Does a Change in a Logo Affect the Value of the Brand? The Case

... hiring Schultz because he was from New York and did not fully align with the company’s principles. He was set on franchising the Starbucks enterprise throughout America. Schultz was so convinced that Starbucks had endless potential that he offered to take a salary cut in exchange for a stake in the ...

... hiring Schultz because he was from New York and did not fully align with the company’s principles. He was set on franchising the Starbucks enterprise throughout America. Schultz was so convinced that Starbucks had endless potential that he offered to take a salary cut in exchange for a stake in the ...

Chapter Accounting for Leases - McGraw Hill Higher Education

... appear in the reporting entity’s statement of financial position. A lessee does not have legal title to the leased asset during the lease term. However, should lack of legal ownership preclude the lessee’s reporting of the asset, and related liability, in the statement of financial position? As the ...

... appear in the reporting entity’s statement of financial position. A lessee does not have legal title to the leased asset during the lease term. However, should lack of legal ownership preclude the lessee’s reporting of the asset, and related liability, in the statement of financial position? As the ...

Defence Audit Guidelines_Final 25 March 2010

... DAGP prepared guidelines pertaining to different sectors and departments. Some of these guidelines are specific to an office (e.g. DG, Works), while the others are applicable across the board (Environment). These Guidelines were circulated among the FAOs for use. However, they were not found helpful ...

... DAGP prepared guidelines pertaining to different sectors and departments. Some of these guidelines are specific to an office (e.g. DG, Works), while the others are applicable across the board (Environment). These Guidelines were circulated among the FAOs for use. However, they were not found helpful ...

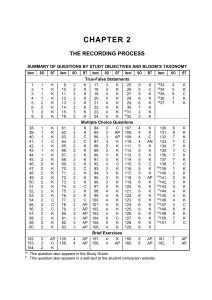

chapter 2

... 1. Explain what an account is and how it helps in the recording process. An account is a record of increases and decreases in specific asset, liability, and owner's equity items. 2. Define debits and credits and explain their use in recording business transactions. The terms debit and credit are syn ...

... 1. Explain what an account is and how it helps in the recording process. An account is a record of increases and decreases in specific asset, liability, and owner's equity items. 2. Define debits and credits and explain their use in recording business transactions. The terms debit and credit are syn ...

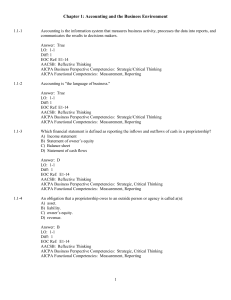

Chapter 1 - Test Bank

... The AICPA's Code of Professional Conduct for Accountants provides guidance to CPAs in the performance of their work. Answer: True LO: 1-3 Diff: 1 EOC Ref: E1-15 AACSB: Reflective Thinking AICPA Business Perspective Competencies: Legal, Regulatory AICPA Functional Competencies: Reporting, Decision Mo ...

... The AICPA's Code of Professional Conduct for Accountants provides guidance to CPAs in the performance of their work. Answer: True LO: 1-3 Diff: 1 EOC Ref: E1-15 AACSB: Reflective Thinking AICPA Business Perspective Competencies: Legal, Regulatory AICPA Functional Competencies: Reporting, Decision Mo ...

A literature review on the evolving framework of bitcoin and its

... unconventional nature, bitcoin is financially valuable, and thus should be within the scope of accountants, as all other assets are. Availability as Securities Bitcoin exposure has become available in various forms of securities as well, aside from as a standalone virtual currency. The most relevant ...

... unconventional nature, bitcoin is financially valuable, and thus should be within the scope of accountants, as all other assets are. Availability as Securities Bitcoin exposure has become available in various forms of securities as well, aside from as a standalone virtual currency. The most relevant ...

Personal Financial Statements, Pro Forma

... Financial Plans, may also apply to personal financial statement engagements. SSARS No. 6 provides an exemption from SSARS No. 1 (e.g., no compilation or review report is required nor the related procedures) for personal financial statements included in written personal financial plans if the followi ...

... Financial Plans, may also apply to personal financial statement engagements. SSARS No. 6 provides an exemption from SSARS No. 1 (e.g., no compilation or review report is required nor the related procedures) for personal financial statements included in written personal financial plans if the followi ...

Table of Contents - Ontario Energy Board

... It should be recognized that in issuing this APH, no rule of general application can be phrased to suit all circumstances or combination of circumstances that may arise, nor is there any substitute for the exercise of professional judgment in the determination of what constitutes fair presentation o ...

