ASIAN COMPANIES` Financial reporting frequency

... by regional practices adopted in that region. In Asia, for example, there is the presence of written regulations, effectively enforced, which ensure that the reporting of companies is explained. There are other regions, like EU, outside the scope of this research but reviewed briefly, which will be ...

... by regional practices adopted in that region. In Asia, for example, there is the presence of written regulations, effectively enforced, which ensure that the reporting of companies is explained. There are other regions, like EU, outside the scope of this research but reviewed briefly, which will be ...

Agribusiness Library

... single owner/operator. A business entity is a professional organization offering something that has real existence. The following factors characterize a sole proprietorship. ...

... single owner/operator. A business entity is a professional organization offering something that has real existence. The following factors characterize a sole proprietorship. ...

Private Equity - Gilbert + Tobin Lawyers

... be independent and that the chair of the audit committee be independent. Once taken private, there is greater freedom in terms of conducting corporate transactions, greater flexibility over the company’s capital structure and significantly less onerous disclosure requirements. Where a private equity ...

... be independent and that the chair of the audit committee be independent. Once taken private, there is greater freedom in terms of conducting corporate transactions, greater flexibility over the company’s capital structure and significantly less onerous disclosure requirements. Where a private equity ...

Презентация5

... positive, the bottom line of the profit and loss statement is labeled as net income. If the net amount (or bottom line) is negative, there is a net loss. A. Revenues and Gains 1. Revenues from primary activities are often referred to as operating revenues. The primary activities of a retailer are pu ...

... positive, the bottom line of the profit and loss statement is labeled as net income. If the net amount (or bottom line) is negative, there is a net loss. A. Revenues and Gains 1. Revenues from primary activities are often referred to as operating revenues. The primary activities of a retailer are pu ...

united states securities and exchange commission - corporate

... Specialty Beauty Business for the periods presented. The supplemental unaudited historical combined financial information has been prepared for illustrative purposes only, and is not necessarily indicative of the operating results or financial position that would have occurred if the Merger had been ...

... Specialty Beauty Business for the periods presented. The supplemental unaudited historical combined financial information has been prepared for illustrative purposes only, and is not necessarily indicative of the operating results or financial position that would have occurred if the Merger had been ...

Shelf Offer

... listed for trade on the stock exchange under a Shelf Offering Report dated May 25, 2016, published under the Shelf Prospectus (hereinafter: the “First Shelf Offering Report”). For details regarding the terms of the Bonds (Series 11), including regarding the linkage terms to the dollar rate of the Bo ...

... listed for trade on the stock exchange under a Shelf Offering Report dated May 25, 2016, published under the Shelf Prospectus (hereinafter: the “First Shelf Offering Report”). For details regarding the terms of the Bonds (Series 11), including regarding the linkage terms to the dollar rate of the Bo ...

NORTH CENTRAL FARM MANAGEMENT EXTENSION COMMITTEE

... of regular payments, usually annual or semiannual, for a period of years. At the end of the lease period the operator can choose to purchase the machine at a price close to fair market value or to extend the lease. If the farmer no longer wants the machine, it can be returned to the dealer or the le ...

... of regular payments, usually annual or semiannual, for a period of years. At the end of the lease period the operator can choose to purchase the machine at a price close to fair market value or to extend the lease. If the farmer no longer wants the machine, it can be returned to the dealer or the le ...

Financial statements

... Non-current interest-bearing liabilities Minority interest Issued capital and reserves ...

... Non-current interest-bearing liabilities Minority interest Issued capital and reserves ...

The Balance Sheet: Assets, Debts and Equity

... expectations of future synergies and market share gains that may or may not be realized. The Financial Accounting Standards Board (FASB) requires companies to test goodwill for impairment at least annually. If the fair value of the goodwill is less than the reported value, the company must recognize ...

... expectations of future synergies and market share gains that may or may not be realized. The Financial Accounting Standards Board (FASB) requires companies to test goodwill for impairment at least annually. If the fair value of the goodwill is less than the reported value, the company must recognize ...

