bookkeeping: flow of information

... The trial balance is a listing of all the ledger accounts, with debits in the left column and credits in the right column. At this point no adjusting entries have been made. The Trial Balance uses the information from the General Ledger to summarise the data to use for preparing the Financial Statem ...

... The trial balance is a listing of all the ledger accounts, with debits in the left column and credits in the right column. At this point no adjusting entries have been made. The Trial Balance uses the information from the General Ledger to summarise the data to use for preparing the Financial Statem ...

رقم الطالب في كشف الحضور:....... دراسات محاسبية باللغة الإنجليزية عدد

... 30. The lower-of-cost-or-market basis is an example of the accounting concept of conservatism. 31. Inventories are reported in the current assets section of the balance sheet immediately below receivables. 32. In a perpetual inventory system, the cost of goods sold under the FIFO method is based on ...

... 30. The lower-of-cost-or-market basis is an example of the accounting concept of conservatism. 31. Inventories are reported in the current assets section of the balance sheet immediately below receivables. 32. In a perpetual inventory system, the cost of goods sold under the FIFO method is based on ...

Streamline - mirrorsa.co.za

... Debtor/Creditor Journal Clearing Account – This account is used where a transaction will require two entries on the system. Both transactions must contra the clearing account, and after the transaction, the clearing account should be zero. For instance, a debtor’s cheque bounces. So the first transa ...

... Debtor/Creditor Journal Clearing Account – This account is used where a transaction will require two entries on the system. Both transactions must contra the clearing account, and after the transaction, the clearing account should be zero. For instance, a debtor’s cheque bounces. So the first transa ...

Liabilities and Shareholders` Equity

... (7) During February: Paid invoices from suppliers of merchandise (see transaction (2) above) with an original purchase price of Ps210,000 in time to receive a 2-percent discount for prompt payment and Ps29,000 to other suppliers after the discount period had elapsed. The firm treats discounts taken ...

... (7) During February: Paid invoices from suppliers of merchandise (see transaction (2) above) with an original purchase price of Ps210,000 in time to receive a 2-percent discount for prompt payment and Ps29,000 to other suppliers after the discount period had elapsed. The firm treats discounts taken ...

download

... Marketable securities are less liquid than cash, but can be readily sold for cash. Net receivables can be collected from others (customers), but not as easily as converting marketable securities to cash. Inventories must be made ready for sale to customers and the money must be collected. There is n ...

... Marketable securities are less liquid than cash, but can be readily sold for cash. Net receivables can be collected from others (customers), but not as easily as converting marketable securities to cash. Inventories must be made ready for sale to customers and the money must be collected. There is n ...

Paper Bookkeeping - Navajo Business, Navajo Nation

... Bookkeeping (also commonly referred to as book-keeping, book keeping or bookeeping) is the recording of all financial transactions undertaken by a business (or an individual). A bookkeeper (or book-keeper), sometimes called an accounting clerk in the US, is a person who keeps the books of an organiz ...

... Bookkeeping (also commonly referred to as book-keeping, book keeping or bookeeping) is the recording of all financial transactions undertaken by a business (or an individual). A bookkeeper (or book-keeper), sometimes called an accounting clerk in the US, is a person who keeps the books of an organiz ...

Weygandt_FinMan_PowerPoint_Review_Ch15

... A bicycle company has these costs: tires, salaries of employees who put tires on the wheels, factory building depreciation, wheel nuts, spokes, salary of factory manager, handlebars, and salaries of factory maintenance employees. Classify each cost as direct materials, direct labor, or overhead. ...

... A bicycle company has these costs: tires, salaries of employees who put tires on the wheels, factory building depreciation, wheel nuts, spokes, salary of factory manager, handlebars, and salaries of factory maintenance employees. Classify each cost as direct materials, direct labor, or overhead. ...

Unit 5 Forms of Business Ownership and Payroll

... o Payroll register: a business form used to record payroll information o Payroll taxes: taxes based on the payroll of a business o Social Security tax: a federal tax paid for old-age, survivors, and disability insurance o Tax base: the maximum amount of earnings on which a tax is calculated o Volunt ...

... o Payroll register: a business form used to record payroll information o Payroll taxes: taxes based on the payroll of a business o Social Security tax: a federal tax paid for old-age, survivors, and disability insurance o Tax base: the maximum amount of earnings on which a tax is calculated o Volunt ...

