lecture notes

... • If a market system is not perfectly competitive, market power may result • Market power is the ability to influence prices • Market power can cause markets to be inefficient because it keeps price and quantity from the equilibrium of supply and demand ...

... • If a market system is not perfectly competitive, market power may result • Market power is the ability to influence prices • Market power can cause markets to be inefficient because it keeps price and quantity from the equilibrium of supply and demand ...

Captive Insurance Companies: a Growing alternative

... U.S. shareholders in an off-shore insurance company that is a “controlled foreign corporation” (CFC) also are subject to the U.S. Subpart F anti-deferral rules. An off-shore insurance company that has at least 25 percent of its stock owned by U.S. shareholders would qualify as a CFC and its sharehol ...

... U.S. shareholders in an off-shore insurance company that is a “controlled foreign corporation” (CFC) also are subject to the U.S. Subpart F anti-deferral rules. An off-shore insurance company that has at least 25 percent of its stock owned by U.S. shareholders would qualify as a CFC and its sharehol ...

CHAPTER 11: NONFARM PROPRIETORS’ INCOME (December 2015) Definitions and Concepts

... rules. Because total depreciation cannot exceed the amount of the investment, the amount of depreciation remaining to be taken in future years was reduced. Hence, depreciation was raised during the “bonus” span and lowered thereafter, and because depreciation is an expense in calculating net income, ...

... rules. Because total depreciation cannot exceed the amount of the investment, the amount of depreciation remaining to be taken in future years was reduced. Hence, depreciation was raised during the “bonus” span and lowered thereafter, and because depreciation is an expense in calculating net income, ...

Illustrative financial audit procedures for a self

... The auditor exercises professional judgement to ensure that the procedures adopted are appropriate to the audit engagement. No allowance has been made for materiality or extent of testing and changes may be necessary when reliance is placed on internal controls. This appendix is not intended to serv ...

... The auditor exercises professional judgement to ensure that the procedures adopted are appropriate to the audit engagement. No allowance has been made for materiality or extent of testing and changes may be necessary when reliance is placed on internal controls. This appendix is not intended to serv ...

CORPORATIONS OUTLINE

... contract, not tort. Potential plaintiff can protect themselves with high rate, for example, credit card companies. Law likes limited liability, but not too much. B. Piercing the Corporate Veil: Very Rare exception to limited liability (law doesn’t want to chill capital formation, etc.: The flipside ...

... contract, not tort. Potential plaintiff can protect themselves with high rate, for example, credit card companies. Law likes limited liability, but not too much. B. Piercing the Corporate Veil: Very Rare exception to limited liability (law doesn’t want to chill capital formation, etc.: The flipside ...

SECURITIES AND EXCHANGE COMMISSION WASHINGTON, DC

... The accompanying consolidated financial statements have been prepared in accordance with the instructions to Form 10-Q and do not include all the information and footnote disclosure required by generally accepted accounting principles for complete consolidated financial statements. In the opinion of ...

... The accompanying consolidated financial statements have been prepared in accordance with the instructions to Form 10-Q and do not include all the information and footnote disclosure required by generally accepted accounting principles for complete consolidated financial statements. In the opinion of ...

SERVICESOURCE INTERNATIONAL, INC.

... “ServiceSource finished 2015 with a strong quarter, exceeding guidance across all revenue and profitability metrics. The fourth quarter capped a year that saw ServiceSource make extraordinary progress rebuilding the company’s leadership, strengthening customer relationships and improving operational ...

... “ServiceSource finished 2015 with a strong quarter, exceeding guidance across all revenue and profitability metrics. The fourth quarter capped a year that saw ServiceSource make extraordinary progress rebuilding the company’s leadership, strengthening customer relationships and improving operational ...

NBER WORKING PAPER SERIES INEFFICIENCY OF CORPORATE INVESTMENT AND DISTORTION OF SAVINGS

... Unfortunately, Japanese national income data historically do not include such a CCAdj. Rather, under SNA68 depreciation using the tax code's provisions for service lives and historic cost was reported. Under SNA93, beginning with 1990 data, an adjustment that reflects the difference between historic ...

