Part 3. Financial Institutions

... Mutual funds companies earn income in two ways. The first is that the managers are paid fees by the investors based on the value of the assets in the firm. Numbers around 0.5% are typical. Some mutual funds also charge a fee when the funds are first purchased, called a “load”. For example, if you in ...

... Mutual funds companies earn income in two ways. The first is that the managers are paid fees by the investors based on the value of the assets in the firm. Numbers around 0.5% are typical. Some mutual funds also charge a fee when the funds are first purchased, called a “load”. For example, if you in ...

ap_macro_4-1_money_and_banking

... • You ask your grandmother to lend you $100 and write this down on a piece of paper: "I owe you (IOU) $100, and I will pay you back in a year plus 5% interest." • Your grandmother just bought a bond. Bonds are loans, or IOUs, that represent debt that the government or a corporation must repay to an ...

... • You ask your grandmother to lend you $100 and write this down on a piece of paper: "I owe you (IOU) $100, and I will pay you back in a year plus 5% interest." • Your grandmother just bought a bond. Bonds are loans, or IOUs, that represent debt that the government or a corporation must repay to an ...

Investment Companies Insights

... comment. Investors will only be able to invest in Vanguards own funds, mostly passive funds, at an average price of 0.14% of invested amount. By selling its funds directly to UK investors Vanguard is seen by many to be introducing a new price war. For much of the past year the references to costs an ...

... comment. Investors will only be able to invest in Vanguards own funds, mostly passive funds, at an average price of 0.14% of invested amount. By selling its funds directly to UK investors Vanguard is seen by many to be introducing a new price war. For much of the past year the references to costs an ...

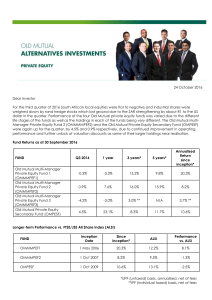

24 October 2016 Dear Investor For the third quarter of 2016 South

... equity J-curve as the underlying funds near maturity. It has outperformed the ALSI over one, three and five years and is now only 1.3% per annum behind the ALSI since inception. Further performance unlock is possible as more assets are realised over the next 15 months before the fund matures. OMMMPE ...

... equity J-curve as the underlying funds near maturity. It has outperformed the ALSI over one, three and five years and is now only 1.3% per annum behind the ALSI since inception. Further performance unlock is possible as more assets are realised over the next 15 months before the fund matures. OMMMPE ...

gabelli food of all nations nextshares

... About NextShares: Shares of NextShares funds are normally bought and sold in the secondary market through a broker, and may not be individually purchased or redeemed from the fund. In the secondary market, buyers and sellers transact with each other, rather than with the fund. NextShares funds issue ...

... About NextShares: Shares of NextShares funds are normally bought and sold in the secondary market through a broker, and may not be individually purchased or redeemed from the fund. In the secondary market, buyers and sellers transact with each other, rather than with the fund. NextShares funds issue ...

Private Equity Funds in Namibia: Venturing Forth

... • Venture capital now spending time trying to salvage start-ups rather than seeking new targets • Bad time to exit good time to buy into new projects • In 1999 venture capital funds generated an IRR of ...

... • Venture capital now spending time trying to salvage start-ups rather than seeking new targets • Bad time to exit good time to buy into new projects • In 1999 venture capital funds generated an IRR of ...

fund risks - Royal London pensions for employers and trustees

... movements in price than funds which invest in lower risk assets such as UK government bonds and cash. But over the long term higher risk funds would be expected to produce better returns than lower risk funds, although this is not guaranteed. Long-term investments Funds which invest in higher risk a ...

... movements in price than funds which invest in lower risk assets such as UK government bonds and cash. But over the long term higher risk funds would be expected to produce better returns than lower risk funds, although this is not guaranteed. Long-term investments Funds which invest in higher risk a ...

KSCVX Cusip Change 12 31 07

... In an effort to enhance operating efficiency and product offerings, the Keeley Funds implemented the following changes to their family of funds effective December 31, 2007. 1 - The Keeley Small Cap Value Fund, Inc. was merged into a newly created series of the Keeley Funds, Inc., the KEELEY Small Ca ...

... In an effort to enhance operating efficiency and product offerings, the Keeley Funds implemented the following changes to their family of funds effective December 31, 2007. 1 - The Keeley Small Cap Value Fund, Inc. was merged into a newly created series of the Keeley Funds, Inc., the KEELEY Small Ca ...

