* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download Accounting II Scope and Sequence

Survey

Document related concepts

Transcript

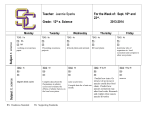

Accounting II– Scope and Sequence - Year at a Glance Accounting II- First Semester – South Western – Century 21 Accounting Three Weeks 1st 3 weeks 2nd 3 weeks 3rd 3 weeks 4th 3 weeks 5th 3 weeks 6th 3 weeks Topics/ Concepts Recording Purchases Cash Payments Using Special Journals Recording Sales and Cash Receipts Using Special Journals Accounting for Plant Assets and Depreciation Accounting for Inventory Accounting for Notes and Interest Accounting for Accrued Revenue And Expenses Accounting for Uncollectible Accounts Receivable Resource: Century 21 Accounting Ch 18 Ch 19, Ch 20 Ch 21 Ch 22 Ch 23 Ch 24 Teks—1B, 1C, 2A, 2D, 2E,2F, 5C, Teks—1B, 1D, 2C, 4A, 4B, 4C,4H, 5A, 5B , 5C Teks—1B, 4D, 4E, 4F, 4G, Teks—1B, 5C, 7E, 1F, Teks—1B, 3J, 3K, 5A, 5B, Teks—1A, 1B, 1C, 1D, 1E, 1F, 1G, 1H, 1I, 1J, 1K, 2A, 2B, 2C, 2D, 2E, 2F, 3J, 3K, 4A, 4B, 4C, 4D, 4E, 4F, 4G, 4H, 5A, 5B, 5C Accounting II- Second Semester – South Western – Century 21 Accounting Three Weeks 7th 3 weeks 8th 3 weeks 9th 3 weeks 10th 3 weeks 11th 3 weeks 12th3 weeks Distributing Dividends And Preparing a Work Sheet Financial Statements And End-of-Fiscal Period Entries for a Corporation How the Program Works Sales and Cash Receipts Corporations Topics/ Concepts Automated Accounting 8 General LedgerService Business End-of Fiscal Period Payroll End-of Fiscal Period Discounts and Memorandums Accounts Payable Purchases and Cash Payments Plant Assets Accounts Receivable Resource: Century 21 Accounting/ Automated 8 Ch 25 Ch 26 Ch 1-4 Ch 5-8 Ch 9-12 Applications Teks—1A, 1B, 1C, 2A, 2B, 2C, 2G, 2I, 2K, 3A, 3D, 3E, 5A, 5B, 5C Teks—2D, 2E, 2F, 2H, 2I, 2N, 3A, 3D, 3E, 4B, 4C, 5B, 5C, 5D Teks—1A,1C, 2A, 2G, 5A, 5B, 5C, 5D Teks—1A, 1C, 2H, 2J, 3A, 3B, 3C, 5B, 5C, 5D Teks— 1A, 1B, 1C, 2B, 2C, 2D, 2E, 2F, 2H, 2I, 2J, 2K, 3E,, 5B, 5C, 5D Teks—5A, 5B, 5C, 5D Recording Purchases Cash Payments Using Special Journals: Approximate Time: 3 Weeks (1st 3 weeks) Objectives/concepts TEKS Topics (not in sequential order) All of these objectives are addressed throughout the topics. Students will understand accounting concepts related to purchases and cash payments. South-Western: Century 21 Accounting 1B 1C Students will analyze and record expenses and purchases using a cash payments journal. Students will analyze and record petty cash and post using a cash payments journal. Students will analyze and record transactions and post using a general journal. Recording purchases, trade discounts, and purchases discounts on account using a purchases journal 1B 1C Students will understand accounting practices related to purchases and cash payments. Students will analyze and record purchases on account and post using a purchases journal. Suggested Resources 2A 2D 2E 2F Recording expenses and purchases, trade discounts, and purchases discount using a contra accounts and cash payments journal ELOs The student analyzes forms of business organizations. The student applies the basic accounting concepts to perform advanced accounting procedures. The student applies accounting knowledge when making business decisions. The student identifies and researches career opportunities in accounting. Journalizing petty cash and posting using a cash payments journal 5C 5C Chpt. 18 Assess. Recording transactions involving purchases returns and allowances using a general journal The student employs productivity skills as they apply to accounting. TAKS Obj. NA Recording Sales and Cash Receipts Using Special Journals: Approximate Time: 3 weeks (2nd 3 Weeks) Objectives/concepts TEKS All of these objectives are addressed throughout the topics. 1B 1D Students will understand accounting concepts related to cash receipts and sales. 2C Students will understand accounting practices related to cash receipts and sales. 4A 4B 4C 4H Students will analyze and record transactions and post, using a cash payments journal. Students will analyze and record transactions for international sales. Journalizing and posting cash sales and sales on account using a sales journal Suggested Resources Proving and ruling a sales journal SouthWestern: Century 21 Accounting Journalizing and posting a cash payments journal Chapter 19 Journalizing cash and credit card sales Chapter 20 Calculating and journalizing cash receipts on account with a sales discount Proving and ruling a cash receipts journal Students will analyze and record sales on account and post, using a sales journal. Students will analyze and record cash receipts and post, using a cash receipts journal. Topics (not in sequential order) Assess. ELOs The student analyzes forms of business organizations. The student applies the basic accounting concepts