* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

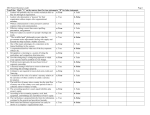

Download 1. Which of the following statements best describes the IFRS

Microsoft Dynamics GP wikipedia , lookup

Auditor's report wikipedia , lookup

Sustainability accounting wikipedia , lookup

Internal control wikipedia , lookup

Mergers and acquisitions wikipedia , lookup

Debits and credits wikipedia , lookup

Accounting ethics wikipedia , lookup

Going concern wikipedia , lookup

Mark-to-market accounting wikipedia , lookup

International Financial Reporting Standards wikipedia , lookup