What Board Members Need to Know About Not-for

... the cash outflow? Trends. As with the other statements, looking at trends in the Statement of Cash Flows is important. How does your overall cash activity compare to the prior year? Are there any unexpected variances? Are your cash balances or reserves growing over time? If so, do you have an antici ...

... the cash outflow? Trends. As with the other statements, looking at trends in the Statement of Cash Flows is important. How does your overall cash activity compare to the prior year? Are there any unexpected variances? Are your cash balances or reserves growing over time? If so, do you have an antici ...

Jarden Corporation

... Stock-based compensation costs, which are included in selling, general and administrative expenses (“SG&A”), were $19.1 and $15.6 for the three months ended March 31, 2012 and 2011, respectively. Interest expense is net of interest income of $1.7 and $1.2 for the three months ended March 31, 2012 an ...

... Stock-based compensation costs, which are included in selling, general and administrative expenses (“SG&A”), were $19.1 and $15.6 for the three months ended March 31, 2012 and 2011, respectively. Interest expense is net of interest income of $1.7 and $1.2 for the three months ended March 31, 2012 an ...

ch0114-1 - Testbank Byte

... Purchase and sale of property, plant, and equipment would be common to all businesses—the types of assets would vary according to the type of business and some types of businesses require a larger investment in long-lived assets. A new business or expanding business would be more apt to acquire prop ...

... Purchase and sale of property, plant, and equipment would be common to all businesses—the types of assets would vary according to the type of business and some types of businesses require a larger investment in long-lived assets. A new business or expanding business would be more apt to acquire prop ...

chapter 1 power point notes

... using units of money as the common denominator. It assumes that the monetary unit is stable. Adjustments are not made for changes in currency value or inflation. ...

... using units of money as the common denominator. It assumes that the monetary unit is stable. Adjustments are not made for changes in currency value or inflation. ...

SIGNATURE THEATRE COMPANY, INC. FINANCIAL

... Company, Inc. (a not-for-profit corporation) as of June 30, 2011, and the related statements of activities and cash flows for the year then ended. These financial statements are the responsibility of the Organization’s management. Our responsibility is to express an opinion on these financial statem ...

... Company, Inc. (a not-for-profit corporation) as of June 30, 2011, and the related statements of activities and cash flows for the year then ended. These financial statements are the responsibility of the Organization’s management. Our responsibility is to express an opinion on these financial statem ...

Acc Plus Aut09

... reporting standards and are playing an increasingly important role in business combinations. They are obviously very difficult in practice to distinguish from goodwill but the IASB are convinced that by separating them from goodwill it helps to better explain what assets the acquirer has actually bo ...

... reporting standards and are playing an increasingly important role in business combinations. They are obviously very difficult in practice to distinguish from goodwill but the IASB are convinced that by separating them from goodwill it helps to better explain what assets the acquirer has actually bo ...

Weygandt_FinMan_PowerPoint_Review_Ch15

... Indicate whether the following statements are true or false. 4. Managers’ activities and responsibilities can be classified False ...

... Indicate whether the following statements are true or false. 4. Managers’ activities and responsibilities can be classified False ...

Download attachment

... protocol based on XBRL: taxonomy currently being developed by CEBS – The initiative of developing an XBRL taxonomy for COREP was supported by the industry in the public consultation process that ended on 30 April ...

... protocol based on XBRL: taxonomy currently being developed by CEBS – The initiative of developing an XBRL taxonomy for COREP was supported by the industry in the public consultation process that ended on 30 April ...

Financial Accounting and Accounting Standards

... accounting period in which it is earned. b. Companies should match expenses with revenues. c. The economic life of a business can be divided into artificial time periods. d. The fiscal year should correspond with the calendar ...

... accounting period in which it is earned. b. Companies should match expenses with revenues. c. The economic life of a business can be divided into artificial time periods. d. The fiscal year should correspond with the calendar ...

Materiality in Planning and Performing an Audit

... (for example, a significant business acquisition); and relevant changes of conditions in the industry or economic environment in which the entity operates. For example, when, as a starting point, materiality for the financial statements as a whole is determined for a particular entity based on a per ...

... (for example, a significant business acquisition); and relevant changes of conditions in the industry or economic environment in which the entity operates. For example, when, as a starting point, materiality for the financial statements as a whole is determined for a particular entity based on a per ...

Chapter 3 Using Accrual Accounting to Measure Income

... Prepare and post adjusting entries. Prepare an adjusted trial balance to ensure accuracy of debits and credits after posting. Prepare financial statements. ...

... Prepare and post adjusting entries. Prepare an adjusted trial balance to ensure accuracy of debits and credits after posting. Prepare financial statements. ...

FASB: Status of Statement 5

... Disclosure of the nature of an accrual 5 made pursuant to the provisions of paragraph 8, and in some circumstances the amount accrued, may be necessary for the financial statements not to be misleading. 10. If no accrual is made for a loss contingency because one or both of the conditions in paragra ...

... Disclosure of the nature of an accrual 5 made pursuant to the provisions of paragraph 8, and in some circumstances the amount accrued, may be necessary for the financial statements not to be misleading. 10. If no accrual is made for a loss contingency because one or both of the conditions in paragra ...

FASB: Status of Statement 5

... Disclosure of the nature of an accrual 5 made pursuant to the provisions of paragraph 8, and in some circumstances the amount accrued, may be necessary for the financial statements not to be misleading. 10. If no accrual is made for a loss contingency because one or both of the conditions in paragra ...

... Disclosure of the nature of an accrual 5 made pursuant to the provisions of paragraph 8, and in some circumstances the amount accrued, may be necessary for the financial statements not to be misleading. 10. If no accrual is made for a loss contingency because one or both of the conditions in paragra ...

