Determining How Costs Behave

... Nonlinearity and Cost Functions A nonlinear cost function is a cost function in which the graph of total costs versus the level of a single activity is not a straight line within the relevant range. Economies of scale Quantity discounts Step cost functions ©2003 Prentice Hall Business Publishing, C ...

... Nonlinearity and Cost Functions A nonlinear cost function is a cost function in which the graph of total costs versus the level of a single activity is not a straight line within the relevant range. Economies of scale Quantity discounts Step cost functions ©2003 Prentice Hall Business Publishing, C ...

Phantom Stock Plan - Schiff Benefits Group

... between the date the employee is credited with the phantom shares and the date the benefit is paid. Instead of merely paying a benefit equal to the appreciation in value of the “phantom” stock between the date the “phantom” shares are granted and the payment date, it is possible to structure the ben ...

... between the date the employee is credited with the phantom shares and the date the benefit is paid. Instead of merely paying a benefit equal to the appreciation in value of the “phantom” stock between the date the “phantom” shares are granted and the payment date, it is possible to structure the ben ...

Day 7 chap 3 Rev.-FI5-Ex-Pr

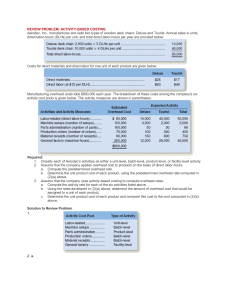

... PROBLEM 3–12A Contrasting ABC and Conventional Product Costs [LO2, LO3, LO4] Precision Manufacturing Inc. (PMI) makes two types of industrial component parts—the EX300 and the TX500. It annually produces 60,000 units of EX300 and 12,500 units of TX500. The company's conventional cost system allocate ...

... PROBLEM 3–12A Contrasting ABC and Conventional Product Costs [LO2, LO3, LO4] Precision Manufacturing Inc. (PMI) makes two types of industrial component parts—the EX300 and the TX500. It annually produces 60,000 units of EX300 and 12,500 units of TX500. The company's conventional cost system allocate ...

CHAPTER 9 The Cost of Capital

... The rate of return investors require on the firm’s common equity using new equity is ke. ...

... The rate of return investors require on the firm’s common equity using new equity is ke. ...

Chapter 18

... • Stock valuations used for all plan purposes must be made by an independent appraiser • ESOPs only – participants who have reached age 55 and have at least ten years of participation must be allowed an annual election to diversify investments in ...

... • Stock valuations used for all plan purposes must be made by an independent appraiser • ESOPs only – participants who have reached age 55 and have at least ten years of participation must be allowed an annual election to diversify investments in ...

Basic Accounting - University of Calicut

... 6.The policy ‘anticipate the profit and provide for all possible losses’ arises due to (a) convention of consistency (b) convention of conservatism (c) convention of full disclosure (d) convention of materiality. 7. Revenue is generally recognized as being earned at the point of time (a) sale is mad ...

... 6.The policy ‘anticipate the profit and provide for all possible losses’ arises due to (a) convention of consistency (b) convention of conservatism (c) convention of full disclosure (d) convention of materiality. 7. Revenue is generally recognized as being earned at the point of time (a) sale is mad ...

CJAR Fundamentalist Perspective on Accounting Jiang

... part of our analysis―to which the reader may take exception― is the statement of “good practice” principles in section III. All policy research must start with normative statements and we choose to make normative statements about practice to resolve accounting issues. These principles of good practi ...

... part of our analysis―to which the reader may take exception― is the statement of “good practice” principles in section III. All policy research must start with normative statements and we choose to make normative statements about practice to resolve accounting issues. These principles of good practi ...

download

... {ASSETS = LIABILITIES + STOCKHOLDERS’ EQUITY} Dated as of a specific date Format o ...

... {ASSETS = LIABILITIES + STOCKHOLDERS’ EQUITY} Dated as of a specific date Format o ...

Uses of Marginal Costing

... accountant has to provide information about the behaviour of fixed and variable costs over the planned rate of output (relevant range). For the purposes of a number of special decisions relating to alternative courses of-action, such as making or buying a component, the accountant has to provide cos ...

... accountant has to provide information about the behaviour of fixed and variable costs over the planned rate of output (relevant range). For the purposes of a number of special decisions relating to alternative courses of-action, such as making or buying a component, the accountant has to provide cos ...