RTF - Review of Business Taxation

... majority ownership of an entity in the year a loss was incurred is the same as in the year the loss is sought to be recouped. An amendment is required to remedy a defect in the test. The defect stems from the lack of any requirement to test for proportionate changes in shareholding among a continuin ...

... majority ownership of an entity in the year a loss was incurred is the same as in the year the loss is sought to be recouped. An amendment is required to remedy a defect in the test. The defect stems from the lack of any requirement to test for proportionate changes in shareholding among a continuin ...

Lost Profits Dilemma

... Numerous jurisdictions hold to the view that when the loss of business is alleged to be caused by the wrongful acts of another, damages are measured by one of two alternative methods: (1) the going concern value; or (2) lost future profits. [T]he courts allow a plaintiff to recover either the presen ...

... Numerous jurisdictions hold to the view that when the loss of business is alleged to be caused by the wrongful acts of another, damages are measured by one of two alternative methods: (1) the going concern value; or (2) lost future profits. [T]he courts allow a plaintiff to recover either the presen ...

part ii--establishment of corporations

... (d) give a statement of corporate intent to the voting shareholders within 2 months after the delivery of the draft. (3) The Portfolio Minister shall lay a statement of corporate intent before the Legislative Assembly within 15 sitting days after receiving it. (4) Before laying a statement before th ...

... (d) give a statement of corporate intent to the voting shareholders within 2 months after the delivery of the draft. (3) The Portfolio Minister shall lay a statement of corporate intent before the Legislative Assembly within 15 sitting days after receiving it. (4) Before laying a statement before th ...

Hybrid Securities: A Basic Look at Monthly Income Preferred

... the company experiences cash flow difficulties. In this regard, these securities are similar to conventional preferred stock, which can also suspend dividend payments. MIPS can typically suspend dividend payments for as long as five years, although the company would first have to stop paying dividen ...

... the company experiences cash flow difficulties. In this regard, these securities are similar to conventional preferred stock, which can also suspend dividend payments. MIPS can typically suspend dividend payments for as long as five years, although the company would first have to stop paying dividen ...

How U.S. Multinational Companies Strengthen the U.S. Economy

... What forces drive companies to be more productive? There is a wealth of evidence from many industries and countries that a central driving force is competition. Companies exposed to high competitive intensity—in not just their output markets but the markets for labor and capital as well—tend to be m ...

... What forces drive companies to be more productive? There is a wealth of evidence from many industries and countries that a central driving force is competition. Companies exposed to high competitive intensity—in not just their output markets but the markets for labor and capital as well—tend to be m ...

OCTAGON 88 RESOURCES, INC.

... Other long-lived assets – Property and equipment are stated at cost less accumulated depreciation computed principally using accelerated methods over the estimated useful lives of the assets. Repairs are charged to expense as incurred. Impairment of long-lived assets is recognized when the fair valu ...

... Other long-lived assets – Property and equipment are stated at cost less accumulated depreciation computed principally using accelerated methods over the estimated useful lives of the assets. Repairs are charged to expense as incurred. Impairment of long-lived assets is recognized when the fair valu ...

John G. Llewellyn, PLLC

... Just one entity, or many? Although some investors form only one LLC or corporation to hold all of their properties, some set up separate entities for each property. The factors to consider in determining whether to form one or more entities include, but are not limited to: the number of properties, ...

... Just one entity, or many? Although some investors form only one LLC or corporation to hold all of their properties, some set up separate entities for each property. The factors to consider in determining whether to form one or more entities include, but are not limited to: the number of properties, ...

Paper - IIOA!

... However the process of constructing a consistent datum for an economy-wide model is a real burden that researchers should overcome. Greater the extent of disaggregation across sectors, factors and institutions the more difficult task of reconciliation will be. Inconsistencies require modelers to mak ...