Click to download Firth AVF March 2012

... not less than 40 stocks and not more than 100 stocks, it is not restricted in or subject to any material concentration or diversification restrictions, and may hold a more limited number of investment positions. The Compartment will typically be near fully invested but may hold liquid assets on an a ...

... not less than 40 stocks and not more than 100 stocks, it is not restricted in or subject to any material concentration or diversification restrictions, and may hold a more limited number of investment positions. The Compartment will typically be near fully invested but may hold liquid assets on an a ...

SPECIAL TOPIC: Building a Circular Flow Diagram McCaffery © F

... ACTUALLY the important consideration. At the same time, foreign entities buy US made goods and services which we call Exports. And the money for those exports flow into the US’s Circular Flow as an Injection. As long as X = M the Capital Inflows arrow is unnecessary. But they seldom do equal each ot ...

... ACTUALLY the important consideration. At the same time, foreign entities buy US made goods and services which we call Exports. And the money for those exports flow into the US’s Circular Flow as an Injection. As long as X = M the Capital Inflows arrow is unnecessary. But they seldom do equal each ot ...

top of the line thinking - Northern Funds

... Asset Allocation Risk: An asset allocation strategy does not guarantee any specific result or profit nor protect against a loss. Equity Risk: Equity securities (stocks) are more volatile and carry more risk than other forms of investments, including investments in high-grade fixed income securities. ...

... Asset Allocation Risk: An asset allocation strategy does not guarantee any specific result or profit nor protect against a loss. Equity Risk: Equity securities (stocks) are more volatile and carry more risk than other forms of investments, including investments in high-grade fixed income securities. ...

Debunking some myths and misconceptions about

... We often hear that a benefit of active management is that the manager can move into cash or defensive positions to curb portfolio losses during market downturns or bear markets. In reality, the probability that these managers will move fund assets at just the right time is very low. Most events that ...

... We often hear that a benefit of active management is that the manager can move into cash or defensive positions to curb portfolio losses during market downturns or bear markets. In reality, the probability that these managers will move fund assets at just the right time is very low. Most events that ...

August 2016 FUND NAME ESTIMATED PRICE ESTIMATED

... other use of, or taking of any action in reliance upon, this information by persons or entities other than the intended recipient is prohibited. Past performance is not indicative of future results. The price of this Fund(s) or any investment and any income from it can go down as well as up and may ...

... other use of, or taking of any action in reliance upon, this information by persons or entities other than the intended recipient is prohibited. Past performance is not indicative of future results. The price of this Fund(s) or any investment and any income from it can go down as well as up and may ...

RBC Emerging Markets Bond Fund

... Please read the prospectus or Fund Facts document before investing. Except as otherwise noted, the indicated rates of return are the historical annual compounded total returns including changes in unit value and reinvestment of all distributions and do not take into account sales, redemption, distri ...

... Please read the prospectus or Fund Facts document before investing. Except as otherwise noted, the indicated rates of return are the historical annual compounded total returns including changes in unit value and reinvestment of all distributions and do not take into account sales, redemption, distri ...

money market fund

... The Fund is not a money market fund, which maintains a $1.00 NAV, and the Fund’s share price will fluctuate with its returns. Bond Risk: Bond funds will tend to experience smaller fluctuations in value than stock funds. However, investors in any bond fund should anticipate fluctuations in price, esp ...

... The Fund is not a money market fund, which maintains a $1.00 NAV, and the Fund’s share price will fluctuate with its returns. Bond Risk: Bond funds will tend to experience smaller fluctuations in value than stock funds. However, investors in any bond fund should anticipate fluctuations in price, esp ...

International Portfolio Investment

... spiders, investors can trade a whole stock market index as if it were a single stock. Being open-end funds, WEBS trade at prices that are very close to their net asset values. In addition to single country index funds, investors can achieve global diversification instantaneously just by holding shar ...

... spiders, investors can trade a whole stock market index as if it were a single stock. Being open-end funds, WEBS trade at prices that are very close to their net asset values. In addition to single country index funds, investors can achieve global diversification instantaneously just by holding shar ...

Introduction to Money and the Financial System

... general rule, if you are more than 10 minutes late, you should not enter the classroom. If you arrive late, but need to see the instructor or pick up lecture notes, please return at the end of the ...

