Adjusting Entries

... Prepaid Expenses • Expenses paid in cash and recorded as assets before they are used – When the cost is incurred, an asset (prepaid) is increased (debited) to show the future service or benefit, and cash is decreased ...

... Prepaid Expenses • Expenses paid in cash and recorded as assets before they are used – When the cost is incurred, an asset (prepaid) is increased (debited) to show the future service or benefit, and cash is decreased ...

What is Accounting? - masif-emba-fais-s12

... Reproduction or translation of this work beyond that permitted in Section 117 of the 1976 United States Copyright Act without the express written permission of the copyright owner is unlawful. Request for further information should be addressed to the Permissions Department, John Wiley & Sons, Inc. ...

... Reproduction or translation of this work beyond that permitted in Section 117 of the 1976 United States Copyright Act without the express written permission of the copyright owner is unlawful. Request for further information should be addressed to the Permissions Department, John Wiley & Sons, Inc. ...

Honors Accounting - Rutherford Public Schools

... Honors Accounting I will prepare students for the rigor of college accounting. Students will develop an understanding of double-entry accounting. Topics covered include the following: accounting cycle, accounting systems, internal controls, journals, receivables and payables, accruals and deferrals, ...

... Honors Accounting I will prepare students for the rigor of college accounting. Students will develop an understanding of double-entry accounting. Topics covered include the following: accounting cycle, accounting systems, internal controls, journals, receivables and payables, accruals and deferrals, ...

Trading Volume Reaction to the Earnings Reconciliation from IFRS

... U.S. GAAP during the period of 1995-2004. They find that investors in the U.S. markets trade on the earnings reconciliation information from IAS to U.S. GAAP during this time period. They also find weak evidence that there is a short-term trading volume reaction in the local markets to the same earn ...

... U.S. GAAP during the period of 1995-2004. They find that investors in the U.S. markets trade on the earnings reconciliation information from IAS to U.S. GAAP during this time period. They also find weak evidence that there is a short-term trading volume reaction in the local markets to the same earn ...

accounting - WordPress.com

... This contrasts to the other major accounting method, accrual accounting, which requires income to be recognized in a company's books at the time the revenue is earned (but not necessarily received) and records expenses when liabilities are incurred (but not necessarily paid for). ...

... This contrasts to the other major accounting method, accrual accounting, which requires income to be recognized in a company's books at the time the revenue is earned (but not necessarily received) and records expenses when liabilities are incurred (but not necessarily paid for). ...

Chapter 16, TEST 16B

... _____ _____ 2. The multiple-step form of income statement lists all revenue items and their total, followed by all expense items and their total, to produce a difference that is either net income or net loss. _____ _____ 3. Gross sales plus sales returns and allowances is called net sales. _____ ___ ...

... _____ _____ 2. The multiple-step form of income statement lists all revenue items and their total, followed by all expense items and their total, to produce a difference that is either net income or net loss. _____ _____ 3. Gross sales plus sales returns and allowances is called net sales. _____ ___ ...

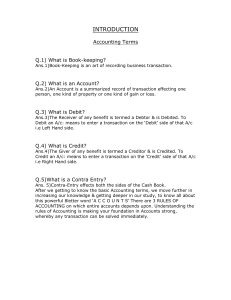

Basics Of Accounting

... increasing our knowledge & getting deeper in our study, to know all about this powerful 8letter word ‘A C C O U N T S’ There are 3 RULES OF ACCOUNTING on which entire accounts depends upon. Understanding the rules of Accounting is making your foundation in Accounts strong, whereby any transaction ca ...

... increasing our knowledge & getting deeper in our study, to know all about this powerful 8letter word ‘A C C O U N T S’ There are 3 RULES OF ACCOUNTING on which entire accounts depends upon. Understanding the rules of Accounting is making your foundation in Accounts strong, whereby any transaction ca ...

FIN_Course_SLO

... 2. Recommend whether to lease, buy, or mortgage a real property acquisition; 3. Justify whether to renovate, refinance, demolish or expand real property; 4. Evaluate when and how to divest (sell, trade, or abandon) real property. 5. Explain how real estate is defined physically and legally. 6. Expla ...

... 2. Recommend whether to lease, buy, or mortgage a real property acquisition; 3. Justify whether to renovate, refinance, demolish or expand real property; 4. Evaluate when and how to divest (sell, trade, or abandon) real property. 5. Explain how real estate is defined physically and legally. 6. Expla ...

