Preparing and Using Financial Accounting`s Reports

... With the fall of the Roman Empire in about the 5th century A.D., both trade and associated recordkeeping became stagnant in Europe, though activities still continued in Constantinople, North Africa, the Middle East, India, China, and elsewhere. Many ideas and inventions that we now take for granted ...

... With the fall of the Roman Empire in about the 5th century A.D., both trade and associated recordkeeping became stagnant in Europe, though activities still continued in Constantinople, North Africa, the Middle East, India, China, and elsewhere. Many ideas and inventions that we now take for granted ...

Movement in Reserves Statement - Pembrokeshire Coast National

... and are offset against the expenditure against those headings to arrive at the net budget. The net budget for each service also includes a “capital charge”. This is based on the assets used by services and is made up of a charge for depreciation (being the value of assets used-up by a service during ...

... and are offset against the expenditure against those headings to arrive at the net budget. The net budget for each service also includes a “capital charge”. This is based on the assets used by services and is made up of a charge for depreciation (being the value of assets used-up by a service during ...

Download attachment

... reporting entity. As a result, the CICA Handbook – Accounting has been restructured to move away from a single financial reporting framework referred to as Canadian generally accepted accounting principles (GAAP) to include various different financial reporting frameworks in Canadian GAAP. These dif ...

... reporting entity. As a result, the CICA Handbook – Accounting has been restructured to move away from a single financial reporting framework referred to as Canadian generally accepted accounting principles (GAAP) to include various different financial reporting frameworks in Canadian GAAP. These dif ...

Free sample of

... b. The current market value is assumed to be less relevant than the original cost paid c. The preparation of financial statements for a specific time period assumes that the statement of financial position covers a designated period of time d. Financial statements are prepared assuming that inflatio ...

... b. The current market value is assumed to be less relevant than the original cost paid c. The preparation of financial statements for a specific time period assumes that the statement of financial position covers a designated period of time d. Financial statements are prepared assuming that inflatio ...

Libby Libby Short - McGraw Hill Higher Education

... This statement reports the change in retained earnings that results from the net income (or loss) for the period less any distribution of dividends. Other changes that do not affect the operations of the current period are also reported in this statement. McGraw-Hill Ryerson ...

... This statement reports the change in retained earnings that results from the net income (or loss) for the period less any distribution of dividends. Other changes that do not affect the operations of the current period are also reported in this statement. McGraw-Hill Ryerson ...

Bharti Infratel Limited India

... looking statements on our current beliefs, expectations and intentions as to facts, actions and events that will or may occur in the future. Such statements generally are identified by forward-looking words such as “believe,” “plan,” “anticipate,” “continue,” “estimate,” “expect,” “may,” “will” or o ...

... looking statements on our current beliefs, expectations and intentions as to facts, actions and events that will or may occur in the future. Such statements generally are identified by forward-looking words such as “believe,” “plan,” “anticipate,” “continue,” “estimate,” “expect,” “may,” “will” or o ...

TRUE/FALSE. Write `T` if the statement is true and `F` if the statement

... the inventory if the payment is made 20 days later? A) The accounting entry would be a $20 debit to Inventory, a $1,000 debit to Accounts Payable and a $1,020 credit to Cash. B) The accounting entry would be a $1,000 debit to Accounts Payable, a $20 credit to Inventory and a $980 credit to Cash. C) ...

... the inventory if the payment is made 20 days later? A) The accounting entry would be a $20 debit to Inventory, a $1,000 debit to Accounts Payable and a $1,020 credit to Cash. B) The accounting entry would be a $1,000 debit to Accounts Payable, a $20 credit to Inventory and a $980 credit to Cash. C) ...

Research exercise on charities SORP (FRS 102)

... their reserves and approach to reserves more fully. This could now be revisited in light of themes arising out of the implementation of the new SORPs. Suggested additional guidance on reserves could cover the following areas: why reserves are held, possible reasons for using reserves, basis of calcu ...

... their reserves and approach to reserves more fully. This could now be revisited in light of themes arising out of the implementation of the new SORPs. Suggested additional guidance on reserves could cover the following areas: why reserves are held, possible reasons for using reserves, basis of calcu ...

