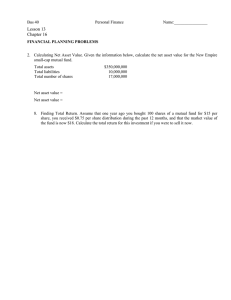

Lesson 13 key - Bakersfield College

... 8. Finding Total Return. Assume that one year ago you bought 100 shares of a mutual fund for $15 per share, you received $0.75 per share distribution during the past 12 months, and that the market value of the fund is now $18. Calculate the total return for this investment if you were to sell it now ...

... 8. Finding Total Return. Assume that one year ago you bought 100 shares of a mutual fund for $15 per share, you received $0.75 per share distribution during the past 12 months, and that the market value of the fund is now $18. Calculate the total return for this investment if you were to sell it now ...

Filmifunding Some numbers reflect the bottom line. Some

... and would be close-ended with a lock- in world cinema and that shall hap.n period of five years. "Since each pen by utilising the depth of talent film project takes 12-18 months we that exists in the Indian marketplace, cannot have an open-ended fund like along with creating production any other mut ...

... and would be close-ended with a lock- in world cinema and that shall hap.n period of five years. "Since each pen by utilising the depth of talent film project takes 12-18 months we that exists in the Indian marketplace, cannot have an open-ended fund like along with creating production any other mut ...

Notes on chapter 9

... known as industrial paper. These papers carry lower than average interest cost and tend to be lower than prime bank loan rate. Often prime rate charged by banks remains unchanged even as market condition changes. However dealer papers are very sensitive to market changes and credit availability cond ...

... known as industrial paper. These papers carry lower than average interest cost and tend to be lower than prime bank loan rate. Often prime rate charged by banks remains unchanged even as market condition changes. However dealer papers are very sensitive to market changes and credit availability cond ...

Collective investment funds

... British collective investment funds that pool money from lots of investors go back to 1868. The first funds were investment companies - listed companies that offer shares to investors and then buy shares in other companies with the monies they collect in. Just like fully functioning companies, inves ...

... British collective investment funds that pool money from lots of investors go back to 1868. The first funds were investment companies - listed companies that offer shares to investors and then buy shares in other companies with the monies they collect in. Just like fully functioning companies, inves ...

summary sheet

... managing and choosing the right stocks for their investors. You can choose the fund that best suits your personality and meet your investment objectives-this is called your Risk vs Return profile and it’s unique to you. Its high risk to put all your money into 1 or 2 stocks. But in a mutual fund you ...

... managing and choosing the right stocks for their investors. You can choose the fund that best suits your personality and meet your investment objectives-this is called your Risk vs Return profile and it’s unique to you. Its high risk to put all your money into 1 or 2 stocks. But in a mutual fund you ...

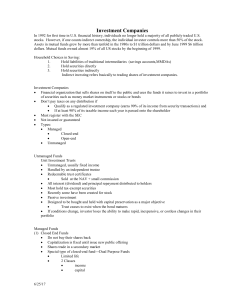

FIN4504c3

... Qualify as a regulated investment company (earns 90% of its income from security transactions) and If at least 90% of its taxable income each year is passed onto the shareholder Must register with the SEC Not insured or guaranteed Types: Managed ...

... Qualify as a regulated investment company (earns 90% of its income from security transactions) and If at least 90% of its taxable income each year is passed onto the shareholder Must register with the SEC Not insured or guaranteed Types: Managed ...

Life_401_Power_Point_investing 1.9 MB

... Know the source of the money Be bold when others are fearful and be fearful when others are bold Never give a Broker control Use only FINRA Brokers and SEC ...

... Know the source of the money Be bold when others are fearful and be fearful when others are bold Never give a Broker control Use only FINRA Brokers and SEC ...

Money Market Regulations

... not subject to liquidity fees and gates. Retail funds are primarily held by “natural persons” (individuals) and sold through an intermediary. Like government funds, retail funds are exempt from FNAV rules, although subject to potential liquidity fees and gates. All other funds not classified as gove ...

