Higher National Diploma in Business Finance 1. Read

... c. A tax imposed as a percentage of invoice value of goods or services. d. A tax on money earned as wages or salary. e. A state of economy where prices and wages are rising to keep pace with each other. f. The most important industries in a country. g. The action of imposing taxes. h. Lack of work. ...

... c. A tax imposed as a percentage of invoice value of goods or services. d. A tax on money earned as wages or salary. e. A state of economy where prices and wages are rising to keep pace with each other. f. The most important industries in a country. g. The action of imposing taxes. h. Lack of work. ...

Goals and Governance of the Corporation This chapter introduces

... Provide managers with incentive schemes that produce big returns if shareholders gain but little or nothing if they do not. Board of Directors Through a vote, the board of directors gives shareholders an opportunity to have a say in the operations of a firm. Blockholders Individual investors who hol ...

... Provide managers with incentive schemes that produce big returns if shareholders gain but little or nothing if they do not. Board of Directors Through a vote, the board of directors gives shareholders an opportunity to have a say in the operations of a firm. Blockholders Individual investors who hol ...

Chapter 8: Business Organizations Section 1

... – Partnerships are easy to start up, have more assets to contribute, and are subject to few regulations. But, like sole proprietorships, there is unlimited liability for at least one of the partners. – Franchises allow each owner a level of control and benefit from the support of the parent company. ...

... – Partnerships are easy to start up, have more assets to contribute, and are subject to few regulations. But, like sole proprietorships, there is unlimited liability for at least one of the partners. – Franchises allow each owner a level of control and benefit from the support of the parent company. ...

Offshore Finance and the Netherlands

... arranger The Dutch SFI is a shell company and formally acts as issuer of the notes A large Dutch trust firm is responsible for all local administrative tasks and ...

... arranger The Dutch SFI is a shell company and formally acts as issuer of the notes A large Dutch trust firm is responsible for all local administrative tasks and ...

IT 55 - The Business Expansion Scheme (BES)

... • Recycling activities in relation to waste material – require an employment grant or financial assistance from an industrial development agency. Qualifying Trades and Other Commercial Activities A company carrying on a qualifying trade may also carry on other trading activities provided it receives ...

... • Recycling activities in relation to waste material – require an employment grant or financial assistance from an industrial development agency. Qualifying Trades and Other Commercial Activities A company carrying on a qualifying trade may also carry on other trading activities provided it receives ...

CFO Survey: One-fourth of Dividend

... “This is an important issue,” said Dr. John Graham, finance professor at Fuqua and director of the survey. “Only about one in four public companies currently pay dividends, in sharp contrast to 20 or 30 years ago when nearly three-fourths paid dividends. Many investors have wondered when non-dividen ...

... “This is an important issue,” said Dr. John Graham, finance professor at Fuqua and director of the survey. “Only about one in four public companies currently pay dividends, in sharp contrast to 20 or 30 years ago when nearly three-fourths paid dividends. Many investors have wondered when non-dividen ...

U.S. Federal Income Tax Issues in Acquisitions and Amalgamations

... U.S. shareholder level and do not specifically affect the non-U.S. corporation. Although the PFIC rules traditionally have been an area in which there are varying levels of compliance, particularly among exploration companies with few U.S. shareholders, new U.S. tax rules enacted in March 2010 now r ...

... U.S. shareholder level and do not specifically affect the non-U.S. corporation. Although the PFIC rules traditionally have been an area in which there are varying levels of compliance, particularly among exploration companies with few U.S. shareholders, new U.S. tax rules enacted in March 2010 now r ...

Consolidation

... Interests held by related There is no specific provision for parties and “de facto” agents related parties or de facto agents. may be considered in determining control of a VIE. SPEs can be VIEs. Considers specific indicators of Consolidation rules focus on whether an entity has control of ...

... Interests held by related There is no specific provision for parties and “de facto” agents related parties or de facto agents. may be considered in determining control of a VIE. SPEs can be VIEs. Considers specific indicators of Consolidation rules focus on whether an entity has control of ...

