Governmental Accounting

... maintain those funds required by law and sound financial administration. Only the minimum number of funds consistent with legal and operating requirements should be established, however, since unnecessary funds result in inflexibility, undue complexity, and inefficient financial administration. ...

... maintain those funds required by law and sound financial administration. Only the minimum number of funds consistent with legal and operating requirements should be established, however, since unnecessary funds result in inflexibility, undue complexity, and inefficient financial administration. ...

Our multi asset class funds: their diversification benefits and

... instruments the Fund holds and its long-term objectives, there is a possibility that, over the short to medium term, your investment may experience a reduction in its capital value but this is highly unlikely over any rolling 36-month period or longer. ...

... instruments the Fund holds and its long-term objectives, there is a possibility that, over the short to medium term, your investment may experience a reduction in its capital value but this is highly unlikely over any rolling 36-month period or longer. ...

Fact Sheet:SPDR DoubleLine Short Duration Total

... After-tax returns are calculated based on NAV using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on the investor's tax situation and may differ from those shown. The after-tax returns shown ...

... After-tax returns are calculated based on NAV using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on the investor's tax situation and may differ from those shown. The after-tax returns shown ...

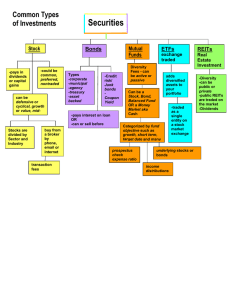

Securities

... Types of stock include Market Capitalization (indicates the size of a company, small-cap is less than one billion, mid-cap is one to 5 billion, large-cap-over is over 5 billion), Defensive (stocks with a stable demand such as groceries, health care or electricity), Cyclical (less stable, often fluct ...

... Types of stock include Market Capitalization (indicates the size of a company, small-cap is less than one billion, mid-cap is one to 5 billion, large-cap-over is over 5 billion), Defensive (stocks with a stable demand such as groceries, health care or electricity), Cyclical (less stable, often fluct ...

Endowment Spending/Payout Policy

... In the preparation of the ALA annual budget, the ALA Executive Director is authorized to include a payout rate of 3% - 5% of the five-year trailing calendar quarterly (20) rolling average of the net asset balance of the ALA Future Fund. Additionally, the Executive Directors of the Divisions and the ...

... In the preparation of the ALA annual budget, the ALA Executive Director is authorized to include a payout rate of 3% - 5% of the five-year trailing calendar quarterly (20) rolling average of the net asset balance of the ALA Future Fund. Additionally, the Executive Directors of the Divisions and the ...

Mutual Funds May 2012

... For much more detail on IRAs: FPW website: www.usu.edu/fpw click on: “past presentations” IRAs March 2006 IRAs convert to Roth Nov. 2009 ...

... For much more detail on IRAs: FPW website: www.usu.edu/fpw click on: “past presentations” IRAs March 2006 IRAs convert to Roth Nov. 2009 ...

In Support of Federal Legislation to Protect American Investors

... WHEREAS, the confidence of investors in the U.S. mutual fund industry is critical for the continuation of a stable economy; and WHEREAS, more than 95 million Americans own mutual funds, which have become the primary investment vehicle for both individual and institutional investors; and WHEREAS, rec ...

... WHEREAS, the confidence of investors in the U.S. mutual fund industry is critical for the continuation of a stable economy; and WHEREAS, more than 95 million Americans own mutual funds, which have become the primary investment vehicle for both individual and institutional investors; and WHEREAS, rec ...

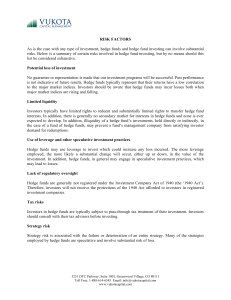

RISK FACTORS As is the case with any type of investment, hedge

... to the major market indices. Investors should be aware that hedge funds may incur losses both when major market indices are rising and falling. Limited liquidity Investors typically have limited rights to redeem and substantially limited rights to transfer hedge fund interests. In addition, there is ...

