Department of Economics - Midlands State University

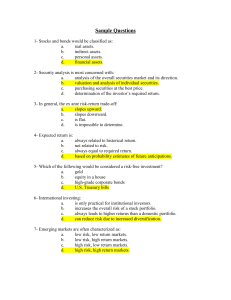

... students to financial mathematics and highlights major issues involved in making investment and financial decisions. It enables each student to be able to analyze various investment vehicles such as common stock, fixed income securities (bonds, preferred stock) and derivative securities (options, fu ...

... students to financial mathematics and highlights major issues involved in making investment and financial decisions. It enables each student to be able to analyze various investment vehicles such as common stock, fixed income securities (bonds, preferred stock) and derivative securities (options, fu ...

The Nasdaq-100 Index Option - The New York Stock Exchange

... The Nasdaq-100 is a modified capitalization weighted index composed of 100 of the largest non-financial securities listed on the Nasdaq Stock Market. The index was created in 1985 with a base value set to 250 on February 1 of that year. After reaching a level of nearly 800 on December 31, 1993, the ...

... The Nasdaq-100 is a modified capitalization weighted index composed of 100 of the largest non-financial securities listed on the Nasdaq Stock Market. The index was created in 1985 with a base value set to 250 on February 1 of that year. After reaching a level of nearly 800 on December 31, 1993, the ...

Update - UBC Computer Science - University of British Columbia

... data exploration Convenient API for interactive control and navigation of graphs Stock market graph is large hyperbolic space has good information density ...

... data exploration Convenient API for interactive control and navigation of graphs Stock market graph is large hyperbolic space has good information density ...

PowerPoint ****

... Fourth Market The direct trading of exchange-listed securities between investors (large institutions) ...

... Fourth Market The direct trading of exchange-listed securities between investors (large institutions) ...

BAML Partners with Thesys on New High-Speed Trading

... requirements while also providing clients with extremely fast access to markets. “While we’ve deployed pre-trade risk checks for some time now, BofAML Express gives our clients an edge by compressing latency to levels unimaginable just a short time ago without compromising any controls,” said Michae ...

... requirements while also providing clients with extremely fast access to markets. “While we’ve deployed pre-trade risk checks for some time now, BofAML Express gives our clients an edge by compressing latency to levels unimaginable just a short time ago without compromising any controls,” said Michae ...

Long-Term Capital Management

... – As Russia collapsed, fixed-income traders flocked to more liquid assets (e.g. on-the-run TBills) – Spreads between on-the-run and off-the-run Treasuries widened dramatically ● Short positions increased in price relative to long positions – Issuance of US Treasuries declined into the 90s, reducing ...

... – As Russia collapsed, fixed-income traders flocked to more liquid assets (e.g. on-the-run TBills) – Spreads between on-the-run and off-the-run Treasuries widened dramatically ● Short positions increased in price relative to long positions – Issuance of US Treasuries declined into the 90s, reducing ...

The Structure and Performance of Securities Markets

... Expect to earn a profit by “buying low and selling high” Take a risk on a change of price in the securities they own ...

... Expect to earn a profit by “buying low and selling high” Take a risk on a change of price in the securities they own ...

Learning Goals

... pay it, and considering that any trader can either put in a limit or market order and so, in equilibrium, would be indifferent between the two, it must be the case that the net costs for the two types of trades are equal. Hence l-s = s+m, or s = (l-m)/2 That is, the bid-ask spread (i.e. the differen ...

... pay it, and considering that any trader can either put in a limit or market order and so, in equilibrium, would be indifferent between the two, it must be the case that the net costs for the two types of trades are equal. Hence l-s = s+m, or s = (l-m)/2 That is, the bid-ask spread (i.e. the differen ...

CSE RULE 11 – Trading of Other Listed Securities

... recognized in a jurisdiction in Canada as eligible for trading as Other Listed Securities provided such securities are not suspended or subject to a regulatory halt. ...

... recognized in a jurisdiction in Canada as eligible for trading as Other Listed Securities provided such securities are not suspended or subject to a regulatory halt. ...

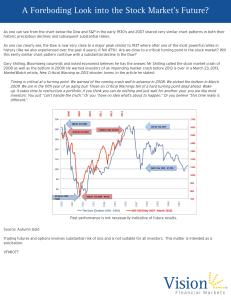

A Foreboding Look into the Stock Market`s Future?

... As one can see from the chart below the Dow and S&P in the early 1930’s and 2007 shared very similar chart patterns in both their historic precipitous declines and subsequent substantial rallies. As one can clearly see, the Dow is now very close to a major peak similar to 1937 where after one of the ...

... As one can see from the chart below the Dow and S&P in the early 1930’s and 2007 shared very similar chart patterns in both their historic precipitous declines and subsequent substantial rallies. As one can clearly see, the Dow is now very close to a major peak similar to 1937 where after one of the ...

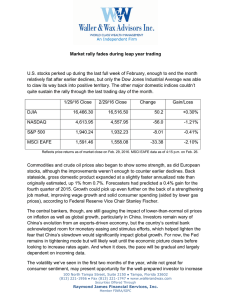

Market rally fades during leap year trading U.S. stocks perked up

... The MSCI EAFE (Europe, Australia, Far East) index is an unmanaged index that is generally considered representative of the international stock market. International investing involves additional risks such as currency fluctuations, differing financial accounting standards, and possible political and ...

... The MSCI EAFE (Europe, Australia, Far East) index is an unmanaged index that is generally considered representative of the international stock market. International investing involves additional risks such as currency fluctuations, differing financial accounting standards, and possible political and ...