... Unfortunately, Japanese national income data historically do not include such a CCAdj. Rather, under SNA68 depreciation using the tax code's provisions for service lives and historic cost was reported. Under SNA93, beginning with 1990 data, an adjustment that reflects the difference between historic ...

Reporting Requirements and General Instruction guide Quart…

... Where a superannuation entity has total assets that qualify it to be considered within the largest 200 superannuation entities in the industry, it is required to complete version B of this form. The ABS has indicated that it only requires these entities to be subject to the specific reporting requi ...

... Where a superannuation entity has total assets that qualify it to be considered within the largest 200 superannuation entities in the industry, it is required to complete version B of this form. The ABS has indicated that it only requires these entities to be subject to the specific reporting requi ...

Document

... Accounting standards and basis of preparation The consolidated financial statements for the six months ended June 30, 2014 have been prepared in accordance with IAS 34 - Interim Financial Reporting. As condensed financial statements, they do not include all the disclosures required by International ...

... Accounting standards and basis of preparation The consolidated financial statements for the six months ended June 30, 2014 have been prepared in accordance with IAS 34 - Interim Financial Reporting. As condensed financial statements, they do not include all the disclosures required by International ...

Kabe Exploration Inc.

... applicable to a going concern, which contemplates the realization of assets and liquidation of liabilities in the normal course of business. The Company has not yet established an ongoing source of revenues sufficient to cover its operating costs and to allow it to continue as a going concern. The C ...

... applicable to a going concern, which contemplates the realization of assets and liquidation of liabilities in the normal course of business. The Company has not yet established an ongoing source of revenues sufficient to cover its operating costs and to allow it to continue as a going concern. The C ...

GYRODYNE CO OF AMERICA INC Filing Type: SCD 13D

... * The remainder of this cover page shall be filled out for a reporting person's initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page. The information required ...

... * The remainder of this cover page shall be filled out for a reporting person's initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page. The information required ...

welfarePolluteIV

... • Let MCf be the marginal costs incurred by the firm • Let MCp be the marginal costs caused by pollution and not paid by the firm • MC = MCp + MCf – previous example MCp could be a constant t ...

... • Let MCf be the marginal costs incurred by the firm • Let MCp be the marginal costs caused by pollution and not paid by the firm • MC = MCp + MCf – previous example MCp could be a constant t ...

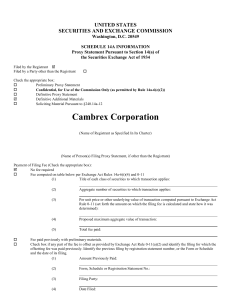

united states securities and exchange commission - corporate

... Cambrex Corporation has filed with the SEC and mailed to its stockholders a definitive proxy statement in connection with the special meeting of stockholders to approve the Bio Businesses transaction. The definitive proxy statement contains important information about Cambrex Corporation, the transa ...

... Cambrex Corporation has filed with the SEC and mailed to its stockholders a definitive proxy statement in connection with the special meeting of stockholders to approve the Bio Businesses transaction. The definitive proxy statement contains important information about Cambrex Corporation, the transa ...

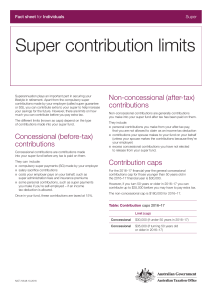

Super contribution limits

... ■■ the full amount of your associated earnings will be included in your assessable income and taxed at your marginal tax rate ■■ a non-refundable tax offset equal to 15% of your associated earnings is applied to allow for the 15% tax already paid by your fund. ...

... ■■ the full amount of your associated earnings will be included in your assessable income and taxed at your marginal tax rate ■■ a non-refundable tax offset equal to 15% of your associated earnings is applied to allow for the 15% tax already paid by your fund. ...