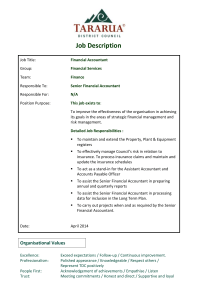

Application for Vacancy - Tararua District Council

... Note The above performance standards are provided as a guide only. The precise performance measures for this position will need further discussion between the jobholder and manager as part of the performance development process. ...

... Note The above performance standards are provided as a guide only. The precise performance measures for this position will need further discussion between the jobholder and manager as part of the performance development process. ...

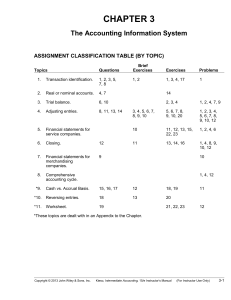

chap.3 - HCC Learning Web

... cycle. Adjusting entries are entries made at the end of accounting period to bring all accounts up to date on an accrual accounting basis so that correct financial statements can be prepared. Adjusting entries are necessary to achieve a proper matching of revenues and expenses in the determination o ...

... cycle. Adjusting entries are entries made at the end of accounting period to bring all accounts up to date on an accrual accounting basis so that correct financial statements can be prepared. Adjusting entries are necessary to achieve a proper matching of revenues and expenses in the determination o ...

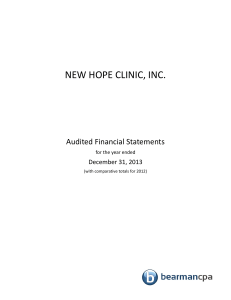

NHC Financial Statements

... We have audited the accompanying financial statements of New Hope Clinic, Inc. (“New Hope”), a nonprofit organization, which comprise the statement of financial position as of December 31, 2013, and the related statements of activities, functional expenses, and cash flows, for the year then ended, a ...

... We have audited the accompanying financial statements of New Hope Clinic, Inc. (“New Hope”), a nonprofit organization, which comprise the statement of financial position as of December 31, 2013, and the related statements of activities, functional expenses, and cash flows, for the year then ended, a ...

Financial Reporting Regulation, Information Asymmetry and

... the intuition: with the adoption of IFRS, firms operating in Greece were required to report related party transactions, discontinued operations, segment reporting, and cash flows statements (GAAP, 2001). This information can be valuable to external investors, both national and foreign, who are consi ...

... the intuition: with the adoption of IFRS, firms operating in Greece were required to report related party transactions, discontinued operations, segment reporting, and cash flows statements (GAAP, 2001). This information can be valuable to external investors, both national and foreign, who are consi ...

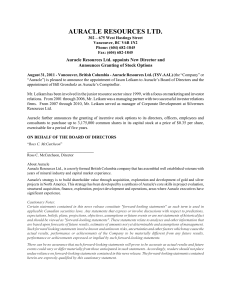

AURACLE RESOURCES LTD.

... projects in North America. This strategy has been developed by a synthesis of Auracle's core skills in project evaluation, structured acquisition, finance, exploration, project development and operations, areas where Auracle executives have significant experience. Cautionary Notes: Certain statement ...

... projects in North America. This strategy has been developed by a synthesis of Auracle's core skills in project evaluation, structured acquisition, finance, exploration, project development and operations, areas where Auracle executives have significant experience. Cautionary Notes: Certain statement ...

Accounting and Neoliberalism: A Critical - Research Online

... On the other hand and as seen in the spreading use of share options, the shift in the incentive structures of top decision makers has aligned management interest with that of institutional investors. Referring to Crotty (2005)’s research, the average proportion of the earnings of the top 100 CEO’s t ...

... On the other hand and as seen in the spreading use of share options, the shift in the incentive structures of top decision makers has aligned management interest with that of institutional investors. Referring to Crotty (2005)’s research, the average proportion of the earnings of the top 100 CEO’s t ...

Accounting I

... d. Show that the accounting equation is in balance. STANDARD 4 Students will identify and use source documents for journalizing transactions, post journal entries to a ledger, and prepare a trial balance. Objective 1: Use source documents to analyze business transactions. a. Identify different types ...

... d. Show that the accounting equation is in balance. STANDARD 4 Students will identify and use source documents for journalizing transactions, post journal entries to a ledger, and prepare a trial balance. Objective 1: Use source documents to analyze business transactions. a. Identify different types ...

