Statement of Owners` Equity

... Accounting procedures and practices must be adapted to accommodate an international business environment. The International Accounting Standards Committee (IASC) was established in 1973 to promote worldwide consistency in financial reporting practices. The IASC soon developed its first set of accoun ...

... Accounting procedures and practices must be adapted to accommodate an international business environment. The International Accounting Standards Committee (IASC) was established in 1973 to promote worldwide consistency in financial reporting practices. The IASC soon developed its first set of accoun ...

Managing Financial Aspects of a Business

... What is accrual basis of accounting? What is cash basis? Effects of transactions and other events are recognised when they occur ( not when cash or cash equivalents received or paid) ...

... What is accrual basis of accounting? What is cash basis? Effects of transactions and other events are recognised when they occur ( not when cash or cash equivalents received or paid) ...

Module 5 – Understanding the Basic Elements of School Board

... PSA Standards or IFRSs based on assessment of users’ needs ...

... PSA Standards or IFRSs based on assessment of users’ needs ...

The Impact Of Switching To International Financial Reporting

... either be a subsidiary or a branch of a company. The reason this decision would be important is that some foreign countries tax branches differently than subsidiaries and vice versa. The final decision is the method of financing used for foreign operations. Businesses can choose to either finance th ...

... either be a subsidiary or a branch of a company. The reason this decision would be important is that some foreign countries tax branches differently than subsidiaries and vice versa. The final decision is the method of financing used for foreign operations. Businesses can choose to either finance th ...

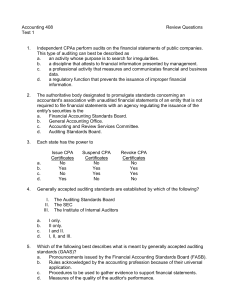

Test 1, Review Questions

... The opinion of an independent party is needed because a company may not be objective with respect to its own financial statements. d. It is a customary courtesy that all stockholders receive an independent report on management's stewardship in managing the affairs of the business. 11. Which paragrap ...

... The opinion of an independent party is needed because a company may not be objective with respect to its own financial statements. d. It is a customary courtesy that all stockholders receive an independent report on management's stewardship in managing the affairs of the business. 11. Which paragrap ...

會計學原理Principles of Accounts

... Why Accounting? (II) • If you are an accounting clerk • You need to know HOW to: – Post the entries (入帳) – Calculate Profit or Loss (盈利或 虧損); – Prepare the Balance Sheet (資產 及負債表); – Make tax provision; – Deal with financial problems for the company, etc. ...

... Why Accounting? (II) • If you are an accounting clerk • You need to know HOW to: – Post the entries (入帳) – Calculate Profit or Loss (盈利或 虧損); – Prepare the Balance Sheet (資產 及負債表); – Make tax provision; – Deal with financial problems for the company, etc. ...

Lesson 1 PowerPoint

... the residual interest in the assets of an entity that remains after deducting its liabilities. Called shareholders’ equity or stockholders’ equity for a corporation. Increases in equity of a particular business enterprise resulting from transfers to it from other entities of something of value to ob ...

... the residual interest in the assets of an entity that remains after deducting its liabilities. Called shareholders’ equity or stockholders’ equity for a corporation. Increases in equity of a particular business enterprise resulting from transfers to it from other entities of something of value to ob ...

1. Accountants refer to an economic event as a a. purchase. b. sale

... The conceptual framework developed by the Financial Accounting Standards Board a. was approved by a vote of all accountants. b. are rules that all accountants must follow. c. is viewed as providing a constitution for setting accounting standards for financial reporting. d. is legally binding on all ...

... The conceptual framework developed by the Financial Accounting Standards Board a. was approved by a vote of all accountants. b. are rules that all accountants must follow. c. is viewed as providing a constitution for setting accounting standards for financial reporting. d. is legally binding on all ...

NATIONAL ASSEMBLY

... Whether the Public Investment Corporation holds any financial interest in certain companies (name furnished) in the form of (a) equity, (b) debt or (c) any other form; if not, why not; if so, what (i) was the initial value of the financial interest, (ii) was the date of the transaction, (iii) is the ...

... Whether the Public Investment Corporation holds any financial interest in certain companies (name furnished) in the form of (a) equity, (b) debt or (c) any other form; if not, why not; if so, what (i) was the initial value of the financial interest, (ii) was the date of the transaction, (iii) is the ...

