Super fund mergers could cross sectors

... Not-for-profit funds are often controlled by a trustee corporation and the shares of the trustee corporation are typically held by the sponsoring organisations, including unions and employer organisations. In theory, an industry fund could merge with a retail fund if these organisations sold their i ...

... Not-for-profit funds are often controlled by a trustee corporation and the shares of the trustee corporation are typically held by the sponsoring organisations, including unions and employer organisations. In theory, an industry fund could merge with a retail fund if these organisations sold their i ...

Functions of Money

... means there is an agreed-to measure for stating the prices of goods and services. (simplifies price comparisons.) ...

... means there is an agreed-to measure for stating the prices of goods and services. (simplifies price comparisons.) ...

File

... Keywords: asianinvestor | awards | investment performance | hedge funds | hedge fund awards | alternatives AsianInvestor is pleased to announce the 2010 winners for institutional funds management. We conclude the awards announcements today by recognising the best in hedge funds and alternatives hous ...

... Keywords: asianinvestor | awards | investment performance | hedge funds | hedge fund awards | alternatives AsianInvestor is pleased to announce the 2010 winners for institutional funds management. We conclude the awards announcements today by recognising the best in hedge funds and alternatives hous ...

FT One of the few active operators

... returns,” says Mark Young, real estate analyst at Oriel Securities. “However, these high levels of indebtedness are now a cause for concern, leading to severe de-ratings in recent months.” Develica Deutschland, a German commercial property investment fund, is the biggest faller to date. It is 286 pe ...

... returns,” says Mark Young, real estate analyst at Oriel Securities. “However, these high levels of indebtedness are now a cause for concern, leading to severe de-ratings in recent months.” Develica Deutschland, a German commercial property investment fund, is the biggest faller to date. It is 286 pe ...

Critical Graphs Required for Success on the AP Macroeconomics

... Easy key to remembering the effect on the market: Ask yourself who has the money at the end of the day? For all transactions, the SELLER will have the money at the end of the day. So, for example, if the Fed wishes to expand M, it must have the market be the seller with the Fed BUYING bonds. ...

... Easy key to remembering the effect on the market: Ask yourself who has the money at the end of the day? For all transactions, the SELLER will have the money at the end of the day. So, for example, if the Fed wishes to expand M, it must have the market be the seller with the Fed BUYING bonds. ...

News Release - First American Funds

... Bancorp affiliate, nor are they insured by the Federal Deposit Insurance Corporation, the Federal Reserve Board, or any other agency. An investment in such products involves investment risk, including possible loss of principal. A Fund’s sponsor has no legal obligation to provide financial support t ...

... Bancorp affiliate, nor are they insured by the Federal Deposit Insurance Corporation, the Federal Reserve Board, or any other agency. An investment in such products involves investment risk, including possible loss of principal. A Fund’s sponsor has no legal obligation to provide financial support t ...

BEF Monthly Report-Master copy_Sep_11.xlsx

... Balanced investment policy that aims at long term capital gains with minimum possible risk to accommodate the fund's nature. Fund's manager may invest in short and mid-term money market/debt instruments until proper investment opportunities arise. ...

... Balanced investment policy that aims at long term capital gains with minimum possible risk to accommodate the fund's nature. Fund's manager may invest in short and mid-term money market/debt instruments until proper investment opportunities arise. ...

press release text the wall street journal category kings

... in accounting methods. These risks can be greater for investments in emerging markets. ETF investments involve additional risks such as the market price trading at a discount to its net asset value, an active secondary trading market may not develop or be maintained or trading may be halted by the e ...

... in accounting methods. These risks can be greater for investments in emerging markets. ETF investments involve additional risks such as the market price trading at a discount to its net asset value, an active secondary trading market may not develop or be maintained or trading may be halted by the e ...

EY widescreen presentation

... Industry-wide digital platforms supporting MF distribution in India (stock exchange platforms, MF utility and possible ecommerce platforms for future) ...

... Industry-wide digital platforms supporting MF distribution in India (stock exchange platforms, MF utility and possible ecommerce platforms for future) ...

Money & Banking

... Transaction Demand – Money kept for purchases, direct relationship with GDP Asset Demand – Money kept as a store of value for later use Total Value = Transactions + Assets ...

... Transaction Demand – Money kept for purchases, direct relationship with GDP Asset Demand – Money kept as a store of value for later use Total Value = Transactions + Assets ...

Money Market

... Commercial paper - Unsecured promissory notes with a fixed maturity of one to 270 days; usually sold at a discount from face value. Eurodollar deposit - Deposits made in U.S. dollars at a bank or bank branch located outside the United States. ...

... Commercial paper - Unsecured promissory notes with a fixed maturity of one to 270 days; usually sold at a discount from face value. Eurodollar deposit - Deposits made in U.S. dollars at a bank or bank branch located outside the United States. ...

