income tax computation and property income

... • Change must be notified to HMRC on or before 31 January following the tax year in which the change is to be made • The first accounts to the new accounting date must not be >18 months • There must not have been another change of accounting date during the previous five tax years unless for genuine ...

... • Change must be notified to HMRC on or before 31 January following the tax year in which the change is to be made • The first accounts to the new accounting date must not be >18 months • There must not have been another change of accounting date during the previous five tax years unless for genuine ...

Cooperatives as Unique Corporations

... A. A corporation is a business that is treated as a single entity, yet it is owned by several people. 1. The corporation is treated as a single entity; it can own property. 2. The corporation is owned by shareholders —people who own stock in the company. 3. Capital is raised by selling shares of ...

... A. A corporation is a business that is treated as a single entity, yet it is owned by several people. 1. The corporation is treated as a single entity; it can own property. 2. The corporation is owned by shareholders —people who own stock in the company. 3. Capital is raised by selling shares of ...

Charity Gift Aid form 2 sided - St Columba`s Catholic Church

... If you pay Income Tax at the higher or additional rate and want to receive the additional tax relief due to you, you must include all your Gift Aid donations on your Self-Assessment tax return or ask HM Revenue and Customs to adjust your tax code. ...

... If you pay Income Tax at the higher or additional rate and want to receive the additional tax relief due to you, you must include all your Gift Aid donations on your Self-Assessment tax return or ask HM Revenue and Customs to adjust your tax code. ...

Unit R061 - Different types of business - Activity

... Effectively the owner is the business, so John Smith, trading as JS Trading, is liable for all the work done as well as paying any debts if the business folds. However all the profits belong to the owner, who must then pay personal income tax on that money. Partnership The set up of a partnership is ...

... Effectively the owner is the business, so John Smith, trading as JS Trading, is liable for all the work done as well as paying any debts if the business folds. However all the profits belong to the owner, who must then pay personal income tax on that money. Partnership The set up of a partnership is ...

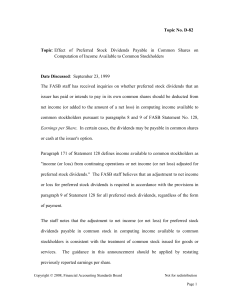

Topic No. D-82 Topic: Effect of Preferred Stock Dividends

... The FASB staff has received inquiries on whether preferred stock dividends that an issuer has paid or intends to pay in its own common shares should be deducted from net income (or added to the amount of a net loss) in computing income available to common stockholders pursuant to paragraphs 8 and 9 ...

... The FASB staff has received inquiries on whether preferred stock dividends that an issuer has paid or intends to pay in its own common shares should be deducted from net income (or added to the amount of a net loss) in computing income available to common stockholders pursuant to paragraphs 8 and 9 ...

English Exam

... received from circulation; to increase the money supply they buy them back, paying with newly created money which is put into circulation in this way. 1. Banks’ loan portfolios are now generally less secure than 20 years ago because blue chip companies issue their own bonds, and banks that receive ...

... received from circulation; to increase the money supply they buy them back, paying with newly created money which is put into circulation in this way. 1. Banks’ loan portfolios are now generally less secure than 20 years ago because blue chip companies issue their own bonds, and banks that receive ...

Chapter: 19

... These ADRs (depository receipts) allow foreign shares to be traded in the United States much like any other security. Through ADRs, one can purchase the stock of Sony Corporation, Honda Motor Co., Ltd., and hundreds of other foreign corporations. The measurement of joint movement ...

... These ADRs (depository receipts) allow foreign shares to be traded in the United States much like any other security. Through ADRs, one can purchase the stock of Sony Corporation, Honda Motor Co., Ltd., and hundreds of other foreign corporations. The measurement of joint movement ...

1 Syed Naved Andrabi April 16, 2008 Taxation

... Two firms are combined on a relatively co-equal basis. ...

... Two firms are combined on a relatively co-equal basis. ...

Current liabilities -- personnel costs

... Payment is very likely at some point. The amount of the payment can be calculated fairly accurately Required accrual journal entry examples --vacation pay that vests and vacation pay that doesn’t vest, if carried forward to another accounting period, sick leave if vests (and will be paid eventua ...

... Payment is very likely at some point. The amount of the payment can be calculated fairly accurately Required accrual journal entry examples --vacation pay that vests and vacation pay that doesn’t vest, if carried forward to another accounting period, sick leave if vests (and will be paid eventua ...

VOL. 2 • 2010

... better chances of success because local experience is available from the start and the amounts to invest are generally less than the cost of an acquisition. The advantages of joint ventures therefore can be: combination of resources, limited investment, immediate availability of foreign talent, ov ...

... better chances of success because local experience is available from the start and the amounts to invest are generally less than the cost of an acquisition. The advantages of joint ventures therefore can be: combination of resources, limited investment, immediate availability of foreign talent, ov ...

mining tax avoidance schemes - International Association of

... • Possible nonnon-disclosure of recoverable precious metals from mineral ores and concentrates. • Mining versus contract mining – An increase in contract mining leading to companies trying to use the favourable tax regime applicable to mining companies. • Thin Capitalisation – Exploiting tax deducti ...

... • Possible nonnon-disclosure of recoverable precious metals from mineral ores and concentrates. • Mining versus contract mining – An increase in contract mining leading to companies trying to use the favourable tax regime applicable to mining companies. • Thin Capitalisation – Exploiting tax deducti ...

