Funds that seek to make money in rising and falling markets

... securities or financial derivatives. Since the goal of a hedge fund is to make money in all market environments, its managers have wide latitude to invest in options, short stocks, or employ other hedging strategies. On the hand, mutual fund managers are often limited in their ability to use such ag ...

... securities or financial derivatives. Since the goal of a hedge fund is to make money in all market environments, its managers have wide latitude to invest in options, short stocks, or employ other hedging strategies. On the hand, mutual fund managers are often limited in their ability to use such ag ...

SEC amends Rule 2a-7 to eliminate dependency on NRSRO ratings

... funds will now be required to make a determination that a security presents minimal credit risks based on analysis of the capacity of the security’s issuer or guarantor to meet its financial obligations. This analysis must consider specific factors, including an issuer’s or guarantor’s financial con ...

... funds will now be required to make a determination that a security presents minimal credit risks based on analysis of the capacity of the security’s issuer or guarantor to meet its financial obligations. This analysis must consider specific factors, including an issuer’s or guarantor’s financial con ...

Consumers - Cloudfront.net

... How can you accumulate wealth? Save. How much people save depends on their income, their expectations, interest rates, & tax laws. Income ...

... How can you accumulate wealth? Save. How much people save depends on their income, their expectations, interest rates, & tax laws. Income ...

Updates to the HealthEquity investment lineup

... HealthEquity strives to provide leading HSA investment options to help maximize your savings. In an effort to increase fee transparency and reduce investment costs, we are improving our mutual fund lineup by eliminating certain offerings and adding others. These changes also address new regulations ...

... HealthEquity strives to provide leading HSA investment options to help maximize your savings. In an effort to increase fee transparency and reduce investment costs, we are improving our mutual fund lineup by eliminating certain offerings and adding others. These changes also address new regulations ...

How can Hedge Funds take advantage of inefficiencies and

... In the last financial crisis, some of these funds bet against the housing market through the credit default swap market. While these complex derivatives did the job in this situation, having instruments that allow an investor to directly express an opinion about either residential or commercial real ...

... In the last financial crisis, some of these funds bet against the housing market through the credit default swap market. While these complex derivatives did the job in this situation, having instruments that allow an investor to directly express an opinion about either residential or commercial real ...

Charity Finance Directors’ Group

... Interest rates - low, lower, lowest Credit ratings – poor or moody! Financial Services Compensation Scheme – worth the paper its printed on? ...

... Interest rates - low, lower, lowest Credit ratings – poor or moody! Financial Services Compensation Scheme – worth the paper its printed on? ...

File - BSC Economics

... b) People buy shares in a mutual fund. c) A pension fund manager buys commercial paper in the secondary market. d) An insurance company buys shares of common stock in the over-the-counter markets. e) None of the above. 9) Which of the following can be described as involving direct finance? a) A corp ...

... b) People buy shares in a mutual fund. c) A pension fund manager buys commercial paper in the secondary market. d) An insurance company buys shares of common stock in the over-the-counter markets. e) None of the above. 9) Which of the following can be described as involving direct finance? a) A corp ...

Key Changes Ahead

... (MMFs) have been used by 401(k) and 403(b) plans to provide a simple, stable and liquid source of income, despite their low returns. The new rules will require committees to re-examine the role of the MMF in their plans and determine which type of fund meets those needs. When the SEC reforms go into ...

... (MMFs) have been used by 401(k) and 403(b) plans to provide a simple, stable and liquid source of income, despite their low returns. The new rules will require committees to re-examine the role of the MMF in their plans and determine which type of fund meets those needs. When the SEC reforms go into ...

Mutual Funds - McDonaldMath

... Mutual Funds Mutual fund – a business that accepts deposits from many people to invest in various ways -each deposit is used to pay for a portion of the stocks or bonds the fund purchases -professionals employed by the fund make ...

... Mutual Funds Mutual fund – a business that accepts deposits from many people to invest in various ways -each deposit is used to pay for a portion of the stocks or bonds the fund purchases -professionals employed by the fund make ...

AP Macro reminders

... increases or decreases, S for the other does the same • If one currency appreciates, the other depreciates • Comparative advantage – OOO, IOU • Money creation – if original deposit is new $, it must be added to created $ to determine total increase to the money supply ...

... increases or decreases, S for the other does the same • If one currency appreciates, the other depreciates • Comparative advantage – OOO, IOU • Money creation – if original deposit is new $, it must be added to created $ to determine total increase to the money supply ...

PNC Taxable Money Market Funds

... The dividend yield paid by PNC Money Market Funds will vary with changes in short-term interest rates. With respect to the PNC Money Market and Government Money Market Funds, the value of debt securities within each Fund’s portfolio may be affected by the ability of the issuer to make principal and ...