... It should be recognized that in issuing this APH, no rule of general application can be phrased to suit all circumstances or combination of circumstances that may arise, nor is there any substitute for the exercise of professional judgment in the determination of what constitutes fair presentation o ...

FINANCIAL ACCOUNTING : MEANING, NATURE AND ROLE OF

... Accounting Practice, Auditing and Business Law. The members of the professional bodies usually have their own associations or organisations, where in they are required to be enrolled compulsorily as Associate member of the Institute of Chartered Accountants (A.C.A.) and fellow of the Institute of Ch ...

... Accounting Practice, Auditing and Business Law. The members of the professional bodies usually have their own associations or organisations, where in they are required to be enrolled compulsorily as Associate member of the Institute of Chartered Accountants (A.C.A.) and fellow of the Institute of Ch ...

MANDATORY EMPHASIS PARAGRAPHS, CLARIFYING

... in the audit report (PCAOB 2011b).1 Some have suggested that such changes to the current form of the audit report could result in increased auditor legal liability (PCAOB 2011a). However, extant research provides little empirical evidence regarding this potential effect. This study specifically addr ...

... in the audit report (PCAOB 2011b).1 Some have suggested that such changes to the current form of the audit report could result in increased auditor legal liability (PCAOB 2011a). However, extant research provides little empirical evidence regarding this potential effect. This study specifically addr ...

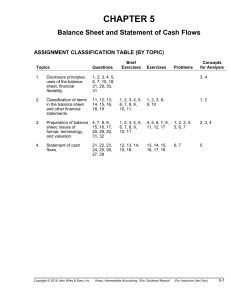

assignment classification table (by topic)

... 19. Battle is incorrect. Retained earnings is a source of assets, but is not an asset itself. For example, even though the funds obtained from issuing a note payable are invested in the business, the note payable is not reported as an asset. It is a source of assets, but it is reported as a liabilit ...

... 19. Battle is incorrect. Retained earnings is a source of assets, but is not an asset itself. For example, even though the funds obtained from issuing a note payable are invested in the business, the note payable is not reported as an asset. It is a source of assets, but it is reported as a liabilit ...

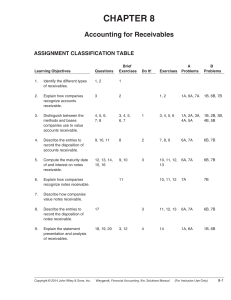

CHAPTER 8 Accounting for Receivables

... Under the direct write-off method, bad debt losses are not estimated and no allowance account is used. When an account is determined to be uncollectible, the loss is debited to Bad Debt Expense. The direct write-off method makes no attempt to match bad debt expense to sales revenues or to show the c ...

... Under the direct write-off method, bad debt losses are not estimated and no allowance account is used. When an account is determined to be uncollectible, the loss is debited to Bad Debt Expense. The direct write-off method makes no attempt to match bad debt expense to sales revenues or to show the c ...

Returns to Buying Earnings and Book Value: Accounting for Growth

... confirmed sale in the market -- are met, all the more so when earnings realizations are deemed particularly uncertain (as in the case of R&D activities, for example). The accounting treatment ties back to risky dividends: dividends are paid out of book value so dividends cannot be paid until earning ...

... confirmed sale in the market -- are met, all the more so when earnings realizations are deemed particularly uncertain (as in the case of R&D activities, for example). The accounting treatment ties back to risky dividends: dividends are paid out of book value so dividends cannot be paid until earning ...

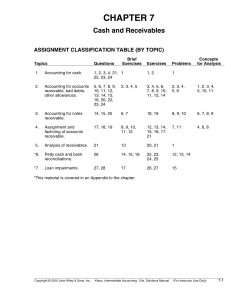

CHAPTER 7 Cash and Receivables

... Allowance for Doubtful Accounts is credited with a percentage of the current year’s credit or total sales. The rate is determined by reference to the relationship between prior years’ credit or total sales and actual bad debts arising therefrom. Consideration should also be given to changes in credi ...

... Allowance for Doubtful Accounts is credited with a percentage of the current year’s credit or total sales. The rate is determined by reference to the relationship between prior years’ credit or total sales and actual bad debts arising therefrom. Consideration should also be given to changes in credi ...

Wey Fin 7e Ch03 chapterspecific

... Consumer electronic products account for about 40% of the lead found in landfills. Environmental groups put a resolution on a recent Apple Computer’s shareholder meeting agenda requiring the company to study how it can increase recycling. The average household has two to three old computers in i ...

