PJM Manual 28:

... Introduction................................................................................................. 9 About PJM Manuals............................................................................................................ 9 About This Manual........................................... ...

... Introduction................................................................................................. 9 About PJM Manuals............................................................................................................ 9 About This Manual........................................... ...

FREE Sample Here

... Bloom’s: Remembering LEARNING OBJECTIVES: ACCT.WARD.16.01-01 - 01-01 ACCREDITING STANDARDS: ACCT.ACBSP.APC.02 - GAAP ACCT.AICPA.BB.03 - Legal ACCT.AICPA.FN.03 - MeasurementBUSPROG: Ethics 9. A business is an organization in which basic resources or inputs, like materials and labor, are assembled and ...

... Bloom’s: Remembering LEARNING OBJECTIVES: ACCT.WARD.16.01-01 - 01-01 ACCREDITING STANDARDS: ACCT.ACBSP.APC.02 - GAAP ACCT.AICPA.BB.03 - Legal ACCT.AICPA.FN.03 - MeasurementBUSPROG: Ethics 9. A business is an organization in which basic resources or inputs, like materials and labor, are assembled and ...

Revised Guidance Statement GS 009: Auditing SMSFs

... useful in planning, conducting and reporting their audits, but it does not relate specifically to APRA funds. See Division 1, Section 6 of the SISA. Regulated funds, under section 19 of the SISA, are funds which have a trustee, either a corporate trustee or governing rules which contain a pension fu ...

... useful in planning, conducting and reporting their audits, but it does not relate specifically to APRA funds. See Division 1, Section 6 of the SISA. Regulated funds, under section 19 of the SISA, are funds which have a trustee, either a corporate trustee or governing rules which contain a pension fu ...

Ethical Leadership for Machiavellians in Business by

... singular focus has led to many examples of unethical corporate behaviour. If there is a way to convince Machiavellian business leaders to make more ethical business decisions, future harms can be avoided. So, the hope is that one of the most ethical leadership theories is powerful enough to combat o ...

... singular focus has led to many examples of unethical corporate behaviour. If there is a way to convince Machiavellian business leaders to make more ethical business decisions, future harms can be avoided. So, the hope is that one of the most ethical leadership theories is powerful enough to combat o ...

FINANCIAL ACCOUNTING : MEANING, NATURE AND ROLE OF

... ascertaining the net profit earned or loss suffered on account of carrying the business. This is done by keeping a proper record of revenues and expense of a particular period. The Profit and Loss Account is prepared at the end of a period and if the amount of revenue for the period is more than the ...

... ascertaining the net profit earned or loss suffered on account of carrying the business. This is done by keeping a proper record of revenues and expense of a particular period. The Profit and Loss Account is prepared at the end of a period and if the amount of revenue for the period is more than the ...

Table of Contents - Ontario Energy Board

... It should be recognized that in issuing this APH, no rule of general application can be phrased to suit all circumstances or combination of circumstances that may arise, nor is there any substitute for the exercise of professional judgment in the determination of what constitutes fair presentation o ...

... It should be recognized that in issuing this APH, no rule of general application can be phrased to suit all circumstances or combination of circumstances that may arise, nor is there any substitute for the exercise of professional judgment in the determination of what constitutes fair presentation o ...

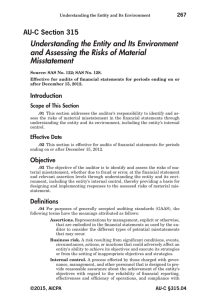

AU-C 315, Understanding the Entity and its Environment

... may include controls relating to financial reporting and operations objectives. 1 Relevant assertion. A financial statement assertion that has a reasonable possibility of containing a misstatement or misstatements that would cause the financial statements to be materially misstated. The determinatio ...

... may include controls relating to financial reporting and operations objectives. 1 Relevant assertion. A financial statement assertion that has a reasonable possibility of containing a misstatement or misstatements that would cause the financial statements to be materially misstated. The determinatio ...

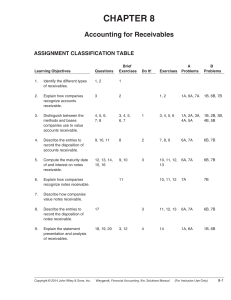

CHAPTER 8 Accounting for Receivables

... The missing amounts are: (a) $15,000, (b) $9,000, (c) 6%, and (d) four months. ...

... The missing amounts are: (a) $15,000, (b) $9,000, (c) 6%, and (d) four months. ...

Does the Big-4 Effect Exist when Reputation and

... to more accurately identify and evaluate financially-troubled firms and their greater competency/independence to provide fair presentation and faithful representation of the auditees’ financial situations, resulting in less use of modified reports. Partners switching from Big-4 to non-Big-4 firms ex ...

