A Day in the Life of an ETF Portfolio Manager

... our sails as quickly. “Nasdaq down again.” The massive order flow once again crashes the system. It’s beginning to feel like a bad episode of The Twilight Zone. We could leave trades unexecuted and trade them on Monday, exposing our funds to risk that stocks won’t open where they closed—the funds wo ...

... our sails as quickly. “Nasdaq down again.” The massive order flow once again crashes the system. It’s beginning to feel like a bad episode of The Twilight Zone. We could leave trades unexecuted and trade them on Monday, exposing our funds to risk that stocks won’t open where they closed—the funds wo ...

Ethics in Finance

... to prevent a shareholder from taking over the company Takeover agent ends up selling the shares back to company at an increased or higher negotiated price ...

... to prevent a shareholder from taking over the company Takeover agent ends up selling the shares back to company at an increased or higher negotiated price ...

financial engineer / front office quantitative researcher

... At Raiffeisen Centrobank, the equity house of Raiffeisen Bank International Group, we focus on equity trading and sales, structured products and company research – working closely together for the benefit of our clients. That makes us one of the leading investment banks in Austria and CEE. ...

... At Raiffeisen Centrobank, the equity house of Raiffeisen Bank International Group, we focus on equity trading and sales, structured products and company research – working closely together for the benefit of our clients. That makes us one of the leading investment banks in Austria and CEE. ...

Lecture 9 Financial Exchanges

... How could 3 milliseconds make a difference? Market participants felt it was imperative: “anyone pinging both markets has to be on this line, or they’re dead”. Within three years, microwave transmission cut round-trip times further …. to 10, then 9, then 8.5 ms. “Any HFT firm that has any ambitions w ...

... How could 3 milliseconds make a difference? Market participants felt it was imperative: “anyone pinging both markets has to be on this line, or they’re dead”. Within three years, microwave transmission cut round-trip times further …. to 10, then 9, then 8.5 ms. “Any HFT firm that has any ambitions w ...

pICkING thE BESt tRADING OppORtUNItIES

... margin loans to take advantage of this positive sentiment, new trading opportunities arise in many different sectors. The question still looms; what quantifies a ‘good’ trading stock and out of more than 2000 companies listed on the ASX, how do I find the best 20 to add to my watch list? Keeping in ...

... margin loans to take advantage of this positive sentiment, new trading opportunities arise in many different sectors. The question still looms; what quantifies a ‘good’ trading stock and out of more than 2000 companies listed on the ASX, how do I find the best 20 to add to my watch list? Keeping in ...

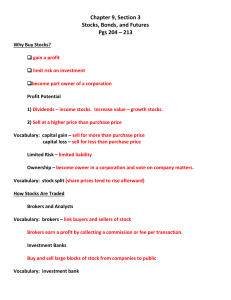

Chapter 9, Section 3 Stocks, Bonds, and Futures Pgs 204 – 213 Why

... From state/local taxes. Safest of all investments. Why Buy Futures? – High risk. Require knowledge of commodity. Traders accept investor’s money today in exchange for promise to deliver goods at a future date. Buyers and sellers make/lose money between price on contract date and price at delivery. V ...

... From state/local taxes. Safest of all investments. Why Buy Futures? – High risk. Require knowledge of commodity. Traders accept investor’s money today in exchange for promise to deliver goods at a future date. Buyers and sellers make/lose money between price on contract date and price at delivery. V ...

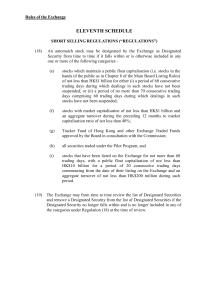

Amendments to the Rules of the Exchange in relation to the

... hands of the public as in Chapter 8 of the Main Board Listing Rules) of not less than HK$1 billion for either (i) a period of 60 consecutive trading days during which dealings in such stocks have not been suspended; or (ii) a period of no more than 70 consecutive trading days comprising 60 trading d ...

... hands of the public as in Chapter 8 of the Main Board Listing Rules) of not less than HK$1 billion for either (i) a period of 60 consecutive trading days during which dealings in such stocks have not been suspended; or (ii) a period of no more than 70 consecutive trading days comprising 60 trading d ...

High-frequency trading

... volumes and high speeds aiming to capture sometimes a fraction of a cent in profit on every trade. • HFT firms make up the low margins with incredibly high volumes of trades, frequently numbering in the millions. • HFT traders often use stimulus-response methods (rapid fire placement and then immedi ...

... volumes and high speeds aiming to capture sometimes a fraction of a cent in profit on every trade. • HFT firms make up the low margins with incredibly high volumes of trades, frequently numbering in the millions. • HFT traders often use stimulus-response methods (rapid fire placement and then immedi ...

Top bloggers pool Harmony Bee Airlie

... Crop stocks higher than expected Corn Soybean China going to need more etc etc ...

... Crop stocks higher than expected Corn Soybean China going to need more etc etc ...

CHAPTER 10: Equity Markets

... Association of Securities Dealers Automated Quotation system and it provides continuous bid/ask information. NASDAQ is an electronic pink sheet. 4. What are the functions of market makers and specialists? How do they differ? Market makers are dealers who regularly quote bids and ask prices in a secu ...

... Association of Securities Dealers Automated Quotation system and it provides continuous bid/ask information. NASDAQ is an electronic pink sheet. 4. What are the functions of market makers and specialists? How do they differ? Market makers are dealers who regularly quote bids and ask prices in a secu ...

Technical Analysis

... file current financial statements with the SEC or a banking or insurance regulator. There are no listing requirements, such as those found on the Nasdaq and New York Stock Exchange, for a company to start trading on the OTCBB. It is important to note that companies listed on the OTCBB are not a part ...

