forecasting financial statements: proforma analysis

... Having obtained a sales forecast, the trial proforma balance sheet can be created. Accounts that tend to vary with sales are typically forecasted first. Often the current assets and liabilities, such as accounts receivable, inventory, and accounts payable, will move with sales. For example, a firm m ...

... Having obtained a sales forecast, the trial proforma balance sheet can be created. Accounts that tend to vary with sales are typically forecasted first. Often the current assets and liabilities, such as accounts receivable, inventory, and accounts payable, will move with sales. For example, a firm m ...

First: Steps of money laundering:

... Third: Behavior of employees of parties subject to the provisions of the Anti Money Laundering Law Modes of behavior described below by employees of parties subject to the provisions of the Anti Money Laundering Law constitute grounds for suspicion of money laundering activity: ...

... Third: Behavior of employees of parties subject to the provisions of the Anti Money Laundering Law Modes of behavior described below by employees of parties subject to the provisions of the Anti Money Laundering Law constitute grounds for suspicion of money laundering activity: ...

Term Sheet Form - Israel Advanced Technology Industries

... and other economic terms of the investment in the event that a Founder cease to be employed by the Company, [50]% of the shares owned by each of the Founders (the “Restricted Shares”), will be subject to adjustment by providing the Company the right to buyback at par value [(provided that this right ...

... and other economic terms of the investment in the event that a Founder cease to be employed by the Company, [50]% of the shares owned by each of the Founders (the “Restricted Shares”), will be subject to adjustment by providing the Company the right to buyback at par value [(provided that this right ...

Computerised Accounting System

... and summarising financial transactions to produce the financial reports for their ultimate analysis. Let us understand these activities in the context of manual and computerised accounting system. • Identifying : The identification of transactions, based on application of accounting principles is, c ...

... and summarising financial transactions to produce the financial reports for their ultimate analysis. Let us understand these activities in the context of manual and computerised accounting system. • Identifying : The identification of transactions, based on application of accounting principles is, c ...

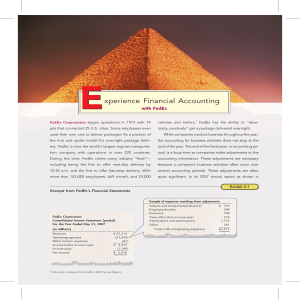

Experience Financial Accounting

... Completing the Accounting Cycle In the previous chapter, we examined how companies use the double-entry accounting system to record business activities that occur during the accounting period. However, accountants also make numerous adjustments at the end of accounting periods for business activitie ...

... Completing the Accounting Cycle In the previous chapter, we examined how companies use the double-entry accounting system to record business activities that occur during the accounting period. However, accountants also make numerous adjustments at the end of accounting periods for business activitie ...

arch capital group ltd. - corporate

... The SEC allows us to “incorporate by reference” the information we file with them, which means we can disclose important information to you by referring you to those documents. The information included in the following documents is incorporated by reference and is considered to be a part of this pro ...

... The SEC allows us to “incorporate by reference” the information we file with them, which means we can disclose important information to you by referring you to those documents. The information included in the following documents is incorporated by reference and is considered to be a part of this pro ...

Chapter 18 Notes File - National Trail Local School District

... **Only purchases of merchandise on account are journalized in the purchases journal. --Items not recorded in the Purchases Journal: supplies, equipment, services. STEPS: Recording an entry in a purchases journal. 1. Write the date 2. Write the vendor name in the Account Credited column 3. Write the ...

... **Only purchases of merchandise on account are journalized in the purchases journal. --Items not recorded in the Purchases Journal: supplies, equipment, services. STEPS: Recording an entry in a purchases journal. 1. Write the date 2. Write the vendor name in the Account Credited column 3. Write the ...

brooks automation, inc. - corporate

... 4.Offering Periods and Stock Options (a)The time periods during which payroll deductions will be accumulated under the Plan shall consist of six month periods (“ Offering Periods ”), commencing on the first day of each Offering Period (“ Offering Commencement Date ”) and ending on the last day of th ...

