Document

... about the organization and construction of its accounting reports. GAAP requires the disclosure of measurement methods, assumptions, etc., that add to the information content of the annual report. Example: Exhibit 1.5 shows that Kmart values its inventory using LIFO and discloses the value of the in ...

... about the organization and construction of its accounting reports. GAAP requires the disclosure of measurement methods, assumptions, etc., that add to the information content of the annual report. Example: Exhibit 1.5 shows that Kmart values its inventory using LIFO and discloses the value of the in ...

NOPSI Electric Rate Schedule LEOPIP-16

... First – Plus or minus the applicable proportionate part of any directly allocable tax, impost or assessment imposed or reduced by any governmental authority after the effective date of this Rider Schedule, which is assessed or levied against the Company or directly affects the Company's cost of oper ...

... First – Plus or minus the applicable proportionate part of any directly allocable tax, impost or assessment imposed or reduced by any governmental authority after the effective date of this Rider Schedule, which is assessed or levied against the Company or directly affects the Company's cost of oper ...

Introduction to Financial Management

... • Dividend growth model DIV1 DIV1 P0 re g re g P0 ...

... • Dividend growth model DIV1 DIV1 P0 re g re g P0 ...

Year 12 accounting term 2 internal controls

... Most business transactions eventually lead to the business receiving cash (cash receipts) or paying cash (cash payments). Because cash is easily stolen, adequate controls must be implemented to ensure that people with dishonest intentions are detected. ...

... Most business transactions eventually lead to the business receiving cash (cash receipts) or paying cash (cash payments). Because cash is easily stolen, adequate controls must be implemented to ensure that people with dishonest intentions are detected. ...

account coding

... The accounting code is designed to provide a way for school districts to effectively manage their finances. The use of the prescribed accounting code also provides the Mississippi Department of Education, as well as other state agencies and the Legislature, the ability to gather and report informati ...

... The accounting code is designed to provide a way for school districts to effectively manage their finances. The use of the prescribed accounting code also provides the Mississippi Department of Education, as well as other state agencies and the Legislature, the ability to gather and report informati ...

Factor Markets With Emphasis on the Labor Market

... conditions in different product markets are different, it follows that the demand for labor in different labor markets will be different, too. The Marginal Physical Product of labor, is affected by individual workers’ own abilities and skills, degree of effort, and other factors of production availa ...

... conditions in different product markets are different, it follows that the demand for labor in different labor markets will be different, too. The Marginal Physical Product of labor, is affected by individual workers’ own abilities and skills, degree of effort, and other factors of production availa ...

Current Liabilities

... adjustments. Companies engaged in interstate commerce must follow the Fair Labor Standards Act. This act, sometimes called the Federal Wage and Hour Law, requires employers to pay a minimum rate of 1½ times the regular rate for all hours worked in excess of 40 hours per week. ...

... adjustments. Companies engaged in interstate commerce must follow the Fair Labor Standards Act. This act, sometimes called the Federal Wage and Hour Law, requires employers to pay a minimum rate of 1½ times the regular rate for all hours worked in excess of 40 hours per week. ...

BSBFIA401 Prepare financial reports

... whether any further debtors need to be written off. The writing off of debtors at balance day is referred to as ‘additional bad debts’. The accounting entries for additional bad debts are the same as for bad debts during the year, as shown in this example. ...

... whether any further debtors need to be written off. The writing off of debtors at balance day is referred to as ‘additional bad debts’. The accounting entries for additional bad debts are the same as for bad debts during the year, as shown in this example. ...

Financial Accounting and Accounting Standards

... Users and Uses of Financial Information Ethics In Financial Reporting Effective financial reporting depends on sound ethical behavior. ...

... Users and Uses of Financial Information Ethics In Financial Reporting Effective financial reporting depends on sound ethical behavior. ...

2015 Accounting Solutions Higher Finalised Marking

... The information in this publication may be reproduced to support SQA qualifications only on a noncommercial basis. If it is to be used for any other purposes written permission must be obtained from SQA’s NQ Assessment team. Where the publication includes materials from sources other than SQA (secon ...

... The information in this publication may be reproduced to support SQA qualifications only on a noncommercial basis. If it is to be used for any other purposes written permission must be obtained from SQA’s NQ Assessment team. Where the publication includes materials from sources other than SQA (secon ...

