Does a Change in a Logo Affect the Value of the Brand? The Case

... that Starbucks was placing larger orders for a particular drip coffeemaker than retail giant Macy’s. When he first entered Starbucks the powerful and pleasant aromas of the coffee beans and the wall displaying the coffee took his breath away.10 And after his first cup of full-flavored, dark-roasted ...

... that Starbucks was placing larger orders for a particular drip coffeemaker than retail giant Macy’s. When he first entered Starbucks the powerful and pleasant aromas of the coffee beans and the wall displaying the coffee took his breath away.10 And after his first cup of full-flavored, dark-roasted ...

Defence Audit Guidelines_Final 25 March 2010

... Pakistan for use in Field Audit Offices (FAOs) for conducting Certification and Compliance with Authority audits. The Manual is based on the INTOSAI Auditing Standards and the international best practices. It covers the entire Audit Cycle and provides guidance with regard to the methods and approach ...

... Pakistan for use in Field Audit Offices (FAOs) for conducting Certification and Compliance with Authority audits. The Manual is based on the INTOSAI Auditing Standards and the international best practices. It covers the entire Audit Cycle and provides guidance with regard to the methods and approach ...

A literature review on the evolving framework of bitcoin and its

... Bitcoin exposure has become available in various forms of securities as well, aside from as a standalone virtual currency. The most relevant types thus far are investment funds and derivatives. Investment funds pool investor capital to strategically allocate towards positions in other assets or comm ...

... Bitcoin exposure has become available in various forms of securities as well, aside from as a standalone virtual currency. The most relevant types thus far are investment funds and derivatives. Investment funds pool investor capital to strategically allocate towards positions in other assets or comm ...

FREE Sample Here

... ACCREDITING STANDARDS: ACCT.ACBSP.APC.09 - Financial Statements ACCT.AICPA.FN.03 - MeasurementBUSPROG: Analytic 49. Profit is the difference between a. assets and liabilities b. the incoming cash and outgoing cash c. the assets purchased with cash contributed by the owner and the cash spent to opera ...

... ACCREDITING STANDARDS: ACCT.ACBSP.APC.09 - Financial Statements ACCT.AICPA.FN.03 - MeasurementBUSPROG: Analytic 49. Profit is the difference between a. assets and liabilities b. the incoming cash and outgoing cash c. the assets purchased with cash contributed by the owner and the cash spent to opera ...

Standard for automatic exchange of financial account

... global level and welcomed on-going efforts made in the G8, G20 and OECD to develop a global standard. On 12 June 2013 the European Commission adopted a legislative proposal to extend the scope of automatic exchange of information in its directive on administrative co-operation. On 19 June 2013 the G ...

... global level and welcomed on-going efforts made in the G8, G20 and OECD to develop a global standard. On 12 June 2013 the European Commission adopted a legislative proposal to extend the scope of automatic exchange of information in its directive on administrative co-operation. On 19 June 2013 the G ...

Revised Guidance Statement GS 009: Auditing SMSFs

... Auditors of APRA regulated superannuation entities, particularly auditors of small APRA funds, may find this Guidance Statement useful in planning, conducting and reporting their audits, but it does not relate specifically to APRA funds. See Division 1, Section 6 of the SISA. Regulated funds, under ...

... Auditors of APRA regulated superannuation entities, particularly auditors of small APRA funds, may find this Guidance Statement useful in planning, conducting and reporting their audits, but it does not relate specifically to APRA funds. See Division 1, Section 6 of the SISA. Regulated funds, under ...

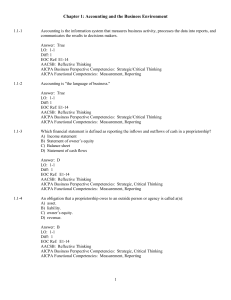

Chapter 1 - Test Bank

... AICPA Business Perspective Competencies: Strategic, Critical Thinking AICPA Functional Competencies: Measurement, Reporting ...

... AICPA Business Perspective Competencies: Strategic, Critical Thinking AICPA Functional Competencies: Measurement, Reporting ...

AH Belo Corporation - corporate

... On February 4, 2008, the Company entered into a $100 million senior revolving credit facility (the “2008 Credit Agreement”), with JP Morgan Chase Bank, N.A., J.P. Morgan Securities, Inc., Banc of America Securities LLC, Bank of America, N.A. and certain other parties thereto. The Credit Agreement wa ...

