Short-Term Savings Vehicles: Money Markets, MARS and VRDOs

... bial “rainy day.” Given this role that money market funds typically play in an investor’s portfolio, investors should seek funds that invest only in the highest investment grade securities. Considering the limitations placed on typical money market funds by the SEC regarding the length of an invest ...

... bial “rainy day.” Given this role that money market funds typically play in an investor’s portfolio, investors should seek funds that invest only in the highest investment grade securities. Considering the limitations placed on typical money market funds by the SEC regarding the length of an invest ...

What does the Fund invest in? FUND PERFORMANCE REPORT

... indicative of and does not represent future returns. Read product materials carefully. Important information about Sun Life Grepa Financial, Inc.’s (SLGFI’s) products may be obtained only from duly authorized SLGFI Bancassurance Sales Officers and Agents. ...

... indicative of and does not represent future returns. Read product materials carefully. Important information about Sun Life Grepa Financial, Inc.’s (SLGFI’s) products may be obtained only from duly authorized SLGFI Bancassurance Sales Officers and Agents. ...

FINANCIAL MARKETS

... Interest Rate – amount of money the borrower must pay for the use of someone else’s money. Expressed in a percentage. Prime Rate – rate of Interest banks charge on loans to their best business customers. Loans – money that is given with the idea that it will be paid in return. Collateral – something ...

... Interest Rate – amount of money the borrower must pay for the use of someone else’s money. Expressed in a percentage. Prime Rate – rate of Interest banks charge on loans to their best business customers. Loans – money that is given with the idea that it will be paid in return. Collateral – something ...

3Q2015 - Oak Ridge Investments

... fluctuate. Investments made in small capitalization companies may be more volatile and less liquid due to limited resources o r product lines and more sensitive to economic factors. The Funds may invest in foreign securities which involves certain risks such as currency volat ility, political and so ...

... fluctuate. Investments made in small capitalization companies may be more volatile and less liquid due to limited resources o r product lines and more sensitive to economic factors. The Funds may invest in foreign securities which involves certain risks such as currency volat ility, political and so ...

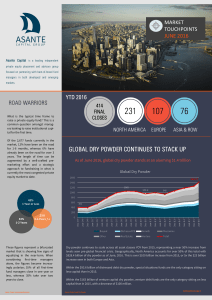

global dry powder continues to stack up

... As the market becomes increasingly bifurcated, the winners are closing oversubscribed funds faster than ever before. By the close of Q3, we expect the average number of months to final close to increase as funds that have been on the road for some time begin to close on capital. Source: Preqin Recen ...

... As the market becomes increasingly bifurcated, the winners are closing oversubscribed funds faster than ever before. By the close of Q3, we expect the average number of months to final close to increase as funds that have been on the road for some time begin to close on capital. Source: Preqin Recen ...

Portfolio Management Analyzing Historical Stock Examples

... – Effect: big gains have major effect on your portfolio value ...

... – Effect: big gains have major effect on your portfolio value ...

FCF New York Life Anchor IV

... ^ The portfolio composition, industry sectors, top ten holdings, and credit analysis are presented to illustrate examples of securities that the fund has bought and diversity of areas in which the fund may invest and may not be representative of the fund’s current or future investments. The top ten ...

... ^ The portfolio composition, industry sectors, top ten holdings, and credit analysis are presented to illustrate examples of securities that the fund has bought and diversity of areas in which the fund may invest and may not be representative of the fund’s current or future investments. The top ten ...

Ch 11: 1.1

... Repo financing is borrowing funds short term using a repurchase agreement, which is the sale of securities together with an agreement for the seller to buy back the securities at a slightly higher price either the next day or within a few days. Repos are short-term loans with the securities serving ...

... Repo financing is borrowing funds short term using a repurchase agreement, which is the sale of securities together with an agreement for the seller to buy back the securities at a slightly higher price either the next day or within a few days. Repos are short-term loans with the securities serving ...

Mutual Funds - Monetta Funds

... objectives. A mutual fund pools the money of thousands of individual investors with common financial goals. Each investor buys shares of ownership in the fund. A mutual fund is managed by a registered investment advisor. This is a company responsible for making all of a mutual fund’s investment deci ...

... objectives. A mutual fund pools the money of thousands of individual investors with common financial goals. Each investor buys shares of ownership in the fund. A mutual fund is managed by a registered investment advisor. This is a company responsible for making all of a mutual fund’s investment deci ...

Goldman Sachs Funds: Questions and Answers on Market Timing

... Goldman Sachs undertakes a variety of measures designed to detect and deter disruptive trading practices, including market-timing activity in the Goldman Sachs Funds, which we have had in place for a number of years. In light of these measures, we have been able to detect, warn, and in certain insta ...

... Goldman Sachs undertakes a variety of measures designed to detect and deter disruptive trading practices, including market-timing activity in the Goldman Sachs Funds, which we have had in place for a number of years. In light of these measures, we have been able to detect, warn, and in certain insta ...

Test Your IQ (Investment Quotient)

... 1. Money Market Securities Which of the following is not a common characteristic of money market securities? a. sold on a discount basis b. mature in less than one year c. most important risk is default risk d. all of the above are characteristics 2. Money Market Securities Which of the following mo ...

... 1. Money Market Securities Which of the following is not a common characteristic of money market securities? a. sold on a discount basis b. mature in less than one year c. most important risk is default risk d. all of the above are characteristics 2. Money Market Securities Which of the following mo ...