to perform advanced accounting procedures. The student applies accounting knowledge when making business decisions. Creating a sales memorandum Journalizing sales returns and allowances Order of posting from special journals Processing an international sale 5A 5B 5C Journalizing an international sale Journalizing time drafts Journalizing cash receipts from time drafts The student identifies and researches career opportunities in accounting. The student employs productivity skills as they apply to accounting. TAKS Obj. NA Recording Sales and Cash Receipts Using Special Journals: Approximate Time: 3 weeks (2nd 3 Weeks) (Cont.) Objectives/concepts TEKS All of these objectives are addressed throughout the topics. Students will understand accounting concepts related to cash receipts and sales. Students will understand accounting practices related to cash receipts and sales. Students will analyze and record sales on account and post, using a sales journal. Students will analyze and record cash receipts and post, using a cash receipts journal. Students will analyze and record transactions and post, using a cash payments journal. Students will analyze and record transactions for international sales. 1B 1D Topics (not in sequential order) Allowance method of recording losses from uncollectible accounts South-Western: Century21 Accounting Calculating estimated uncollectible accounts expenses Chapter 19 Chapter 20 Journalizing adjustments for uncollectible accounts 2C Posting an adjusting entry for uncollectible accounts Journalizing writing off an uncollectible account receivable 4A 4B 4C 4H Reopening an account previously written off Recording cash received for an account previously written off 5A 5B 5C Suggested Resources Posting entries for collecting a written-off receivable Assess. ELOs The student analyzes forms of business organizations. The student applies the basic accounting concepts to perform advanced accounting procedures. The student applies accounting knowledge when making business decisions. The student identifies and researches career opportunities in accounting. The student employs productivity skills as they apply to accounting. TAKS Obj. NA Accounting for Plant Assets and Depreciation: Approximate Time: 3 Weeks (3rd 3 weeks) Objectives/concepts TEKS Topics (not in sequential order) All of these objectives are addressed throughout the topics. Students will understand plant assets, depreciation, and property tax expense and related terms. South Western: Century 21 Accounting 1B Buying plant assets and paying property tax. 4D Students will record the buying of a plant asset and the paying of the property tax. 4E Students will prepare plant asset records and journalize annual depreciation expense. Student will record entries related to disposing of plant assets. Students will calculate depreciation expense using the double declining-balance method. Analyzing financial information for “health” clues. Understanding categories of assets. Students will identify and analyze accounting concepts and practices related to accounting for plant assets, depreciation, and property tax expense. Students will calculate the depreciation expense and book value using the straight-line depreciation method. Suggested Resources Conceptualizing the matching of expenses to revenue Calculating depreciation expense using straightline and double declining balance methods Journalizing depreciation expense ELOs The student analyzes forms of business organizations. Chapter 21 The student applies the basic accounting concepts to perform advanced accounting procedures. The student applies accounting knowledge when making business decisions. The student identifies and researches career opportunities in accounting. The student employs productivity skills as they apply to accounting. 4F 4G Assess. Disposing of plant assets TAKS Obj. NA Accounting for Inventory: Approximate Time 3 Weeks (4th 3 weeks) Objectives/concepts TEKS Topics (not in sequential order) All of these objectives are addressed throughout the topics. Accounting careers: auditing Students will understand accounting terms related to inventory. Students will identify and understand accounting concepts related to inventory. Students will prepare a stock record. Students will determine the cost of inventory using the fifo, lifo, and weighted-average costing methods. Students will estimate the cost of merchandise inventory using the gross profit method of estimating inventory. Suggested Resources South Western: Century 21 Accounting Determining the quantity of merchandise inventory Chapter 22 1B Assess. ELOs The student analyzes forms of business organizations. The student applies the basic accounting concepts to perform advanced accounting procedures. Creating and maintaining stock records 5C Determining the cost of merchandise inventory Comparison of inventory methods 7E Estimating inventory The student applies accounting knowledge when making business decisions. The student identifies and researches career opportunities in accounting. The student employs productivity skills as they apply to accounting. 