Environmental Account Framing Workbook

... extensive process requiring rigorous attention to detail and involving input from a range of stakeholders including experts familiar with the account subject. Many aspects require adherence to standards (accredited or de facto) to ensure the quality of the final account. Components of the process su ...

... extensive process requiring rigorous attention to detail and involving input from a range of stakeholders including experts familiar with the account subject. Many aspects require adherence to standards (accredited or de facto) to ensure the quality of the final account. Components of the process su ...

Empirical evidence on liability caps and earnings management in

... and reached a conclusion that liability caps do not affect audit quality. The study greatly contributed to the European Commission’s recommendation on the matter (European Commission 2008b). It identifies three main reasons why auditors’ liability in Europe should be limited: (1) the poor availabili ...

... and reached a conclusion that liability caps do not affect audit quality. The study greatly contributed to the European Commission’s recommendation on the matter (European Commission 2008b). It identifies three main reasons why auditors’ liability in Europe should be limited: (1) the poor availabili ...

Financial Accounting and Accounting Standards

... since initial recognition, although the decrease cannot yet be identified with individual assets in the group. ...

... since initial recognition, although the decrease cannot yet be identified with individual assets in the group. ...

Fund - McGraw Hill Higher Education - McGraw

... Differences Between Governmental and Private Sector Accounting Major differences between governmental and for-profit entities are as follow: 5. Accountability for the flow of financial resources is a chief objective of governmental accounting. 6. Governmental entities typically are required to es ...

... Differences Between Governmental and Private Sector Accounting Major differences between governmental and for-profit entities are as follow: 5. Accountability for the flow of financial resources is a chief objective of governmental accounting. 6. Governmental entities typically are required to es ...

(revised) compilation engagements

... a reported item in the financial information, and the amount, classification, presentation, or disclosure that is required for the item to be in accordance with the applicable financial reporting framework. Misstatements can arise from error or fraud. Where the financial information is prepared in a ...

... a reported item in the financial information, and the amount, classification, presentation, or disclosure that is required for the item to be in accordance with the applicable financial reporting framework. Misstatements can arise from error or fraud. Where the financial information is prepared in a ...

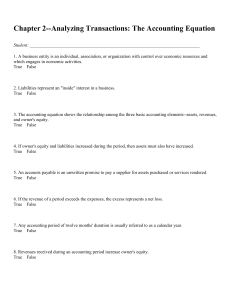

Chapter 2--Analyzing Transactions: The Accounting Equation

... 1. The excess of total revenues over total expenses for the period. 2. A separate record used to summarize changes in each asset, liability, and owner's equity of a business. 3. A formal written promise to pay a supplier or lender a specified sum of money at a definite future time. 4. Withdrawals th ...

... 1. The excess of total revenues over total expenses for the period. 2. A separate record used to summarize changes in each asset, liability, and owner's equity of a business. 3. A formal written promise to pay a supplier or lender a specified sum of money at a definite future time. 4. Withdrawals th ...

accounting revision notes and assessment tasks

... 1. True profits cannot be known – since detailed information about the expenses etc. is not available and true profits cannot known. 2. Financial position of the business cannot be ascertained – under this system statement of affairs is prepared in an unsatisfactory manner thus exact position of tot ...

... 1. True profits cannot be known – since detailed information about the expenses etc. is not available and true profits cannot known. 2. Financial position of the business cannot be ascertained – under this system statement of affairs is prepared in an unsatisfactory manner thus exact position of tot ...

Financial Accounting and Accounting Standards

... a. Companies should recognize revenue in the accounting period in which it is earned. b. Companies should match expenses with revenues. c. The economic life of a business can be divided into artificial time periods. d. The fiscal year should correspond with the calendar ...

... a. Companies should recognize revenue in the accounting period in which it is earned. b. Companies should match expenses with revenues. c. The economic life of a business can be divided into artificial time periods. d. The fiscal year should correspond with the calendar ...

CONCEPTS AND COSTS FOR THE MAINTENANCE OF

... assumed to exist in the current market price (Milham 1994). This methodology has been accepted by economists, governments and accounting standard setters as the theoretically correct value but not by accounting practitioners because of the level of subjectivity. Market price is an imperfect surrogat ...

... assumed to exist in the current market price (Milham 1994). This methodology has been accepted by economists, governments and accounting standard setters as the theoretically correct value but not by accounting practitioners because of the level of subjectivity. Market price is an imperfect surrogat ...

Introduction to Accounting

... If money invested by owners was reported as revenue, this would be counter to the fundamental definition of revenue (i.e. that it results from the operations of the company). The separation of income and capital is a fundamental concept of financial accounting. ...

... If money invested by owners was reported as revenue, this would be counter to the fundamental definition of revenue (i.e. that it results from the operations of the company). The separation of income and capital is a fundamental concept of financial accounting. ...

Flexible-budget variance

... Caution is appropriate before interpreting the productionvolume variance as a measure of the economic cost of unused capacity. • One caveat is that management may have maintained some extra capacity to meet uncertain demand surges that are important to satisfy customer demands. • A second caveat i ...

... Caution is appropriate before interpreting the productionvolume variance as a measure of the economic cost of unused capacity. • One caveat is that management may have maintained some extra capacity to meet uncertain demand surges that are important to satisfy customer demands. • A second caveat i ...

ANNEX Section 1. Cost accounting and accounting

... Accounting separation requirements could be developed starting from historical cost accounting “HCA”; in order to send improved competitive signals to the market, a forward looking cost approach, based on current cost accounting [“CCA”], should be developed as well. If a national regulator decides t ...