Standard Life MyFolio Market Funds

... balanced combination of portfolios. This robust structure forms the basis from which all portfolios are built and provides a consistency across the range. Advisers looking to combine different styles for clients within the MyFolio range can do so knowing the portfolio will have the same underlying c ...

... balanced combination of portfolios. This robust structure forms the basis from which all portfolios are built and provides a consistency across the range. Advisers looking to combine different styles for clients within the MyFolio range can do so knowing the portfolio will have the same underlying c ...

“The Impact of Financial Institutions and Financial ‘Liquidity Lock’ ”

... securities; and some – sometimes called “prime” funds – hold a mix of Treasury issues, agency securities, and short-term debt instruments. While a MMMF that holds only Treasury securities will have no credit risk, it also provides a lower expected return. Prime funds, by holding non-government high- ...

... securities; and some – sometimes called “prime” funds – hold a mix of Treasury issues, agency securities, and short-term debt instruments. While a MMMF that holds only Treasury securities will have no credit risk, it also provides a lower expected return. Prime funds, by holding non-government high- ...

Capital and Money Market

... • Repos: This is a money market instrument which enables collateralised short-term borrowing and lending through sale and purchase in debt instruments. Under a repo transactions, holder of a security can sell it to an investor with an agreement to purchase them at predetermined rate and date. ...

... • Repos: This is a money market instrument which enables collateralised short-term borrowing and lending through sale and purchase in debt instruments. Under a repo transactions, holder of a security can sell it to an investor with an agreement to purchase them at predetermined rate and date. ...

Electrode Placement for Chest Leads, V1 to V6

... • Marketable securities are instruments so widely accepted and purchased by others that they are very similar to cash (Brigham & Ehrhardt, 2011). – T-bills – T-notes – Government agency securities – Certificates of deposit ...

... • Marketable securities are instruments so widely accepted and purchased by others that they are very similar to cash (Brigham & Ehrhardt, 2011). – T-bills – T-notes – Government agency securities – Certificates of deposit ...

Lecture 1 Chapter 1PPT

... Give up purchasing power today in exchange for purchasing power in the future. • Savers: have more funds than they currently need; would like to earn capital income • Borrowers: need more funds than they currently have; willing and able to repay with interest in the future. ...

... Give up purchasing power today in exchange for purchasing power in the future. • Savers: have more funds than they currently need; would like to earn capital income • Borrowers: need more funds than they currently have; willing and able to repay with interest in the future. ...

stocks - Seattle University

... Investors buy shares of mutual funds Shares represent a claim on the investment portfolio of mutual funds Mutual funds can invest in stocks, bonds, real estate, gold, etc. etc. ...

... Investors buy shares of mutual funds Shares represent a claim on the investment portfolio of mutual funds Mutual funds can invest in stocks, bonds, real estate, gold, etc. etc. ...

LionGlobal Asia Bond Fund

... Kong Property’s US$1.5 billion fixed-for-life perpetual securities print and Nanyang Commercial Bank’s US$1.2 billion Basel 3 AT1 bank capital note print. For the month of May, emerging market (EM) hard currency bond funds saw fund inflows of about US$4 billion on still supportive risk appetite. Yea ...

... Kong Property’s US$1.5 billion fixed-for-life perpetual securities print and Nanyang Commercial Bank’s US$1.2 billion Basel 3 AT1 bank capital note print. For the month of May, emerging market (EM) hard currency bond funds saw fund inflows of about US$4 billion on still supportive risk appetite. Yea ...

Appendix 1 Money Market Scheme 19 July

... A Short-Term Money Market Fund must provide daily NAV and price calculations and have daily subscriptions and redemptions of units. ...

... A Short-Term Money Market Fund must provide daily NAV and price calculations and have daily subscriptions and redemptions of units. ...

Keeping Up with the (Paul Tudor) Joneses: a Hedge

... FIRST OF (W)ALL (OF TEXT) Hedge funds are private partnerships in which the manager or general partner (GP) has a significant personal stake in the fund and is free to operate in a variety of markets and to utilize investments and strategies with variable long/short exposures and degrees of leverag ...

... FIRST OF (W)ALL (OF TEXT) Hedge funds are private partnerships in which the manager or general partner (GP) has a significant personal stake in the fund and is free to operate in a variety of markets and to utilize investments and strategies with variable long/short exposures and degrees of leverag ...

NAV | KWD 1.05938 (As of 29-Nov-16)

... The objective of the Fund is to generate competitive Shari'ah compliant returns by increasing its Net Asset Value while maintaining a high level of liquidity. The Fund will pursue its investment objective by investing in short and medium term money market instruments that are Shari’a compliant; Such ...

... The objective of the Fund is to generate competitive Shari'ah compliant returns by increasing its Net Asset Value while maintaining a high level of liquidity. The Fund will pursue its investment objective by investing in short and medium term money market instruments that are Shari’a compliant; Such ...

January 10, 2012 FOR IMMEDIATE RELEASE GuideStone

... the underlying Select Funds. The principal risks of the Funds will change depending on the asset mix of the Select Funds in which they invest. You may directly invest in the Select Funds. The Funds’ value will go up and down in response to changes in the share prices of the investments that they own ...

... the underlying Select Funds. The principal risks of the Funds will change depending on the asset mix of the Select Funds in which they invest. You may directly invest in the Select Funds. The Funds’ value will go up and down in response to changes in the share prices of the investments that they own ...

Investments PPT

... • This is the amount of interest that the Federal Reserve charges banks to borrow money from the government. • The current Federal Funds Rate is: ...

... • This is the amount of interest that the Federal Reserve charges banks to borrow money from the government. • The current Federal Funds Rate is: ...