Individual Items to Note (1040)

... Preparer Number - The preparer number has been converted from ProSystem FX. Therefore, preparer names should be set up with the same number in ProSeries. Number of Assets - The conversion program converts a maximum of 2500 assets. Date of Birth - Verify date of birth in Client Information and Depend ...

... Preparer Number - The preparer number has been converted from ProSystem FX. Therefore, preparer names should be set up with the same number in ProSeries. Number of Assets - The conversion program converts a maximum of 2500 assets. Date of Birth - Verify date of birth in Client Information and Depend ...

chapter 3 the reporting entity and consolidation of less-than

... and subsidiary differ by more than 3 months, a difference in time periods cannot be used as a means of avoiding consolidation. The fiscal period of one of the companies must be adjusted to fall within an acceptable time period and consolidated statement prepared. Q3-18 The noncontrolling interest, o ...

... and subsidiary differ by more than 3 months, a difference in time periods cannot be used as a means of avoiding consolidation. The fiscal period of one of the companies must be adjusted to fall within an acceptable time period and consolidated statement prepared. Q3-18 The noncontrolling interest, o ...

Chapter 1 - Testbankster.com

... to avoid becoming a takeover target. to reduce risk by acquiring established product lines. the operating costs of the combined entity would be more than the sum of the separate entities. ...

... to avoid becoming a takeover target. to reduce risk by acquiring established product lines. the operating costs of the combined entity would be more than the sum of the separate entities. ...

Introduction to Business Combinations and the Conceptual Framework

... a. to increase market share. b. to avoid becoming a takeover target. c. to reduce risk by acquiring established product lines. d. the operating costs of the combined entity would be more than the sum of the separate entities. 18. The parent company concept of consolidation represents the view that t ...

... a. to increase market share. b. to avoid becoming a takeover target. c. to reduce risk by acquiring established product lines. d. the operating costs of the combined entity would be more than the sum of the separate entities. 18. The parent company concept of consolidation represents the view that t ...

additional material 2

... The stimulus plan placed a burden on the year's financial figures. The State stepped up its policy of redistribution in order to sustain growth. Measures to support households totalled € 3 billion. Transfers to companies amounted to € 2 billion, with € 840 million being used to bolster the intervent ...

... The stimulus plan placed a burden on the year's financial figures. The State stepped up its policy of redistribution in order to sustain growth. Measures to support households totalled € 3 billion. Transfers to companies amounted to € 2 billion, with € 840 million being used to bolster the intervent ...

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

... this schedule because of Rule 13d-1(b)(3) or (4), check the following ...

... this schedule because of Rule 13d-1(b)(3) or (4), check the following ...

Income taxes

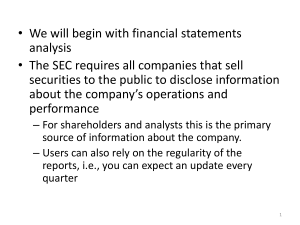

... • We will begin with financial statements analysis • The SEC requires all companies that sell securities to the public to disclose information about the company’s operations and performance – For shareholders and analysts this is the primary source of information about the company. – Users can also ...

... • We will begin with financial statements analysis • The SEC requires all companies that sell securities to the public to disclose information about the company’s operations and performance – For shareholders and analysts this is the primary source of information about the company. – Users can also ...

Accounting Cycle

... Record the amounts, positive or negative, for each transaction – daily and adjusting entries ...

... Record the amounts, positive or negative, for each transaction – daily and adjusting entries ...

Where did donors first get the idea to make

... Majority of planned gifts come from wills Simple gifts to understand and promote Any church can do it Donors more likely to consider major gifts through ...

... Majority of planned gifts come from wills Simple gifts to understand and promote Any church can do it Donors more likely to consider major gifts through ...

Condensed Income Statement

... Condensed formula = [(Merger and restructuring costs if shown on pre-tax basis) * (Marginal tax rate)]+ [Extraordinary charges or expenses if shown on a pre-tax basis) * (Marginal tax rate)] – [(Extraordinary credit or income if shown on a pre-tax basis) * (Marginal tax rate)] + [(Reserve expense (i ...

... Condensed formula = [(Merger and restructuring costs if shown on pre-tax basis) * (Marginal tax rate)]+ [Extraordinary charges or expenses if shown on a pre-tax basis) * (Marginal tax rate)] – [(Extraordinary credit or income if shown on a pre-tax basis) * (Marginal tax rate)] + [(Reserve expense (i ...

Panel Materials - American Bar Association

... If the matter is viewed as a “tax shelter” for purposes of § 6662(d), one additional requirement applies. Beyond showing the existence of “substantial authority” supporting the return position, the taxpayer must also show that he “reasonably believed at the time the return was filed that the tax tre ...

... If the matter is viewed as a “tax shelter” for purposes of § 6662(d), one additional requirement applies. Beyond showing the existence of “substantial authority” supporting the return position, the taxpayer must also show that he “reasonably believed at the time the return was filed that the tax tre ...

GRYFFINDOR The Three Rules For Making A

... industrial markets, made the list, but so did WD-40, a company built on a single, unpatented product that was designed to prevent corrosion on nuclear missiles and has since become most famous as the bane of squeaky hinges. McDonald’s proved to be exceptional, but so did Luby’s, a cafeteria chain, w ...

