It’s All About the Accounting

... consistently stated that the goal is to create one set of world class accounting standards. FASB and IASB have been working on improvements to standards since 2002. The SEC is now accepting IFRS accounting statements from foreign filers. The SEC has also indicated a willingness to consider allowing ...

... consistently stated that the goal is to create one set of world class accounting standards. FASB and IASB have been working on improvements to standards since 2002. The SEC is now accepting IFRS accounting statements from foreign filers. The SEC has also indicated a willingness to consider allowing ...

Sharon - Accounting Solutions

... · A family illness required intervention into the entrepreneurial endeavors of this family. The first two businesses were established but the third was just in infancy. I stepped in to meet their accounting needs at a critical time deciphering what phase each were in and turning that data into valua ...

... · A family illness required intervention into the entrepreneurial endeavors of this family. The first two businesses were established but the third was just in infancy. I stepped in to meet their accounting needs at a critical time deciphering what phase each were in and turning that data into valua ...

Define - kthsyr12acc

... the year to one of his workers. This resulted in the net profit being overstated by $5,000. Referring to a qualitative characteristic, explain why it is important that all information that is useful be included in the Profit & Loss Statement. IDENTIFY ...

... the year to one of his workers. This resulted in the net profit being overstated by $5,000. Referring to a qualitative characteristic, explain why it is important that all information that is useful be included in the Profit & Loss Statement. IDENTIFY ...

3rd Biennial International Conference on Business, Banking & Finance Panel Discussion:

... Cap the exposure to connected parties within a financial group. (FIA 2008 recommends 10% of capital base). ...

... Cap the exposure to connected parties within a financial group. (FIA 2008 recommends 10% of capital base). ...

What You Need To Know

... other guidance that represents good practice that public sector entities are encouraged to follow, and resources for use by public sector entities around the world. The IPSASB aims specifically to enhance the quality and transparency of public financial reporting by: i. Establishing high-quality acc ...

... other guidance that represents good practice that public sector entities are encouraged to follow, and resources for use by public sector entities around the world. The IPSASB aims specifically to enhance the quality and transparency of public financial reporting by: i. Establishing high-quality acc ...

IFRS judgements and estimates

... • However, depreciation ceases when classified as held for sale because IFRS 5 measurement is essentially a process of valuation, rather than allocation (IFRS5.BC29) © 2010 IFRS Foundation. 30 Cannon Street | London EC4M 6XH | UK. www.ifrs.org ...

... • However, depreciation ceases when classified as held for sale because IFRS 5 measurement is essentially a process of valuation, rather than allocation (IFRS5.BC29) © 2010 IFRS Foundation. 30 Cannon Street | London EC4M 6XH | UK. www.ifrs.org ...

2015-230 Presentation of Financial Statements of Not-for

... b. Composition of net assets with donor restrictions at the end of the period and how the restrictions affect the use of resources. Disagree in part – narrative about how the composition affects the use of resources is subjective, may be duplicative of information already in the financials and adds ...

... b. Composition of net assets with donor restrictions at the end of the period and how the restrictions affect the use of resources. Disagree in part – narrative about how the composition affects the use of resources is subjective, may be duplicative of information already in the financials and adds ...

2011 Financials

... We have audited the accompanying financial statements of Windsor-Essex Care for Kids Foundation (the "Foundation"), which comprise the balance sheet as at December 31, 2011 and the statements of revenue, expenses and fund balances and cash flows for the year then ended, and notes, comprising a summa ...

... We have audited the accompanying financial statements of Windsor-Essex Care for Kids Foundation (the "Foundation"), which comprise the balance sheet as at December 31, 2011 and the statements of revenue, expenses and fund balances and cash flows for the year then ended, and notes, comprising a summa ...

Accounting Theory Defined

... Co. is as shown below. Use of the percentage-of-completion method involves some subjectivity. As a result, errors are possible in determining the amount of revenue recognized. To wait until completion would seriously distort the financial statements. If it is not possible to obtain dependable estima ...

... Co. is as shown below. Use of the percentage-of-completion method involves some subjectivity. As a result, errors are possible in determining the amount of revenue recognized. To wait until completion would seriously distort the financial statements. If it is not possible to obtain dependable estima ...

Financial Reporting in Hyperinflationary Economies

... loses purchasing power and an enterprise entity with an excess of monetary liabilities over monetary assets gains purchasing power to the extent the assets and liabilities are not linked to a price level. This gain or loss on the net monetary position may be derived as the difference resulting from ...

... loses purchasing power and an enterprise entity with an excess of monetary liabilities over monetary assets gains purchasing power to the extent the assets and liabilities are not linked to a price level. This gain or loss on the net monetary position may be derived as the difference resulting from ...

FAR Change Alerts - I Pass the CPA Exam!

... prices (unadjusted) in active markets for identical assets or liabilities. Level 2 inputs are inputs (other than quoted prices) included within Level 1 that are observable for the asset or liability, either directly or indirectly. Level 3 inputs are unobservable inputs, such as management’s assumpti ...

... prices (unadjusted) in active markets for identical assets or liabilities. Level 2 inputs are inputs (other than quoted prices) included within Level 1 that are observable for the asset or liability, either directly or indirectly. Level 3 inputs are unobservable inputs, such as management’s assumpti ...