... 4.Offering Periods and Stock Options (a)The time periods during which payroll deductions will be accumulated under the Plan shall consist of six month periods (“ Offering Periods ”), commencing on the first day of each Offering Period (“ Offering Commencement Date ”) and ending on the last day of th ...

Liabilities

... a. A decision by management of an entity to acquire assets in the future gives rise to a present obligation. b. An obligation may be extinguished by a creditor waiving or forfeiting its rights c. Payables arising from the normal course of business due under customary trade terms not exceeding one ye ...

... a. A decision by management of an entity to acquire assets in the future gives rise to a present obligation. b. An obligation may be extinguished by a creditor waiving or forfeiting its rights c. Payables arising from the normal course of business due under customary trade terms not exceeding one ye ...

Balance Sheet Ratios and Analysis for Cooperatives

... Questions to ask about Profitability What are the year to year trends in Net Funds Generated from operations? How steady or volatile are the year to year trends in Net Funds Generated? What portion of average Net Funds Generated is committed to long term debt service? After debt service, wha ...

... Questions to ask about Profitability What are the year to year trends in Net Funds Generated from operations? How steady or volatile are the year to year trends in Net Funds Generated? What portion of average Net Funds Generated is committed to long term debt service? After debt service, wha ...

GAAP

... concept is based on the accounting period concept. It is widely accepted that desire of making profit is the most important motivation to keep the proprietors engaged in business activities. By `matching’ we mean appropriate association of related revenues and expenses pertaining to a particular a ...

... concept is based on the accounting period concept. It is widely accepted that desire of making profit is the most important motivation to keep the proprietors engaged in business activities. By `matching’ we mean appropriate association of related revenues and expenses pertaining to a particular a ...

Calculating ROI for an RFID Asset Tracking System

... another to assign a realistic value to cost of finding those items when they are needed. In some cases the cost may not be limited to the wasted human labor of the person looking for the item, there may be impact on production efficiency or other opportunity costs. Having this information is imperat ...

... another to assign a realistic value to cost of finding those items when they are needed. In some cases the cost may not be limited to the wasted human labor of the person looking for the item, there may be impact on production efficiency or other opportunity costs. Having this information is imperat ...

Chapter Outline Notes

... expense when the related sales are recorded and it reports accounts receivable on the balance sheet at the estimated amount of cash to be collected. 1. Recording bad debts expense. The allowance method estimates bad debts expense at the end of the accounting period and records it with an adjusting e ...

... expense when the related sales are recorded and it reports accounts receivable on the balance sheet at the estimated amount of cash to be collected. 1. Recording bad debts expense. The allowance method estimates bad debts expense at the end of the accounting period and records it with an adjusting e ...

Equity $10000 Land $84000 Notes Payable $10000

... • accounting procedure, once adopted, should continue to be used. – Rules for changing accounting rules to follow. ...

... • accounting procedure, once adopted, should continue to be used. – Rules for changing accounting rules to follow. ...

Chapter 5 Employee Fraud: The

... appear to balance. The perpetrator removes the checks before they are cashed, so any personal checks by the cashier found in a register may flag cover-up of a theft. An auditor should check for reversing transactions, altered cash counts, or register tapes that are "lost." Check Tampering. Not all c ...

... appear to balance. The perpetrator removes the checks before they are cashed, so any personal checks by the cashier found in a register may flag cover-up of a theft. An auditor should check for reversing transactions, altered cash counts, or register tapes that are "lost." Check Tampering. Not all c ...

Code of conduct - Berlin London Beteiligungs Holding AG

... information regarding BLH AG and/or associated companies or regarding a company with which BLH AG transacts business. Such information includes for example management board reports, new products, distribution channels or production methods, corporate transactions, revenues and profitability of the c ...

... information regarding BLH AG and/or associated companies or regarding a company with which BLH AG transacts business. Such information includes for example management board reports, new products, distribution channels or production methods, corporate transactions, revenues and profitability of the c ...

Forecasting Financial Statements May05

... base amount of the asset when sales are zero. Appendix A gives equations for finding the "best fit line," which is the line that minimizes the sum of the squared errors. There are many statistical packages including MS Excel that can perform basic regression ...

