Chapter 12: Market Microstructure and Strategies

... interdealer transactions (FX market) =⇒ pure match makers (connect dealers). ...

... interdealer transactions (FX market) =⇒ pure match makers (connect dealers). ...

Desired Skills and Experience - The Municipal Analysts Group of

... Evaluator - Municipal Bonds-High Yield Interactive Data Corporation is a trusted leader in financial information. Thousands of financial institutions and active traders, as well as hundreds of software and service providers, subscribe to our fixed income evaluations, reference data, real-time market ...

... Evaluator - Municipal Bonds-High Yield Interactive Data Corporation is a trusted leader in financial information. Thousands of financial institutions and active traders, as well as hundreds of software and service providers, subscribe to our fixed income evaluations, reference data, real-time market ...

5th of February 2017 A Trading Shift: Back To Basics Last week was

... What is the real purpose of a research like the one proposed by Resurgam? Take some distance and isolate the best risk-reward trades and also the major trends. We are in a trading environment made of sharp and quick reversals. Faster and short-lived trends. Various quantitative and qualitative metri ...

... What is the real purpose of a research like the one proposed by Resurgam? Take some distance and isolate the best risk-reward trades and also the major trends. We are in a trading environment made of sharp and quick reversals. Faster and short-lived trends. Various quantitative and qualitative metri ...

Global Macro Investment For Presentation at Yale U. October 22

... number of factors while the potential number of factors could be infinite. Certain factors, which were useful for predicting the past, may become irrelevant for the future. There could be structural changes in the market that requires considering new factors; • Are better than gut feelings for most ...

... number of factors while the potential number of factors could be infinite. Certain factors, which were useful for predicting the past, may become irrelevant for the future. There could be structural changes in the market that requires considering new factors; • Are better than gut feelings for most ...

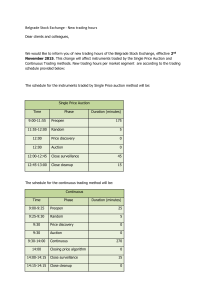

prezentacija ljubljanske borze

... Alternative market for shares (MTF). Full integration of the LJSE in the EU market place: Remote members, foreign vendors, foreign investors, new ...

... Alternative market for shares (MTF). Full integration of the LJSE in the EU market place: Remote members, foreign vendors, foreign investors, new ...

what is the “upstairs market?” the causes of market impact for block

... The upstairs market is a network of broker trading desks and institutional investors where block trades are matched. Unlike trades that are paired at an exchange (or ATS), these trades are typically negotiated via phone. Once a trade has been consummated it is “printed” on a marketplace. In order fo ...

... The upstairs market is a network of broker trading desks and institutional investors where block trades are matched. Unlike trades that are paired at an exchange (or ATS), these trades are typically negotiated via phone. Once a trade has been consummated it is “printed” on a marketplace. In order fo ...

10 Min Options Strategy Handout - MarketClub

... All trades, patterns, charts, systems, etc., discussed in this advertisement and the product materials are for illustrative purposes only and not to be construed as specific advisory recommendations. All ideas and material presented are entirely those of the author and do not necessarily reflect tho ...

... All trades, patterns, charts, systems, etc., discussed in this advertisement and the product materials are for illustrative purposes only and not to be construed as specific advisory recommendations. All ideas and material presented are entirely those of the author and do not necessarily reflect tho ...

File

... • With the same process and stock, intention and definition of objectives separate trading from investing ...

... • With the same process and stock, intention and definition of objectives separate trading from investing ...

Trading Nokia: The Roles of the Helsinki vs. the New York Stock

... between its price formation processes in the different markets becomes an important and interesting issue. Is perhaps one market leading the other in incorporating new information into the price of the stock? Discovering such patterns ...

... between its price formation processes in the different markets becomes an important and interesting issue. Is perhaps one market leading the other in incorporating new information into the price of the stock? Discovering such patterns ...