Slide 1 - Cengage

... revenue and expenses for particular business activities to or to projects, division, department or job sites. The BANKING module is where BANK (or CASH) transactions are tracked. It also allows you to perform Bank Reconciliation with the company records (referred to as ACCOUNT RECONCILIATION). It is ...

... revenue and expenses for particular business activities to or to projects, division, department or job sites. The BANKING module is where BANK (or CASH) transactions are tracked. It also allows you to perform Bank Reconciliation with the company records (referred to as ACCOUNT RECONCILIATION). It is ...

Acceptance Of Deposits

... received by company, within 21 days from date of receipt of money/realization of cheque/date of renewal. A receipt - shall be signed by an officer of company duly authorized by Board in this behalf and shall state date, name and address, amount, ROI and date on which deposit is repayable. ...

... received by company, within 21 days from date of receipt of money/realization of cheque/date of renewal. A receipt - shall be signed by an officer of company duly authorized by Board in this behalf and shall state date, name and address, amount, ROI and date on which deposit is repayable. ...

TRUE/FALSE. Write `T` if the statement is true and `F` if the statement

... the inventory if the payment is made 20 days later? A) The accounting entry would be a $20 debit to Inventory, a $1,000 debit to Accounts Payable and a $1,020 credit to Cash. B) The accounting entry would be a $1,000 debit to Accounts Payable, a $20 credit to Inventory and a $980 credit to Cash. C) ...

... the inventory if the payment is made 20 days later? A) The accounting entry would be a $20 debit to Inventory, a $1,000 debit to Accounts Payable and a $1,020 credit to Cash. B) The accounting entry would be a $1,000 debit to Accounts Payable, a $20 credit to Inventory and a $980 credit to Cash. C) ...

Balance Sheet

... Prepaid Expenses Payment of cash, that is recorded as an asset because service or benefit will be received in the future. ...

... Prepaid Expenses Payment of cash, that is recorded as an asset because service or benefit will be received in the future. ...

Chapter 2 Review of the Accounting Process

... financial position of the company. Events, or transactions, can be classified as either external events or internal events. External events are those that involve an exchange between the company and another entity, and internal events are those that do not involve an exchange transaction. External t ...

... financial position of the company. Events, or transactions, can be classified as either external events or internal events. External events are those that involve an exchange between the company and another entity, and internal events are those that do not involve an exchange transaction. External t ...

Cost of Municipal Services: `Best practice`

... Accounts project being undertaken by National Treasury • Use existing technical forums to agree on technical indicators and definitions thereof • Increase data set to improve accuracy of the benchmarks • Cost benchmarks need to be analysed with an understanding of the context in which they were deve ...

... Accounts project being undertaken by National Treasury • Use existing technical forums to agree on technical indicators and definitions thereof • Increase data set to improve accuracy of the benchmarks • Cost benchmarks need to be analysed with an understanding of the context in which they were deve ...

Note Guide

... b) Advantage: better _______________ c) Disadvantage: may not be able to _________________ to changing conditions ...

... b) Advantage: better _______________ c) Disadvantage: may not be able to _________________ to changing conditions ...

Contract of employment (draft)

... [Except where the absence is due to injury attributable to a third party or results from engagement from employment other than with the Employer, the Employee will be paid as follows for the first [Number of days] of certified absence in any twelve month period: [Details of company sick pay] Company ...

... [Except where the absence is due to injury attributable to a third party or results from engagement from employment other than with the Employer, the Employee will be paid as follows for the first [Number of days] of certified absence in any twelve month period: [Details of company sick pay] Company ...

Treasurer`s Guide - Methacton School District

... monthly accounting. H/S can keep their ledger in an electronic format or can even use a traditional check book to record their account deposits and withdrawals. The Treasurer should be comfortable with any system used to record their monthly transactions. The H/S organization should purchase the sof ...

... monthly accounting. H/S can keep their ledger in an electronic format or can even use a traditional check book to record their account deposits and withdrawals. The Treasurer should be comfortable with any system used to record their monthly transactions. The H/S organization should purchase the sof ...

Accounting 20 Module 4 Lesson 17 Lesson 17

... fixed asset. At the close of each fiscal period, each fixed asset record is brought up to date. The depreciation expense for that period is recorded and the book value of the asset is figured. Study the two examples on pages 650 to 652 in the textbook. Book value is the original asset cost less accu ...