7F TAKS Obj. NA Accounting for Notes and Interest : Approximate Time: 3 Weeks (5th 3 weeks) Objectives/concepts TEKS All of these objectives are addressed throughout the topics. Students will understand accounting concepts related to notes and interest. Students will understand accounting practices related to notes and interest. Students will calculate interest and maturity dates for notes. Students will analyze and record transactions for notes payable. Students will analyze and record transactions for notes receivable. Topics (not in sequential order) Understanding when lending and borrowing are necessary 1B Understanding the use of promissory notes 3J Calculating interest on promissory notes 3K Calculating maturity value and maturity dates on promissory notes Journalizing signing a note payable 5A Journalizing paying interest and principal on a note payable 5B Journalizing signing a note payable for an extension of time Journalizing paying a note payable issued for an extension of time on account Journalizing accepting a note receivable from a customer Journalizing collecting interest and principle on a note payable Journalizing a dishonored note receivable Suggested Resources South Western: Century 21 Accounting Chapter 23 Assess. ELOs TAKS Obj. The student analyzes forms of business organizations. NA The student applies the basic accounting concepts to perform advanced accounting procedures. The student applies accounting knowledge when making business decisions. The student identifies and researches career opportunities in accounting. The student employs productivity skills as they apply to accounting. Accounting for Accrued Revenue And Expenses: Approximate Time: 3 weeks (6th 3 Weeks) Objectives/concepts TEKS All of these objectives are addressed throughout the topics Students will understand accounting concepts related to accrued revenue and accrued expenses. Students will understand accounting practices related to accrued revenue and accrued expenses. Students will analyze and record adjusting, closing, and reversing entries for accrual revenue. Students will analyze and record adjusting, closing, and reversing entries for accrual expenses. 1A 1B 1C 1D 1E 1F 1G 1H 1I 1J 1K 2A 2B 2C 2D 2E 2F 3J 3K 4A 4B 4C 4D 4E 4F 4G 4H 5A 5B 5C Topics (not in sequential order) Suggested Resources Understand the concept of accrual accounting and accounting cycle South Western: Century 21 Accounting Accounting for interest an the end of the year Assess. ELOs The student analyzes forms of business organizations. The student applies the basic accounting concepts to perform advanced accounting procedures. Chapter 24 Creating adjustments for accrued interest income The student applies accounting knowledge when making business decisions. Creating the closing entry for accrued interest income The student identifies and researches career opportunities in accounting. Creating a reversing entry for accrued interest income The student employs productivity skills as they apply to accounting. Collecting a note receivable issued in a previous fiscal period Creating adjustments for accrued interest expense Creating the closing entry for accrued interest expense Creating a reversing entry for accrued interest expense Paying a note payable signed in a previous fiscal period Analyzing the effect of not using reversing entries TAKS Obj. NA Distributing Dividends And Preparing a Work Sheet: Approximate Time: 3 weeks (7th 3 weeks) Objectives/concepts TEKS All of these objectives are addressed throughout the topics. Students will understand accounting concepts related to distributing dividends and preparing a work sheet for a merchandising business organized as a corporation. Students will understand accounting practices related to distributing dividends and preparing a work sheet for a merchandising business organized as a corporation. Students will analyze and journalize the declaration and payment of a dividend for a merchandising business organized as a corporation. Students will develop plans for end-of-year adjustments. Students will calculate federal income tax, plan an adjustment for federal income tax expense, and complete a work sheet. 