Bolsa Comercio Santiago (Santiago Stock Exchange)

... amounts, dividends, and other information. This system is operated over the telephone. InfoMail, like FonoBolsa, offers access to some of the same information summarizing the market, its index as well as closing prices Similarly StockView offered directly through the website allows the traders a ...

... amounts, dividends, and other information. This system is operated over the telephone. InfoMail, like FonoBolsa, offers access to some of the same information summarizing the market, its index as well as closing prices Similarly StockView offered directly through the website allows the traders a ...

Stock Market Liquidity: Behavior of Short-Term and Long-Term

... London Stock Exchange. This phenomenon is often referred to as hot potato trading. A typical short-term trader, who also provides liquidity in the market, protects herself against trading with those having superior information through the bid-ask spread. However, there is also the need to process in ...

... London Stock Exchange. This phenomenon is often referred to as hot potato trading. A typical short-term trader, who also provides liquidity in the market, protects herself against trading with those having superior information through the bid-ask spread. However, there is also the need to process in ...

Research Online Trading Sites and DRIPs you will evaluate the

... Research Online Trading Sites and DRIPs you will evaluate the choices in purchasing stock via online brokerage accounts (where you can buy and sell stock via the Internet) and the use of dividend reinvestment plans (known as DIPs and DRIPs) or mutual funds or index funds. For online brokers, you wil ...

... Research Online Trading Sites and DRIPs you will evaluate the choices in purchasing stock via online brokerage accounts (where you can buy and sell stock via the Internet) and the use of dividend reinvestment plans (known as DIPs and DRIPs) or mutual funds or index funds. For online brokers, you wil ...

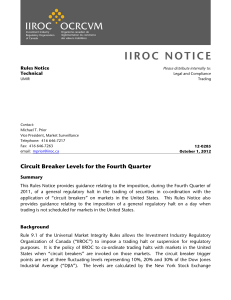

Circuit Breaker Levels for the Fourth Quarter

... Organization of Canada (“IIROC”) to impose a trading halt or suspension for regulatory purposes. It is the policy of IIROC to co-ordinate trading halts with markets in the United States when “circuit breakers” are invoked on those markets. The circuit breaker trigger points are set at three fluctuat ...

... Organization of Canada (“IIROC”) to impose a trading halt or suspension for regulatory purposes. It is the policy of IIROC to co-ordinate trading halts with markets in the United States when “circuit breakers” are invoked on those markets. The circuit breaker trigger points are set at three fluctuat ...

i̇mkb at a glance

... The information and data contained in this publication are presented for general information only. While careful effort has been made to ensure the accuracy of this information, the İMKB assumes no responsibility for any omissions or errors. The data should not be used for investment advise, as the ...

... The information and data contained in this publication are presented for general information only. While careful effort has been made to ensure the accuracy of this information, the İMKB assumes no responsibility for any omissions or errors. The data should not be used for investment advise, as the ...

Untitled

... ways. One strategy is to post buy and sell orders a few pennies from where the market is trading and wait until one of the orders is executed. If crude oil is selling for $90 on the CME, a firm might post an order to sell one contract for $90.03 and a buy order for $89.97. If the sell order suddenly ...

... ways. One strategy is to post buy and sell orders a few pennies from where the market is trading and wait until one of the orders is executed. If crude oil is selling for $90 on the CME, a firm might post an order to sell one contract for $90.03 and a buy order for $89.97. If the sell order suddenly ...

Interest Rate Parity

... two members from amongst the officials of the ministers of central government dealing with Finance and Law. Two members who are professional and have experience or special knowledge relating to securities market. One member from RBI. ...

... two members from amongst the officials of the ministers of central government dealing with Finance and Law. Two members who are professional and have experience or special knowledge relating to securities market. One member from RBI. ...

Slide 1

... • Start of the new trading platform – XETRA (16.06.2008) • X3News – a specialized financial media through which the public companies and the other issuers of securities can fulfill their legal obligations for disclosure of regulated information. (January 2008) ...

... • Start of the new trading platform – XETRA (16.06.2008) • X3News – a specialized financial media through which the public companies and the other issuers of securities can fulfill their legal obligations for disclosure of regulated information. (January 2008) ...

Electrode Placement for Chest Leads, V1 to V6

... Liquid assets: Any asset that is easy to convert to cash. Hard assets: Assets that a company might not be able to convert to cash quickly but that still have significant value (e.g., factory building, real ...

... Liquid assets: Any asset that is easy to convert to cash. Hard assets: Assets that a company might not be able to convert to cash quickly but that still have significant value (e.g., factory building, real ...

NSE DGs pronouncement today may determine market direction

... In the wake of improved market activity on the floor of the Nigerian Stock Exchange (NSE) which led to a recorded four percent gain in just one week, Ndi Okereke-Onyiuke, director-general of the Nigerian Stock Exchange, will today appraise the Exchange’s 2009 performance and review activities of the ...

... In the wake of improved market activity on the floor of the Nigerian Stock Exchange (NSE) which led to a recorded four percent gain in just one week, Ndi Okereke-Onyiuke, director-general of the Nigerian Stock Exchange, will today appraise the Exchange’s 2009 performance and review activities of the ...

History and stories

... Reporters think inflation too complicated and no one cares Makes a big difference, two examples U.S. stocks in the 1970's Long term home price series ...

... Reporters think inflation too complicated and no one cares Makes a big difference, two examples U.S. stocks in the 1970's Long term home price series ...