INSIDER TRADING RWM abides by national and local laws, rules

... RWM abides by national and local laws, rules and regulations, including all applicable guidelines issued by the Philippine Stock Exchange (PSE). It is therefore illegal to buy or sell securities of any company, including RWM’s, based on material non-public information, unless exempted under the law. ...

... RWM abides by national and local laws, rules and regulations, including all applicable guidelines issued by the Philippine Stock Exchange (PSE). It is therefore illegal to buy or sell securities of any company, including RWM’s, based on material non-public information, unless exempted under the law. ...

Listed Index Fund International Bond (Citi WGBI) Monthly

... deterioration in the financial conditions of constituent securities of issuers, or other market causes. Losses may arise from these factors. As such, invested capital is not guaranteed. Additionally, in cases of margin trading, losses may occur in excess of the deposited margin. - When trading ETFs, ...

... deterioration in the financial conditions of constituent securities of issuers, or other market causes. Losses may arise from these factors. As such, invested capital is not guaranteed. Additionally, in cases of margin trading, losses may occur in excess of the deposited margin. - When trading ETFs, ...

Market effciency

... Since stock prices only respond to new information, which by definition arrives randomly, stock prices are said to follow ...

... Since stock prices only respond to new information, which by definition arrives randomly, stock prices are said to follow ...

Optimal execution of portfolio transactions

... During a trading day morning trading activity is different from afternoon. An intelligent trader will collect information in the morning before he trades Most market models assume trade times are random and price behaviour is random Speed of trading may be adjusted according to changing market condi ...

... During a trading day morning trading activity is different from afternoon. An intelligent trader will collect information in the morning before he trades Most market models assume trade times are random and price behaviour is random Speed of trading may be adjusted according to changing market condi ...

CEE Trader - Wiener Börse

... ■ Connection via Internet or private network ■ RSA securID trading login (one login for all markets) ■ Market data sources: CEESEG FIX, Enhanced Broadcast Solution (EnBS), Alliance Data Highway (ADH) ■ Trading interface: CEESEG FIX ...

... ■ Connection via Internet or private network ■ RSA securID trading login (one login for all markets) ■ Market data sources: CEESEG FIX, Enhanced Broadcast Solution (EnBS), Alliance Data Highway (ADH) ■ Trading interface: CEESEG FIX ...

What market features reduce uncertainty?

... These issues are particularly relevant for China as its markets evolve and play an even greater role in development. A particular theme that I want to address is that the design of the market is fundamental to the success of the market. I also want to offer some comments on the current stock market ...

... These issues are particularly relevant for China as its markets evolve and play an even greater role in development. A particular theme that I want to address is that the design of the market is fundamental to the success of the market. I also want to offer some comments on the current stock market ...

Empirical evidence of Efficient market hypothesis on the Indian

... existence of mean reversion illusion in India. In aggregate, it was concluded that the monthly prices do not follow random walks in India. The investors can take the stream of benefits through arbitrage process from profitable opportunities across these markets. This study intends to point out that ...

... existence of mean reversion illusion in India. In aggregate, it was concluded that the monthly prices do not follow random walks in India. The investors can take the stream of benefits through arbitrage process from profitable opportunities across these markets. This study intends to point out that ...

Securities Markets

... defined group of stocks over a period of time Do not include dividends and therefore generally understate total returns However, price changes are primary way to describe the performance of equity markets ...

... defined group of stocks over a period of time Do not include dividends and therefore generally understate total returns However, price changes are primary way to describe the performance of equity markets ...

Changes to Result in Better Framework and Incentive Structure for

... The new MM model is designed to simplify and improve the quality of market making services. It focuses on registration and responsibility of Exchange Participants (EPs) for MM activities and will discontinue registration of third parties known as Registered Traders (see chart on next page). The main ...

... The new MM model is designed to simplify and improve the quality of market making services. It focuses on registration and responsibility of Exchange Participants (EPs) for MM activities and will discontinue registration of third parties known as Registered Traders (see chart on next page). The main ...

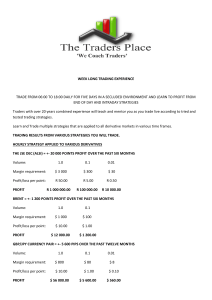

week long trading experience trade from 06:00 to 18:00 daily for five

... Warren began trading stocks in 2003 and progressed to Index and Forex trading in 2004. In 2005 he joined Share Direct, a financial market training company where he trained retail traders in Stocks, Index and Forex trading. He later joined Ideal CFD’s a CFD provider that was bought by IG Markets, he ...

... Warren began trading stocks in 2003 and progressed to Index and Forex trading in 2004. In 2005 he joined Share Direct, a financial market training company where he trained retail traders in Stocks, Index and Forex trading. He later joined Ideal CFD’s a CFD provider that was bought by IG Markets, he ...

Capital Markets in Egypt

... Macroeconomic Stabilization & Improved Performance - Transition to unified flexible FX rate regime (Dec.2004) -- subsequent stabilization - strengthened external position ...

... Macroeconomic Stabilization & Improved Performance - Transition to unified flexible FX rate regime (Dec.2004) -- subsequent stabilization - strengthened external position ...

