- Distribly

... 4. (Solving for i) Lance Murdoc k purchased a wooden statue of a Conquistador for $7,600 to put in his home office 7 years ago. Lance has recently married, and his home office is being converted into a sewing room. His new wife, who has far better taste than Lance, thinks the Conquistador is hideous ...

... 4. (Solving for i) Lance Murdoc k purchased a wooden statue of a Conquistador for $7,600 to put in his home office 7 years ago. Lance has recently married, and his home office is being converted into a sewing room. His new wife, who has far better taste than Lance, thinks the Conquistador is hideous ...

Accounting for Income Taxes Issues for Exempt Organizations

... Improve comparability of revenue recognition practices across companies, industries, jurisdictions and capital markets Provide more useful information to users of financial statements through improved disclosure requirements ...

... Improve comparability of revenue recognition practices across companies, industries, jurisdictions and capital markets Provide more useful information to users of financial statements through improved disclosure requirements ...

lecture_6 - kingscollege.net

... – tax falls on poorly organized consumers, and not on well organized producers. – Dead-weight loss is lower – Revenue is higher ...

... – tax falls on poorly organized consumers, and not on well organized producers. – Dead-weight loss is lower – Revenue is higher ...

CAVCO Presentation

... a fiscal advantage based on labour costs to Canadian-owned production companies producing Canadian content film and television productions Projected value of CPTC for 2013 is $265 million ...

... a fiscal advantage based on labour costs to Canadian-owned production companies producing Canadian content film and television productions Projected value of CPTC for 2013 is $265 million ...

Chapter 11: Structuring the Deal--Payment and Legal Considerations

... In this chapter, the deal structuring process is described in terms of six interdependent components. These include the acquisition vehicle, the post-closing organization, the form of payment, the legal form of the selling entity, the form of acquisition, and tax considerations. This chapter will br ...

... In this chapter, the deal structuring process is described in terms of six interdependent components. These include the acquisition vehicle, the post-closing organization, the form of payment, the legal form of the selling entity, the form of acquisition, and tax considerations. This chapter will br ...

SL 1987-1015 - North Carolina General Assembly

... exemption from income tax under the provisions of G.S. 105-141(b)(19); nor to any funds, evidences of debt, or securities held in an individual retirement account described in section 408(a) of the Code, or an individual retirement annuity described in section 408(b) of the Code, if such individual ...

... exemption from income tax under the provisions of G.S. 105-141(b)(19); nor to any funds, evidences of debt, or securities held in an individual retirement account described in section 408(a) of the Code, or an individual retirement annuity described in section 408(b) of the Code, if such individual ...

Example benefit decision notice

... Weekly gross rent/council tax This is the total amount of rent/council tax that your benefit is based on. Weekly ineligible service charges This amount is for services included in your rent, which we cannot pay for like fuel charges, water rates. This will be paid on This is the date the amount leav ...

... Weekly gross rent/council tax This is the total amount of rent/council tax that your benefit is based on. Weekly ineligible service charges This amount is for services included in your rent, which we cannot pay for like fuel charges, water rates. This will be paid on This is the date the amount leav ...

Joint Stock Companies in Belarus

... The documents in foreign languages should be translated into Belarusian or Russian and notarised, or legalized (apostilled). Representative offices must: ...

... The documents in foreign languages should be translated into Belarusian or Russian and notarised, or legalized (apostilled). Representative offices must: ...

Summer Sports Camp Revenue

... subject to the unrelated business income tax. Over 30 years ago, the IRS considered both scenarios in a single ruling (Rev. Rul. 80-297 (www.irs.gov/pub/irs-tege/rr80-297.pdf)). In the first scenario, a school used its tennis facilities for 10 weeks during the summer to conduct a tennis club that me ...

... subject to the unrelated business income tax. Over 30 years ago, the IRS considered both scenarios in a single ruling (Rev. Rul. 80-297 (www.irs.gov/pub/irs-tege/rr80-297.pdf)). In the first scenario, a school used its tennis facilities for 10 weeks during the summer to conduct a tennis club that me ...

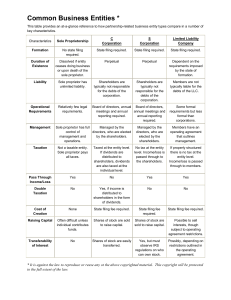

Business Structures

... not more than two or three people, who are partners. The fewest number of businesses are partnerships. People join into partnerships to increase capital, share responsibilities, and pool business skills. Articles of Partnership– a written agreement that provides the details of how a partnership will ...

... not more than two or three people, who are partners. The fewest number of businesses are partnerships. People join into partnerships to increase capital, share responsibilities, and pool business skills. Articles of Partnership– a written agreement that provides the details of how a partnership will ...

Regulation of Business

... which also has delegated authority to make certain compliance and enforcement decisions. ASIC and the Reserve Bank of Australia have other powers to oversee and to enforce the laws and regulations that generally govern financial markets in Australia. The ASX has also created the ASX Corporate Govern ...

... which also has delegated authority to make certain compliance and enforcement decisions. ASIC and the Reserve Bank of Australia have other powers to oversee and to enforce the laws and regulations that generally govern financial markets in Australia. The ASX has also created the ASX Corporate Govern ...

INCOME TAX.

... amount obtained by dividing the tax that would be payable under the First Schedule upon a taxable income from personal exertion equal to his notional income, by that notional income. (b) For every pound of the actual taxable income from property of a taxpayer deriving a notional income, as specified ...