... base amount of the asset when sales are zero. Appendix A gives equations for finding the "best fit line," which is the line that minimizes the sum of the squared errors. There are many statistical packages including MS Excel that can perform basic regression ...

glossary

... Response A: This is one of three forms of business organization discussed in the chapter. Response B: Correct! Response C: This is one of three forms of business organization discussed in the chapter. Response D: This is one of three forms of business organization discussed in the chapter. ...

... Response A: This is one of three forms of business organization discussed in the chapter. Response B: Correct! Response C: This is one of three forms of business organization discussed in the chapter. Response D: This is one of three forms of business organization discussed in the chapter. ...

ppt

... ORGANISATION MAY ACCRUE AFTER FEW YEARS.THESE MAY BE TREATED AS DEFERRED REVENUE EXPENDITURE , CARRIED TO THE BALANCE SHEET , AND WRITTEN OFF TO THE PROFIT & LOSS ACCOUNT OVER A PERIOD OF TIME. ...

... ORGANISATION MAY ACCRUE AFTER FEW YEARS.THESE MAY BE TREATED AS DEFERRED REVENUE EXPENDITURE , CARRIED TO THE BALANCE SHEET , AND WRITTEN OFF TO THE PROFIT & LOSS ACCOUNT OVER A PERIOD OF TIME. ...

1. Paid rent for the next three months. 2. Paid property taxes that

... 8. Account does not appear in either the balance sheet or the income statement. ...

... 8. Account does not appear in either the balance sheet or the income statement. ...

Review of a Company`s Accounting System

... Closing entries are journal entries made by a company at the end of the period, after preparation of the financial statements, to (a) reduce the balances in all temporary accounts (revenue, expense, and dividend accounts) to zero, and (b) update the retained earnings and inventory accounts. Each tem ...

... Closing entries are journal entries made by a company at the end of the period, after preparation of the financial statements, to (a) reduce the balances in all temporary accounts (revenue, expense, and dividend accounts) to zero, and (b) update the retained earnings and inventory accounts. Each tem ...

Fixed Assets, Depreciation, Disposals

... Disposals of plant assets A plant asset may be disposed of in three ways: 1. Discarded, with no cash received 2. Sold for cash 3. Traded in In ACCT 101 we will review the accounting for assets discarded or sold for cash. Accounting for assets traded in will not be covered. The accounting for plant ...

... Disposals of plant assets A plant asset may be disposed of in three ways: 1. Discarded, with no cash received 2. Sold for cash 3. Traded in In ACCT 101 we will review the accounting for assets discarded or sold for cash. Accounting for assets traded in will not be covered. The accounting for plant ...

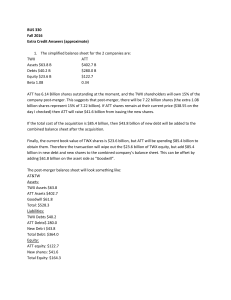

Bonus Assignment solution

... “if”) – then this would be a $2.4 billion cost savings per year, or an additional $2.4 billion of pretax income. Income tax is currently about 30% of its income, so that would leave $1.7 billion of additional net income. This amount would increase TWX earnings per share by 44%. Therefore cost saving ...

... “if”) – then this would be a $2.4 billion cost savings per year, or an additional $2.4 billion of pretax income. Income tax is currently about 30% of its income, so that would leave $1.7 billion of additional net income. This amount would increase TWX earnings per share by 44%. Therefore cost saving ...

Time book

A time book is a mostly outdated accounting record, that registered the hours worked by employees in a certain organization in a certain period. These records usually contain names of employees, type of work, hours worked, and sometimes wages paid.In the 19th and early 20th century time books were separate held records. In those days time books were held by company clerks or foremen or specialized timekeepers. These time books were used by the bookkeeper to determine the wages to be paid. The data was used in financial accounting to determine the weekly, monthly and annual labour costs, and in cost accounting to determine the cost price. Late 19th century additional time cards came in use to register labour hours.Nowadays the time book can be a part of an integrated payroll system, or cost accounting system. Those systems can contain registers that describe the labour time spend to produced products, but those registers are not regularly called time books, but timesheets.