Accounting Principles, 5e

... WORK IN PROCESS – Raw Materials Cost Assigned to a job when materials are issued. A materials requisition slip - the written authorization for issuing raw materials. May be either directly used on a job or may be ...

... WORK IN PROCESS – Raw Materials Cost Assigned to a job when materials are issued. A materials requisition slip - the written authorization for issuing raw materials. May be either directly used on a job or may be ...

Participant

... signed statutory audit report (If exempted from auditing under your national legislation, the statements have to be signed for approval by the board of directors). 4b. If the requested EU-contribution exceeds € K500: the signed external auditors report, which has to include the clear mandate to audi ...

... signed statutory audit report (If exempted from auditing under your national legislation, the statements have to be signed for approval by the board of directors). 4b. If the requested EU-contribution exceeds € K500: the signed external auditors report, which has to include the clear mandate to audi ...

What Is a Contra Asset Account?

... All four transactions add to the value of the accounts listed. Debiting each of the two expense accounts adds to account value, as you would expect from the table in the previous section. However notice here that crediting the two asset accounts adds to their value as well—just the opposite of what ...

... All four transactions add to the value of the accounts listed. Debiting each of the two expense accounts adds to account value, as you would expect from the table in the previous section. However notice here that crediting the two asset accounts adds to their value as well—just the opposite of what ...

benefitfocus,inc. - Investor Relations | Benefitfocus

... includethan forward-looking we do. Management statements presents related certain to thenon-GAAP future business financial and financial measures performance in this presentation of Benefitfocus because itand considers future events them toorbe developments important supplemental involving Benefitfo ...

... includethan forward-looking we do. Management statements presents related certain to thenon-GAAP future business financial and financial measures performance in this presentation of Benefitfocus because itand considers future events them toorbe developments important supplemental involving Benefitfo ...

The purposes of accounting

... This assumption allows you to defer the recognition of some expenses to later periods (such as depreciation), when a business will presumably still be in operation. Bankruptcy values may be lower ...

... This assumption allows you to defer the recognition of some expenses to later periods (such as depreciation), when a business will presumably still be in operation. Bankruptcy values may be lower ...

FA2: Module 9 Tangible and intangible capital assets

... Lump sum purchases: Example The firm purchases land and a building for $100,000. According to the city assessors, the land’s appraised value is $60,000, and the building’s appraised value is $20,000. The entry to record the acquisition is: ...

... Lump sum purchases: Example The firm purchases land and a building for $100,000. According to the city assessors, the land’s appraised value is $60,000, and the building’s appraised value is $20,000. The entry to record the acquisition is: ...

Document

... b. be accumulated in a separate deferred charge account and written off equally over a 40-year period. c. not be written off until the related asset is fully depreciated or disposed of. d. none of the above. ...

... b. be accumulated in a separate deferred charge account and written off equally over a 40-year period. c. not be written off until the related asset is fully depreciated or disposed of. d. none of the above. ...

Are You Legally Monitoring Your Employees` Electronic

... communication is considered legal if the person doing the intercepting is a party to the communication, or if one of the parties involved in the communication consents. The only exception to this proviso is if the purpose of intercepting the communication is to use it to commit a crime or tort. If a ...

... communication is considered legal if the person doing the intercepting is a party to the communication, or if one of the parties involved in the communication consents. The only exception to this proviso is if the purpose of intercepting the communication is to use it to commit a crime or tort. If a ...

Chapter Twelve - Dr.Mahmood Asad

... What is Accounting? • Financial information is primarily based on information generated from accounting. • Accounting: recording, classifying, summarizing, and interpreting financial events and transactions to provide management and other interested parties the information they need to make good de ...

... What is Accounting? • Financial information is primarily based on information generated from accounting. • Accounting: recording, classifying, summarizing, and interpreting financial events and transactions to provide management and other interested parties the information they need to make good de ...

HMF Accounting Manual - Halo Medical Foundation

... Deposits Given / Taken Deposits given / taken should be booked under appropriate tally group with separate ledger name (group wherever necessary). A separate file of all original receipts for Deposits Given should be maintained in Accounts Office. Copies of correspondence should be available in acco ...

... Deposits Given / Taken Deposits given / taken should be booked under appropriate tally group with separate ledger name (group wherever necessary). A separate file of all original receipts for Deposits Given should be maintained in Accounts Office. Copies of correspondence should be available in acco ...