... On February 4, 2008, the Company entered into a $100 million senior revolving credit facility (the “2008 Credit Agreement”), with JP Morgan Chase Bank, N.A., J.P. Morgan Securities, Inc., Banc of America Securities LLC, Bank of America, N.A. and certain other parties thereto. The Credit Agreement wa ...

SMS203 - National Open University of Nigeria

... example, it would be very inconvenient if a cooperative society had pay cash on delivery for all the goods it purchases. It is of the utmost ...

... example, it would be very inconvenient if a cooperative society had pay cash on delivery for all the goods it purchases. It is of the utmost ...

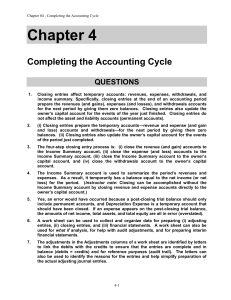

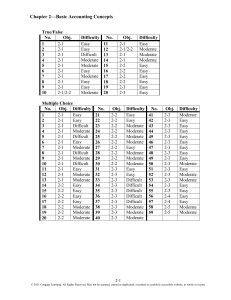

FAP 20e Chapter 4 SM - Arab Academy Research Papers AAST

... expenses. As a result, it temporarily has a balance equal to the net income (or net loss) for the period. (Instructor note: Closing can be accomplished without the Income Summary account by closing revenue and expense accounts directly to the owner’s capital account.) ...

... expenses. As a result, it temporarily has a balance equal to the net income (or net loss) for the period. (Instructor note: Closing can be accomplished without the Income Summary account by closing revenue and expense accounts directly to the owner’s capital account.) ...

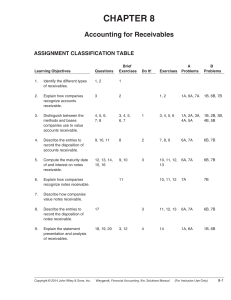

CHAPTER 8 Accounting for Receivables

... Each of the major types of receivables should be identified in the balance sheet or in the notes to the financial statements. Both the gross amount of receivables and the allowance for doubtful accounts should be reported. If collectible within a year or the operating cycle, whichever is longer, the ...

... Each of the major types of receivables should be identified in the balance sheet or in the notes to the financial statements. Both the gross amount of receivables and the allowance for doubtful accounts should be reported. If collectible within a year or the operating cycle, whichever is longer, the ...

FINANCIAL ACCOUNTING : MEANING, NATURE AND ROLE OF

... ascertaining the net profit earned or loss suffered on account of carrying the business. This is done by keeping a proper record of revenues and expense of a particular period. The Profit and Loss Account is prepared at the end of a period and if the amount of revenue for the period is more than the ...

... ascertaining the net profit earned or loss suffered on account of carrying the business. This is done by keeping a proper record of revenues and expense of a particular period. The Profit and Loss Account is prepared at the end of a period and if the amount of revenue for the period is more than the ...

Auditing for Fraud Detection - Professional Education Services

... and other haphazard means. Fraud examiners have a higher success rate because they are called in for a specific purpose when fraud is known or highly suspected. Some aspects of audit methodology make a big difference in the fraud discovery success experience. Financial auditors often utilize inducti ...

... and other haphazard means. Fraud examiners have a higher success rate because they are called in for a specific purpose when fraud is known or highly suspected. Some aspects of audit methodology make a big difference in the fraud discovery success experience. Financial auditors often utilize inducti ...

ASRE 2410 Review of a Financial Report Performed by the Independent Auditor of the Entity. The choice of ASRE 2400

... Definitions ............................................................................ ...

... Definitions ............................................................................ ...

Staff Guidance for Auditors of SEC-Registered Brokers and

... schedules of a broker or dealer. 5 These standards and related amendments were approved by the SEC on February 12, 2014, and are effective for fiscal years ending on or after June 1, 2014, which coincides with the effective date for the amendments to SEC Rule 17a-5. 6 This publication was developed ...

... schedules of a broker or dealer. 5 These standards and related amendments were approved by the SEC on February 12, 2014, and are effective for fiscal years ending on or after June 1, 2014, which coincides with the effective date for the amendments to SEC Rule 17a-5. 6 This publication was developed ...