... Consumer electronic products account for about 40% of the lead found in landfills. Environmental groups put a resolution on a recent Apple Computer’s shareholder meeting agenda requiring the company to study how it can increase recycling. The average household has two to three old computers in i ...

SMS203 - National Open University of Nigeria

... Every proprietor of a business has invested money in his business. This money is used to buy goods and services which he intends to sell at a later date and, very often, to buy the premises, fixtures, machinery, etc. required to carry on the business. The amount of money which he invests in his busi ...

... Every proprietor of a business has invested money in his business. This money is used to buy goods and services which he intends to sell at a later date and, very often, to buy the premises, fixtures, machinery, etc. required to carry on the business. The amount of money which he invests in his busi ...

Chapter 3 - Bellevue College

... Consumer electronic products account for about 40% of the lead found in landfills. Environmental groups put a resolution on a recent Apple Computer’s shareholder meeting agenda requiring the company to study how it can increase recycling. The average household has two to three old computers in i ...

... Consumer electronic products account for about 40% of the lead found in landfills. Environmental groups put a resolution on a recent Apple Computer’s shareholder meeting agenda requiring the company to study how it can increase recycling. The average household has two to three old computers in i ...

Chapter 01 Financial Statements and Business Decisions

... A. It includes a listing of assets at their market values. B. It includes a listing of assets, liabilities, and stockholders' equity at their market values. C. It provides information pertaining to a company's assets and the providers of the assets. D. It provides information pertaining to a company ...

... A. It includes a listing of assets at their market values. B. It includes a listing of assets, liabilities, and stockholders' equity at their market values. C. It provides information pertaining to a company's assets and the providers of the assets. D. It provides information pertaining to a company ...

NONCURRENT ASSETS

... • Of the property, plant, and equipment assets, land alone is not depreciated. ...

... • Of the property, plant, and equipment assets, land alone is not depreciated. ...

The Effect of Audit Firm Specialization on Earnings Management

... monitoring role, an information role and an insurance role) (Wallace, 1981). How the auditor fulfils these roles determines the level of audit quality (Fernando et al., 2010). Audit quality is an important market performance measure in the market for audit services. The extent of industry-based expe ...

... monitoring role, an information role and an insurance role) (Wallace, 1981). How the auditor fulfils these roles determines the level of audit quality (Fernando et al., 2010). Audit quality is an important market performance measure in the market for audit services. The extent of industry-based expe ...

Auditing for Fraud Detection - Professional Education Services

... Auditors. This course is sold with the understanding that the publisher is not engaged in rendering legal, accounting, or other professional advice and assumes no liability whatsoever in connection with its use. Since tax laws are constantly changing, and are subject to differing interpretations, we ...

... Auditors. This course is sold with the understanding that the publisher is not engaged in rendering legal, accounting, or other professional advice and assumes no liability whatsoever in connection with its use. Since tax laws are constantly changing, and are subject to differing interpretations, we ...

Download attachment

... 3. There are various supportable views on whether existing auditing standards or the CASs should be applied to the January 1, 2010 opening statement of financial position. Therefore, in auditing this financial statement, the auditor may choose to apply: (a) the auditing standards in Part II of the ...

... 3. There are various supportable views on whether existing auditing standards or the CASs should be applied to the January 1, 2010 opening statement of financial position. Therefore, in auditing this financial statement, the auditor may choose to apply: (a) the auditing standards in Part II of the ...

Guidance on the Determination of Realised Profits and

... Under common law, a company cannot lawfully make a distribution out of capital. Thus, the directors must consider, both at the time of proposing the distribution and at the time it is made (see paragraph 2.10 below), whether the company, subsequent to the balance sheet date to which the „relevant ac ...

... Under common law, a company cannot lawfully make a distribution out of capital. Thus, the directors must consider, both at the time of proposing the distribution and at the time it is made (see paragraph 2.10 below), whether the company, subsequent to the balance sheet date to which the „relevant ac ...

FREE Sample Here - Find the cheapest test bank for your

... Full file at http://testbankeasy.eu/Test-bank-for-Accounting,-25th-Edition---Carl-S.-Warren 81. Denzel Jones owns and operates Crystal Cleaning Company. Recently, Denzel withdrew $10,000 from Crystal Cleaning, and he contributed $6,000, in his name, to Habitat for Humanity. The contribution of the ...

... Full file at http://testbankeasy.eu/Test-bank-for-Accounting,-25th-Edition---Carl-S.-Warren 81. Denzel Jones owns and operates Crystal Cleaning Company. Recently, Denzel withdrew $10,000 from Crystal Cleaning, and he contributed $6,000, in his name, to Habitat for Humanity. The contribution of the ...