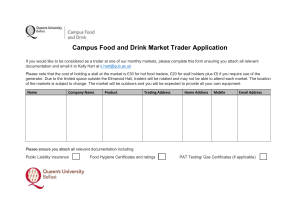

trader application form

... Campus Food and Drink Market Trader Application If you would like to be considered as a trader at one of our monthly markets, please complete this form ensuring you attach all relevant documentation and email it to Kelly Hart at [email protected] Please note that the cost of holding a stall at the ma ...

... Campus Food and Drink Market Trader Application If you would like to be considered as a trader at one of our monthly markets, please complete this form ensuring you attach all relevant documentation and email it to Kelly Hart at [email protected] Please note that the cost of holding a stall at the ma ...

- Cambridge Capital Group

... fundamental basis. Like now, we felt very uncomfortable when managing previous portfolios during that period with the upside potential for equities and the stock market given the associated risk and repositioned a vast majority of our client’s capital to alternative assets like bonds and other fixed ...

... fundamental basis. Like now, we felt very uncomfortable when managing previous portfolios during that period with the upside potential for equities and the stock market given the associated risk and repositioned a vast majority of our client’s capital to alternative assets like bonds and other fixed ...

Lecture 2

... In general we can say markets are "efficient" with respect to some information set f if: ...

... In general we can say markets are "efficient" with respect to some information set f if: ...

світовий валютний ринок forex .аналізйого функціювання

... 1.The object of my master's research is the international currency market FOREX 2. The subject of the master's study is the mechanism of functioning of the global currency market FOREX 3.The purpose of my master's research is the theoretical analysis of functioning of the global currency market FOR ...

... 1.The object of my master's research is the international currency market FOREX 2. The subject of the master's study is the mechanism of functioning of the global currency market FOREX 3.The purpose of my master's research is the theoretical analysis of functioning of the global currency market FOR ...

Press Release

... investors to automatically copy the trades of Top Traders. In recent years, ayondo has won several accolades, including Europe’s leading Financial Technology providers (“FinTech 50”). Other honours include the International Financial Award Best Social Trading Platform and Broker of the Year. ...

... investors to automatically copy the trades of Top Traders. In recent years, ayondo has won several accolades, including Europe’s leading Financial Technology providers (“FinTech 50”). Other honours include the International Financial Award Best Social Trading Platform and Broker of the Year. ...

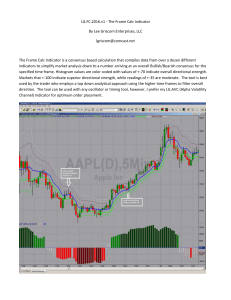

LG.FC.2016.v1

... specified time frame. Histogram values are color coded with values of +-70 indicate overall directional strength. Markets that +-100 indicate superior directional strength, while readings of +-35 are moderate. The tool is best used by the trader who employs a top down analytical approach using the h ...

... specified time frame. Histogram values are color coded with values of +-70 indicate overall directional strength. Markets that +-100 indicate superior directional strength, while readings of +-35 are moderate. The tool is best used by the trader who employs a top down analytical approach using the h ...

entrada - Bolsa de Madrid

... In their report they state that in the present environment, where high frequency and algorithmic trading predominate, liquidity problems are an inherent difficultly that must be addressed. Indeed, even in the absence of extraordinary market events, limit order books can quickly empty and prices can ...

... In their report they state that in the present environment, where high frequency and algorithmic trading predominate, liquidity problems are an inherent difficultly that must be addressed. Indeed, even in the absence of extraordinary market events, limit order books can quickly empty and prices can ...

01-03-2017 Weekly Market Review

... Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed by Private Capital Grou ...

... Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed by Private Capital Grou ...

Chapter 11

... Security Market Indexes are used to track overall market and sector performance for stocks, bonds, and other investments Well-known stock market indexes: – Dow Jones Industrial Average • Based on price – Standard & Poor’s (S&P) 500 • Based on market value ...

... Security Market Indexes are used to track overall market and sector performance for stocks, bonds, and other investments Well-known stock market indexes: – Dow Jones Industrial Average • Based on price – Standard & Poor’s (S&P) 500 • Based on market value ...

Document

... spread in the Amman Stock Exchange. Daily trading data for 50 selected companies, during a 6 years’ time period from 2001 to 2006, was collected from ASE publications. The suggested explanatory variables (security's specific factors: stock price, price volatility, trading volume, number of trades), ...

... spread in the Amman Stock Exchange. Daily trading data for 50 selected companies, during a 6 years’ time period from 2001 to 2006, was collected from ASE publications. The suggested explanatory variables (security's specific factors: stock price, price volatility, trading volume, number of trades), ...

Pro-Active Investor 12-07-09

... Buy & hold is safe I should trade based on News My Guru tells me when to buy Mutual funds are a smart way to balance your portfolio I should study companies Financials The best time to make money is when the market is going up Shorting is un-American - not cool ...

... Buy & hold is safe I should trade based on News My Guru tells me when to buy Mutual funds are a smart way to balance your portfolio I should study companies Financials The best time to make money is when the market is going up Shorting is un-American - not cool ...

Supply and Demand from the Bottom Up aka Zero

... • Sellers: – Have cost to cover – Wish to sell 1 unit ...

... • Sellers: – Have cost to cover – Wish to sell 1 unit ...