On Market Makers` Contribution to Trading Efficiency in Options

... to market makers in exchange for obligations they would assume. These obligations include the obligation to enter quotes for sell and buy orders. Market makers began to operate in March 2004. This event creates laboratory-like conditions that allow us to examine market makers’ contribution to option ...

... to market makers in exchange for obligations they would assume. These obligations include the obligation to enter quotes for sell and buy orders. Market makers began to operate in March 2004. This event creates laboratory-like conditions that allow us to examine market makers’ contribution to option ...

Chapter 12.2 notes - Effingham County Schools

... you don’t understand • Consistency – invest consistently over long periods of time ...

... you don’t understand • Consistency – invest consistently over long periods of time ...

the golden ticket gold day-trading system

... class strategies. CONTACT US Feel free to contact us at [email protected] if you have any questions. ...

... class strategies. CONTACT US Feel free to contact us at [email protected] if you have any questions. ...

What Trading Teaches Us About Life

... Note: This article first appeared on the TraderFeed site, 8/14/06 ...

... Note: This article first appeared on the TraderFeed site, 8/14/06 ...

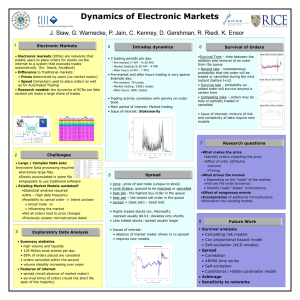

SciDAC Poster: INCITE

... Possibility to cancel order -> Intent unclear: actual trade vs influencing the market Not all orders lead to price changes Previously unseen microstructure detail ...

... Possibility to cancel order -> Intent unclear: actual trade vs influencing the market Not all orders lead to price changes Previously unseen microstructure detail ...

Lalin Dias, VP Exchange Systems, MillenniumIT

... MillenniumIT is a leading provider of high performance, flexible and multi-asset class technology to exchanges, broker-dealers, clearing houses, depositories and regulators. Its trading engine, smart order routing, market data, clearing, CSD and surveillance products have been implemented at over 30 ...

... MillenniumIT is a leading provider of high performance, flexible and multi-asset class technology to exchanges, broker-dealers, clearing houses, depositories and regulators. Its trading engine, smart order routing, market data, clearing, CSD and surveillance products have been implemented at over 30 ...

gbpusd - Forex Factory

... of currencies may fluctuate and investors may lose all or more than their original investments. Risks also include, but are not limited to, the potential for changing political and/or economic conditions that may substantially affect the price and/or liquidity of a currency. The impact of seasonal a ...

... of currencies may fluctuate and investors may lose all or more than their original investments. Risks also include, but are not limited to, the potential for changing political and/or economic conditions that may substantially affect the price and/or liquidity of a currency. The impact of seasonal a ...

Math Club Meeting #4 Friday, March 12th, 2010

... His talk was titled Math Finance and Quantitative Trading Strategies. The talk can be summarized in a few sentences said by Arindam Kundu himself: “In the last decade, mathematical and computational engineers have devised innovative strategies to generate consistent returns in the markets using a co ...

... His talk was titled Math Finance and Quantitative Trading Strategies. The talk can be summarized in a few sentences said by Arindam Kundu himself: “In the last decade, mathematical and computational engineers have devised innovative strategies to generate consistent returns in the markets using a co ...

Document

... – revealing orders and/or trades, – forming an active market with numerous traders, – discovering the asset’s price (price discovery), and – deepening the order “book” and/or building trading volume (quantity discovery). ...

... – revealing orders and/or trades, – forming an active market with numerous traders, – discovering the asset’s price (price discovery), and – deepening the order “book” and/or building trading volume (quantity discovery). ...

Financial Health- Understanding the Market

... Basics I Learned 1. Stockbrokers are salesmen 2. There are two types of traders Fundamental Traders Technical traders 3. How stock market functions 4. Simply economics of supply and demand 5. Stock market is slow to move up and fast to move down ...

... Basics I Learned 1. Stockbrokers are salesmen 2. There are two types of traders Fundamental Traders Technical traders 3. How stock market functions 4. Simply economics of supply and demand 5. Stock market is slow to move up and fast to move down ...