... to more accurately identify and evaluate financially-troubled firms and their greater competency/independence to provide fair presentation and faithful representation of the auditees’ financial situations, resulting in less use of modified reports. Partners switching from Big-4 to non-Big-4 firms ex ...

A literature review on the evolving framework of bitcoin and its

... Hacking risk is another risk due to Bitcoin being based online. Mt.Gox, a popular bitcoin exchange, was shut down in 2014, due to a hacking incident in which a large volume of bitcoin was stolen26. Bitcoin wallets are also subject to theft, if users do not take the right precautions to ensure their ...

... Hacking risk is another risk due to Bitcoin being based online. Mt.Gox, a popular bitcoin exchange, was shut down in 2014, due to a hacking incident in which a large volume of bitcoin was stolen26. Bitcoin wallets are also subject to theft, if users do not take the right precautions to ensure their ...

Returns to Buying Earnings and Book Value: Accounting for Growth

... deemed particularly uncertain (as in the case of R&D activities, for example). The accounting treatment ties back to risky dividends: dividends are paid out of book value so dividends cannot be paid until earnings are recognized and closed to book value.2 Accounting rules also determine the division ...

... deemed particularly uncertain (as in the case of R&D activities, for example). The accounting treatment ties back to risky dividends: dividends are paid out of book value so dividends cannot be paid until earnings are recognized and closed to book value.2 Accounting rules also determine the division ...

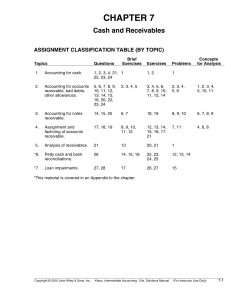

CHAPTER 7 Cash and Receivables

... The net method is desirable from a theoretical standpoint because it values the receivable at its net realizable value. In addition, recording the sales at net provides a better assessment of the revenue that was earned from the sale of the product. If the purchasing company fails to take the discou ...

... The net method is desirable from a theoretical standpoint because it values the receivable at its net realizable value. In addition, recording the sales at net provides a better assessment of the revenue that was earned from the sale of the product. If the purchasing company fails to take the discou ...

SMS203 - National Open University of Nigeria

... Every proprietor of a business has invested money in his business. This money is used to buy goods and services which he intends to sell at a later date and, very often, to buy the premises, fixtures, machinery, etc. required to carry on the business. The amount of money which he invests in his busi ...

... Every proprietor of a business has invested money in his business. This money is used to buy goods and services which he intends to sell at a later date and, very often, to buy the premises, fixtures, machinery, etc. required to carry on the business. The amount of money which he invests in his busi ...

Wey Fin 7e Ch03 chapterspecific

... Consumer electronic products account for about 40% of the lead found in landfills. Environmental groups put a resolution on a recent Apple Computer’s shareholder meeting agenda requiring the company to study how it can increase recycling. The average household has two to three old computers in i ...

... Consumer electronic products account for about 40% of the lead found in landfills. Environmental groups put a resolution on a recent Apple Computer’s shareholder meeting agenda requiring the company to study how it can increase recycling. The average household has two to three old computers in i ...

Chapter 3 - Bellevue College

... Consumer electronic products account for about 40% of the lead found in landfills. Environmental groups put a resolution on a recent Apple Computer’s shareholder meeting agenda requiring the company to study how it can increase recycling. The average household has two to three old computers in i ...

... Consumer electronic products account for about 40% of the lead found in landfills. Environmental groups put a resolution on a recent Apple Computer’s shareholder meeting agenda requiring the company to study how it can increase recycling. The average household has two to three old computers in i ...

Personal Financial Statements, Pro Forma

... Committee has been developing new service opportunities for CPAs. One type of engagement that may drive growth opportunity is providing clients with information about their businesses in the form of performance measures. Such information would tell management whether it has achieved its performance ...

... Committee has been developing new service opportunities for CPAs. One type of engagement that may drive growth opportunity is providing clients with information about their businesses in the form of performance measures. Such information would tell management whether it has achieved its performance ...

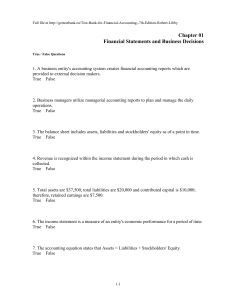

Chapter 01 Financial Statements and Business Decisions

... 16. In the United States, the Securities and Exchange Commission (SEC) is considering the adoption of International Financial Reporting Standards (IFRS). True False ...

... 16. In the United States, the Securities and Exchange Commission (SEC) is considering the adoption of International Financial Reporting Standards (IFRS). True False ...