... file current financial statements with the SEC or a banking or insurance regulator. There are no listing requirements, such as those found on the Nasdaq and New York Stock Exchange, for a company to start trading on the OTCBB. It is important to note that companies listed on the OTCBB are not a part ...

Economics Chapter 11 Test Study Guide

... Vocabulary Terms put option Individual Retirement Account (IRA) portfolio diversification capital market tax-exempt Standard and Poor’s 500 (S & P 500) bear market mutual fund finance company 401 (k) plan Concepts Municipal Bonds What are they? What is their risk level? W ...

... Vocabulary Terms put option Individual Retirement Account (IRA) portfolio diversification capital market tax-exempt Standard and Poor’s 500 (S & P 500) bear market mutual fund finance company 401 (k) plan Concepts Municipal Bonds What are they? What is their risk level? W ...

Regulatory Focus on Market Structure and Trading Issues

... for the purpose of creating a false appearance of trading activity “Quote Stuffing” is often described as entering large number of orders and canceling those orders immediately for the purpose of slowing down quoting networks responsible for updating the NBBO Statements in electronic communicati ...

... for the purpose of creating a false appearance of trading activity “Quote Stuffing” is often described as entering large number of orders and canceling those orders immediately for the purpose of slowing down quoting networks responsible for updating the NBBO Statements in electronic communicati ...

CFA-AFR-Dark-Pools-2.. - CFA Society Melbourne

... Citing a survey by the London-based CFA Institute, Philip Stafford reports trading of US equities on dark pools has grown by 48 per cent in the past three years, and accounts for 31 per cent of total market volume as of March. – Rhodri Preece, director of capital markets policy at the CFA and author ...

... Citing a survey by the London-based CFA Institute, Philip Stafford reports trading of US equities on dark pools has grown by 48 per cent in the past three years, and accounts for 31 per cent of total market volume as of March. – Rhodri Preece, director of capital markets policy at the CFA and author ...

Prof. Giovanni Petrella

... This course covers two main topics from an empirical standpoint: price efficiency and market liquidity. The course includes trading simulations to provide in-class demonstrations of relevant concepts and hands-on experience in making trading decisions in different market structures. Students - on a ...

... This course covers two main topics from an empirical standpoint: price efficiency and market liquidity. The course includes trading simulations to provide in-class demonstrations of relevant concepts and hands-on experience in making trading decisions in different market structures. Students - on a ...

Recessions Happened Each Time Federal Taxes Reached 18% of

... Post Mid Term Returns Have Been Shrinking During Current Kuznets Bear Cycle This year may be first time, ever, that 3rd Year was not profitable ...

... Post Mid Term Returns Have Been Shrinking During Current Kuznets Bear Cycle This year may be first time, ever, that 3rd Year was not profitable ...

rainbow trading corporation spyglass trading. lp

... • 90-95% of trades are in options • Most opening positions are selling option wings expiring in the spot month – Routine and systematic in equity names we know – Also sell some index options – Expectation is for option to expire worthless ...

... • 90-95% of trades are in options • Most opening positions are selling option wings expiring in the spot month – Routine and systematic in equity names we know – Also sell some index options – Expectation is for option to expire worthless ...

assessing behaviour within an environment of uncertainty and risk

... This one day event is designed to explore how a candidate’s behaviour may affect the way they make decisions within an environment of uncertainty and risk. After candidates receive a contemporary market overview and platform demonstration they will take to their live trading terminal to execute trad ...

... This one day event is designed to explore how a candidate’s behaviour may affect the way they make decisions within an environment of uncertainty and risk. After candidates receive a contemporary market overview and platform demonstration they will take to their live trading terminal to execute trad ...

Charting and Technical Analysis

... specialists have more information about future price movements than other investors. Investors who use this indicator will often sell stocks when specialists do, and buy when they do. 2. Insider buying/selling: The ratio of insider buying to selling is often tracked for stocks with the idea that ins ...

... specialists have more information about future price movements than other investors. Investors who use this indicator will often sell stocks when specialists do, and buy when they do. 2. Insider buying/selling: The ratio of insider buying to selling is often tracked for stocks with the idea that ins ...

Operating Instruction nº 54/2017 INITIAL

... Bursátil (MAB). During the opening auction, orders shall be allowed that entail prices within a 50% static range of the reference price. The dynamic range shall be of 8%. The price resulting from this auction shall be considered to be the static price. From the next session on, the static range shal ...

... Bursátil (MAB). During the opening auction, orders shall be allowed that entail prices within a 50% static range of the reference price. The dynamic range shall be of 8%. The price resulting from this auction shall be considered to be the static price. From the next session on, the static range shal ...

The causal impact of algorithmic trading

... of all trading, one of the largest exchange in the world by transaction intensity. 2. Uses an exogenous event: Introduction of co-location services in Jan 2010, which was followed by an S-curve of adoption. 3. Data recorded well: Every order explicitly tagged as “AT” or “non-AT” for every security a ...

... of all trading, one of the largest exchange in the world by transaction intensity. 2. Uses an exogenous event: Introduction of co-location services in Jan 2010, which was followed by an S-curve of adoption. 3. Data recorded well: Every order explicitly tagged as “AT” or “non-AT” for every security a ...

Q2 2008 Market Commentary (Excerpt)

... markets still play out over weeks and months, so, as a result, we have markets moving up and down violently long before the full effect of the underlying events becomes known. This has only added to the confusion as the largest financial institutions and market players routinely try to "game each ot ...

... markets still play out over weeks and months, so, as a result, we have markets moving up and down violently long before the full effect of the underlying events becomes known. This has only added to the confusion as the largest financial institutions and market players routinely try to "game each ot ...