ADVANCED ACCOUNTING (02)

... 12. The beginning merchandise inventory plus the net delivered cost of purchases minus the ending merchandise inventory equals the _______. A. total merchandise available for sale B. cost of goods sold C. gross profit on sales D. net income 13. The total of the balances in the creditor’s accounts sh ...

... 12. The beginning merchandise inventory plus the net delivered cost of purchases minus the ending merchandise inventory equals the _______. A. total merchandise available for sale B. cost of goods sold C. gross profit on sales D. net income 13. The total of the balances in the creditor’s accounts sh ...

Word Format - Years 11 and 12 - School Curriculum and Standards

... non-commercial purposes in educational institutions, provided that the School Curriculum and Standards Authority is acknowledged as the copyright owner, and that the Authority’s moral rights are not infringed. Copying or communication for any other purpose can be done only within the terms of the Co ...

... non-commercial purposes in educational institutions, provided that the School Curriculum and Standards Authority is acknowledged as the copyright owner, and that the Authority’s moral rights are not infringed. Copying or communication for any other purpose can be done only within the terms of the Co ...

Transparency, accountability and economic policy for governments

... of Australia, Canada, UK, the US and other jurisdictions require accrual accounting that uses standards that are not IPSAS or IPSAS based, with different approaches taken. The UK whole of government report uses IFRS, whereas the financial reports of the governments of Canada and the US use locally w ...

... of Australia, Canada, UK, the US and other jurisdictions require accrual accounting that uses standards that are not IPSAS or IPSAS based, with different approaches taken. The UK whole of government report uses IFRS, whereas the financial reports of the governments of Canada and the US use locally w ...

accounting standards and information: inferences from cross

... finds that U.S. GAAP earnings are more value-relevant than figures produced under Swiss national standards, but does not find a significant difference between Swiss GAAP and IAS. Second, in a similarly conceived exercise, Eccher and Healy (2000) find that Chinese investors appear to react no more s ...

... finds that U.S. GAAP earnings are more value-relevant than figures produced under Swiss national standards, but does not find a significant difference between Swiss GAAP and IAS. Second, in a similarly conceived exercise, Eccher and Healy (2000) find that Chinese investors appear to react no more s ...

General Fund

... Basic Principles: Category 3—Basis of Accounting • Pointers on recognizing EXPENDITURES: – Liabilities are recorded when they are incurred. – The offsetting debit will usually be to: • Expenditures (and thus reported in the current operating statement) OR • The Net Assets—Unrestricted account in th ...

... Basic Principles: Category 3—Basis of Accounting • Pointers on recognizing EXPENDITURES: – Liabilities are recorded when they are incurred. – The offsetting debit will usually be to: • Expenditures (and thus reported in the current operating statement) OR • The Net Assets—Unrestricted account in th ...

Lecture Syllabus Financial Assurance and

... (6) The significance and (actual and potential) consequences of external accounting (7) Ethics, public trust and the role of audit (8) The audit expectations gap (9) The nature of the audit in public sector organisations (10) The role of education, training and development for the audit practitioner ...

... (6) The significance and (actual and potential) consequences of external accounting (7) Ethics, public trust and the role of audit (8) The audit expectations gap (9) The nature of the audit in public sector organisations (10) The role of education, training and development for the audit practitioner ...

Governmental Funds

... Funds (one or more) To account for financial resources in which the government (or other designated trustee) is acting in a trustee capacity for the employees of the government to provide retirement benefits ...

... Funds (one or more) To account for financial resources in which the government (or other designated trustee) is acting in a trustee capacity for the employees of the government to provide retirement benefits ...

Financial Accounting and Accounting Standards

... First Level: Basic Objectives Financial reporting should provide information that: (a) is useful to present and potential investors and creditors and other users in making rational investment, credit, and similar decisions. (b) helps present and potential investors and creditors and other users in ...

... First Level: Basic Objectives Financial reporting should provide information that: (a) is useful to present and potential investors and creditors and other users in making rational investment, credit, and similar decisions. (b) helps present and potential investors and creditors and other users in ...

FINANCIAL STATEMENTS DECEMBER 31, 2015 toge

... Predisan-USA, Inc. We have audited the accompanying financial statements of Predisan-USA, Inc. ("Organization"), which comprise the statement of financial position as of December 31, 2015, and the related statements of activities, functional expenses and cash flows for the year then ended and the re ...

... Predisan-USA, Inc. We have audited the accompanying financial statements of Predisan-USA, Inc. ("Organization"), which comprise the statement of financial position as of December 31, 2015, and the related statements of activities, functional expenses and cash flows for the year then ended and the re ...