Download attachment

... • CICA Explanatory Memorandum “Reporting on Financial Statements under Canadian Auditing Standards” that helps stakeholders understand the decision-making process followed by the auditor when reporting on financial statements, and the form of the auditor’s report, under the CASs. • CICA Guide “Ass ...

... • CICA Explanatory Memorandum “Reporting on Financial Statements under Canadian Auditing Standards” that helps stakeholders understand the decision-making process followed by the auditor when reporting on financial statements, and the form of the auditor’s report, under the CASs. • CICA Guide “Ass ...

FREE Sample Here - Find the cheapest test bank for your

... 57. Two common areas of accounting that respectively provide information to internal and external users are: A. forensic accounting and financial accounting B. managerial accounting and financial accounting C. managerial accounting and environmental accounting D. financial accounting and tax account ...

... 57. Two common areas of accounting that respectively provide information to internal and external users are: A. forensic accounting and financial accounting B. managerial accounting and financial accounting C. managerial accounting and environmental accounting D. financial accounting and tax account ...

ETHICAL DECISION MAKING - KRISTIN SMITH

... the study of management, which is embedded with human intentionality and managerial choice (Ghoshal, 2005). Management involves decisions that impact others, and thus it is a moral activity. Ignoring the normative dimension of management by hiding behind the guise of “true scholarly work” is, consc ...

... the study of management, which is embedded with human intentionality and managerial choice (Ghoshal, 2005). Management involves decisions that impact others, and thus it is a moral activity. Ignoring the normative dimension of management by hiding behind the guise of “true scholarly work” is, consc ...

Fund - McGraw Hill Higher Education - McGraw

... Long-term debt principal not due within the next year is not reported on the balance sheet, but are scheduled and reported in the government-wide financial statements. ...

... Long-term debt principal not due within the next year is not reported on the balance sheet, but are scheduled and reported in the government-wide financial statements. ...

Auditing for Fraud Detection - Professional Education Services

... and other haphazard means. Fraud examiners have a higher success rate because they are called in for a specific purpose when fraud is known or highly suspected. Some aspects of audit methodology make a big difference in the fraud discovery success experience. Financial auditors often utilize inducti ...

... and other haphazard means. Fraud examiners have a higher success rate because they are called in for a specific purpose when fraud is known or highly suspected. Some aspects of audit methodology make a big difference in the fraud discovery success experience. Financial auditors often utilize inducti ...

Financial Accounting and Accounting Standards

... Non-Recognition of Interest Element A company should measure receivables in terms of their present value. In practice, companies ignore interest revenue related to accounts receivable because, for current assets, the amount of the discount is not usually material in relation to the net income for th ...

... Non-Recognition of Interest Element A company should measure receivables in terms of their present value. In practice, companies ignore interest revenue related to accounts receivable because, for current assets, the amount of the discount is not usually material in relation to the net income for th ...

MANDATORY EMPHASIS PARAGRAPHS, CLARIFYING

... most significant matters that the auditor encounters during the audit within the actual body of audit report will increase the relevance of the audit report. While the Big 4 audit firms agree that the identification of critical audit matters would provide meaningful information to investors and othe ...

... most significant matters that the auditor encounters during the audit within the actual body of audit report will increase the relevance of the audit report. While the Big 4 audit firms agree that the identification of critical audit matters would provide meaningful information to investors and othe ...

The Effect of Audit Firm Specialization on Earnings Management

... The demand for auditing in capital markets can be analyzed from three perspectives (i.e., a monitoring role, an information role and an insurance role) (Wallace, 1981). How the auditor fulfils these roles determines the level of audit quality (Fernando et al., 2010). Audit quality is an important m ...

... The demand for auditing in capital markets can be analyzed from three perspectives (i.e., a monitoring role, an information role and an insurance role) (Wallace, 1981). How the auditor fulfils these roles determines the level of audit quality (Fernando et al., 2010). Audit quality is an important m ...

Accounting ethics

Accounting ethics is primarily a field of applied ethics and is part of business ethics and human ethics, the study of moral values and judgments as they apply to accountancy. It is an example of professional ethics. Accounting introduced by Luca Pacioli, and later expanded by government groups, professional organizations, and independent companies. Ethics are taught in accounting courses at higher education institutions as well as by companies training accountants and auditors.Due to the diverse range of accounting services and recent corporate collapses, attention has been drawn to ethical standards accepted within the accounting profession. These collapses have resulted in a widespread disregard for the reputation of the accounting profession. To combat the criticism and prevent fraudulent accounting, various accounting organizations and governments have developed regulations and remedies for improved ethics among the accounting profession.