Policy and Procedures for Contract Services

... agency, the fee should not exceed the maximum approved rate of that agency. The Office of Sponsored Program Accounting will monitor the payment process to further ensure that proper rates are used when federal funds are expended. When completing the agreement, the initiating department should make c ...

... agency, the fee should not exceed the maximum approved rate of that agency. The Office of Sponsored Program Accounting will monitor the payment process to further ensure that proper rates are used when federal funds are expended. When completing the agreement, the initiating department should make c ...

PROBLEMS ON ACCEPT OR REJECT SPECIAL ORDER DECISION

... c) Assume that 75 percent of the variable marketing costs can be eliminated. What would be the effect on the net income from accepting this order?(TU 2046) P – 12. The Kathmandu Product Ltd.; a company engaged in production of specialized goods called ‘Kath Craft’ has been utilizing its capacity onl ...

... c) Assume that 75 percent of the variable marketing costs can be eliminated. What would be the effect on the net income from accepting this order?(TU 2046) P – 12. The Kathmandu Product Ltd.; a company engaged in production of specialized goods called ‘Kath Craft’ has been utilizing its capacity onl ...

File

... Fair Value Principle states that assets and liabilities should be reported at fair value (the price received to sell an asset or settle a liability). Selection of which principle to follow generally relates to trade-offs between relevance and faithful representation. ...

... Fair Value Principle states that assets and liabilities should be reported at fair value (the price received to sell an asset or settle a liability). Selection of which principle to follow generally relates to trade-offs between relevance and faithful representation. ...

Certified Hospitality Accountant Executive (CHAE) Review

... Transactions are then “posted” to the appropriate ledger accounts with reference back to the journal. Trial Balance A list of all accounts and the balances (either debit or credit in separate columns) All debit balances are added and all credit balances are added. The totals are compared - s ...

... Transactions are then “posted” to the appropriate ledger accounts with reference back to the journal. Trial Balance A list of all accounts and the balances (either debit or credit in separate columns) All debit balances are added and all credit balances are added. The totals are compared - s ...

chapter 24 uncollectible ar

... When it becomes clear that the charge customer will not pay, amount owned is removed from accounting records ...

... When it becomes clear that the charge customer will not pay, amount owned is removed from accounting records ...

ACCT 2301 PP Ch 9

... P1: Prepare entries to account for short-term notes payable. P2: Compute and record employee payroll deductions and liabilities. P3: Compute and record employer payroll expenses and liabilities. P4: Account for estimated liabilities, including warranties and bonuses. P5: Appendix 9A – Identify and d ...

... P1: Prepare entries to account for short-term notes payable. P2: Compute and record employee payroll deductions and liabilities. P3: Compute and record employer payroll expenses and liabilities. P4: Account for estimated liabilities, including warranties and bonuses. P5: Appendix 9A – Identify and d ...

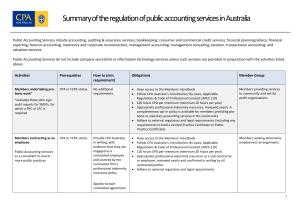

Australia

... • 120 hours CPD per triennium (minimum 20 hours per year) • Appropriate professional indemnity insurance, reviewed yearly. A complimentary opt-in policy is available for members providing probono or voluntary accounting services in the community • Adhere to external regulatory and legal requirements ...

... • 120 hours CPD per triennium (minimum 20 hours per year) • Appropriate professional indemnity insurance, reviewed yearly. A complimentary opt-in policy is available for members providing probono or voluntary accounting services in the community • Adhere to external regulatory and legal requirements ...

Time book

A time book is a mostly outdated accounting record, that registered the hours worked by employees in a certain organization in a certain period. These records usually contain names of employees, type of work, hours worked, and sometimes wages paid.In the 19th and early 20th century time books were separate held records. In those days time books were held by company clerks or foremen or specialized timekeepers. These time books were used by the bookkeeper to determine the wages to be paid. The data was used in financial accounting to determine the weekly, monthly and annual labour costs, and in cost accounting to determine the cost price. Late 19th century additional time cards came in use to register labour hours.Nowadays the time book can be a part of an integrated payroll system, or cost accounting system. Those systems can contain registers that describe the labour time spend to produced products, but those registers are not regularly called time books, but timesheets.