LESSON ONE

... NB: Property, plant and equipment and capital and reserves require disclosure notes to show details and movement in the period ...

... NB: Property, plant and equipment and capital and reserves require disclosure notes to show details and movement in the period ...

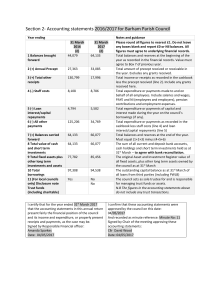

section 2 Accounts - Barham Parish Council

... The sum of all current and deposit bank accounts, cash holdings and short term investments held as at 31st March – to agree with bank reconciliation. The original Asset and Investment Register value of all fixed assets, plus other long term assets owned by the council as at 31st March The outstandin ...

... The sum of all current and deposit bank accounts, cash holdings and short term investments held as at 31st March – to agree with bank reconciliation. The original Asset and Investment Register value of all fixed assets, plus other long term assets owned by the council as at 31st March The outstandin ...

Transaction Analysis

... the accounting profession recognizes as a general guide for financial reporting purposes. Standard-setting bodies determine these guidelines: ...

... the accounting profession recognizes as a general guide for financial reporting purposes. Standard-setting bodies determine these guidelines: ...

REVIEW OF ILLUSTRATIVE FINANCIAL STATEMENTS IN

... • An entity must prepare general price-level adjustedfinancial statements when its functional currency is hyperinflationary • IFRS for SMEs provides indicators of hyperinflationbut not an absolute rate. One indicator is where cumulative inflation approaches or exceeds 100% over a 3 year period. • In ...

... • An entity must prepare general price-level adjustedfinancial statements when its functional currency is hyperinflationary • IFRS for SMEs provides indicators of hyperinflationbut not an absolute rate. One indicator is where cumulative inflation approaches or exceeds 100% over a 3 year period. • In ...

Document

... used to summarize and communicate financial information about a company. A company’s integrated accounting system produces three major statements: the income statement, the balance sheet, and the cash flow statement, as well as a supporting statement called the changes in owners’ ...

... used to summarize and communicate financial information about a company. A company’s integrated accounting system produces three major statements: the income statement, the balance sheet, and the cash flow statement, as well as a supporting statement called the changes in owners’ ...

Accounting degree

... This training is available in Helsinki and Oulu, and can also be tailored tailored to specific companies or groups. The training is suitable for ...

... This training is available in Helsinki and Oulu, and can also be tailored tailored to specific companies or groups. The training is suitable for ...

[Business Communication]

... Responsible for the information in the financial statements and disclosures. Chief Executive Officer (CEO): highest officer of the company Chief Financial Officer (CFO): highest officer associated with the financial and accounting side of the business Accounting Staff: prepare the details of t ...

... Responsible for the information in the financial statements and disclosures. Chief Executive Officer (CEO): highest officer of the company Chief Financial Officer (CFO): highest officer associated with the financial and accounting side of the business Accounting Staff: prepare the details of t ...

6.02C - Determining Working Capital-1

... Complete the Income Statement and Balance Sheet for the Sole Source Company. The financial information is located in the 6.02 – Sole Source Financial Statements file. Once both statements have been completed, fill in the blanks below. ...

... Complete the Income Statement and Balance Sheet for the Sole Source Company. The financial information is located in the 6.02 – Sole Source Financial Statements file. Once both statements have been completed, fill in the blanks below. ...

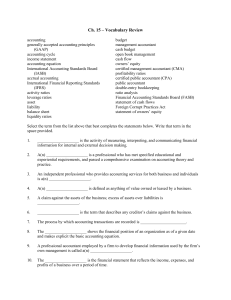

Ch. 15 – Vocabulary Review accounting generally accepted

... A(n) ____________________ is a professional who has met specified educational and experiential requirements, and passed a comprehensive examination on accounting theory and ...

... A(n) ____________________ is a professional who has met specified educational and experiential requirements, and passed a comprehensive examination on accounting theory and ...

Is it time to change SOX? Solongo Batbaatar MA0N0228

... should be implemented in a more efficient and cost effective manner. ...

... should be implemented in a more efficient and cost effective manner. ...

![[Business Communication]](http://s1.studyres.com/store/data/019415784_1-ce36fb3f425a6ddeee29c0708b32d6a8-300x300.png)