1A 1B 1C Topics (not in sequential order) Suggested Resources Accounting for a corporation South Western: Century 21 Accounting Understanding stockholders’ equity accounts used by a corporation Understanding the declaration of a dividend Distributing the dividend through payment to stockholders 2A 2B 2C 2G 2I 2K 3A 3D 3E 5A 5B 5C Preparing adjustments for: Interest income Uncollectible accounts expense Merchandise inventory Supplies Prepaid insurance Depreciation expense Interest expense Preparing adjustments for federal income tax expense Calculating federal income tax expense Completing a work sheet Chapter 25 Assess. ELOs The student analyzes forms of business organizations. The student applies the basic accounting concepts to perform advanced accounting procedures. The student applies accounting knowledge when making business decisions. The student identifies and researches career opportunities in accounting. The student employs productivity skills as they apply to accounting. TAKS Obj. NA Financial Statements And End-of-Fiscal Period Entries for a Corporation: Approximate Time: 3 Weeks (8th 3 weeks) Objectives/concepts TEKS Topics (not in sequential order) All of these objectives are addressed throughout the topics. Students will understand accounting concepts related to financial statements for a merchandising business organized as a corporation. Students will understand accounting practices related to financial statements for a merchandising business organized as a corporation. Students will prepare and analyze an income statement for a merchandising business organized as a corporation. Students will prepare a statement of stockholders’ equity for a merchandising business organized as a corporation. Students will prepare and analyze an balance sheet for a merchandising business organized as a corporation. Students will record adjusting, closing, and reversing entries for a merchandising business organized as a corporation. Analyzing and preparing an income statement for a corporation 2D 2E 2F 2H 2I 2N 4B 4C Analyzing and preparing a balance sheet for a corporation Calculating working capital and the current ratio Recording adjusting and closing entries for a corporation Comparing closing entries for debit and credit balance accounts 5B 5C 5D South Western: Century 21 Accounting Chapter 26 Analyzing and preparing the capital stock section of the statement of stockholders’ equity Analyzing and preparing the retained earnings section of the statement of stockholders’ equity 3A 3D 3E Suggested Resources Creating closing entry to record net income Creating closing for dividends Creating reversing entries Analyzing the accounting cycle for a merchandising business organized as a corporation Assess. ELOs The student analyzes forms of business organizations. The student applies the basic accounting concepts to perform advanced accounting procedures. The student applies accounting knowledge when making business decisions. The student identifies and researches career opportunities in accounting. The student employs productivity skills as they apply to accounting. TAKS Obj. NA Introduction to Automated 8 and Accounting for a Service Business: Approximate Time: 3 Weeks (9th 3 weeks) Objectives/concepts TEKS Topics (not in sequential order) All of these objectives are addressed throughout the topics. Students will understand accounting concepts related to the accounting cycle of a service business. South Western: Century21 Accounting 1A 1C Students will disaggregate entries in given automated systems and compare to manual systems. Students will generate financial statements for a service business from an automated system. Students will compare two automated accounting systems for performance and utility. Translating manual records to an automated system Analyzing journal entries and posting to a general ledger for a service business Students will identify the role of an auditor in the accounting system. Students will synthesize accounting concepts to automated systems. Suggested Resources 2A 2G 5A 5B 5C 5D Recording purchases and cash payments utilizing an automated system Analyzing and comparing end-ofperiod adjusting and closing entries for a service business Analyze uses of automated systems for service businesses Automated 8 Chapters 1 – 4 Assess. ELOs The student analyzes forms of business organizations. The student applies the basic accounting concepts to perform advanced accounting procedures. Peachtree The student applies accounting knowledge when making business decisions. The student identifies and researches career opportunities in accounting. The student employs productivity skills as they apply to accounting. TAKS Obj. NA Automated 8 and Accounting for a Merchandising Business: Approximate Time: 3 Weeks (10th 3 weeks) Objectives/concepts TEKS Topics (not in sequential order) All of these objectives are addressed throughout the topics. Students will understand the accounting concepts related to the accounting cycle of a merchandising business. Students will identify the accounting concepts related to the use of an automated accounting system for a merchandising business. Students will analyze and record sales discounts and