... industrial markets, made the list, but so did WD-40, a company built on a single, unpatented product that was designed to prevent corrosion on nuclear missiles and has since become most famous as the bane of squeaky hinges. McDonald’s proved to be exceptional, but so did Luby’s, a cafeteria chain, w ...

Definition of a Reporting Entity

... – Instances where double-entry system used but proprietorship is not underlying objective ...

... – Instances where double-entry system used but proprietorship is not underlying objective ...

Chapter title

... Common costs arise because of the overall operation of the company and would not disappear if any particular segment were eliminated. It is important to realize that the traceable fixed costs of one segment may be a common fixed cost of another segment. ...

... Common costs arise because of the overall operation of the company and would not disappear if any particular segment were eliminated. It is important to realize that the traceable fixed costs of one segment may be a common fixed cost of another segment. ...

session22test

... 1. Dividends, at least for US companies, are often described as “sticky”. Which of the following do we mean when we say that dividends are sticky? a. Companies are reluctant to pay dividends b. Companies are reluctant to change dividends per share c. Companies are reluctant to change dividend payout ...

... 1. Dividends, at least for US companies, are often described as “sticky”. Which of the following do we mean when we say that dividends are sticky? a. Companies are reluctant to pay dividends b. Companies are reluctant to change dividends per share c. Companies are reluctant to change dividend payout ...

Reading a Pay Stub

... paychecks. Using the menu on the website, students will answer the following questions (Note: Words in bold type are intended to guide students’ search.). • How must an employer report his/her employees’ tips to the IRS? Answer: Report tips and any collected and uncollected Social Security and Medi ...

... paychecks. Using the menu on the website, students will answer the following questions (Note: Words in bold type are intended to guide students’ search.). • How must an employer report his/her employees’ tips to the IRS? Answer: Report tips and any collected and uncollected Social Security and Medi ...

introduction to the financial statements

... Costs concerning future reporting periods are deferred and apportioned in time as prepayments (e.g. insurance costs) in a way that a portion of these costs is charged to appropriate accounting period, if it is material. Accruals are reported in the amount of probable liabilities relating to the curr ...

... Costs concerning future reporting periods are deferred and apportioned in time as prepayments (e.g. insurance costs) in a way that a portion of these costs is charged to appropriate accounting period, if it is material. Accruals are reported in the amount of probable liabilities relating to the curr ...

Chapter 13

... S/Hs control firm’s investment policy until default occurs • Firm’s managers, acting for the S/Hs, would reject merger – Even though value-maximizing, S/Hs have to contribute additional $1,000,000 cash, yet firm will still default in 30 days – If firm all-equity financed, S/Hs would invest additiona ...

... S/Hs control firm’s investment policy until default occurs • Firm’s managers, acting for the S/Hs, would reject merger – Even though value-maximizing, S/Hs have to contribute additional $1,000,000 cash, yet firm will still default in 30 days – If firm all-equity financed, S/Hs would invest additiona ...

PRSI Cover for Spouses Working on Farms

... they are (i) an employee, full-time or part-time, or (ii) self-employed with an annual income from all sources of 3,174 or more. In return they are covered for contributory non-means tested pensions and other social insurance benefits. Under the rules of social insurance, a person who is employed by ...

... they are (i) an employee, full-time or part-time, or (ii) self-employed with an annual income from all sources of 3,174 or more. In return they are covered for contributory non-means tested pensions and other social insurance benefits. Under the rules of social insurance, a person who is employed by ...

Estates Trusts & Pensions Journal - Frostiak and Leslie Chartered

... To qualify, the fees must be paid to a person whose principal business includes the provision of such services. Provided the amounts paid are reasonable, the total fees can be deducted from the income of a trust, even though part or all of the fees may have been charged to the capital account of the ...

... To qualify, the fees must be paid to a person whose principal business includes the provision of such services. Provided the amounts paid are reasonable, the total fees can be deducted from the income of a trust, even though part or all of the fees may have been charged to the capital account of the ...

Converting a Sole Proprietorship to an LLC

... can expose a business owner’s personal assets to the risks and liabilities of their business operation. State statutes generally allow a sole proprietor to conduct business as a limited liability company (LLC). The intent is to provide a broader protection from liability. The concept of the LLC stat ...

... can expose a business owner’s personal assets to the risks and liabilities of their business operation. State statutes generally allow a sole proprietor to conduct business as a limited liability company (LLC). The intent is to provide a broader protection from liability. The concept of the LLC stat ...

Patheon NV (Form: 8-K, Received: 03/16/2017 07:19:20)

... acquired in acquisitions), interest expense (excluding amortization of the deferred financing costs), and tax expense. In addition, we exclude discrete tax items and apply an estimated tax effect on adjustments within the calculation. The estimated tax effect is calculated using statutory tax rates ...

... acquired in acquisitions), interest expense (excluding amortization of the deferred financing costs), and tax expense. In addition, we exclude discrete tax items and apply an estimated tax effect on adjustments within the calculation. The estimated tax effect is calculated using statutory tax rates ...

Short-term investments - McGraw Hill Higher Education

... All companies desire a high return on total assets. To improve the return, the company must meet any decline in profit margin or total asset turnover with an increase in the other. Companies consider these components in planning strategies. ...

... All companies desire a high return on total assets. To improve the return, the company must meet any decline in profit margin or total asset turnover with an increase in the other. Companies consider these components in planning strategies. ...