1999 - School of Business and Social Sciences

... 6264 Man. and Fin. Accounting test 2, 6187 Financial Accounting, 6360 Accounting test 2. Assignment 1. In the following you will find a number of multiple choice questions or statements. Three possible answers a, b and c is cited to every question or statement. You should only give one answer to eve ...

... 6264 Man. and Fin. Accounting test 2, 6187 Financial Accounting, 6360 Accounting test 2. Assignment 1. In the following you will find a number of multiple choice questions or statements. Three possible answers a, b and c is cited to every question or statement. You should only give one answer to eve ...

AT1- 1 Achievement Test 1 Achievement Test 1: Chapters 1 and 2

... b. Selecting the economic activities relevant to a particular organization. c. Preparing accounting reports, including financial statements. d. Quantifying events in dollars and cents. ____ 9. The current source of "GAAP" in the private sector is the a. Accounting Principles Board. b. Internal Reven ...

... b. Selecting the economic activities relevant to a particular organization. c. Preparing accounting reports, including financial statements. d. Quantifying events in dollars and cents. ____ 9. The current source of "GAAP" in the private sector is the a. Accounting Principles Board. b. Internal Reven ...

Accounting Relief for Business Acquisitions with

... other income effects resulting from the change to provisional amounts; this effect must be calculated as if the accounting had been completed at the acquisition date. An entity has the option to present separately on the face of the financial statements or disclose in the notes the portion of the am ...

... other income effects resulting from the change to provisional amounts; this effect must be calculated as if the accounting had been completed at the acquisition date. An entity has the option to present separately on the face of the financial statements or disclose in the notes the portion of the am ...

Amendments to Prospective Financial Statements

... The reporting periods covered by prospective financial statements shall coincide with those for which interim or annual historical general purpose financial statements will subsequently be presented. ...

... The reporting periods covered by prospective financial statements shall coincide with those for which interim or annual historical general purpose financial statements will subsequently be presented. ...

Understanding Financ.. - Loughborough University

... possible to get a much more realistic analysis of budgetary performance. The purpose of a flexed budget, therefore, is to account for changes in the budget variables and, consequently, to assess real ...

... possible to get a much more realistic analysis of budgetary performance. The purpose of a flexed budget, therefore, is to account for changes in the budget variables and, consequently, to assess real ...

Year End Financial Report for 2016

... The Cass Soil and Water Conservation District’s discussion and analysis provides an overview of the district’s financial activities for the fiscal year ended 2016. Since this information is designed to focus on the current year’s activities, resulting changes, and currently known facts, it should be ...

... The Cass Soil and Water Conservation District’s discussion and analysis provides an overview of the district’s financial activities for the fiscal year ended 2016. Since this information is designed to focus on the current year’s activities, resulting changes, and currently known facts, it should be ...

Jean-Pierre Landau: Procyclicality

... It may be necessary to look at other tools in order to address procyclicality and pre-empt the build up of imbalances. Those tools have to act more directly on individual and collective incentives. This is where accounting may matter most. Economically, it will always remain difficult, when looking ...

... It may be necessary to look at other tools in order to address procyclicality and pre-empt the build up of imbalances. Those tools have to act more directly on individual and collective incentives. This is where accounting may matter most. Economically, it will always remain difficult, when looking ...

In Practice The negative impact of complex corporate structures in

... negative net worth of £187m. It had been in the warning area ever since its first set of accounts in March 2006, with a peak H-Score of 5 out of 100. It was balance sheet insolvent as from March 2007, unlike PGL which maintained a positive net asset position throughout the period of ownership by HNo ...

... negative net worth of £187m. It had been in the warning area ever since its first set of accounts in March 2006, with a peak H-Score of 5 out of 100. It was balance sheet insolvent as from March 2007, unlike PGL which maintained a positive net asset position throughout the period of ownership by HNo ...

Developing a Cost Accounting System for First Government Contract

... acceptable cost accounting system for identifying recorded costs for that contract and to maintain supporting cost systems such as timekeeping, indirect costs grouping, and project cost subsidiary ledger. The company’s accounting system was rejected by DCAA during an audit, and the foreign entity re ...