memorandums using an automated system. Students will generate financial statements for a merchandising business using an automated system. Assess. ELOs South Western: Century 21 Accounting 1A 1C Analyzing and recording sales and cash receipts for a merchandising business Automated 8 Chapters 5 – 8 2H 2J Analyzing and comparing end-of -fiscal period adjusting and closing entries for a merchandising business Peachtree 3A 3B 3C Students will compare the utility of manual depreciation schedules to automatically generated schedules. Students will analyze and record sales and cash receipts using an automated system. Suggested Resources 5B 5C 5D Microsoft Excel The student analyzes forms of business organizations. The student applies the basic accounting concepts to perform advanced accounting procedures. Analyzing and recording sales discounts and memorandums for a merchandising business The student applies accounting knowledge when making business decisions. Comparing depreciation schedules for plant assets utilizing a manual system and an automated system The student identifies and researches career opportunities in accounting. Creating a modified spreadsheet using Excel to schedule depreciation for plant assets The student employs productivity skills as they apply to accounting. Evaluating financial statement production using an automated system TAKS Obj. NA Automated 8 and Accounting for a Corporation: Approximate Time: 3 weeks (11th 3 Weeks) Objectives/concepts TEKS Topics (not in sequential order) All of these objectives are addressed throughout the topics. Students will understand accounting concepts related to automated payroll records. Suggested Resources South Western: Century 21 Accounting 1A 1B 1C Recording payroll information and employee earnings record using an automated system Automated 8 Chapters 9 – 12 Assess. ELOs The student analyzes forms of business organizations. The student applies the basic accounting concepts to perform advanced accounting procedures. Peachtree Students will identify accounting practices related to automated payroll records. Students will complete a payroll register and an employee earnings record using an automated system . Students will create an automated check register and write checks. Students will journalize and post transactions for payments on account and the receipt of cash on account. Students will disaggregate the financial statements of a corporation. 2B 2C 2D 2E 2F 2H 2I 2J 2K 3E 5B 5C 5D Preparing a payroll register using an automated system Preparing and writing checks using an automated system Journalizing and posting to the ledger payment of payroll using an automated system Analyzing and recording accounts payable and payments on account using an automated system Analyzing and recording accounts receivable and receipt of cash on account using an automated system Analyzing and comparing the financial statements of a corporation The student applies accounting knowledge when making business decisions. The student identifies and researches career opportunities in accounting. The student employs productivity skills as they apply to accounting. TAKS Obj. NA Development and Application of an Automated System: Approximate Time: 3 weeks (12th 3 Weeks) Objectives/concepts TEKS Topics (not in sequential order) All of these objectives are addressed throughout the topics. Students will develop an accounting system to produce end-of-period entries for a corporation. Students will create and prepare a work sheet for a corporation using an automated system. Students will prepare an income statement, statement of stockholders’ equity, and balance sheet for a corporation using an automated system. Students will create and journalize adjusting, closing, and reversing entries for a corporation using an automated system. Students will plan and journalize reversing entries for accruals for a corporation using an automated system. Suggested Resources South Western: Century 21 Accounting Peachtree Accounting 5A 5B 5C 5D Planning and creating an accounting system Preparing trial balances from general ledger Planning adjusting entries Preparing an income statement Preparing a statement of stockholders’ equity Preparing a balance sheet Creating closing entries Creating reversing entries for accruals Journalizing reversals Analyzing system for errors Determine most appropriate methods for depreciation Compare inventory methods for most accurate and accepted Assess. ELOs The student analyzes forms of business organizations. The student applies the basic accounting concepts to perform advanced accounting procedures. The student applies accounting knowledge when making business decisions. The student identifies and researches career opportunities in accounting. The student employs productivity skills as they apply to accounting. TAKS Obj. NA