Review of a Company`s Accounting System

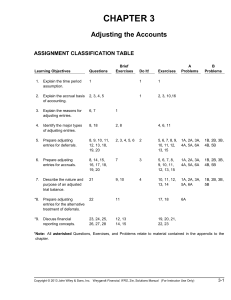

... adjustments; (c) carry over adjusted amounts of each account to the proper column of the appropriate financial statement; (d) subtotal the income statement debit and credit columns to determine pretax income, and compute income tax; (e) total the financial statement debit and credit columns in seque ...

... adjustments; (c) carry over adjusted amounts of each account to the proper column of the appropriate financial statement; (d) subtotal the income statement debit and credit columns to determine pretax income, and compute income tax; (e) total the financial statement debit and credit columns in seque ...

Download Dissertation

... assumptions. It is likely that after the recognition of funded status, more underfunded firms would increase their discount rate for pension liabilities to reduce net pension liabilities that should be recognized. Also, more underfunded firms would manage their plan assets either more conservatively ...

... assumptions. It is likely that after the recognition of funded status, more underfunded firms would increase their discount rate for pension liabilities to reduce net pension liabilities that should be recognized. Also, more underfunded firms would manage their plan assets either more conservatively ...

Appendix

... when budgetary control is turned on in the general ledger. General Ledger A detail summary of transactions affecting all asset liability, equity, revenue and expense accounts. Gifts Funds received from external sources that are donative in nature, bestowed voluntarily and without expectation of any ...

... when budgetary control is turned on in the general ledger. General Ledger A detail summary of transactions affecting all asset liability, equity, revenue and expense accounts. Gifts Funds received from external sources that are donative in nature, bestowed voluntarily and without expectation of any ...

extract

... opinions are determined not by the objective facts but by the records and interpretations to which they have access. Few men will deny that our views about the goodness or badness of different institutions are largely determined by what we believe to have been their effects in the past. There is sca ...

... opinions are determined not by the objective facts but by the records and interpretations to which they have access. Few men will deny that our views about the goodness or badness of different institutions are largely determined by what we believe to have been their effects in the past. There is sca ...

Chapter 01 Financial Statements and Business Decisions

... 26. Which of the following correctly describes the various financial statements? A. An income statement covers a period of time. B. The cash flow statement is a point in time financial statement. C. The balance sheet is a period of time financial statement. D. The statement of retained earnings is a ...

... 26. Which of the following correctly describes the various financial statements? A. An income statement covers a period of time. B. The cash flow statement is a point in time financial statement. C. The balance sheet is a period of time financial statement. D. The statement of retained earnings is a ...

internal-auditing-instructional-material

... d. A statement of positive assurance on those items of compliance tested and negative assurance on those items not tested. This should include significant instances of noncompliance and instances of or indicating of fraud, abuse or illegal acts found during or in connection with the audit. However, ...

... d. A statement of positive assurance on those items of compliance tested and negative assurance on those items not tested. This should include significant instances of noncompliance and instances of or indicating of fraud, abuse or illegal acts found during or in connection with the audit. However, ...

accounting revision notes and assessment tasks

... 1. True profits cannot be known – since detailed information about the expenses etc. is not available and true profits cannot known. 2. Financial position of the business cannot be ascertained – under this system statement of affairs is prepared in an unsatisfactory manner thus exact position of tot ...

... 1. True profits cannot be known – since detailed information about the expenses etc. is not available and true profits cannot known. 2. Financial position of the business cannot be ascertained – under this system statement of affairs is prepared in an unsatisfactory manner thus exact position of tot ...

The Auditor - Whose Agent Is He Anyway

... encourage managers to strive to maximise the reported profit of the company; by creating artificial profits they increase their own return. The downside is that a perceived increase in returns prompts shareholders to increase their share in the company, based on biased financial statements. The audi ...

... encourage managers to strive to maximise the reported profit of the company; by creating artificial profits they increase their own return. The downside is that a perceived increase in returns prompts shareholders to increase their share in the company, based on biased financial statements. The audi ...

Tangible Capital Assets - Waterloo Public Library

... “Fair Value” is the amount of consideration that would be agreed upon in an arm’s length transaction between knowledgeable, willing parties who are under no compulsion to act. “Gain on disposal” is the amount by which the net proceeds realized upon an asset’s disposal exceeds the asset’s net book va ...

... “Fair Value” is the amount of consideration that would be agreed upon in an arm’s length transaction between knowledgeable, willing parties who are under no compulsion to act. “Gain on disposal” is the amount by which the net proceeds realized upon an asset’s disposal exceeds the asset’s net book va ...

