Accounting as an Information System

... means of communicating important accounting information to users. Financial statements represent models of the business enterprise because they show the business in financial terms. Financial statements are not perfect pictures of the real thing. Copyright © by Houghton Mifflin Company. All righ ...

... means of communicating important accounting information to users. Financial statements represent models of the business enterprise because they show the business in financial terms. Financial statements are not perfect pictures of the real thing. Copyright © by Houghton Mifflin Company. All righ ...

Accounting for Government and Society

... and climate change. This then will be our focus, although there are many other areas where it is being recognized that accounting has an impact. Some of these are obvious and been well known for a long time. Well known impacts include the effects on the allocation of resources in society, and accoun ...

... and climate change. This then will be our focus, although there are many other areas where it is being recognized that accounting has an impact. Some of these are obvious and been well known for a long time. Well known impacts include the effects on the allocation of resources in society, and accoun ...

Financial Year 2015

... services, infrastructure and asset management. He has been associated with IL&FS for 27 years and is currently working as the Joint Managing Director and CEO of IL&FS and is in charge of finance, operations, compliance and risk management portfolios for the IL&FS Group. His responsibilities at IL&FS ...

... services, infrastructure and asset management. He has been associated with IL&FS for 27 years and is currently working as the Joint Managing Director and CEO of IL&FS and is in charge of finance, operations, compliance and risk management portfolios for the IL&FS Group. His responsibilities at IL&FS ...

Accounting as an Information System

... means of communicating important accounting information to users. Financial statements represent models of the business enterprise because they show the business in financial terms. Financial statements are not perfect pictures of the real thing. Copyright © by Houghton Mifflin Company. All righ ...

... means of communicating important accounting information to users. Financial statements represent models of the business enterprise because they show the business in financial terms. Financial statements are not perfect pictures of the real thing. Copyright © by Houghton Mifflin Company. All righ ...

The Future is Efficient Annual Report 2010

... strongest and most profitable supplier in the few markets where we operate. There are still plenty of growth opportunities and the market size allows for a doubling of Visma in our current markets. Investments in product development and innovation are key factors for Visma’s success. The willingness ...

... strongest and most profitable supplier in the few markets where we operate. There are still plenty of growth opportunities and the market size allows for a doubling of Visma in our current markets. Investments in product development and innovation are key factors for Visma’s success. The willingness ...

An examination of the fraudulent factors associated with

... Need to obtain additional debt or equity financing to stay competitive-including financing of major research and development or capital expenditures Marginal ability to meet exchange listing requirements or debt repayment or other debt covenant requirements Perceived or real adverse effects of repor ...

... Need to obtain additional debt or equity financing to stay competitive-including financing of major research and development or capital expenditures Marginal ability to meet exchange listing requirements or debt repayment or other debt covenant requirements Perceived or real adverse effects of repor ...

RAILROAD ACCOUNTING: ITS PROBLEMS AND THEIR EFFECT

... 1. Because of the difference between book value of property other than ties, rail and other track materials on certain railroads as compared with the valuation determined by the Interstate Commerce Commission, which is the basis for computing book depreciation, there are certain material amounts car ...

... 1. Because of the difference between book value of property other than ties, rail and other track materials on certain railroads as compared with the valuation determined by the Interstate Commerce Commission, which is the basis for computing book depreciation, there are certain material amounts car ...

Chapter 3 - Aufinance

... • Insider trading refers to buying or selling a financial asset based on special knowledge or privileges, before that privileged information becomes publicly known. • Asymmetric information refers to the inequalities in the quantity and quality of information available across different locations wit ...

... • Insider trading refers to buying or selling a financial asset based on special knowledge or privileges, before that privileged information becomes publicly known. • Asymmetric information refers to the inequalities in the quantity and quality of information available across different locations wit ...

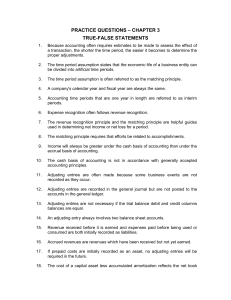

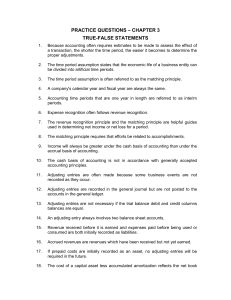

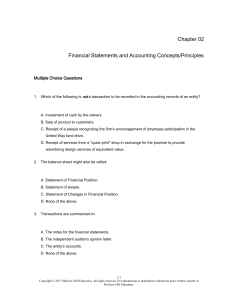

practiceqs_chapter3

... A contra asset account is subtracted from a related account in the balance sheet. ...

... A contra asset account is subtracted from a related account in the balance sheet. ...

Chapter #3 Practice Q`s

... A contra asset account is subtracted from a related account in the balance sheet. ...

... A contra asset account is subtracted from a related account in the balance sheet. ...

Western Kentucky University Accountants’ Report and Financial Statements

... taken as a whole. BKD has expressed an unqualified opinion on the financial statements stating that such statements present fairly, in all material respects, the financial position of the University as of June 30, 2003 and 2002, and the changes in its financial position and its cash flows for the ye ...

... taken as a whole. BKD has expressed an unqualified opinion on the financial statements stating that such statements present fairly, in all material respects, the financial position of the University as of June 30, 2003 and 2002, and the changes in its financial position and its cash flows for the ye ...