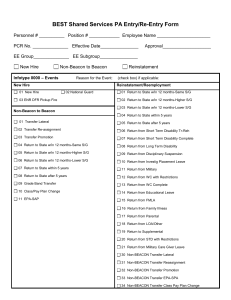

Entry/Re-Entry Form - Amazon Web Services

... Contract Type: (Please check box) if applicable RE Ret Ex from Lmt M1 MedCare EE Elig ...

... Contract Type: (Please check box) if applicable RE Ret Ex from Lmt M1 MedCare EE Elig ...

HSA Contribution and Withdrawal Rules

... your annual tax return. Election can be changed on a month-bymonth basis. Can be made by others on your behalf and deducted on your tax return. Can be made via a one-time transfer your HSA, subject to contribution limits. ...

... your annual tax return. Election can be changed on a month-bymonth basis. Can be made by others on your behalf and deducted on your tax return. Can be made via a one-time transfer your HSA, subject to contribution limits. ...

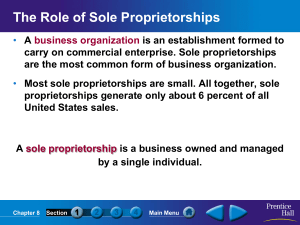

Chapter 8 onlevel

... (d) corporations have more potential for growth 2. A horizontal merger (a) combines two or more firms involved in different stages of producing the same good or service. (b) combines two or more partnerships into a larger partnership. (c) combines two or more firms competing in the same market with ...

... (d) corporations have more potential for growth 2. A horizontal merger (a) combines two or more firms involved in different stages of producing the same good or service. (b) combines two or more partnerships into a larger partnership. (c) combines two or more firms competing in the same market with ...

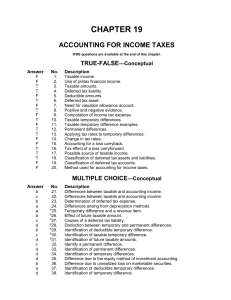

Solution 19-105

... Calculate loss to be reported after NOL carryback. Calculate loss to be reported after NOL carryback. Calculate loss to be reported after NOL carryforward. Determine income tax refund following an NOL carryback. Calculate income tax benefit from an NOL carryback. Calculate income tax payable after N ...

... Calculate loss to be reported after NOL carryback. Calculate loss to be reported after NOL carryback. Calculate loss to be reported after NOL carryforward. Determine income tax refund following an NOL carryback. Calculate income tax benefit from an NOL carryback. Calculate income tax payable after N ...

Luxembourg Reserved Alternative Investment Fund (RAIF)

... > institutional investors > professional investors > any other investors (i) which elect to be treated as well-informed investors and (ii) invest at least €125,000 or (iii) have a recommendation from a credit institution or any other professional of the financial sector or a management company Such ...

... > institutional investors > professional investors > any other investors (i) which elect to be treated as well-informed investors and (ii) invest at least €125,000 or (iii) have a recommendation from a credit institution or any other professional of the financial sector or a management company Such ...

Statement of Cash Flow

... to make sure that all valuable investments are made so that free cash flow is what is left after accounting for investments necessary for the efficient operation of the firm. We find this value for the last period from the statement of cash flow in the investment cash flow section once we ignore the ...

... to make sure that all valuable investments are made so that free cash flow is what is left after accounting for investments necessary for the efficient operation of the firm. We find this value for the last period from the statement of cash flow in the investment cash flow section once we ignore the ...

Current Liabilities

... period - sometimes called Revenue. Expenditure – An amount of money which has been spent by, or goes out from, the business during an accounting period. ...

... period - sometimes called Revenue. Expenditure – An amount of money which has been spent by, or goes out from, the business during an accounting period. ...

STANDARDS, INTERPRETATION AND CHANGES TO PUBLISHED

... also no joint operations on the basis of which the Group has rights to assets under an arrangement and liabilities for related debts. The revised IAS 28 “Investments in Associates and Joint Ventures” is being expanded to include rules governing accounting for interests in joint ventures. The equity ...

... also no joint operations on the basis of which the Group has rights to assets under an arrangement and liabilities for related debts. The revised IAS 28 “Investments in Associates and Joint Ventures” is being expanded to include rules governing accounting for interests in joint ventures. The equity ...