Slide 1 - Cengage

... in price to $2,500 shortly after purchasing it, the value in the accounting records remains the same. Any change in the market value of the asset does not get reflected in the accounting records. This principle is followed even when the value of the asset increases. Click to continue. ...

... in price to $2,500 shortly after purchasing it, the value in the accounting records remains the same. Any change in the market value of the asset does not get reflected in the accounting records. This principle is followed even when the value of the asset increases. Click to continue. ...

classified balance sheet

... A net income of $78,700 ($678,450 – $599,750) would be reported. When the Debit column of the Balance Sheet columns is more than the Credit column, net income is reported. If the Credit column exceeds the Debit column, a net loss is reported. ...

... A net income of $78,700 ($678,450 – $599,750) would be reported. When the Debit column of the Balance Sheet columns is more than the Credit column, net income is reported. If the Credit column exceeds the Debit column, a net loss is reported. ...

ch02_sm_rankin

... range of users in making economic decisions. Financial statements also show the results of the management’s stewardship of the resources entrusted to it. To meet this objective, financial statements provide information about an entity’s: (a) assets; (b) liabilities; (c) equity; (d) income and expens ...

... range of users in making economic decisions. Financial statements also show the results of the management’s stewardship of the resources entrusted to it. To meet this objective, financial statements provide information about an entity’s: (a) assets; (b) liabilities; (c) equity; (d) income and expens ...

schedule of deadlines for the june 30, 2017 preliminary ledger

... During June and the first few weeks of July - up to the June Preliminary Ledger close on July 14. During this period, please monitor June financial activity with the use of the On-Line Financial System Reports or FS-QDB - GL Open Transactions. Please make sure to post expense transfers, income and e ...

... During June and the first few weeks of July - up to the June Preliminary Ledger close on July 14. During this period, please monitor June financial activity with the use of the On-Line Financial System Reports or FS-QDB - GL Open Transactions. Please make sure to post expense transfers, income and e ...

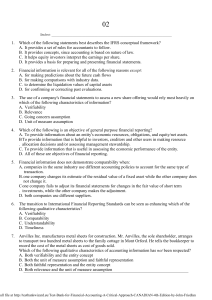

1. Which of the following statements best describes the IFRS

... A. To provide users with easy comparison with the industry. B. To provide users with a perspective on the economy. C. Because making comparisons using accounting information can be difficult and misleading. D. Because making comparisons significantly contributes to the interpretation of accounting i ...

... A. To provide users with easy comparison with the industry. B. To provide users with a perspective on the economy. C. Because making comparisons using accounting information can be difficult and misleading. D. Because making comparisons significantly contributes to the interpretation of accounting i ...

Asset section of the balance sheet

... Separate entity. Activities of the business are separate from activities of the owners, all other persons and other entities Unit-of-measure assumption states that accounting information should be measured and reported in the national monetary unit. Continuity (going-concern) assumption states that ...

... Separate entity. Activities of the business are separate from activities of the owners, all other persons and other entities Unit-of-measure assumption states that accounting information should be measured and reported in the national monetary unit. Continuity (going-concern) assumption states that ...

Sample September / December 2015 answers

... is a risk that revenue and profits may be overstated. Revenue has increased by 2·2% and profit before tax by 6·5%, which may indicate overstatement. Disclosure for listed companies This is the first set of financial statements produced since Dali Co became listed. There is a risk that the new financ ...

... is a risk that revenue and profits may be overstated. Revenue has increased by 2·2% and profit before tax by 6·5%, which may indicate overstatement. Disclosure for listed companies This is the first set of financial statements produced since Dali Co became listed. There is a risk that the new financ ...

Accounting I - Mr. K`s Pages

... will not be allowed references on exams. The points will be converted into a final grade. The final grading scale is as follows: 100% - 90% = A 89% - 80% = B 79% - 70% = C 69% - 60% = D Below 59% = F These competencies represent the minimum requirements necessary to gain credit for this co ...

... will not be allowed references on exams. The points will be converted into a final grade. The final grading scale is as follows: 100% - 90% = A 89% - 80% = B 79% - 70% = C 69% - 60% = D Below 59% = F These competencies represent the minimum requirements necessary to gain credit for this co ...

Financial capital

... No. 2 of Seville a request for official recognition of a standstill contract backed by over 75 % of the creditors to whom it was addressed. This standstill agreement was officially recognized by the same court on April 6, 2016, granting Abengoa a maximum period of seven months, from that time, to co ...

... No. 2 of Seville a request for official recognition of a standstill contract backed by over 75 % of the creditors to whom it was addressed. This standstill agreement was officially recognized by the same court on April 6, 2016, granting Abengoa a maximum period of seven months, from that time, to co ...

Impact of Inflation Accounting Application on Key Financial Ratios

... accounting were significiantly different from IAS 29. According to Taw Law, only balance sheets of companies were required to be adjusted. Items of income statements were not adjusted but the net monetary profit or loss was taken into account. Those two different regulations, The Law 5024 and Commun ...

... accounting were significiantly different from IAS 29. According to Taw Law, only balance sheets of companies were required to be adjusted. Items of income statements were not adjusted but the net monetary profit or loss was taken into account. Those two different regulations, The Law 5024 and Commun ...

preference shares - LPS Business Department

... Shares are the equal parts into which a company’s capital is divided ORDINARY SHARES (equity shares) These are the most common type of share. • The ordinary shareholders are the owners of the business and as such have voting rights. This means that the have control of the company. They appoint and d ...

... Shares are the equal parts into which a company’s capital is divided ORDINARY SHARES (equity shares) These are the most common type of share. • The ordinary shareholders are the owners of the business and as such have voting rights. This means that the have control of the company. They appoint and d ...