... However the process of constructing a consistent datum for an economy-wide model is a real burden that researchers should overcome. Greater the extent of disaggregation across sectors, factors and institutions the more difficult task of reconciliation will be. Inconsistencies require modelers to mak ...

BALANCED BUDGETS AND BUSINESS CYCLES: EVIDENCE

... the state level, however, consumers can avoid future tax increases by leaving the state, a much less costly option than leaving the nation.1 Finally, the growing internationalization of capital markets means that much of the national debt is held externally. While this does not increase the ability ...

... the state level, however, consumers can avoid future tax increases by leaving the state, a much less costly option than leaving the nation.1 Finally, the growing internationalization of capital markets means that much of the national debt is held externally. While this does not increase the ability ...

Global Accounting Standards Report

... nonprofit organizations FASB pursue “improve and adopt” approach ...

... nonprofit organizations FASB pursue “improve and adopt” approach ...

EASTMAN CHEMICAL CO (Form: 8-K/A, Received

... Taminco. The accompanying Statements do not reflect the costs of any integration activities or benefits that may result from realization of future cost savings from operating efficiencies or any revenue or other synergies expected to result from the Acquisition. In addition, certain non-recurring it ...

... Taminco. The accompanying Statements do not reflect the costs of any integration activities or benefits that may result from realization of future cost savings from operating efficiencies or any revenue or other synergies expected to result from the Acquisition. In addition, certain non-recurring it ...

Exercises Unit Twelve

... Sales may be made on credit or for cash. Every sales transaction should supported by a business document that provides written evidence of the sale. Cash register tapes provide evidence of cash sales. A sale invoice provides support for a credit sale. The original copy of the invoice goes to the cus ...

... Sales may be made on credit or for cash. Every sales transaction should supported by a business document that provides written evidence of the sale. Cash register tapes provide evidence of cash sales. A sale invoice provides support for a credit sale. The original copy of the invoice goes to the cus ...

Transactions Related to Shares

... This is the number of shares the company is permitted to sell (set by the government) most corporations are granted the right to sell an unlimited number of shares. • Par Value Shares Par value shares are shares in a company that has a specific value as set out in its charter. The company does not h ...

... This is the number of shares the company is permitted to sell (set by the government) most corporations are granted the right to sell an unlimited number of shares. • Par Value Shares Par value shares are shares in a company that has a specific value as set out in its charter. The company does not h ...

Dividend and Payout Policy (for you to read) Dividend Policy (aka

... • It also gets us to ask the right question: How does a change in payout policy affect the size of the pie? → Different tax implications of different policies. → Different policies may send different signals about the firm to ...

... • It also gets us to ask the right question: How does a change in payout policy affect the size of the pie? → Different tax implications of different policies. → Different policies may send different signals about the firm to ...

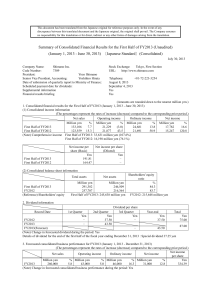

Summary of Financial Results FY2013-1H

... 1. Qualitative Information on Consolidated Financial Performance for the Period under Review (1) Consolidated Results of Operations During the first half of the fiscal year ending December 31, 2013, in Europe, there were concerns about the fiscal management of the Portuguese government, and further ...

... 1. Qualitative Information on Consolidated Financial Performance for the Period under Review (1) Consolidated Results of Operations During the first half of the fiscal year ending December 31, 2013, in Europe, there were concerns about the fiscal management of the Portuguese government, and further ...

A Contractarian Defense of Corporate

... (the “corporation”) controlled by a relatively unconstrained hierarchy? Since they do so freely when they enter into their relationship with the corporation, it seems reasonable to presume that they do so because they believe they will gain more than they will lose. In other words, they believe that ...

... (the “corporation”) controlled by a relatively unconstrained hierarchy? Since they do so freely when they enter into their relationship with the corporation, it seems reasonable to presume that they do so because they believe they will gain more than they will lose. In other words, they believe that ...