... acceptable cost accounting system for identifying recorded costs for that contract and to maintain supporting cost systems such as timekeeping, indirect costs grouping, and project cost subsidiary ledger. The company’s accounting system was rejected by DCAA during an audit, and the foreign entity re ...

Institute for Accounting and Auditing of FBiH

... 5. Legal & Regulatory Reform - to have a nationwide law on accounting and auditing that fully embraces International Accounting Standards and International Standards on Auditing ...

... 5. Legal & Regulatory Reform - to have a nationwide law on accounting and auditing that fully embraces International Accounting Standards and International Standards on Auditing ...

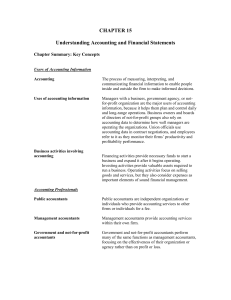

CHAPTER 15 Understanding Accounting and Financial

... The statement of owners’ equity shows the components of the change in owners’ equity from the end of the prior year to the end of the current year. ...

... The statement of owners’ equity shows the components of the change in owners’ equity from the end of the prior year to the end of the current year. ...

Course Outline - Jackson College

... 6. To analyze and interpret non-routine business decisions using a variety of managerial accounting tools, i.e. C-V-P analysis, differential cost analysis, present and future value. 7. To develop an awareness of the differences between managerial accounting and financial accounting in the U.S. and a ...

... 6. To analyze and interpret non-routine business decisions using a variety of managerial accounting tools, i.e. C-V-P analysis, differential cost analysis, present and future value. 7. To develop an awareness of the differences between managerial accounting and financial accounting in the U.S. and a ...

Contrapartida

... detectar el fraude. Según señala el párrafo 3 de la Norma Internacional de Auditoría 240 - The auditor’s responsibilities relating to fraud in an audit of financial statements- “(…) Two types of intentional misstatements are relevant to the auditor – misstatements resulting from fraudulent financial ...

... detectar el fraude. Según señala el párrafo 3 de la Norma Internacional de Auditoría 240 - The auditor’s responsibilities relating to fraud in an audit of financial statements- “(…) Two types of intentional misstatements are relevant to the auditor – misstatements resulting from fraudulent financial ...

Chapter 5 The Time Value of Money

... • Measuring costs and value • Recognition principles • Managing financial statements • The effect of recent accounting scandals ...

... • Measuring costs and value • Recognition principles • Managing financial statements • The effect of recent accounting scandals ...

APES 205 Conformity with Accounting Standards

... Public Practice. However, consultations with a prospective Client prior to such agreement are not part of an Engagement. Financial Statements means a structured representation of historical financial information, including related notes, intended to communicate an entity’s economic resources or obli ...

... Public Practice. However, consultations with a prospective Client prior to such agreement are not part of an Engagement. Financial Statements means a structured representation of historical financial information, including related notes, intended to communicate an entity’s economic resources or obli ...

Reporting Paper

... from service. According to the FASB Pre-Codification Standards, the accrual accounting of these postretirement benefits should apply three basic aspects of pension accounting, namely, delayed recognition of certain events, reporting net cost, and offsetting liabilities and related assets. The compan ...

... from service. According to the FASB Pre-Codification Standards, the accrual accounting of these postretirement benefits should apply three basic aspects of pension accounting, namely, delayed recognition of certain events, reporting net cost, and offsetting liabilities and related assets. The compan ...

Chapter 1 - Pearson Schools and FE Colleges

... financial statements. The prudence concept. When preparing financial statements, accountants often have to use their judgement in determining the valuation of a particular asset, i.e. premises, machinery etc., or perhaps deciding whether an outstanding debt will ever be paid. It is the accountant’s du ...

... financial statements. The prudence concept. When preparing financial statements, accountants often have to use their judgement in determining the valuation of a particular asset, i.e. premises, machinery etc., or perhaps deciding whether an outstanding debt will ever be paid. It is the accountant’s du ...