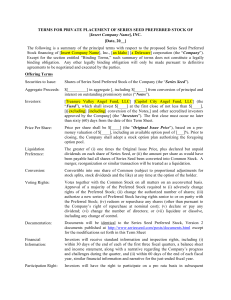

Polaris Seed Round Term Sheet

... and is not intended to be complete. Except as provided under "Expenses" and "Exclusivity Period", which are intended to be legally binding on the Company, this summary of terms is not an offer, or an agreement, and a legally enforceable agreement will arise only upon the Investors’ completion of a s ...

... and is not intended to be complete. Except as provided under "Expenses" and "Exclusivity Period", which are intended to be legally binding on the Company, this summary of terms is not an offer, or an agreement, and a legally enforceable agreement will arise only upon the Investors’ completion of a s ...

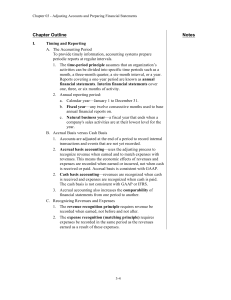

Chapter Outline Notes

... approach is the slightly more complex entry required when the cash subsequently changes hands (i.e., when cash is received for the asset that was originally accrued or when cash is paid for the liability that was originally accrued). C. Accounting with Reversing Entries 1. A reversing entry is the e ...

... approach is the slightly more complex entry required when the cash subsequently changes hands (i.e., when cash is received for the asset that was originally accrued or when cash is paid for the liability that was originally accrued). C. Accounting with Reversing Entries 1. A reversing entry is the e ...

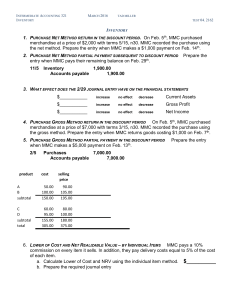

2162 Final ch 8-9 Inventory

... index was 1.06 for 2014 and 1.10 for 2015. Use dollar-value LIFO to calculate the amount you will report for inventory on the 12/31/14 and 12/31/15 balance sheets. 12. GROSS PROFIT METHOD OF ESTIMATING INVENTORY BALANCE Use the Gross Profit Method to estimate the inventory balance in one of MMC’s wa ...

... index was 1.06 for 2014 and 1.10 for 2015. Use dollar-value LIFO to calculate the amount you will report for inventory on the 12/31/14 and 12/31/15 balance sheets. 12. GROSS PROFIT METHOD OF ESTIMATING INVENTORY BALANCE Use the Gross Profit Method to estimate the inventory balance in one of MMC’s wa ...

Strategic Staffing - Computer Resource Team

... familiar with the current trends in staffing, that’s great. If your organization is benefiting from their implementation, that’s even better. If you are interested in learning more about current strategies and tactics in staffing, read on. This article outlines several popular staffing trends and pr ...

... familiar with the current trends in staffing, that’s great. If your organization is benefiting from their implementation, that’s even better. If you are interested in learning more about current strategies and tactics in staffing, read on. This article outlines several popular staffing trends and pr ...

Chapter 5

... – Explanatory notes disclosing changes in account procedures, or significant events occurring after balance sheet dates ...

... – Explanatory notes disclosing changes in account procedures, or significant events occurring after balance sheet dates ...

Test 1 Answers

... a. addresses the relationship between the journal and the balance sheet b. determines whether the normal balance of an account is a debit or credit c. requires that the dollar amount of debits equal the dollar amount of credits on a trial balance d. determines that expenses related to revenue be rep ...

... a. addresses the relationship between the journal and the balance sheet b. determines whether the normal balance of an account is a debit or credit c. requires that the dollar amount of debits equal the dollar amount of credits on a trial balance d. determines that expenses related to revenue be rep ...

TERMS FOR PRIVATE PLACEMENT OF SERIES SEED

... Founder at a price of $.0001 per share. The repurchase right shall lapse over a four year period commencing on the closing of the Series Seed financing, and shall be exercisable by the Company (i) upon the Founder’s termination of service to the Company for cause or (ii) upon the Founder’s voluntary ...

... Founder at a price of $.0001 per share. The repurchase right shall lapse over a four year period commencing on the closing of the Series Seed financing, and shall be exercisable by the Company (i) upon the Founder’s termination of service to the Company for cause or (ii) upon the Founder’s voluntary ...

Appendix B - College of the Redwoods

... Book value. Value as shown in the “book” of accounts. In the case of assets subject to reduction by valuation allowances, “book value” refers to cost or stated value less any appropriate allowance. A distinction is sometimes made between “gross book value” and “net book value,” the former designatin ...