Financial Accounting Standards Board (FASB)

... of the AICPA has defined Generally Accepted Accounting Principles (GAAP) in the context of a phrase included in the standard auditor’s opinion: “present fairly…in conformity with generally accepted accounting principles.” ...

... of the AICPA has defined Generally Accepted Accounting Principles (GAAP) in the context of a phrase included in the standard auditor’s opinion: “present fairly…in conformity with generally accepted accounting principles.” ...

Chapter 1 - Class notes file from textbook

... entities budget is very important. --budget is the culmination of the political process. --the budget is the key fiscal document. ...

... entities budget is very important. --budget is the culmination of the political process. --the budget is the key fiscal document. ...

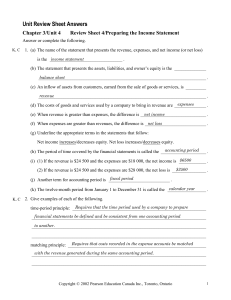

Chapter 3/Unit 4 Review Sheet 4/Preparing the Income Statement

... balance sheet __________________________________________________________________________ ...

... balance sheet __________________________________________________________________________ ...

download

... GAAP earnings number with some revenues, expenses, gains, and losses excluded. • The concern with pro forma earnings is that companies can report pro forma earnings merely in an effort to make their results seem better than they actual were. ...

... GAAP earnings number with some revenues, expenses, gains, and losses excluded. • The concern with pro forma earnings is that companies can report pro forma earnings merely in an effort to make their results seem better than they actual were. ...

Irish Pension Schemes, new SORP (Statement of Recommended

... preference to user market values to value some highly liquid exchange traded bonds. It may be considered appropriate to classify these instruments as category (a) instead of c(i). In any event, valuation techniques will need to be confirmed by the investment managers and disclosed in the notes to th ...

... preference to user market values to value some highly liquid exchange traded bonds. It may be considered appropriate to classify these instruments as category (a) instead of c(i). In any event, valuation techniques will need to be confirmed by the investment managers and disclosed in the notes to th ...

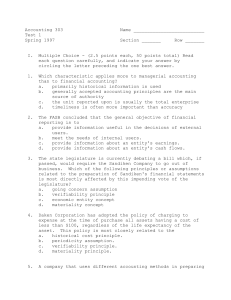

Test 1, Spring 1997 - College of Business Administration

... the unit reported upon is usually the total enterprise d. timeliness is often more important than accuracy ...

... the unit reported upon is usually the total enterprise d. timeliness is often more important than accuracy ...

Slide 1

... 1. Recognize revenue when it is earned. 2. Proceeds need not be in cash. 3. Measure revenue by cash received plus cash value of items received. ...

... 1. Recognize revenue when it is earned. 2. Proceeds need not be in cash. 3. Measure revenue by cash received plus cash value of items received. ...

6) The SEC and FASB are two organizations that are primarily

... No, the adjusted trial balance merely proves the equality of the total debit and total credit balances in the ledger after adjustments are posted. It has no other purpose. They can because that is the only reason that an adjusted trial balance is prepared. Yes, adjusting entries have been recorded i ...

... No, the adjusted trial balance merely proves the equality of the total debit and total credit balances in the ledger after adjustments are posted. It has no other purpose. They can because that is the only reason that an adjusted trial balance is prepared. Yes, adjusting entries have been recorded i ...

LO 5 - Test Banks Shop

... The statement shows readers where the company got cash and how it used that cash Relationships among the financial statements Income statement: compute the net income (loss) Statement of retained earnings: compute the ending balance of retained earnings using net income from the income stateme ...

... The statement shows readers where the company got cash and how it used that cash Relationships among the financial statements Income statement: compute the net income (loss) Statement of retained earnings: compute the ending balance of retained earnings using net income from the income stateme ...

Proceedings of 10th Asia - Pacific Business and Humanities Conference

... Qatar has witnessed significant economic growth since 2008 with GDP increasing by about 10 percent annually on an average, and it is consistently listed among the richest nations in the world since then. A study on the financial behaviour of the Qatari nationals would reveal their role in this achie ...

... Qatar has witnessed significant economic growth since 2008 with GDP increasing by about 10 percent annually on an average, and it is consistently listed among the richest nations in the world since then. A study on the financial behaviour of the Qatari nationals would reveal their role in this achie ...

Personal Finance in Turbulent Times

... >> The 5 obstacles you'll face >> The 5 steps that will put you on the road to ...

... >> The 5 obstacles you'll face >> The 5 steps that will put you on the road to ...

What is Accounting?

... IFRS tends to be simpler in its accounting and disclosure requirements; some people say more “principles-based.” GAAP is more detailed; some people say it is more “rules-based.” This difference in approach has resulted in a debate about the merits of “principles-based” versus “rules-based” standards ...

... IFRS tends to be simpler in its accounting and disclosure requirements; some people say more “principles-based.” GAAP is more detailed; some people say it is more “rules-based.” This difference in approach has resulted in a debate about the merits of “principles-based” versus “rules-based” standards ...