INTRODUCTION TO

... of Fund schemes create conflict of interest. Henceforth, AMCs shall not enter into any revenue sharing arrangement with the underlying funds in any manner and shall not receive any revenue by whatever means from the underlying fund. These guidelines set by the SEBI will lead to greater transparenc ...

... of Fund schemes create conflict of interest. Henceforth, AMCs shall not enter into any revenue sharing arrangement with the underlying funds in any manner and shall not receive any revenue by whatever means from the underlying fund. These guidelines set by the SEBI will lead to greater transparenc ...

Interest Rate Parity

... two members from amongst the officials of the ministers of central government dealing with Finance and Law. Two members who are professional and have experience or special knowledge relating to securities market. One member from RBI. ...

... two members from amongst the officials of the ministers of central government dealing with Finance and Law. Two members who are professional and have experience or special knowledge relating to securities market. One member from RBI. ...

Firms and Financial Markets

... • Commercial banks collect the savings of individuals as well as businesses and then lend those pooled savings to other individuals and businesses. • They make money by charging a rate of interest to borrowers that exceeds the rate they pay to savers. • Commercial banks are subject to strict governm ...

... • Commercial banks collect the savings of individuals as well as businesses and then lend those pooled savings to other individuals and businesses. • They make money by charging a rate of interest to borrowers that exceeds the rate they pay to savers. • Commercial banks are subject to strict governm ...

Government Obligations Fund (TR Shares)

... Despite a pullback in inflation and softening in some economic data, short-term interest rates marched higher in the second quarter, aided by actions taken by the US Federal Reserve. The central bank in June raised the target funds range another 25 basis points—the third increase in six months—and s ...

... Despite a pullback in inflation and softening in some economic data, short-term interest rates marched higher in the second quarter, aided by actions taken by the US Federal Reserve. The central bank in June raised the target funds range another 25 basis points—the third increase in six months—and s ...

Opening Statement - Department of Finance ( 4 June 2014)

... the Securities and Exchange Commission is advanced in its deliberations on how best to approach the regulation of Money Market Funds. It is looking at several different approaches but has already made clear that it sees capital buffers as the least effective way to achieve the goal of mitigating run ...

... the Securities and Exchange Commission is advanced in its deliberations on how best to approach the regulation of Money Market Funds. It is looking at several different approaches but has already made clear that it sees capital buffers as the least effective way to achieve the goal of mitigating run ...

Strong first year for Smartfund 80% Protected

... “We believe that Smartfund 80% Protected is ideal for clients who are reluctant to take risks with their investments, such as investors approaching or in retirement. Smartfund 80% Protected offers an alternative to low-risk investments that may not deliver a client’s financial objectives in the cur ...

... “We believe that Smartfund 80% Protected is ideal for clients who are reluctant to take risks with their investments, such as investors approaching or in retirement. Smartfund 80% Protected offers an alternative to low-risk investments that may not deliver a client’s financial objectives in the cur ...

Senate Passes Amended Version of Emergency Economic

... The Treasury Department has now opened its Temporary Guarantee Program for Money Market Funds (the “Money Market Guarantee Program”). The Money Market Guarantee Program is available to any money market fund which (i) is registered under the Investment Company Act of 1940, (ii) has a policy of mainta ...

... The Treasury Department has now opened its Temporary Guarantee Program for Money Market Funds (the “Money Market Guarantee Program”). The Money Market Guarantee Program is available to any money market fund which (i) is registered under the Investment Company Act of 1940, (ii) has a policy of mainta ...

Lecture 1 Chapter 1

... • Facilitate Payments – commercial bank checking accounts • Channel Funds from Savers to Borrowers • Enable Risk Sharing - Classic examples are insurance and forward markets ...

... • Facilitate Payments – commercial bank checking accounts • Channel Funds from Savers to Borrowers • Enable Risk Sharing - Classic examples are insurance and forward markets ...

Indirect Investing

... Investor has greater control over realization of capital gains/losses than with a mutual fund ...

... Investor has greater control over realization of capital gains/losses than with a mutual fund ...

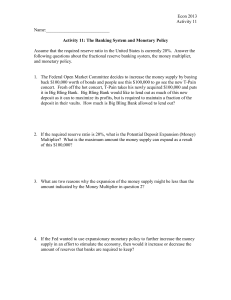

Activity 11 - The Banking System and Monetary Policy

... Assume that the required reserve ratio in the United States is currently 20%. Answer the following questions about the fractional reserve banking system, the money multiplier, and monetary policy. ...

... Assume that the required reserve ratio in the United States is currently 20%. Answer the following questions about the fractional reserve banking system, the money multiplier, and monetary policy. ...