... Book value. Value as shown in the “book” of accounts. In the case of assets subject to reduction by valuation allowances, “book value” refers to cost or stated value less any appropriate allowance. A distinction is sometimes made between “gross book value” and “net book value,” the former designatin ...

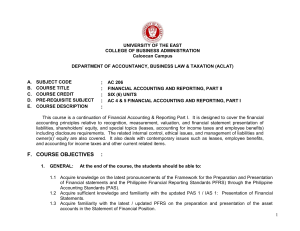

UNIVERSITY OF THE EAST – CALOOCAN CAMPUS

... This course is a continuation of Financial Accounting & Reporting Part I. It is designed to cover the financial accounting principles relative to recognition, measurement, valuation, and financial statement presentation of liabilities, shareholders’ equity, and special topics (leases, accounting for ...

... This course is a continuation of Financial Accounting & Reporting Part I. It is designed to cover the financial accounting principles relative to recognition, measurement, valuation, and financial statement presentation of liabilities, shareholders’ equity, and special topics (leases, accounting for ...

Unit 2 Assets - Georgia CTAE | Home

... company’s asset cash. Ask students to discuss what might happen with a company’s cash if no internal controls were in place. Introduce students to the change fund. Ask how many have worked with cash registers and what the cash fund was for their job. Ask what happened if they came up short or over. ...

... company’s asset cash. Ask students to discuss what might happen with a company’s cash if no internal controls were in place. Introduce students to the change fund. Ask how many have worked with cash registers and what the cash fund was for their job. Ask what happened if they came up short or over. ...

Accounting for Current Liabilities

... income taxes withheld no later than one month following the close of each quarter. Companies generally file and remit federal unemployment taxes annually on or before January 31 of the subsequent year. Companies usually file and pay state unemployment taxes by the end of the month following each qua ...

... income taxes withheld no later than one month following the close of each quarter. Companies generally file and remit federal unemployment taxes annually on or before January 31 of the subsequent year. Companies usually file and pay state unemployment taxes by the end of the month following each qua ...

accounting - WordPress.com

... An art because it can be learnt by practice and not by mere listening to it like scientific rules. Every accountant is not same. Many are good and other make mistakes, like every person is not a great artist. It is science because it is based on many rules, concepts, conventions and assumptions. If ...

... An art because it can be learnt by practice and not by mere listening to it like scientific rules. Every accountant is not same. Many are good and other make mistakes, like every person is not a great artist. It is science because it is based on many rules, concepts, conventions and assumptions. If ...

PART A - Chabot College

... The area of accounting that involves the preparation of internal reports for a firm's executives and the analysis of the data in these reports to aid in decision making is known as: a. Government accounting. ...

... The area of accounting that involves the preparation of internal reports for a firm's executives and the analysis of the data in these reports to aid in decision making is known as: a. Government accounting. ...

Unit 3 – Journals and Ledgers, Keeping track of it all

... The accounts are given numbers which place them in the same order as they appear on the balance sheet and income statement. These numbers are usually assigned in the following series and sequence: This course will use the number series as illustrated above. However, some systems, such as Simply Acco ...

... The accounts are given numbers which place them in the same order as they appear on the balance sheet and income statement. These numbers are usually assigned in the following series and sequence: This course will use the number series as illustrated above. However, some systems, such as Simply Acco ...

Accountant Job Description

... Verify that invoice has been received, not a packing slip, drop ticket, etc. Verify that invoice has not been paid in a prior payment period Verify materials/services were received from the person that placed the order Verify invoice against Purchase Order Verify Mn sales tax has been charged for ap ...

... Verify that invoice has been received, not a packing slip, drop ticket, etc. Verify that invoice has not been paid in a prior payment period Verify materials/services were received from the person that placed the order Verify invoice against Purchase Order Verify Mn sales tax has been charged for ap ...

Time book

A time book is a mostly outdated accounting record, that registered the hours worked by employees in a certain organization in a certain period. These records usually contain names of employees, type of work, hours worked, and sometimes wages paid.In the 19th and early 20th century time books were separate held records. In those days time books were held by company clerks or foremen or specialized timekeepers. These time books were used by the bookkeeper to determine the wages to be paid. The data was used in financial accounting to determine the weekly, monthly and annual labour costs, and in cost accounting to determine the cost price. Late 19th century additional time cards came in use to register labour hours.Nowadays the time book can be a part of an integrated payroll system, or cost accounting system. Those systems can contain registers that describe the labour time spend to produced products, but those registers are not regularly called time books, but timesheets.