SALARY PACKAGING AUTHORITY FORM

... I note that the University recommends that employees seek independent financial advice before participating in any salary sacrifice arrangement. Having considered the University’s recommendation, I authorise the following salary packaging arrangement to apply until further notice. The University is ...

... I note that the University recommends that employees seek independent financial advice before participating in any salary sacrifice arrangement. Having considered the University’s recommendation, I authorise the following salary packaging arrangement to apply until further notice. The University is ...

Fluor Enterprises, Inc. v. Michigan Department of Treasury

... 2. In a decision affirmed by the West Virginia Supreme Court, the Circuit held that the corporate net income and business franchise taxes had been properly imposed on MBNA, since the gross receipts attributable to a West Virginia source far exceeded the statutory threshold for nexus and concluded th ...

... 2. In a decision affirmed by the West Virginia Supreme Court, the Circuit held that the corporate net income and business franchise taxes had been properly imposed on MBNA, since the gross receipts attributable to a West Virginia source far exceeded the statutory threshold for nexus and concluded th ...

On the Hook: Directors Liability for Corporate Tax

... proceeding can be brought against a director if it is commenced more than two years after the person last ceased to be a director of the corporation.12 If there is more than one director of a corporation, the director who absorbs the liability of the claim is entitled to seek contribution from the o ...

... proceeding can be brought against a director if it is commenced more than two years after the person last ceased to be a director of the corporation.12 If there is more than one director of a corporation, the director who absorbs the liability of the claim is entitled to seek contribution from the o ...

E-Commerce and Accounting Principles

... “Shared objective to develop common accounting standard for use in the world’s capital markets. Consistency, comparability, and efficiency of financial statements, enabling global markets to move with less friction Roadmap for the removal for the reconciliation requirement for non-US companies that ...

... “Shared objective to develop common accounting standard for use in the world’s capital markets. Consistency, comparability, and efficiency of financial statements, enabling global markets to move with less friction Roadmap for the removal for the reconciliation requirement for non-US companies that ...

Document

... I recently watched a UK television programme which focused upon the best destinations to own a holiday home. The emphasis was not on climate but the location which offered the best potential capital gain on the investment for the UK investor. Surprisingly it was the countries that have recently join ...

... I recently watched a UK television programme which focused upon the best destinations to own a holiday home. The emphasis was not on climate but the location which offered the best potential capital gain on the investment for the UK investor. Surprisingly it was the countries that have recently join ...

Application of the United Nations Model to payments received under

... home loans, which generally carry a fixed interest rate. It would like to issue debt to increase its ability to make more loans, and it would like that borrowing to carry a fixed interest rate to provide a natural hedge of its assets. It borrows $100 million from a private investor, at a floating ra ...

... home loans, which generally carry a fixed interest rate. It would like to issue debt to increase its ability to make more loans, and it would like that borrowing to carry a fixed interest rate to provide a natural hedge of its assets. It borrows $100 million from a private investor, at a floating ra ...

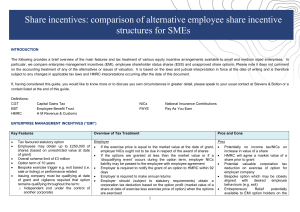

comparison of employee share incentive structures for SMEs

... Stevens & Bolton LLP is a limited liability partnership registered in England with registered number OC306955 and is authorised and regulated by the Solicitors Regulation Authority with SRA number 401245. A list of the members may be inspected at it registered office. ...

... Stevens & Bolton LLP is a limited liability partnership registered in England with registered number OC306955 and is authorised and regulated by the Solicitors Regulation Authority with SRA number 401245. A list of the members may be inspected at it registered office. ...

equipment leasing association 1999 lease accountants

... • Understand why lessors can't get support used to seeing from vendor • Revenue recognition errors account for more than 70% of accounting misstatements in securities litigation ...