MANDATORY EMPHASIS PARAGRAPHS, CLARIFYING

... regarding the audit of the financial statements, but concerns about the transparency and relevance of the current audit reporting model have prompted the Public Company Accounting Oversight Board (PCAOB) to consider changing the content and form of the standard audit report (PCAOB 2011b; PCAOB 2013) ...

... regarding the audit of the financial statements, but concerns about the transparency and relevance of the current audit reporting model have prompted the Public Company Accounting Oversight Board (PCAOB) to consider changing the content and form of the standard audit report (PCAOB 2011b; PCAOB 2013) ...

IBAC Annual Report 2014/15 - Independent broad

... As a young organisation and the first body tasked with exposing and preventing corruption in Victoria’s public sector, we needed to establish ways to measure IBAC’s reach and success. By regularly reviewing our progress and activities across four strategic priority areas, we have confirmed performan ...

... As a young organisation and the first body tasked with exposing and preventing corruption in Victoria’s public sector, we needed to establish ways to measure IBAC’s reach and success. By regularly reviewing our progress and activities across four strategic priority areas, we have confirmed performan ...

FREE Sample Here - We can offer most test bank and

... 29. Companies prepare classified and comparative financial statements because a. They are required by international accounting principles b. They provide financial statement readers with useful information about trends in financial position and operating performance c. They are required by the IRS d ...

... 29. Companies prepare classified and comparative financial statements because a. They are required by international accounting principles b. They provide financial statement readers with useful information about trends in financial position and operating performance c. They are required by the IRS d ...

Table of Contents - Ontario Energy Board

... businesses not regulated by the Board, or where the regulated entity conducts more than one activity regulated by the Board, the distributor is required to disclose separately information about each operating segment in accordance with the Operating Segment disclosure requirements that a distributor ...

... businesses not regulated by the Board, or where the regulated entity conducts more than one activity regulated by the Board, the distributor is required to disclose separately information about each operating segment in accordance with the Operating Segment disclosure requirements that a distributor ...

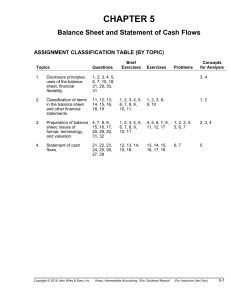

assignment classification table (by topic)

... estimates of the future cash flows that will be generated by these “assets” (for all three types) and the ability to control the use of the asset (in the case of employees). Being able to reliably measure the expected future benefits and to control the use of an item are essential elements of the de ...

... estimates of the future cash flows that will be generated by these “assets” (for all three types) and the ability to control the use of the asset (in the case of employees). Being able to reliably measure the expected future benefits and to control the use of an item are essential elements of the de ...

Wey Fin 7e Ch03 chapterspecific

... YES: As more states impose laws holding companies responsible, and as more courts levy pollution-related fines, it becomes increasingly likely that companies will have to pay large amounts in the future. NO: The amounts still are too difficult to estimate. Putting inaccurate estimates on the financi ...

... YES: As more states impose laws holding companies responsible, and as more courts levy pollution-related fines, it becomes increasingly likely that companies will have to pay large amounts in the future. NO: The amounts still are too difficult to estimate. Putting inaccurate estimates on the financi ...

A The framework of uniform chart of accounts

... It is not only the owners or shareholders of a company who are directly related with the operations and results of that company. Apart from these people, establishments which have commercial, financial and economical relationships with the company, including individuals, creditors, finance and inves ...

... It is not only the owners or shareholders of a company who are directly related with the operations and results of that company. Apart from these people, establishments which have commercial, financial and economical relationships with the company, including individuals, creditors, finance and inves ...

Chapter 3 - Bellevue College

... YES: As more states impose laws holding companies responsible, and as more courts levy pollution-related fines, it becomes increasingly likely that companies will have to pay large amounts in the future. NO: The amounts still are too difficult to estimate. Putting inaccurate estimates on the financi ...

... YES: As more states impose laws holding companies responsible, and as more courts levy pollution-related fines, it becomes increasingly likely that companies will have to pay large amounts in the future. NO: The amounts still are too difficult to estimate. Putting inaccurate estimates on the financi ...