... not subject to liquidity fees and gates. Retail funds are primarily held by “natural persons” (individuals) and sold through an intermediary. Like government funds, retail funds are exempt from FNAV rules, although subject to potential liquidity fees and gates. All other funds not classified as gove ...

Money Market Fund Reform and Your Corporate

... fund families will produce, like the weekly or daily liquidity tests? ...

... fund families will produce, like the weekly or daily liquidity tests? ...

Fidelity Investments Statement on Money Market Mutual Funds and

... reform, but based on data included in our response, the SEC should have also excluded all municipal (tax-exempt) money market funds, as well retail prime (general purpose) funds. In October 2013, Fidelity and other asset management firms jointly submitted an additional SEC comment letter that offere ...

... reform, but based on data included in our response, the SEC should have also excluded all municipal (tax-exempt) money market funds, as well retail prime (general purpose) funds. In October 2013, Fidelity and other asset management firms jointly submitted an additional SEC comment letter that offere ...

Georgia State University Policy 5.10.06 Endowment Funds

... Full Policy Text Endowment funds may be invested in cash and cash equivalents, U.S. Government and Agency securities, certificates of deposit, banker's acceptances, corporate bonds, commercial paper, common stocks, and pooled investment funds. Endowment funds may be invested in the Total Return Fund ...

... Full Policy Text Endowment funds may be invested in cash and cash equivalents, U.S. Government and Agency securities, certificates of deposit, banker's acceptances, corporate bonds, commercial paper, common stocks, and pooled investment funds. Endowment funds may be invested in the Total Return Fund ...

An-Investment-Plan-f.. - Bob

... b. Vanguard: Total Market (VTSAX) – available through any broker i. Vanguard 800-992-8327 (Not recommended) ii. Fidelity ...

... b. Vanguard: Total Market (VTSAX) – available through any broker i. Vanguard 800-992-8327 (Not recommended) ii. Fidelity ...

A Project Report Presentation On *SBI Mutual Fund

... deposit issued by banks, Commercial Paper issued companies and inter-bank call money. Aim to provide easy liquidity, preservation of capital and moderate income. Gilt Funds Invest in Gilts which are government securities with medium to long term maturities, typically over one year. Gilt funds invest ...

... deposit issued by banks, Commercial Paper issued companies and inter-bank call money. Aim to provide easy liquidity, preservation of capital and moderate income. Gilt Funds Invest in Gilts which are government securities with medium to long term maturities, typically over one year. Gilt funds invest ...

What is a Mutual Fund?

... Investing in mutual funds helps individual investors “diversify their portfolios.” Investors cannot buy a mutual fund’s shares on margin (using money borrowed from a broker to buy stock) or sell them short (sale of a stock borrowed from a broker. Short sellers believe a stock’s price will drop enabl ...

... Investing in mutual funds helps individual investors “diversify their portfolios.” Investors cannot buy a mutual fund’s shares on margin (using money borrowed from a broker to buy stock) or sell them short (sale of a stock borrowed from a broker. Short sellers believe a stock’s price will drop enabl ...

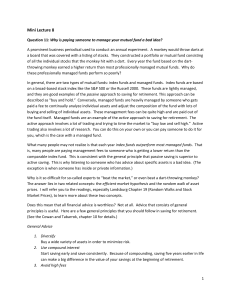

Mini Lecture 8

... of all the individual stocks that the monkey hit with a dart. Every year the fund based on the dartthrowing monkey earned a higher return than most professionally managed mutual funds. Why do these professionally managed funds perform so poorly? In general, there are two types of mutual funds: index ...

... of all the individual stocks that the monkey hit with a dart. Every year the fund based on the dartthrowing monkey earned a higher return than most professionally managed mutual funds. Why do these professionally managed funds perform so poorly? In general, there are two types of mutual funds: index ...