... to the major market indices. Investors should be aware that hedge funds may incur losses both when major market indices are rising and falling. Limited liquidity Investors typically have limited rights to redeem and substantially limited rights to transfer hedge fund interests. In addition, there is ...

BUSINESS ENGLISH 1

... A person dealing with cash transactions in a bank, shop, etc. A piece of metal used as money The money used in a country Money owed by one person to another Sum payable as a first instalment on a purchase; money placed in an account in a bank Give money especially to charity; make a donation The rat ...

... A person dealing with cash transactions in a bank, shop, etc. A piece of metal used as money The money used in a country Money owed by one person to another Sum payable as a first instalment on a purchase; money placed in an account in a bank Give money especially to charity; make a donation The rat ...

Summary of Investments

... Attached are summaries of the MHCO investments managed by the NC Masonic Foundation (NCMF) and by Edward Jones. Income earned from the investments is reinvested in the accounts. Funds may be withdrawn from the accounts as needed to meet operational shortfalls or for designated distributions. Withdra ...

... Attached are summaries of the MHCO investments managed by the NC Masonic Foundation (NCMF) and by Edward Jones. Income earned from the investments is reinvested in the accounts. Funds may be withdrawn from the accounts as needed to meet operational shortfalls or for designated distributions. Withdra ...

Liquidity Tiering for Higher Yields in the Tax

... These are exceptionally challenging times for income investors. With the Federal Reserve (Fed) holding short-term rates unusually low for the foreseeable future and possible structural changes coming for money market funds, investors are increasingly challenged to balance their income and liquidity ...

... These are exceptionally challenging times for income investors. With the Federal Reserve (Fed) holding short-term rates unusually low for the foreseeable future and possible structural changes coming for money market funds, investors are increasingly challenged to balance their income and liquidity ...

What does the Fund invest in? FUND PERFORMANCE REPORT

... *Portfolio Mix & Sector Allocation may shift depending on market conditions. ...

... *Portfolio Mix & Sector Allocation may shift depending on market conditions. ...

Investment Fund

... Fund Overview The fund is a money market fund with a very low risk profile. The fund’s main aim is to provide a stable and secure return to the conservative investor, who does not wish to be affected by the volatility normally associated with the equity, property and international markets. The fund’ ...

... Fund Overview The fund is a money market fund with a very low risk profile. The fund’s main aim is to provide a stable and secure return to the conservative investor, who does not wish to be affected by the volatility normally associated with the equity, property and international markets. The fund’ ...

Wells Fargo announces effective dates for changes to certain money

... manages $122 billion in assets under management (as of December 31, 2015). If you have any questions, please contact the Institutional Sales Desk at 1-888-253-6584. ...

... manages $122 billion in assets under management (as of December 31, 2015). If you have any questions, please contact the Institutional Sales Desk at 1-888-253-6584. ...

SEBI (Venture Capital Funds) Regulations, 1996

... • SEBI (Alternate Investment Funds) Regulations, 2012 All VCFs/FVCFs registered as AIF AIF shall have a minimum corpus of Rs 20 crore The fund or any of its scheme shall not have more than 1,000 investors AIF shall not accept investment of value less than Rs. 1 cr from an investor Not to i ...

... • SEBI (Alternate Investment Funds) Regulations, 2012 All VCFs/FVCFs registered as AIF AIF shall have a minimum corpus of Rs 20 crore The fund or any of its scheme shall not have more than 1,000 investors AIF shall not accept investment of value less than Rs. 1 cr from an investor Not to i ...

Submission - Review of the managed investments act 1998

... reshape mutual fund regulation in Canada by establishing a comprehensive system to better protect investors while still responding to the needs of the $427 billion mutual fund industry. A concept proposal on a new framework for regulating the mutual fund industry will be published for comment on Mar ...

... reshape mutual fund regulation in Canada by establishing a comprehensive system to better protect investors while still responding to the needs of the $427 billion mutual fund industry. A concept proposal on a new framework for regulating the mutual fund industry will be published for comment on Mar ...

