* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download chapter 24 uncollectible ar

Survey

Document related concepts

Transcript

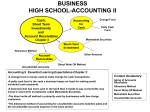

Chapter 24 Uncollectible Accounts Receivable Section 1 The Direct Write-Off Method Direct Write Of Method Businesses sell on credit because expect to make more than only accepting cash Increases Sales, Increases Profits Check customer credit rating, often require a credit application Uncollectible Accounts (Bad Debt): customer fails to pay amount due on account Becomes an expense to the business Removed from AR recorded to expense Direct Write Off Method Primarily used by small businesses with few charge customers Direct Write Off Method: when businesses determine that amount owed is not going to be paid uncollectible amount removed from AR/Subsidiary (CR) and recorded as an expense Writing Off An Uncollectible Account AR/Robert Galvin Sales Sales Tax Payable 265 Entry when not collectible p. 653-654 Uncollectible Account Expense 265 AR/Robert Galvin 250 15 265 Figure 24-1 p. 654 Posting NOTE: description column notes Collecting a Written-Off Account Entries p. 655-656 Customer’s account is reinstated AR/Robert Galvin 265 Uncollectible Account Expense 2. 265 Cash Receipt is recorded Cash in Bank AR/Robert Galvin 265 Figure 24-2 p. 656 Subsidiary Ledger shows: Write Off Reinstate Cash Receipt 265 Section 2 The Allowance Method The Allowance Method Businesses that have many charge customers use the Allowance Method Allows businesses to match revenue with expenses incurred to earn that revenue Matching Uncollectible Accounts Expense with Revenue Fundamental Principle – revenue should be matched with the expenses incurred in generating that revenue Meaning: expenses incurred to earn revenue should be recorded in the same period as the revenue Usually the uncollectible account is not determined until a later period Ex. Sale in late 2012 not determined uncollectible until 2013 So estimates are done Matching Uncollectible Accounts Expense with Revenue (cont.) Estimated uncollectible amount is recorded as an adjusting entry at the end of the period Meets 2 Objectives AR is reduced to amount the business can reasonably expect to receive 2. Estimated uncollectible account expense is charged to the current period 1. The Allowance Method Allowance Method: accounting for uncollectible accounts matches the estimated uncollectible accounts expense with sales made in the same period Estimated uncollectible accounts expense is recorded as an adjustment on th Worksheet 2 Accounts Affected 1. 2. Uncollectible Accounts Expense Allowance for Uncollectible Accounts The Allowance Method (cont.) When estimated, the business does not know which customers will not pay Can not be CR to AR/Subsidiary New Account: Allowance for Uncollectible Accounts (Contra Asset Account) Allowance for Uncollectible Accounts + On the Balance Sheet as deduction from AR The Allowance Method (cont.) By using the Allowance for Uncollectible Accounts Method AR still = total of customer accounts in subsidiary Allowance for uncollectible accounts balance represents amount the business estimates to be uncollectible Difference between AR & Allowance for Uncollectible Accounts represents book value of AR The Allowance Method (cont.) Book Value of AR: amount a business can reasonably expect to collect from AR Figure 24-3 p. 660 Illustrates how adjustment is recorded and extended on the Worksheet Notice Allowance for Uncollectible Accounts has $125 in Trail Balance CR column, this is carried over from the previous year New balance extended 1st to adjusted Trail Balance CR column and then Balance Sheet CR column The Allowance Method (cont.) Entry p. 660 Dec 31 Uncollectible Accounts Expense 1350 Allowance for Uncollectible Accounts 1350 Reporting Estimated Uncollectible Amounts on the Financial Statements Uncollectible Accounts Expense appears on the Income Statement Figure 24-4 p. 661, placement under Operating Expense Allowance for Uncollectible Accounts appears on the Balance Sheet Figure 24-5 p. 661 immediately below AR AR & Allowance for balance entered in 1st column Difference (Book Value) entered in 2nd column Journalizing the Adjusting Entry for Uncollectible Accounts After Worksheet and Financial Statements are prepared, adjusting entries are journalized Information for entries found in adjustments section of the Worksheet Figure 24-3 p. 660-661 Figure 24-6 p. 662 Entry & Posting Dec 31 Uncollectible Accounts Expense 1350 Allowance for Uncollectible Accounts POST 1350 Journalizing the Adjusting Entry for Uncollectible Accounts (cont.) At the end of the period Uncollectible Accounts Expense is closed to the Income Summary account Balance of Allowance for Uncollectible Accounts is not affected Writing Off Uncollectible AR When it becomes clear that the charge customer will not pay, amount owned is removed from accounting records Allowance for Uncollectible Accounts - at the end of the period it is “filled up” by adjusting entries Account balance is saved until it is needed in the future When a charge customer account finally proves uncollectible, the business dips into reservoir to write off Meaning: Allowance for Uncollectible Accounts is decreased when a specific account is written off Writing Off Uncollectible AR (cont.) Example p. 663 Allowance for Uncollectible Accounts (-) AR/Subsidiary (-) $ $ With this method no expense account is affected, expense is recorded as an adjusting entry Collecting an Account Written Off by the Allowance Method 1st reinstate the customer’s account Ex. P. 664-665 Date AR/Subsidiary Allowance for Uncollectible Accounts POST 2nd record the cash receipt Figure 24-7 p. 665 Subsidiary Shows 1. Written Off 2. Reinstated 3. Collected in Full $ $ Section 3 Estimating Uncollectible Accounts Receivable % of Net Sales Method % of Net Sales Method: the business assumes that a % of each ale will be uncollectible To Determine: 1. 2. 3. 4. Determine % Calculate net sales Multiply net sales by % Enter amount calculated above on Worksheet % of Net Sales Method (cont.) 1. 2. Ex. P. 667-668 P. 667 (bottom) P. 669 (top) Sales Less: Discounts Returns & Allowances Net Sales 3. 4. $ $ $ -$ $ Net Sales x % = Estimated Uncollectible Amount Enter estimated uncollectible as adjustment on the Worksheet, later it will be journalized Beginning the next period Allowance for Uncollectible Accounts will have $1475 CR balance (125 previous and 1350 this period) The Aging of AR Methods The Aging of AR Methods: uncollectible accounts expense is based on the date each customer account is due Ensures that the longer accounts are overdue, less likely to collect To Determine… 1. Age, classify or group accounts according to date 2. 3. 4. Ex 0-30, 31-60, 61-90, 90+ Determine % for each group Multiply amount per group by % for that group and add results Enter on the Worksheet total estimated uncollectible (from #3) adjusted by any balance in Allowance for Uncollectible Accounts The Aging of AR Methods (cont.) Ex. P. 668 P. 668 (bottom) 2. P. 669 (middle) 3. P. 669 (middle) 4. P. 669 last 3 paragraphs and T Accounts 1.