American Finances

... Compound interest is POWERFUL! • What is compound interest? • Compound interest is interest on interest • Example…say you deposit 100$ in the bank. At the end of the year you earn 10% on your deposit. So now you have 110.00 in the bank. The next year you earn 10% on 110.00 and now you have 121.00. ...

... Compound interest is POWERFUL! • What is compound interest? • Compound interest is interest on interest • Example…say you deposit 100$ in the bank. At the end of the year you earn 10% on your deposit. So now you have 110.00 in the bank. The next year you earn 10% on 110.00 and now you have 121.00. ...

Daily Liquid Assets - Goldman Sachs Asset Management

... The following report provides the percentage of the daily and weekly liquid assets for the Financial Square Money Market Funds and the VIT Money Market Fund. This is provided for shareholder information purposes only. Rule 2a-7 of the Investment Company Act of 1940 provides that money market funds m ...

... The following report provides the percentage of the daily and weekly liquid assets for the Financial Square Money Market Funds and the VIT Money Market Fund. This is provided for shareholder information purposes only. Rule 2a-7 of the Investment Company Act of 1940 provides that money market funds m ...

Opt for short-term debt funds as an alternative to FDs

... the past one year, these funds investors should look for funds have given an average return with a low expense ratio. They of 7.50 per cent. Even in the should also check the quality future, their returns should be of the securities in their portable to match the average folios. "Selecting a fund fr ...

... the past one year, these funds investors should look for funds have given an average return with a low expense ratio. They of 7.50 per cent. Even in the should also check the quality future, their returns should be of the securities in their portable to match the average folios. "Selecting a fund fr ...

Answers to Chapter 1 Questions

... would have to approach the savers of funds, such as households, directly in order to fund their investment projects and fill their borrowing needs. This would be extremely costly because of the up-front information costs faced by potential lenders. These include costs associated with identifying pot ...

... would have to approach the savers of funds, such as households, directly in order to fund their investment projects and fill their borrowing needs. This would be extremely costly because of the up-front information costs faced by potential lenders. These include costs associated with identifying pot ...

How Stocks Promote Growth

... Where do they get the money? (2) • For a publicly traded firm, it’s easy: • Sell partial ownership of the company – Instant cash to pay for expansion of business! – Cost of failure falls on investors, decreasing the risk of loss for the original owner, making them more likely to take the chance. – ...

... Where do they get the money? (2) • For a publicly traded firm, it’s easy: • Sell partial ownership of the company – Instant cash to pay for expansion of business! – Cost of failure falls on investors, decreasing the risk of loss for the original owner, making them more likely to take the chance. – ...

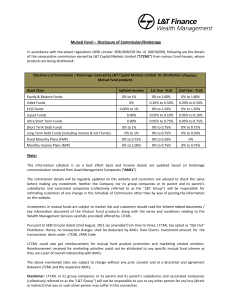

Mutual Fund – Disclosure of Commission/Brokerage Note:

... The commission details will be regularly updated on this website and customers are advised to check the same before making any investment. Neither the Company nor its group companies or its parent and its parent’s subsidiaries and associated companies (collectively referred to as the "L&T Group”) wi ...

... The commission details will be regularly updated on this website and customers are advised to check the same before making any investment. Neither the Company nor its group companies or its parent and its parent’s subsidiaries and associated companies (collectively referred to as the "L&T Group”) wi ...

To the Point: New rules may affect how entities classify and

... Refer to SEC Release No. 33-9616, Money Market Fund Reform; Amendments to Form PF, issued on July 23, 2014. These money market funds are held by institutional investors (i.e., not retail investors) and generally invest in a variety of taxable short-term obligations issued by corporations and banks, ...

... Refer to SEC Release No. 33-9616, Money Market Fund Reform; Amendments to Form PF, issued on July 23, 2014. These money market funds are held by institutional investors (i.e., not retail investors) and generally invest in a variety of taxable short-term obligations issued by corporations and banks, ...