The State of Arizona continues to offer the

... The State of Arizona continues to offer the School Tax Credit that can pass up to $400 (for married persons filing jointly) from your State tax bill to a public/charter school of your choice, without costing you anything! (Single and head of household filers may contribute up to $200). The taxpayer ...

... The State of Arizona continues to offer the School Tax Credit that can pass up to $400 (for married persons filing jointly) from your State tax bill to a public/charter school of your choice, without costing you anything! (Single and head of household filers may contribute up to $200). The taxpayer ...

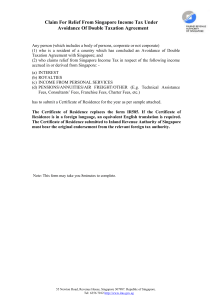

Certificate of Residence from Non-Residents

... Certificate of Residence For the Year(s) ____/____/____ To: The Comptroller of Income Tax, Singapore ...

... Certificate of Residence For the Year(s) ____/____/____ To: The Comptroller of Income Tax, Singapore ...

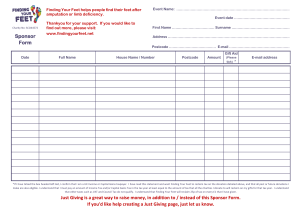

Sponsor Form Just Giving is a great way to raise money, in addition

... make are also eligible. I understand that I must pay an amount of Income Tax and/or Capital Gains Tax in the tax year at least equal to the amount of tax that all the charities I donate to will reclaim on my gifts for that tax year. I understand that other taxes such as VAT and Council Tax do not qu ...

... make are also eligible. I understand that I must pay an amount of Income Tax and/or Capital Gains Tax in the tax year at least equal to the amount of tax that all the charities I donate to will reclaim on my gifts for that tax year. I understand that other taxes such as VAT and Council Tax do not qu ...

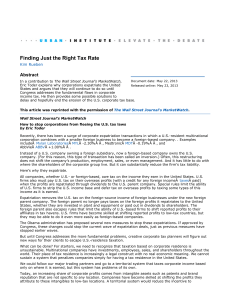

Finding Just the Right Tax Rate

... Instead of a U.S. company owning a foreign subsidiary, now a foreign-based company owns the U.S. company. (For this reason, this type of transaction has been called an inversion.) Often, this restructuring does not shift the company’s production, employment, sales, or even management. And it has lit ...

... Instead of a U.S. company owning a foreign subsidiary, now a foreign-based company owns the U.S. company. (For this reason, this type of transaction has been called an inversion.) Often, this restructuring does not shift the company’s production, employment, sales, or even management. And it has lit ...

Submission to Review of Australia’s Tax System

... economic downturn are the classic nutcrackers of failure”. Thirty-three years on and we still have not learnt that lesson. The viability of many companies is currently threatened by excessive exposure to debt, as it was in previous recessions, so company failures can be expected over the next few ye ...

... economic downturn are the classic nutcrackers of failure”. Thirty-three years on and we still have not learnt that lesson. The viability of many companies is currently threatened by excessive exposure to debt, as it was in previous recessions, so company failures can be expected over the next few ye ...