CHAPTER 7

... 1. safeguard assets (physically) 2. ensure reliable financial reporting 3. ensure that management’s objectives are carried out. We are most interested in the first two objectives as accountants. 5. Read Appendix 7A. List some internal control procedures related to cash. ...

... 1. safeguard assets (physically) 2. ensure reliable financial reporting 3. ensure that management’s objectives are carried out. We are most interested in the first two objectives as accountants. 5. Read Appendix 7A. List some internal control procedures related to cash. ...

KAPP Edge Solutions

... The balance sheet has two sides – Assets side and the Liabilities side. Assets are shown on the right hand side and the liabilities are shown on the left hand side of the Balance Sheet. (in traditional way, its changed now) The balance sheet is based on the equation that what an entity owns on ...

... The balance sheet has two sides – Assets side and the Liabilities side. Assets are shown on the right hand side and the liabilities are shown on the left hand side of the Balance Sheet. (in traditional way, its changed now) The balance sheet is based on the equation that what an entity owns on ...

INTRODUCTION - Georgia CTAE | Home

... • Introduce the lesson‐ Review the sections of the multi‐step income statement using the text. Have the students practice setting up sections of an income statement individually, then put all the sections together. • Assessment Activity – Form students into teams, give each team the informati ...

... • Introduce the lesson‐ Review the sections of the multi‐step income statement using the text. Have the students practice setting up sections of an income statement individually, then put all the sections together. • Assessment Activity – Form students into teams, give each team the informati ...

Exam 1 Review

... b. The company’s investors c. The SEC d. The company’s management 30. One of the main disadvantages of a corporation when compared to a partnership is that a. The stockholders’ have limited liability b. The stockholder’s are treated as separate legal entity from the corporation c. The corporation an ...

... b. The company’s investors c. The SEC d. The company’s management 30. One of the main disadvantages of a corporation when compared to a partnership is that a. The stockholders’ have limited liability b. The stockholder’s are treated as separate legal entity from the corporation c. The corporation an ...

chapter 2 - CSUN.edu

... likely to overstate assets and income. Many times items in inventory become obsolete or damaged. In this instance inventory items should be listed at market value if it is lower than cost. ...

... likely to overstate assets and income. Many times items in inventory become obsolete or damaged. In this instance inventory items should be listed at market value if it is lower than cost. ...

Product and Service Costing: Job-Order System

... 3. Explain the difference between job-order and process costing, and identify the source documents used in joborder costing. 4. Describe the cost flows associated with job-order costing, and prepare the journal entries. 5. Explain why multiple overhead rates may be preferred to a single, plantwide r ...

... 3. Explain the difference between job-order and process costing, and identify the source documents used in joborder costing. 4. Describe the cost flows associated with job-order costing, and prepare the journal entries. 5. Explain why multiple overhead rates may be preferred to a single, plantwide r ...

What is Accounting?

... The conceptual framework that underlies IFRS is very similar to that used to develop GAAP. The basic definitions provided in this textbook for the key elements of financial statements, that is, assets, liabilities, equity, revenues (referred to as income), and expenses, are simplified versions of th ...

... The conceptual framework that underlies IFRS is very similar to that used to develop GAAP. The basic definitions provided in this textbook for the key elements of financial statements, that is, assets, liabilities, equity, revenues (referred to as income), and expenses, are simplified versions of th ...

download

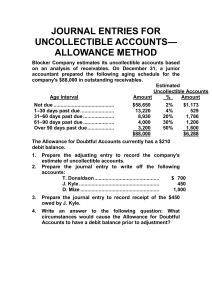

... circumstances would cause the Allowance for Doubtful Accounts to have a debit balance prior to adjustment? The actual amount of uncollectible accounts written off in the prior accounting period was greater than the estimate used to record the adjusting entry for bad debts. ...

... circumstances would cause the Allowance for Doubtful Accounts to have a debit balance prior to adjustment? The actual amount of uncollectible accounts written off in the prior accounting period was greater than the estimate used to record the adjusting entry for bad debts. ...