SB-FRS 29 Financial Reporting in Hyperinflationary Economies

... The financial statements of an entity whose functional currency is the currency of a hyperinflationary economy, whether they are based on a historical cost approach or a current cost approach, shall be stated in terms of the measuring unit current at the end of the reporting period. The correspondin ...

... The financial statements of an entity whose functional currency is the currency of a hyperinflationary economy, whether they are based on a historical cost approach or a current cost approach, shall be stated in terms of the measuring unit current at the end of the reporting period. The correspondin ...

Key differences between HEA funding statement accounting

... In the HEA Funding Statement Research Income includes expenditure on fixed assets. In the GAAP Financial Statements such expenditure is excluded. The expenditure is capitalised and depreciated with a matching credit for grant amortisation. Research Overhead Income received is disclosed as Other Inco ...

... In the HEA Funding Statement Research Income includes expenditure on fixed assets. In the GAAP Financial Statements such expenditure is excluded. The expenditure is capitalised and depreciated with a matching credit for grant amortisation. Research Overhead Income received is disclosed as Other Inco ...

Audited Financial Statements

... accompanying financial statements follows: Basis of Accounting The financial statements of the Organization have been prepared on the accrual basis of accounting in accordance with U.S. generally accepted accounting principles. Financial Statement Presentation The Organization presents financial inf ...

... accompanying financial statements follows: Basis of Accounting The financial statements of the Organization have been prepared on the accrual basis of accounting in accordance with U.S. generally accepted accounting principles. Financial Statement Presentation The Organization presents financial inf ...

ANALYSIS 1 Methods of Analysis Name ACC281: Accounting

... reported as 10% of sales. Vertical analysis can also be used on the balance sheet by comparing each balance sheet item to total assets. Each item is then reported as a percentage of total assets. For example, if cash equals $5,000 and total assets equals $25,000, then cash would be reported as 20% o ...

... reported as 10% of sales. Vertical analysis can also be used on the balance sheet by comparing each balance sheet item to total assets. Each item is then reported as a percentage of total assets. For example, if cash equals $5,000 and total assets equals $25,000, then cash would be reported as 20% o ...

Commodity-murabaha-transactions-in-the-absence-of-specific

... However the economic substance of the transaction taken as a whole is that Bank A has loaned 100 to Party B for 12 months to be repaid at an amount of 105. Bank A’s profit of 5 represents a finance cost to Party B. While the commodity is the subject of the transaction, it is actually nothing more th ...

... However the economic substance of the transaction taken as a whole is that Bank A has loaned 100 to Party B for 12 months to be repaid at an amount of 105. Bank A’s profit of 5 represents a finance cost to Party B. While the commodity is the subject of the transaction, it is actually nothing more th ...

REPORTS TO: General Manager - California Special Districts

... Develop methods for compilation and preparation of financial reports and statistical statements. Understand and utilize data processing and specialized accounting operations in developing and/or revising departmental policies and procedures. ...

... Develop methods for compilation and preparation of financial reports and statistical statements. Understand and utilize data processing and specialized accounting operations in developing and/or revising departmental policies and procedures. ...

The purposes of accounting

... accounting treatment available • Conforming to GAAP/IFRS does not mean that the information provided is good, but it is the start ...

... accounting treatment available • Conforming to GAAP/IFRS does not mean that the information provided is good, but it is the start ...

An Introduction to GAAP Basis Financial Report

... • Generally Accepted Accounting Principles (GAAP) • Chapter 405 of the Laws of 1981 – Report to Legislature MUST be completed by July 29th • Chapter 551 of the Laws of 1989 – Report reconciles receipts to revenue and disbursements to expenditures by department and major function • Accounting Basis – ...

... • Generally Accepted Accounting Principles (GAAP) • Chapter 405 of the Laws of 1981 – Report to Legislature MUST be completed by July 29th • Chapter 551 of the Laws of 1989 – Report reconciles receipts to revenue and disbursements to expenditures by department and major function • Accounting Basis – ...