CEAP RB FORM NO - CEAP Retirement Plan Office

... or convert assets into cash immediately or in instances where conversion to cash is possible but at a loss. This may happen due to various reasons such as absence of buyers or an underdeveloped capital market. D. Credit Risk/Default Risk – This is the possibility that the Fund may experience losses ...

... or convert assets into cash immediately or in instances where conversion to cash is possible but at a loss. This may happen due to various reasons such as absence of buyers or an underdeveloped capital market. D. Credit Risk/Default Risk – This is the possibility that the Fund may experience losses ...

Mutual Funds - Iowa State University Extension and Outreach

... this comes annual management fees,” Swanson adds. In addition there may be other fees. “Avoid load funds that either charge an up-front sales fee or a redemption fee when you redeem your shares within a certain number of years. Also avoid funds that charge 12b-1 marketing fees.” ...

... this comes annual management fees,” Swanson adds. In addition there may be other fees. “Avoid load funds that either charge an up-front sales fee or a redemption fee when you redeem your shares within a certain number of years. Also avoid funds that charge 12b-1 marketing fees.” ...

Diversified Growth Funds – What are they?

... Diversification (and DGFs) reduce reliance on equities as the main source of return i.e. they offer exposure to a variety of return sources and this is the main reason to invest in such a fund. The theory is that if equities were to fall significantly that a DGF would not fall by as much (or would r ...

... Diversification (and DGFs) reduce reliance on equities as the main source of return i.e. they offer exposure to a variety of return sources and this is the main reason to invest in such a fund. The theory is that if equities were to fall significantly that a DGF would not fall by as much (or would r ...

G-7 recommends vigilance on hedge funds

... Policy makers worry that a major hedge fund failure could endanger the stability of the funds' lenders, which tend to be the biggest international investment banks, leading to chaos in major financial markets. The collapse of one fund, Long-Term Capital Management, in 1998 prompted U.S. officials to ...

... Policy makers worry that a major hedge fund failure could endanger the stability of the funds' lenders, which tend to be the biggest international investment banks, leading to chaos in major financial markets. The collapse of one fund, Long-Term Capital Management, in 1998 prompted U.S. officials to ...

Hedge Fund Vs Mutual Funds

... Hedge funds are like mutual funds in some ways. Investment professionals in a hedge fund pool in money from investors to be managed - exactly like the mutual funds do. And, subject to some minor restrictions, investors in hedge funds can withdraw their money as they can in a mutual fund. Nothing els ...

... Hedge funds are like mutual funds in some ways. Investment professionals in a hedge fund pool in money from investors to be managed - exactly like the mutual funds do. And, subject to some minor restrictions, investors in hedge funds can withdraw their money as they can in a mutual fund. Nothing els ...

Activity 2:

... elaborating the strategy for the venture capital funds creation. BIC Bratislava has presented the Israeli experience of the Venture capital industry creation, the experience of the Latvian Ministry of Economy with the VC funds creation and the own results coming out of the ESTER project, e.g. the de ...

... elaborating the strategy for the venture capital funds creation. BIC Bratislava has presented the Israeli experience of the Venture capital industry creation, the experience of the Latvian Ministry of Economy with the VC funds creation and the own results coming out of the ESTER project, e.g. the de ...

Goldman Sachs Financial Square Government Fund

... The money market fund's weighted average life (WAL) is an average of the final maturities (or where applicable the date of demand) of all securities held in the portfolio, weighted by each security's percentage of net assets. Simple average yield is used to show performance under a year. Assets Unde ...

... The money market fund's weighted average life (WAL) is an average of the final maturities (or where applicable the date of demand) of all securities held in the portfolio, weighted by each security's percentage of net assets. Simple average yield is used to show performance under a year. Assets Unde ...

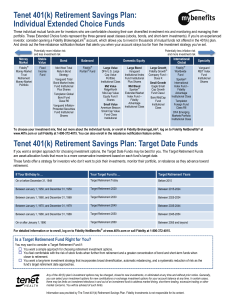

Tenet 401(k) Retirement Savings Plan: Individual Extended Choice

... If you want a simpler approach for choosing investment options, the Target Date Funds may be best for you. The Target Retirement Funds are asset-allocation funds that move to a more conservative investment based on each fund’s target date. These funds offer a strategy for investors who don’t want to ...

... If you want a simpler approach for choosing investment options, the Target Date Funds may be best for you. The Target Retirement Funds are asset-allocation funds that move to a more conservative investment based on each fund’s target date. These funds offer a strategy for investors who don’t want to ...

Invest NI Access to Finance February 2013

... Whiterock Capital Partners - a consortium led by Braveheart Investment Group are managing this Fund. ...

... Whiterock Capital Partners - a consortium led by Braveheart Investment Group are managing this Fund. ...

honors pre-calculus - Tolland Public Schools

... Accounting II Essential Learning Expectations-Chapter 3: •A change fund is money used to make change for cash transactions. ...

... Accounting II Essential Learning Expectations-Chapter 3: •A change fund is money used to make change for cash transactions. ...

ch03 - U of L Class Index

... shares to the public and uses the proceeds to invest in marketable securities Acts as conduit for distribution of dividends, interest, and realized gains Offers the benefits of diversification ...

... shares to the public and uses the proceeds to invest in marketable securities Acts as conduit for distribution of dividends, interest, and realized gains Offers the benefits of diversification ...