... • Understand why lessors can't get support used to seeing from vendor • Revenue recognition errors account for more than 70% of accounting misstatements in securities litigation ...

Bankruptcy and Miller Channels

... contribute. Markets fail. Note: old debt would contribute if it could do so in a coordinated manner. There is an externality element. One purpose of bankruptcy is to coordinate the interests of debt. ...

... contribute. Markets fail. Note: old debt would contribute if it could do so in a coordinated manner. There is an externality element. One purpose of bankruptcy is to coordinate the interests of debt. ...

4,5,6 Test Review

... Ppay: Price buyers pay. This top price will always be what the buyer pays. In this case the buyer give the whole amount to the firm. ...

... Ppay: Price buyers pay. This top price will always be what the buyer pays. In this case the buyer give the whole amount to the firm. ...

DOING BUSINESS IN AZERBAIJAN

... The current general corporate tax rate in Azerbaijan is 20% (for the year 2015). If turnover does not exceed AZN 200,000 for the last 12 months, then the company becomes a simplified tax payer, which is 4% from sales. It ranges within the regions from 2–4% for supporting regional development. An ann ...

... The current general corporate tax rate in Azerbaijan is 20% (for the year 2015). If turnover does not exceed AZN 200,000 for the last 12 months, then the company becomes a simplified tax payer, which is 4% from sales. It ranges within the regions from 2–4% for supporting regional development. An ann ...

SOLE PROPRIETORSHIP The sole proprietorship is

... of the business is taxed before it is passed to the individual owners for further taxation. The net income is after all deductions, such as salaries and fringe benefits. Any profit distributed from net income is considered dividends, which are further taxable and are not deductible, and because of t ...

... of the business is taxed before it is passed to the individual owners for further taxation. The net income is after all deductions, such as salaries and fringe benefits. Any profit distributed from net income is considered dividends, which are further taxable and are not deductible, and because of t ...

Bankruptcy and Miller Channels

... Clienteles for the debt channel 1-TB > (1-TC)(1-TS) Low income investors (Low TB and TS ) Pension funds (TB = TS = 0) IRA's (low TB, TS, because deferred) ...

... Clienteles for the debt channel 1-TB > (1-TC)(1-TS) Low income investors (Low TB and TS ) Pension funds (TB = TS = 0) IRA's (low TB, TS, because deferred) ...

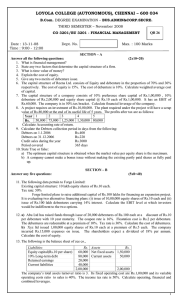

LOYOLA COLLEGE (AUTONOMOUS), CHENNAI – 600 034

... 8. A project requires an investment of Rs.10,00,000. The plant required under the project will have a scrap value of Rs.80,000 at the end of its useful life of 5 years. The profits after tax are as follows: ...

... 8. A project requires an investment of Rs.10,00,000. The plant required under the project will have a scrap value of Rs.80,000 at the end of its useful life of 5 years. The profits after tax are as follows: ...

Document

... 2.State the physical properties of halogens and their gradation down the group. 3. state the chemical properties of halogens and their gradation down the group. 4.list five[5] compounds of each of the halogens. 5. state any four[4] uses of each of the halogens listed above. 6. describe the laborator ...

... 2.State the physical properties of halogens and their gradation down the group. 3. state the chemical properties of halogens and their gradation down the group. 4.list five[5] compounds of each of the halogens. 5. state any four[4] uses of each of the halogens listed above. 6. describe the laborator ...

Mobile Site | Terms of Use | Privacy policy | Feedback | Advertise

... unincorporated businesses or persons working on their own are usually not so protected. Tax advantages. Different structures are treated differently in tax law, and may have advantages for this reason. Disclosure and compliance requirements. Different business structures may be required to make less ...

... unincorporated businesses or persons working on their own are usually not so protected. Tax advantages. Different structures are treated differently in tax law, and may have advantages for this reason. Disclosure and compliance requirements. Different business structures may be required to make less ...