... amount obtained by dividing the tax that would be payable under the First Schedule upon a taxable income from personal exertion equal to his notional income, by that notional income. (b) For every pound of the actual taxable income from property of a taxpayer deriving a notional income, as specified ...

Business Organizations - Cornerstone Charter Academy

... business owned by two or more persons. This shares many of the same strengths and weaknesses as a sole proprietorship. Partnerships represent about 8% or all businesses and ...

... business owned by two or more persons. This shares many of the same strengths and weaknesses as a sole proprietorship. Partnerships represent about 8% or all businesses and ...

chapter eight

... In panels (a) and (b), the demand curve and the size of the tax are the same, but the price elasticity of supply is different. Notice that the more elastic the supply curve, the larger the deadweight loss of the tax. ...

... In panels (a) and (b), the demand curve and the size of the tax are the same, but the price elasticity of supply is different. Notice that the more elastic the supply curve, the larger the deadweight loss of the tax. ...

1 - Madeira City Schools

... 1. Write the debit amounts in the Adjustments Debit column. 2. Write the credit amounts in the Adjustments Credit column. 3. Label the two parts of the Supplies—Office adjustment with small letter a and small letter b in parentheses. ...

... 1. Write the debit amounts in the Adjustments Debit column. 2. Write the credit amounts in the Adjustments Credit column. 3. Label the two parts of the Supplies—Office adjustment with small letter a and small letter b in parentheses. ...

50 days of Pres. Trump – can the US equity rally

... $500bn providing 1-2% of EPS upside. EPS would be further boosted by any tax amnesty as a large number of companies that keep cash overseas, estimated at $ 1 trillion would be repatriated leading to further buybacks. In 2016 83% of net income was distributed as buybacks and dividends. Corporate tax ...

... $500bn providing 1-2% of EPS upside. EPS would be further boosted by any tax amnesty as a large number of companies that keep cash overseas, estimated at $ 1 trillion would be repatriated leading to further buybacks. In 2016 83% of net income was distributed as buybacks and dividends. Corporate tax ...

Globe Specialty Metals, Inc. Reports Preliminary Fiscal 2007 Earnings

... Globe Metallurgical, Inc., a US manufacturer of silicon metal and silicon‐based alloys from November 12, 2006 Globe Metales S.A., an Argentinean based manufacturer of silicon‐based alloys from November 20, 2006 Globe Metais Industria e Comercio S.A., a Brazilian based manufacturer of silicon me ...

... Globe Metallurgical, Inc., a US manufacturer of silicon metal and silicon‐based alloys from November 12, 2006 Globe Metales S.A., an Argentinean based manufacturer of silicon‐based alloys from November 20, 2006 Globe Metais Industria e Comercio S.A., a Brazilian based manufacturer of silicon me ...

Corporate Finance

... Deferred income taxes reflect the net tax effects of temporary differences between the carrying amounts of assets and liabilities for financial reporting purposes and the amounts used for income tax purposes. Deferred tax assets are created when future taxable income is expected to exceed pretax i ...

... Deferred income taxes reflect the net tax effects of temporary differences between the carrying amounts of assets and liabilities for financial reporting purposes and the amounts used for income tax purposes. Deferred tax assets are created when future taxable income is expected to exceed pretax i ...

What is a Property Authorised Investment Fund

... Why do PAIFs sometimes have feeder funds? As the PAIF is structured as an OEIC, the majority of investors can access it directly. However, the PAIF rules state that no single 'corporate investor' may hold more than 10% of the Fund directly (these rules were introduced to avoid foreign companies set ...

... Why do PAIFs sometimes have feeder funds? As the PAIF is structured as an OEIC, the majority of investors can access it directly. However, the PAIF rules state that no single 'corporate investor' may hold more than 10% of the Fund directly (these rules were introduced to avoid foreign companies set ...

Intro - Charity Tax Group

... Q: MTD and unemployment. My clients have stated that this may be the only option open to them as they will not be able to operate and pay for digital operations required. The threshold should be the same as the VAT registration threshold, is this being considered? A: The Government has committed to ...

... Q: MTD and unemployment. My clients have stated that this may be the only option open to them as they will not be able to operate and pay for digital operations required. The threshold should be the same as the VAT registration threshold, is this being considered? A: The Government has committed to ...

TAXATION GUIDANCE INTRODUCTION Shareholders` Odd

... previously cancelled part of its nominal share capital, there is uncertainty as to the methodology which should be used to calculate this distribution component. The uncertainty relates to whether when a company repurchases its own shares the “new consideration” (for the purposes of section 1115 of ...

... previously cancelled part of its nominal share capital, there is uncertainty as to the methodology which should be used to calculate this distribution component. The uncertainty relates to whether when a company repurchases its own shares the “new consideration” (for the purposes of section 1115 of ...

Advantages

... “You don’t have to worry about burning bridges, if you’re building your own” – Kerry E. Wagner ...

... “You don’t have to worry about burning bridges, if you’re building your own” – Kerry E. Wagner ...

Corporate Class: Tax-efficient Investing

... strategies available as of the date indicated and is not intended to be comprehensive investment advice applicable to the circumstances of the individual and should not be considered as personal investment advice or an offer or solicitation to buy or sell securities. This should not be construed to ...

... strategies available as of the date indicated and is not intended to be comprehensive investment advice applicable to the circumstances of the individual and should not be considered as personal investment advice or an offer or solicitation to buy or sell securities. This should not be construed to ...