Document

... the two mid-term exams on week 12. Students can sign up for the retake exam during the seminar on week 11, whereby they must choose in advance which of the two mid-term exams they wish to retake. In case a student’s total score after the exam retake is less than 25 points, he or she has failed the c ...

... the two mid-term exams on week 12. Students can sign up for the retake exam during the seminar on week 11, whereby they must choose in advance which of the two mid-term exams they wish to retake. In case a student’s total score after the exam retake is less than 25 points, he or she has failed the c ...

Pay Equity Policy - Erie County Industrial Development Agency

... basis of gender continues to be a problem throughout the United States. It is the position of the ECIDA that no company receiving public funds or public benefits should be allowed to break the law and discriminate against any of its employees on the basis of gender. To that end, this policy seeks to ...

... basis of gender continues to be a problem throughout the United States. It is the position of the ECIDA that no company receiving public funds or public benefits should be allowed to break the law and discriminate against any of its employees on the basis of gender. To that end, this policy seeks to ...

PSA 510: Initial Engagements * Opening Balances

... consistently applied or changes in accounting policies have been properly accounted for and adequately disclosed. ...

... consistently applied or changes in accounting policies have been properly accounted for and adequately disclosed. ...

PowerPoint

... • Set-up pre-award AUs and continuous follow-up on award notice and subcontracts • Review monthly expenditure reports and communicate corrections to SPA as soon as possible; generate ad-hoc reports as needed in WebFOCUS https://webreports.luc.edu/ • Timely revision of payroll forms to avoid overdraf ...

... • Set-up pre-award AUs and continuous follow-up on award notice and subcontracts • Review monthly expenditure reports and communicate corrections to SPA as soon as possible; generate ad-hoc reports as needed in WebFOCUS https://webreports.luc.edu/ • Timely revision of payroll forms to avoid overdraf ...

Accounting Processes

... benefit rate and facilities and administrative cost rate allocations. a. Once all processes are complete and journal entries are posted to the general ledger, Accounting closes the period. At this point, no further transactions may be processed. This usually occurs by the fourth business day of the ...

... benefit rate and facilities and administrative cost rate allocations. a. Once all processes are complete and journal entries are posted to the general ledger, Accounting closes the period. At this point, no further transactions may be processed. This usually occurs by the fourth business day of the ...

2174 321 syllabus

... Borrowed $30,000 for Coast National Bank by issuing a $30,000 note due in two years with 10% interest payable annually. Purchased the assets of a distressed competitor for $75,000 in cash. The assets consisted of inventory with an estimated market value of $80,000; supplies worth $6,000 and equipmen ...

... Borrowed $30,000 for Coast National Bank by issuing a $30,000 note due in two years with 10% interest payable annually. Purchased the assets of a distressed competitor for $75,000 in cash. The assets consisted of inventory with an estimated market value of $80,000; supplies worth $6,000 and equipmen ...

Application Form For the Registration of a

... Section 4(1) of Companies Act No. 7 of 2007 (“the Act”) [If there is insufficient space on the form to supply the information required, attach a separate sheet containing the information set out in the prescribed format] ...

... Section 4(1) of Companies Act No. 7 of 2007 (“the Act”) [If there is insufficient space on the form to supply the information required, attach a separate sheet containing the information set out in the prescribed format] ...

C1w

... States that only transactions expressed in terms of money be included in accounting records. Assumes that unit of measure remains constant over time. Economic entity assumption Assumes economic events can be identified with a particular unit of accountability. Requires economic activities ...

... States that only transactions expressed in terms of money be included in accounting records. Assumes that unit of measure remains constant over time. Economic entity assumption Assumes economic events can be identified with a particular unit of accountability. Requires economic activities ...

SO 2 Describe the flow of costs in a job order cost accounting system.

... the activity base. Wallace expects annual overhead costs to be $280,000 and direct labor costs for the year to be $350,000, the overhead rate is 80%, computed as follows: ...

... the activity base. Wallace expects annual overhead costs to be $280,000 and direct labor costs for the year to be $350,000, the overhead rate is 80%, computed as follows: ...