February 2004 - McCarthy Asset Management, Inc.

... time the market, and if bonds do not provide a safe haven during the next market downtown, how can an investor succeed? I feel there are three critical steps to achieving successful investing. The first is to take a long-term approach. Try to ignore the month-to-month gyrations in the market. The go ...

... time the market, and if bonds do not provide a safe haven during the next market downtown, how can an investor succeed? I feel there are three critical steps to achieving successful investing. The first is to take a long-term approach. Try to ignore the month-to-month gyrations in the market. The go ...

continued from cover - Association Reserves

... unexpected expenditures. This amount shall be defined as the base liquid portion. ...

... unexpected expenditures. This amount shall be defined as the base liquid portion. ...

Statement to TFAC

... asked how money was created. Russell L. Munk, Assistant General Council answered stating “The actual creation of money always involves the extension of credit (loans) from private commercial banks.” ...

... asked how money was created. Russell L. Munk, Assistant General Council answered stating “The actual creation of money always involves the extension of credit (loans) from private commercial banks.” ...

CREF Money Market

... more sensitive to adverse issuer, political, regulatory, market, or economic developments. Loss of Money: Because the investment’s market value may fluctuate up and down, an investor may lose money, including part of the principal, when he or she buys or sells the investment. Market/Market Volatilit ...

... more sensitive to adverse issuer, political, regulatory, market, or economic developments. Loss of Money: Because the investment’s market value may fluctuate up and down, an investor may lose money, including part of the principal, when he or she buys or sells the investment. Market/Market Volatilit ...

Download attachment

... bias helped the fund return 72% in the year ended March 31, handily beating its benchmark MSCI World index, which returned 22%. Tech stocks have taken a beating the past several weeks, so many Islamic equity funds might not do so well in the second quarter. But there are plenty of Muslim-targeted in ...

... bias helped the fund return 72% in the year ended March 31, handily beating its benchmark MSCI World index, which returned 22%. Tech stocks have taken a beating the past several weeks, so many Islamic equity funds might not do so well in the second quarter. But there are plenty of Muslim-targeted in ...

closed-end fund “at the market” equity shelf offerings

... part of normal trading volume on the fund’s stock exchange, such ATM Offering is referred to as an issuance of shares “at the market”. Such ATM Offerings may allow these funds to pursue additional investment opportunities without the need to sell existing portfolio investments and — assuming all els ...

... part of normal trading volume on the fund’s stock exchange, such ATM Offering is referred to as an issuance of shares “at the market”. Such ATM Offerings may allow these funds to pursue additional investment opportunities without the need to sell existing portfolio investments and — assuming all els ...

BGF European Value Fund

... Source: BlackRock, data as of 30 April, 2015. Performance is shown in EUR on a NAV to NAV price basis with income reinvested. Fund performance figures are calculated net of fees. The above Fund data is for information only. ^Morningstar All Rights Reserved. Morningstar Rating as of 30/04/2015. Inves ...

... Source: BlackRock, data as of 30 April, 2015. Performance is shown in EUR on a NAV to NAV price basis with income reinvested. Fund performance figures are calculated net of fees. The above Fund data is for information only. ^Morningstar All Rights Reserved. Morningstar Rating as of 30/04/2015. Inves ...

CLARENDON COLLEGE Book Value Market Value Book Value

... Debt Investments >1 year: U.S. Government U.S. Government Agency ...

... Debt Investments >1 year: U.S. Government U.S. Government Agency ...

Poof

... You might think it would be a simple matter for businesses to figure out how much money they have at risk in their relationships with these troubled companies, but that's not the case. I'm told by insiders that even in this digital age, billions of dollars in liabilities are toted up each day on pap ...

... You might think it would be a simple matter for businesses to figure out how much money they have at risk in their relationships with these troubled companies, but that's not the case. I'm told by insiders that even in this digital age, billions of dollars in liabilities are toted up each day on pap ...