... fixed asset. At the close of each fiscal period, each fixed asset record is brought up to date. The depreciation expense for that period is recorded and the book value of the asset is figured. Study the two examples on pages 650 to 652 in the textbook. Book value is the original asset cost less accu ...

Chapter 2 - UNI Business

... balance, and the date the trial balance is prepared. Step 2. List the accounts from the ledger, and enter their debit or credit balance in the Debit or Credit column of the trial balance. Step 3. Total the Debit and Credit columns of the trial balance. Step 4. Verify that the total of the Debit colu ...

... balance, and the date the trial balance is prepared. Step 2. List the accounts from the ledger, and enter their debit or credit balance in the Debit or Credit column of the trial balance. Step 3. Total the Debit and Credit columns of the trial balance. Step 4. Verify that the total of the Debit colu ...

CHANGES IN FASB 13 RULES TO CHANGE COMMERCIAL REAL

... A key point to consider with regards to the proposed accounting changes is that, in all likelihood, existing operating leases, signed prior to the implementation of the new rules, will require reclassification as capital leases that must be accounted for on the balance sheet. This means that real es ...

... A key point to consider with regards to the proposed accounting changes is that, in all likelihood, existing operating leases, signed prior to the implementation of the new rules, will require reclassification as capital leases that must be accounted for on the balance sheet. This means that real es ...

What is Accounting? - masif-emba-fais-s12

... to the Permissions Department, John Wiley & Sons, Inc. The purchaser may make back-up copies for his/her own use only and not for distribution or resale. The Publisher assumes no responsibility for errors, omissions, or damages, caused by the use of these programs or from the use of the information ...

... to the Permissions Department, John Wiley & Sons, Inc. The purchaser may make back-up copies for his/her own use only and not for distribution or resale. The Publisher assumes no responsibility for errors, omissions, or damages, caused by the use of these programs or from the use of the information ...

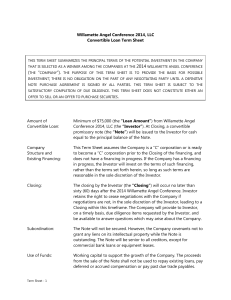

RAIN-2013-Term

... Common Stock at any time while the Note is outstanding, at the option of the Investor. The Note will convert into that number of shares of the Company’s Common Stock equal to the quotient obtained by dividing (i) the aggregate amount of principal and accrued interest due under this Note, by (ii) the ...

... Common Stock at any time while the Note is outstanding, at the option of the Investor. The Note will convert into that number of shares of the Company’s Common Stock equal to the quotient obtained by dividing (i) the aggregate amount of principal and accrued interest due under this Note, by (ii) the ...

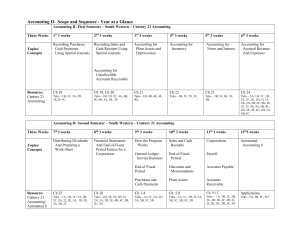

Accounting II Scope and Sequence

... Reopening an account previously written off Recording cash received for an account previously written off ...

... Reopening an account previously written off Recording cash received for an account previously written off ...

2014 WAC term sheet v2 (00537204).DOCX

... Future Financing: Optional Conversion. The Note and accrued interest will be convertible at the option of the Investor into shares of equity of the next class or series issued by the Company (the “Next Equity Financing”) at a conversion price equal to: (a) if the conversion occurs before the end of ...

... Future Financing: Optional Conversion. The Note and accrued interest will be convertible at the option of the Investor into shares of equity of the next class or series issued by the Company (the “Next Equity Financing”) at a conversion price equal to: (a) if the conversion occurs before the end of ...

Time book

A time book is a mostly outdated accounting record, that registered the hours worked by employees in a certain organization in a certain period. These records usually contain names of employees, type of work, hours worked, and sometimes wages paid.In the 19th and early 20th century time books were separate held records. In those days time books were held by company clerks or foremen or specialized timekeepers. These time books were used by the bookkeeper to determine the wages to be paid. The data was used in financial accounting to determine the weekly, monthly and annual labour costs, and in cost accounting to determine the cost price. Late 19th century additional time cards came in use to register labour hours.Nowadays the time book can be a part of an integrated payroll system, or cost accounting system. Those systems can contain registers that describe the labour time spend to produced products, but those registers are not regularly called time books, but timesheets.