Accounting Theory Defined

... The gross profit recognized each period for Warrior Construction Co. is as shown below. Use of the percentage-of-completion method involves some subjectivity. As a result, errors are possible in determining the amount of revenue recognized. To wait until completion would seriously distort the financ ...

... The gross profit recognized each period for Warrior Construction Co. is as shown below. Use of the percentage-of-completion method involves some subjectivity. As a result, errors are possible in determining the amount of revenue recognized. To wait until completion would seriously distort the financ ...

Adjusting Entries

... – Some items are not recorded daily – Some costs are not recorded during the accounting period, as they expire due to the passage of time – Some items may be unrecorded ...

... – Some items are not recorded daily – Some costs are not recorded during the accounting period, as they expire due to the passage of time – Some items may be unrecorded ...

Appendix 1 Job Description

... Manage the supplier accounts, analysing aged creditors, investigating and correcting differences and working with budget holders to ensure accounts on hold are properly monitored and progressed. Maintain an authorised signatory list in line with the Scheme of Delegation and ensure invoices are appro ...

... Manage the supplier accounts, analysing aged creditors, investigating and correcting differences and working with budget holders to ensure accounts on hold are properly monitored and progressed. Maintain an authorised signatory list in line with the Scheme of Delegation and ensure invoices are appro ...

Double-Entry Accounting

... mandatory “equal” position. It is also possible to make changes (additions or subtractions) to only one side of the scale. For example, an equal dollar value added to and then subtracted from the asset total would not cause the overall formula to be out of balance. ...

... mandatory “equal” position. It is also possible to make changes (additions or subtractions) to only one side of the scale. For example, an equal dollar value added to and then subtracted from the asset total would not cause the overall formula to be out of balance. ...

TEST 1

... Single-entry bookkeeping is characterized by the fact that only one entry 5……………….. for each transaction, just like in your check register. In one column, entries are recorded as a positive or negative amount. In single-entry bookkeeping, you can actually keep 6…………………, one column for revenue and on ...

... Single-entry bookkeeping is characterized by the fact that only one entry 5……………….. for each transaction, just like in your check register. In one column, entries are recorded as a positive or negative amount. In single-entry bookkeeping, you can actually keep 6…………………, one column for revenue and on ...

Embracing the Millennial American Dream

... The new interpretation, which does not have to go before the public for comments, formally accepts the so-called “economic realities” six-part test for determining whether workers are employees or contractors.28 Problems for startups arise because the interpretation downplays the employer’s lack of ...

... The new interpretation, which does not have to go before the public for comments, formally accepts the so-called “economic realities” six-part test for determining whether workers are employees or contractors.28 Problems for startups arise because the interpretation downplays the employer’s lack of ...

Jonathan Heller ED 605 Unit Plan PATHWAY: Financial

... receive the money. The banker should set up the money and the county clerk should set out the title cards during this 20 minutes. Transactions: The first 10 rolls will be for the month of Oct. The first roll would use the transaction date of Oct 1, the second roll, Oct 2, the third roll, Oct 3. etc. ...

... receive the money. The banker should set up the money and the county clerk should set out the title cards during this 20 minutes. Transactions: The first 10 rolls will be for the month of Oct. The first roll would use the transaction date of Oct 1, the second roll, Oct 2, the third roll, Oct 3. etc. ...

Time book

A time book is a mostly outdated accounting record, that registered the hours worked by employees in a certain organization in a certain period. These records usually contain names of employees, type of work, hours worked, and sometimes wages paid.In the 19th and early 20th century time books were separate held records. In those days time books were held by company clerks or foremen or specialized timekeepers. These time books were used by the bookkeeper to determine the wages to be paid. The data was used in financial accounting to determine the weekly, monthly and annual labour costs, and in cost accounting to determine the cost price. Late 19th century additional time cards came in use to register labour hours.Nowadays the time book can be a part of an integrated payroll system, or cost accounting system. Those systems can contain registers that describe the labour time spend to produced products, but those registers are not regularly called time books, but timesheets.