Limited Partnership

... The Quick-Inc Guide to Business Entities LLCs on MyCorporation.com LLCs on BizFilings.com BizFilings.com Comparison of: C Corp to S Corp, S Corp to LLC, C Corp to LLC ...

... The Quick-Inc Guide to Business Entities LLCs on MyCorporation.com LLCs on BizFilings.com BizFilings.com Comparison of: C Corp to S Corp, S Corp to LLC, C Corp to LLC ...

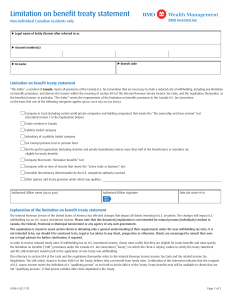

Limitation on benefit treaty statement

... statements. Please note that there are various tests which must be met by each entity in order to be classified as a “qualified person”. The categories applicable to the Treaty are: 1. Company or trust that meets the ownership and base erosion test – This test generally requires that more than 50% o ...

... statements. Please note that there are various tests which must be met by each entity in order to be classified as a “qualified person”. The categories applicable to the Treaty are: 1. Company or trust that meets the ownership and base erosion test – This test generally requires that more than 50% o ...

Financial Literacy

... Sales tax - tax added onto an item when it is sold. EX1) Find the total cost of an item priced ____with a sales tax of ___. ...

... Sales tax - tax added onto an item when it is sold. EX1) Find the total cost of an item priced ____with a sales tax of ___. ...

Sample Powerpoint Slides

... – Tax Equity: Typically will take a major stake in the project for the first 5 years (to maximize depreciation and tax benefits) and then become a background player for remaining ~10 or so years – Main equity investors at this point are: Banks and insurance companies (and Google) ...

... – Tax Equity: Typically will take a major stake in the project for the first 5 years (to maximize depreciation and tax benefits) and then become a background player for remaining ~10 or so years – Main equity investors at this point are: Banks and insurance companies (and Google) ...

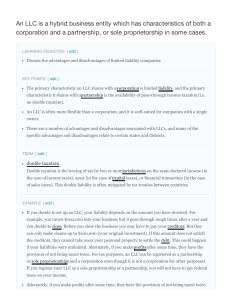

An LLC is a hybrid business entity which has characteristics of both

... Many jurisdictions levy a franchise tax or capital values tax on LLCs. In essence, this franchise or business privilege tax is the fee the LLC pays the state for the benefit of limited liability. The amount of the franchise tax can be based on the following: ...

... Many jurisdictions levy a franchise tax or capital values tax on LLCs. In essence, this franchise or business privilege tax is the fee the LLC pays the state for the benefit of limited liability. The amount of the franchise tax can be based on the following: ...

THE MEXICAN MAQUILADORA INDUSTRY LEGAL FRAMEWORK

... in the interior of Mexico. It is payable by the Maquiladora company on all purchases of goods and services in Mexico, as well as on all definitive imports. Temporary imports are exempt from IVA. The 0% rate is applicable on all exports of the company. The amount payable is the difference between the ...

... in the interior of Mexico. It is payable by the Maquiladora company on all purchases of goods and services in Mexico, as well as on all definitive imports. Temporary imports are exempt from IVA. The 0% rate is applicable on all exports of the company. The amount payable is the difference between the ...

Rewriting the Income Tax Act - Exposure Draft

... Non-cash dividends Dividends paid to companies under control of non-residents Certain amounts of interest ...

... Non-cash dividends Dividends paid to companies under control of non-residents Certain amounts of interest ...

Evans School of Public Affairs, Mark Long PBAF 516

... Moving from the Nash Equilibrium (High, High) to (Medium, Low) lowers B's profits by $15 (from $20 to $5) – thus, B needs a payment of at least $15 to be enticed to agree to this combination of strategies. A mutually beneficial exchange could occur with A paying B between $15 and $65 for B to produc ...

... Moving from the Nash Equilibrium (High, High) to (Medium, Low) lowers B's profits by $15 (from $20 to $5) – thus, B needs a payment of at least $15 to be enticed to agree to this combination of strategies. A mutually beneficial exchange could occur with A paying B between $15 and $65 for B to produc ...

FOLIO INVESTMENTS, INC. (formerly FOLIOfn Investments, Inc.) (A

... Intangible Asset, Net: A recognized intangible asset that has a finite useful life is amortized over its estimated life using the straight-line method. The Company’s intangible asset consists of an acquired customer list intangible, which will be amortized over three years using the straight-line me ...

... Intangible Asset, Net: A recognized intangible asset that has a finite useful life is amortized over its estimated life using the straight-line method. The Company’s intangible asset consists of an acquired customer list intangible, which will be amortized over three years using the straight-line me ...

Utilizing Capital Loss Carry-Forwards - Twenty

... also may be attractive to those with capital loss carry‐forwards. Although the preferred stock is a fixed‐income vehicle, these preferreds’ dividends are usually part capital gain. By law, mutual fund distributions are taxed the same to all holders; the owner of the common share receives the ...

... also may be attractive to those with capital loss carry‐forwards. Although the preferred stock is a fixed‐income vehicle, these preferreds’ dividends are usually part capital gain. By law, mutual fund distributions are taxed the same to all holders; the owner of the common share receives the ...