... The dividend yield paid by PNC Money Market Funds will vary with changes in short-term interest rates. With respect to the PNC Money Market and Government Money Market Funds, the value of debt securities within each Fund’s portfolio may be affected by the ability of the issuer to make principal and ...

HSBC Money Market Fund

... The Board will be permitted to impose a liquidity fee on redemptions from the Fund (up to a maximum of 2%1) or temporarily restrict redemptions from the Fund for up to 10 business days in any 90 day period, if weekly liquidity levels fall below the required regulatory thresholds. ...

... The Board will be permitted to impose a liquidity fee on redemptions from the Fund (up to a maximum of 2%1) or temporarily restrict redemptions from the Fund for up to 10 business days in any 90 day period, if weekly liquidity levels fall below the required regulatory thresholds. ...

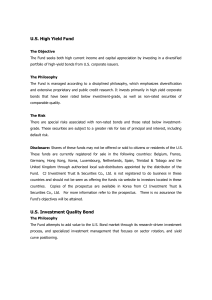

US High Yield Fund

... The Fund seeks both high current income and capital appreciation by investing in a diversified portfolio of high-yield bonds from U.S. corporate issuers. The Philosophy The Fund is managed according to a disciplined philosophy, which emphasizes diversification and extensive proprietary and public cr ...

... The Fund seeks both high current income and capital appreciation by investing in a diversified portfolio of high-yield bonds from U.S. corporate issuers. The Philosophy The Fund is managed according to a disciplined philosophy, which emphasizes diversification and extensive proprietary and public cr ...

Characteristics of Money

... Characteristics of Money Durable Portable Divisible-denominations Uniformity- $1 is worth a $1. Limited Supply Accepted Types of Money Commodity money- objects Representative money- IOU’s Fiat money (legal tender)- government decree A Money standard is the manner in which a nation ...

... Characteristics of Money Durable Portable Divisible-denominations Uniformity- $1 is worth a $1. Limited Supply Accepted Types of Money Commodity money- objects Representative money- IOU’s Fiat money (legal tender)- government decree A Money standard is the manner in which a nation ...

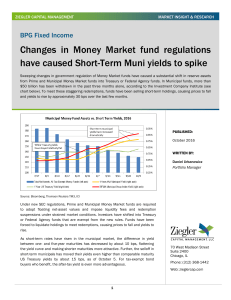

Changes In Money Market Fund Regulations

... Part of this short-term municipal selling has been in the “bread and butter” holdings that Municipal Money funds use for liquidity, Variable-Rate Demand Notes (VRDNs), which have cheapened significantly. VRDNs are securities that typically have a longer-term final maturity and “for which the intere ...

... Part of this short-term municipal selling has been in the “bread and butter” holdings that Municipal Money funds use for liquidity, Variable-Rate Demand Notes (VRDNs), which have cheapened significantly. VRDNs are securities that typically have a longer-term final maturity and “for which the intere ...

download

... terms of total assets. Many investors will stay in cash longer than they should-paralyzed by the three-year bear market. The investment environment is especially disheartening for those who first entered the market in the late 1990s, put their faith in professional fund managers-and discovered their ...

... terms of total assets. Many investors will stay in cash longer than they should-paralyzed by the three-year bear market. The investment environment is especially disheartening for those who first entered the market in the late 1990s, put their faith in professional fund managers-and discovered their ...

Investment Policy Money Market Funds Rpt

... Money market funds are mutual funds that invest in short-term money market instruments. By definition, Money Market Funds are widely diversified, using many forms of money market securities including types which this council does not currently have the expertise or risk appetite to hold directly. Ho ...

... Money market funds are mutual funds that invest in short-term money market instruments. By definition, Money Market Funds are widely diversified, using many forms of money market securities including types which this council does not currently have the expertise or risk appetite to hold directly. Ho ...

Chapter 3 – Outline

... b. Spot Markets – assets that are bought and sold at current prices for immediate delivery c. Future Markets – assets that are bought and sold at a specified price to be delivered at a specified date d. Money Markets – assets that mature in a short period of time – typically less than one year e. Ca ...

... b. Spot Markets – assets that are bought and sold at current prices for immediate delivery c. Future Markets – assets that are bought and sold at a specified price to be delivered at a specified date d. Money Markets – assets that mature in a short period of time – typically less than one year e. Ca ...

STATE OF WISCONSIN INVESTMENT BOARD PORTFOLIO

... STATE OF WISCONSIN INVESTMENT BOARD PORTFOLIO PERFORMANCE WITH BENCHMARKS PERIODS ENDING 6/30/16 ANNUALIZED RETURNS (%) ...

... STATE OF WISCONSIN INVESTMENT BOARD PORTFOLIO PERFORMANCE WITH BENCHMARKS PERIODS ENDING 6/30/16 ANNUALIZED RETURNS (%) ...