... general rule, if you are more than 10 minutes late, you should not enter the classroom. If you arrive late, but need to see the instructor or pick up lecture notes, please return at the end of the ...

Dreyfus Yield Enhancement Strategy Fund

... Bond Risk: Bonds are subject generally to interest rate, credit, liquidity, call and market risks, to varying degrees. Generally, all other factors being equal, bond prices are inversely related to interest-rate changes and rate increases can cause price declines. Credit Risk: High yield bonds are s ...

... Bond Risk: Bonds are subject generally to interest rate, credit, liquidity, call and market risks, to varying degrees. Generally, all other factors being equal, bond prices are inversely related to interest-rate changes and rate increases can cause price declines. Credit Risk: High yield bonds are s ...

- SlideBoom

... Fund supermarkets have had a tremendous impact on the structure of the mutual fund industry. They have: – Boosted the growth of the registered investment adviser segment. – Created opportunities for boutique firms, by providing them ...

... Fund supermarkets have had a tremendous impact on the structure of the mutual fund industry. They have: – Boosted the growth of the registered investment adviser segment. – Created opportunities for boutique firms, by providing them ...

Value drivers

... the tremendous opportunities to the Mutual Funds in these areas. MFs may link themselves to the Credit Cards. Mutual Funds units may assume the position of the Virtual Cash, over the period of time, in all dimensions of life. Trading of Credit derivatives (both purchase and sale). Mutual Funds may b ...

... the tremendous opportunities to the Mutual Funds in these areas. MFs may link themselves to the Credit Cards. Mutual Funds units may assume the position of the Virtual Cash, over the period of time, in all dimensions of life. Trading of Credit derivatives (both purchase and sale). Mutual Funds may b ...

Section 5 Lecture

... must serve as a medium of exchange, a store of value, and unit of account. • Two aggregate measures of the money supply are M1 and M2. • M1 is the narrowest definition. You will most often work with this definition. • M2 adds several other assets, known as near-moneys, that can easily be converted i ...

... must serve as a medium of exchange, a store of value, and unit of account. • Two aggregate measures of the money supply are M1 and M2. • M1 is the narrowest definition. You will most often work with this definition. • M2 adds several other assets, known as near-moneys, that can easily be converted i ...

Performance as of 10/31/2014

... NAV. Some performance results reflect expense subsidies and waivers in effect during certain periods. Absent these waivers, results would have been less favorable. Risks: There is no guarantee that the funds will reach their objective. An investment in the Funds is subject to risk including the poss ...

... NAV. Some performance results reflect expense subsidies and waivers in effect during certain periods. Absent these waivers, results would have been less favorable. Risks: There is no guarantee that the funds will reach their objective. An investment in the Funds is subject to risk including the poss ...

Delta Strategy Group Summary of Open Meeting (October 13, 2016)

... management programs will ensure assets can be sold to meet redemption requests. Funds must classify their assets into four categories, which are based on how quickly the asset can be sold for cash. Commissioner Piwowar: The liquidity risk management recommendation reflects thoughtful consideration o ...

... management programs will ensure assets can be sold to meet redemption requests. Funds must classify their assets into four categories, which are based on how quickly the asset can be sold for cash. Commissioner Piwowar: The liquidity risk management recommendation reflects thoughtful consideration o ...

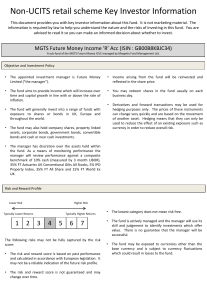

Document

... The manager has discretion over the assets held within the fund. As a means of monitoring performance the manager will review performance against a composite benchmark of 10% cash (measured by 3 month LIBOR), 35% FT Actuaries UK Conventional Gilts All Stocks, 5% IPD Property Index, 35% FT All Share ...

... The manager has discretion over the assets held within the fund. As a means of monitoring performance the manager will review performance against a composite benchmark of 10% cash (measured by 3 month LIBOR), 35% FT Actuaries UK Conventional Gilts All Stocks, 5% IPD Property Index, 35% FT All Share ...

Active Management can help make these kinds of market declines

... presented, please visit www.iaclarington.com or call 1-800-530-0204. Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. The indicated rates of return include changes in share or unit value a ...

... presented, please visit www.iaclarington.com or call 1-800-530-0204. Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. The indicated rates of return include changes in share or unit value a ...