Stable Value: Not all funds are created equal

... It is important to understand how a fund is allocating assets and why. In the current interest rate environment, there are differences between portfolios that need to be taken into consideration. A fund’s duration directly impacts a manager’s ability to raise capital for liquidations, put new capita ...

... It is important to understand how a fund is allocating assets and why. In the current interest rate environment, there are differences between portfolios that need to be taken into consideration. A fund’s duration directly impacts a manager’s ability to raise capital for liquidations, put new capita ...

Financial institutions

... Life insurance companies take premiums, invest these funds in stocks, bonds, real estate, and mortgages, and then make payments to beneficiaries. Life insurance companies also offer a variety of taxdeferred savings plans designed to provide retirement benefits. ...

... Life insurance companies take premiums, invest these funds in stocks, bonds, real estate, and mortgages, and then make payments to beneficiaries. Life insurance companies also offer a variety of taxdeferred savings plans designed to provide retirement benefits. ...

The Financial Crisis

... banks led people to rush banks to demand funds Fractional-reserve banking means that bank runs destroy banks FDIC stopped bank runs in U.S. Modern runs in repo market (which killed Lehmann Brothers), money market funds ...

... banks led people to rush banks to demand funds Fractional-reserve banking means that bank runs destroy banks FDIC stopped bank runs in U.S. Modern runs in repo market (which killed Lehmann Brothers), money market funds ...

CLTL - PowerShares Treasury Collateral Portfolio fund in

... such as dealing with multiple CUSIPs and rolling over frequently due to their short maturities. CLTL is wrapped in an efficient ETF vehicle which addresses potential challenges that come with using Treasury Bills as collateral pledge. Unlike Treasury Bills, CLTL has a single CUSIP and does not need ...

... such as dealing with multiple CUSIPs and rolling over frequently due to their short maturities. CLTL is wrapped in an efficient ETF vehicle which addresses potential challenges that come with using Treasury Bills as collateral pledge. Unlike Treasury Bills, CLTL has a single CUSIP and does not need ...

saving and investing slide show

... Price changes several times daily (value) Long term investment (20 years) High risk, not insured – could lose investment Buy low, sell high … Must sell ownership to see profit (profit = income= taxes) Sometimes Dividends are paid based on profit of company (Earnings to shareholder – pay tax) Paid on ...

... Price changes several times daily (value) Long term investment (20 years) High risk, not insured – could lose investment Buy low, sell high … Must sell ownership to see profit (profit = income= taxes) Sometimes Dividends are paid based on profit of company (Earnings to shareholder – pay tax) Paid on ...

Emergency Savings Accounts

... make.) Savings accounts are insured by the FDIC (for banks) or NCUA (for credit unions), so you won’t lose your money even if your financial institution goes out of business. In exchange for total liquidity and stability, savings accounts usually provide a very low investment return. Money market de ...

... make.) Savings accounts are insured by the FDIC (for banks) or NCUA (for credit unions), so you won’t lose your money even if your financial institution goes out of business. In exchange for total liquidity and stability, savings accounts usually provide a very low investment return. Money market de ...

The Word from Hansard - Alliance Partnership

... management team to join Invesco Perpetual has put the success story under threat, said analysts. The firm that has gathered the most asset this year so far is PIMCO, which has attracted EURO10.4bn in the third quarter alone and EURO23.1bn year to date. Meanwhile, Laurence Fink, chief executive offic ...

... management team to join Invesco Perpetual has put the success story under threat, said analysts. The firm that has gathered the most asset this year so far is PIMCO, which has attracted EURO10.4bn in the third quarter alone and EURO23.1bn year to date. Meanwhile, Laurence Fink, chief executive offic ...

Document in Word format - Hong Kong Monetary Authority

... system for a substantial increase in the amount of Exchange Fund paper. The demand is so great that the Exchange Fund short-term bills now have a negative yield, which means that the banks are even prepared to pay for holding them, instead of just sitting on the money in their clearing accounts. We ...

... system for a substantial increase in the amount of Exchange Fund paper. The demand is so great that the Exchange Fund short-term bills now have a negative yield, which means that the banks are even prepared to pay for holding them, instead of just sitting on the money in their clearing accounts. We ...

Reading Ch 2 A Tycoon Of The MUTUAL FUNDS

... especially those for municipal bonds, can provide tax- free interest. However, be sure to read all of the fine print to see if you qualify. Growth. These search out stocks that are most likely to experience a rapid price increase. The basic philosophy here is to buy low and sell high. Of course, thi ...

... especially those for municipal bonds, can provide tax- free interest. However, be sure to read all of the fine print to see if you qualify. Growth. These search out stocks that are most likely to experience a rapid price increase. The basic philosophy here is to buy low and sell high. Of course, thi ...

Document

... • This section will help you recognize and avoid different types of investment fraud. You'll also learn what questions to ask before investing, where to get information about companies, who to call for help, and what to do if you run into ...

... • This section will help you recognize and avoid different types of investment fraud. You'll also learn what questions to ask before investing, where to get information about companies, who to call for help, and what to do if you run into ...

Thought leadership | Financial Intelligence

... funds. Government and Treasury money market funds were exempted from new liquidity fees and redemption gates provisions and will continue to seek a $1.00 net asset value (NAV). However, under the forthcoming rules, government and Treasury funds could voluntarily adopt gates and/or fees, as long as a ...

... funds. Government and Treasury money market funds were exempted from new liquidity fees and redemption gates provisions and will continue to seek a $1.00 net asset value (NAV). However, under the forthcoming rules, government and Treasury funds could voluntarily adopt gates and/or fees, as long as a ...