... Accounting separation requirements could be developed starting from historical cost accounting “HCA”; in order to send improved competitive signals to the market, a forward looking cost approach, based on current cost accounting [“CCA”], should be developed as well. If a national regulator decides t ...

Financial Accounting and Accounting Standards

... the next payment of salaries will not occur until November 9. The employees receive total salaries of $2,000 for a five-day work week, or $400 per day. Thus, accrued salaries at October 31 are ...

... the next payment of salaries will not occur until November 9. The employees receive total salaries of $2,000 for a five-day work week, or $400 per day. Thus, accrued salaries at October 31 are ...

Initial Accounting of Inventory

... in protecting their rights, in managing their financial resources, and in developing or regaining their abilities to the maximum extent possible; and that accomplishes these objectives through providing, in each case, the form of assistance that least interferes with the legal capacity of a person t ...

... in protecting their rights, in managing their financial resources, and in developing or regaining their abilities to the maximum extent possible; and that accomplishes these objectives through providing, in each case, the form of assistance that least interferes with the legal capacity of a person t ...

framework for the preparation and presentation of financial

... groups, and recipients of goods, services and transfers provided or made by government. Taxpayers are required to provide resources to the government and other entities and are interested in information about how the funds have been used. They are also interested in information on whether the govern ...

... groups, and recipients of goods, services and transfers provided or made by government. Taxpayers are required to provide resources to the government and other entities and are interested in information about how the funds have been used. They are also interested in information on whether the govern ...

Read the full report

... Garry is a Professor of Accounting and Head, School of Accounting at RMIT University. He has been employed in the Australian higher education sector since 1985 after gaining experience in the IT industry, professional accounting services and in the financial services industry. His published research ...

... Garry is a Professor of Accounting and Head, School of Accounting at RMIT University. He has been employed in the Australian higher education sector since 1985 after gaining experience in the IT industry, professional accounting services and in the financial services industry. His published research ...

Accounting Concepts - Association of Certified Fraud Examiners

... The statement of cash flows reports a company’s sources and uses of cash during the accounting period. Often used by potential investors and other interested parties in tandem with the income statement to determine a company’s true financial performance. The statement of cash flows is broken d ...

... The statement of cash flows reports a company’s sources and uses of cash during the accounting period. Often used by potential investors and other interested parties in tandem with the income statement to determine a company’s true financial performance. The statement of cash flows is broken d ...

FREE Sample Here - Find the cheapest test bank for your

... standards. ANS: F 39. The IASC does not have authority to enforce its standards, but these standards have been adopted in whole or in part by many countries. ANS: T 40. Domestic accounting standards have developed to meet the needs of international environments. ANS: F 41. It is generally recognized ...

... standards. ANS: F 39. The IASC does not have authority to enforce its standards, but these standards have been adopted in whole or in part by many countries. ANS: T 40. Domestic accounting standards have developed to meet the needs of international environments. ANS: F 41. It is generally recognized ...

Approved form - Australian Prudential Regulation Authority

... superannuation entity], which comprise part of the APRA Annual Return, for the [year / period] ended .../.../.... I have conducted an independent reasonable assurance engagement on the relevant forms in order to express an opinion on them to the [trustee / trustees] of ………………………. [insert name of the ...

... superannuation entity], which comprise part of the APRA Annual Return, for the [year / period] ended .../.../.... I have conducted an independent reasonable assurance engagement on the relevant forms in order to express an opinion on them to the [trustee / trustees] of ………………………. [insert name of the ...

PDF

... indicator frameworks listed below. Our inventory is by no means exhaustive. What we sought was an organic process by which improvements could be made over time to the GPI framework through application, experimentation and further research. Our goal is to improve the elegance and practicality of the ...

... indicator frameworks listed below. Our inventory is by no means exhaustive. What we sought was an organic process by which improvements could be made over time to the GPI framework through application, experimentation and further research. Our goal is to improve the elegance and practicality of the ...

Revenue recognition: determinants of the accounts receivable and

... 2.3 The importance of a good revenue recognition system The importance of revenue recognition (rules) is big for managers, standard setters, investors and auditors. The amount as well as the timing of revenue recognition is important. Many decisions of investors depend on the effects that revenue r ...

... 2.3 The importance of a good revenue recognition system The importance of revenue recognition (rules) is big for managers, standard setters, investors and auditors. The amount as well as the timing of revenue recognition is important. Many decisions of investors depend on the effects that revenue r ...

Key concepts for accounting for biodiversity

... hierarchy such as populations, species and ecosystems will be the focus of environmental accounting. Indeed, it has been proposed that landscapes (featuring multiple ecosystems) are an appropriate scale for managing biodiversity [7]. Accounting at the ecosystem level is the subject of an issues pape ...

... hierarchy such as populations, species and ecosystems will be the focus of environmental accounting. Indeed, it has been proposed that landscapes (featuring multiple ecosystems) are an appropriate scale for managing biodiversity [7]. Accounting at the ecosystem level is the subject of an issues pape ...

Research exercise on charities SORP (FRS 102)

... SORP Committee member suggestions for changes to the SORP Charity regulator themes for making changes to the SORP Your ideas for items to remove, change or add to improve the SORP Responses are welcome on one of more of the areas identified. If responding to two or more areas, you may wish ...

... SORP Committee member suggestions for changes to the SORP Charity regulator themes for making changes to the SORP Your ideas for items to remove, change or add to improve the SORP Responses are welcome on one of more of the areas identified. If responding to two or more areas, you may wish ...