Financial Accounting and Accounting Standards

... proper separation of duties, companies must develop and monitor an organizational chart. When one corporation went through this exercise, it found that out of 17,000 employees, there were 400 people who did not report to anyone. The corporation also had 35 people who reported to each other. In addit ...

... proper separation of duties, companies must develop and monitor an organizational chart. When one corporation went through this exercise, it found that out of 17,000 employees, there were 400 people who did not report to anyone. The corporation also had 35 people who reported to each other. In addit ...

PUBLIC SECTOR ACCOUNTING REFORM Tatjana Jovanović

... The global economic crisis has underscored the importance of accountable and transparent use of public funds, in particular in light of deteriorating fiscal position and rising public debts. There is now a growing consensus that good information on government activities matters. It can help policy ...

... The global economic crisis has underscored the importance of accountable and transparent use of public funds, in particular in light of deteriorating fiscal position and rising public debts. There is now a growing consensus that good information on government activities matters. It can help policy ...

Główne zagadnienia

... General costs (period costs) Logically there should be no costs left after allocation (orphan costs) since ultimately every dollar spent has to be covered The problem is that share of direct costs (naturally allocated) decreases while the one of general costs growths rapidly and in some most advance ...

... General costs (period costs) Logically there should be no costs left after allocation (orphan costs) since ultimately every dollar spent has to be covered The problem is that share of direct costs (naturally allocated) decreases while the one of general costs growths rapidly and in some most advance ...

national curriculum statement

... as amended. This company law allows for the establishment of a company with limited liability. The law governs the formation and operation of businesses that are established as separate entities, the owners are able to separate themselves from the business. Credits: At least one component of every a ...

... as amended. This company law allows for the establishment of a company with limited liability. The law governs the formation and operation of businesses that are established as separate entities, the owners are able to separate themselves from the business. Credits: At least one component of every a ...

Paper Bookkeeping - Navajo Business, Navajo Nation

... all financial transactions undertaken by a business (or an individual). A bookkeeper (or book-keeper), sometimes called an accounting clerk in the US, is a person who keeps the books of an organization. The organization might be a business, a charity or even a local sports club. Two methods are wide ...

... all financial transactions undertaken by a business (or an individual). A bookkeeper (or book-keeper), sometimes called an accounting clerk in the US, is a person who keeps the books of an organization. The organization might be a business, a charity or even a local sports club. Two methods are wide ...

Advanced Oxygen Technologies 10K, June 30, 2012 - aoxy

... The Private Securities Litigation Reform Act of 1995 provides a safe harbor for forward-looking statements made by or on behalf of Advanced Oxygen Technologies, Inc. and its wholly owned subsidiary ("AOXY" or the "Company"). We may, from time to time, make written or oral statements that are "forwar ...

... The Private Securities Litigation Reform Act of 1995 provides a safe harbor for forward-looking statements made by or on behalf of Advanced Oxygen Technologies, Inc. and its wholly owned subsidiary ("AOXY" or the "Company"). We may, from time to time, make written or oral statements that are "forwar ...

Notes to the Financial Statements

... The governmental fund financial statements were prepared using the current financial resources measurement focus and the modified accrual basis of accounting. Under this method, revenues are recognized when measurable and available. “Measurable” means the amount of the transaction can be determined ...

... The governmental fund financial statements were prepared using the current financial resources measurement focus and the modified accrual basis of accounting. Under this method, revenues are recognized when measurable and available. “Measurable” means the amount of the transaction can be determined ...

Revenue recognition: determinants of the accounts receivable and

... (2005) to control for changes of other accruals and its components. Finally I include a dummy variable for opportunistic behavior in my model to see how opportunistic behavior is influencing the change in accounts receivable and deferred revenue and a control variable or the opportunistic behavior ...

... (2005) to control for changes of other accruals and its components. Finally I include a dummy variable for opportunistic behavior in my model to see how opportunistic behavior is influencing the change in accounts receivable and deferred revenue and a control variable or the opportunistic behavior ...

Words - corporate

... the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenue and expenses during the reporting period. Actual results could differ from those estimates. Accounts Receivable Accounts rece ...

... the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenue and expenses during the reporting period. Actual results could differ from those estimates. Accounts Receivable Accounts rece ...

... Impairment Tests.” The proposed FSP would amend FAS 141, Business Combinations, FAS 142, Goodwill and Other Intangible Assets, and FAS.144, Accounting for the Impairment or Disposal of Long-Lived Assets, to clarify the guidance on fair value measurements in those Statements. The proposed FSP wou ...

Free Sample

... 50. Volunteer, Inc. is in the process of liquidating and going out of business. The firm has $69,820 in cash, inventory totaling $214,000, accounts receivable of $144,000, plant and equipment with a $384,000 book value, and total liabilities of $614,000. It is estimated that the inventory can be di ...

... 50. Volunteer, Inc. is in the process of liquidating and going out of business. The firm has $69,820 in cash, inventory totaling $214,000, accounts receivable of $144,000, plant and equipment with a $384,000 book value, and total liabilities of $614,000. It is estimated that the inventory can be di ...

5. Financial Statement Forecasts

... The prospective investors are those who have surplus capital to invest in some profitable opportunities. Therefore, they often have to decide whether to invest their capital in the company's share. The financial statement analysis is also important to them because they can obtain useful information ...

... The prospective investors are those who have surplus capital to invest in some profitable opportunities. Therefore, they often have to decide whether to invest their capital in the company's share. The financial statement analysis is also important to them because they can obtain useful information ...