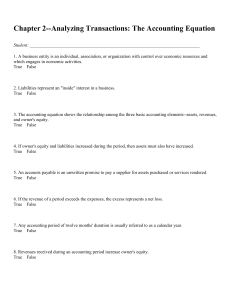

Chapter 2--Analyzing Transactions: The Accounting Equation

... 1. The excess of total revenues over total expenses for the period. 2. A separate record used to summarize changes in each asset, liability, and owner's equity of a business. 3. A formal written promise to pay a supplier or lender a specified sum of money at a definite future time. 4. Withdrawals th ...

... 1. The excess of total revenues over total expenses for the period. 2. A separate record used to summarize changes in each asset, liability, and owner's equity of a business. 3. A formal written promise to pay a supplier or lender a specified sum of money at a definite future time. 4. Withdrawals th ...

FREE Sample Here

... 54. The accounting system uses a device called an account. An account A. is created each time a transaction takes place. B. accumulates the increases and decreases that occur during the period for a single item. C. is created only for income statement items. D. is created only for balance sheet item ...

... 54. The accounting system uses a device called an account. An account A. is created each time a transaction takes place. B. accumulates the increases and decreases that occur during the period for a single item. C. is created only for income statement items. D. is created only for balance sheet item ...

Document

... (a) Under the time period assumption, an accountant is required to determine the relevance of each business transaction to specific accounting periods. (b) An accounting time period of one year in length is referred to as a fiscal year. A fiscal year that extends from January 1 to December 31 is ref ...

... (a) Under the time period assumption, an accountant is required to determine the relevance of each business transaction to specific accounting periods. (b) An accounting time period of one year in length is referred to as a fiscal year. A fiscal year that extends from January 1 to December 31 is ref ...

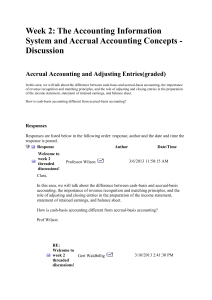

Top of Form Week 2: The Accounting Information System and

... at the time of signing the deal. Expenses also do not show in cash-basis until the cash actually is used to pay for the expense and for accrual-basis it would show up at the time of, for example, signing a contract to buy new furniture even if the payment is not yet made. Bottom line, the difference ...

... at the time of signing the deal. Expenses also do not show in cash-basis until the cash actually is used to pay for the expense and for accrual-basis it would show up at the time of, for example, signing a contract to buy new furniture even if the payment is not yet made. Bottom line, the difference ...

Using regulatory accounting in developing utility rate

... • GASB 62 (Regulated Operations) is the accounting tool used by public utilities where strictly following GASB does not necessarily meet their business model and the intent of certain accounting transactions that will benefit future periods or be charged against future periods. • All utilities are r ...

... • GASB 62 (Regulated Operations) is the accounting tool used by public utilities where strictly following GASB does not necessarily meet their business model and the intent of certain accounting transactions that will benefit future periods or be charged against future periods. • All utilities are r ...

introduction - Financial Accounting Standards Research Initiative

... ownership approach” proposed, among other approaches, by the FASB and IASB.2 We don’t mean to be pedantic about this, and the FASB-IASB may well choose a design for “general-purpose” financial reporting. If so, the design here shows what the common shareholder (and equity analyst) will lose if finan ...

... ownership approach” proposed, among other approaches, by the FASB and IASB.2 We don’t mean to be pedantic about this, and the FASB-IASB may well choose a design for “general-purpose” financial reporting. If so, the design here shows what the common shareholder (and equity analyst) will lose if finan ...

The Role of Accounting in a Society

... conceptual solutions in order to make them function better (Cooper, 2015). A good illustration of this is the concept of fair value measurement. Although the credibility of the efficient market theory as the foundation of a substantial part of accounting theory (including the fair value measurement) ...

... conceptual solutions in order to make them function better (Cooper, 2015). A good illustration of this is the concept of fair value measurement. Although the credibility of the efficient market theory as the foundation of a substantial part of accounting theory (including the fair value measurement) ...

Lesson Preparation Project

... or above the cap would motivate managers to “take a bath” whereby they will try to reduce or minimize net income. By taking a bath below the bogey, managers will then increase the probability of receiving a bonus the following year since current write-offs will reduce future amortization charges. Li ...

... or above the cap would motivate managers to “take a bath” whereby they will try to reduce or minimize net income. By taking a bath below the bogey, managers will then increase the probability of receiving a bonus the following year since current write-offs will reduce future amortization charges. Li ...