Specific parameters for the Liquidity Provider Raiffeisen Centrobank

... Minimum volume corresponding to the firm bid-ask quote applies to every limit order in the firm offer, respectively 500 instruments for the buy order and 500 instruments for the sell order. Note2: The responsibility of the Liquidity Provider to provide the minimum volume correspondent to the ask quo ...

... Minimum volume corresponding to the firm bid-ask quote applies to every limit order in the firm offer, respectively 500 instruments for the buy order and 500 instruments for the sell order. Note2: The responsibility of the Liquidity Provider to provide the minimum volume correspondent to the ask quo ...

David Aranzabal

... Time flexibility is a great advantage for people with various schedules and allows for adaptation to everyone's day ...

... Time flexibility is a great advantage for people with various schedules and allows for adaptation to everyone's day ...

DAINAM Securities

... growth.Jobless claims rose by 2,000 to 279,000 in the week ended June 6, a Labor Department report showed Thursday in Washington. The median forecast of 48 economists surveyed by Bloomberg called for 275,000. The four-week average of initial applications also crept up. The data indicate employers ar ...

... growth.Jobless claims rose by 2,000 to 279,000 in the week ended June 6, a Labor Department report showed Thursday in Washington. The median forecast of 48 economists surveyed by Bloomberg called for 275,000. The four-week average of initial applications also crept up. The data indicate employers ar ...

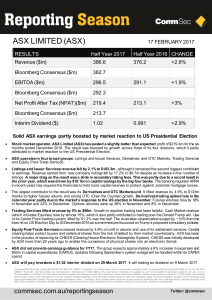

View PDF Report

... in the process of replacing its CHESS (Clearing House Electronic Subregister System). CHESS was initially developed by ASX more than 20 years ago to enable the conversion of physical shares into an electronic format. ...

... in the process of replacing its CHESS (Clearing House Electronic Subregister System). CHESS was initially developed by ASX more than 20 years ago to enable the conversion of physical shares into an electronic format. ...

Emerging Markets presentation. - Undergraduate Investment Society

... S Investments produce returns in origin country’s currency S Investors must convert to realize gains in USD S Currency fluctuations can impact total returns of security ...

... S Investments produce returns in origin country’s currency S Investors must convert to realize gains in USD S Currency fluctuations can impact total returns of security ...

Lecture 02 - Basics of Investing I

... Supply and Demand! (What affects supply / demand of a stock?) ...

... Supply and Demand! (What affects supply / demand of a stock?) ...

Job Title: Trading Compliance Officer Location: Downtown

... We are located in downtown Vancouver at the Bentall One Building (corner of Burrard and Pender), two blocks away from the Burrard Skytrain station. Qualified candidates are asked to submit their resume with cover letter in confidence to. www.qtrade.ca/careers. Candidates must have legal work authori ...

... We are located in downtown Vancouver at the Bentall One Building (corner of Burrard and Pender), two blocks away from the Burrard Skytrain station. Qualified candidates are asked to submit their resume with cover letter in confidence to. www.qtrade.ca/careers. Candidates must have legal work authori ...

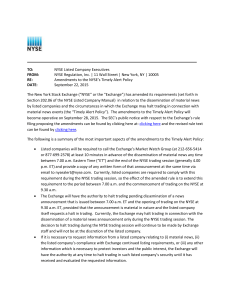

TO: NYSE Listed Company Executives FROM: NYSE Regulation, Inc

... continues after 4:00 p.m. ET on other exchanges, if a listed company releases material news immediately after the NYSE close there can be significant price movement on other markets when compared to the last sale price on the Exchange. The result, therefore, is that a DMM can be executing trades at ...

... continues after 4:00 p.m. ET on other exchanges, if a listed company releases material news immediately after the NYSE close there can be significant price movement on other markets when compared to the last sale price on the Exchange. The result, therefore, is that a DMM can be executing trades at ...

mfin202sampletest2

... C. 1. What dividend yield would be reported in the financial press for a stock that currently pays a $1 dividend per quarter and the most recent stock price was $40? A. 2.5% B. 4.0% C. 10.0% D. 15.0% B. 2. Which of the following observations provides evidence against strong-form market efficiency? A ...

... C. 1. What dividend yield would be reported in the financial press for a stock that currently pays a $1 dividend per quarter and the most recent stock price was $40? A. 2.5% B. 4.0% C. 10.0% D. 15.0% B. 2. Which of the following observations provides evidence against strong-form market efficiency? A ...

Rupee likely to show upward movement According to Lt Col Ajay

... Rupee likely to show upward movement According to Lt Col Ajay CEO www.astromoneyguru.com -Financial astrology today bullion and crude oil are looking positive during day trading in Asian future market. Indian bullion may show firm opening. But as per finical astrology some profit booking also expect ...

... Rupee likely to show upward movement According to Lt Col Ajay CEO www.astromoneyguru.com -Financial astrology today bullion and crude oil are looking positive during day trading in Asian future market. Indian bullion may show firm opening. But as per finical astrology some profit booking also expect ...

Foreign Exchange (FX) Market

... Network of financial institutions and brokers in which individuals, businesses, banks, and governments buy and sell the currencies of different countries The liquidity of the market provides businesses with access to international markets for goods and services by providing foreign currency necessar ...

... Network of financial institutions and brokers in which individuals, businesses, banks, and governments buy and sell the currencies of different countries The liquidity of the market provides businesses with access to international markets for goods and services by providing foreign currency necessar ...

Why Do People Trade? - Ethiopia Commodity Exchange

... who want to sell or buy at a particular time or location. This is also called providing liquidity to the market. Put another way, clients pay dealers to take marketing problems off of their hands. Brokers are agents who arrange trade for their clients. Unlike dealers, brokers do not trade directly ...

... who want to sell or buy at a particular time or location. This is also called providing liquidity to the market. Put another way, clients pay dealers to take marketing problems off of their hands. Brokers are agents who arrange trade for their clients. Unlike dealers, brokers do not trade directly ...

College of Business Trading Room LCD Stock Ticker

... theories they have been taught. There is also a Bloomberg Certification which students will be able to acquire while enrolled here offering another way for graduates to stand out while involved in the job search. The trading room and Bloomberg terminals are not simply focu ...

... theories they have been taught. There is also a Bloomberg Certification which students will be able to acquire while enrolled here offering another way for graduates to stand out while involved in the job search. The trading room and Bloomberg terminals are not simply focu ...

my presentation - Fuller Treacy Money

... economy was in severe recession, or perhaps even worse. ...

... economy was in severe recession, or perhaps even worse. ...

File - BSC Economics

... a) A corporation's stock is traded in an over-the-counter market. b) People buy shares in a mutual fund. c) A pension fund manager buys commercial paper in the secondary market. d) An insurance company buys shares of common stock in the over-the-counter markets. e) None of the above. 9) Which of the ...

... a) A corporation's stock is traded in an over-the-counter market. b) People buy shares in a mutual fund. c) A pension fund manager buys commercial paper in the secondary market. d) An insurance company buys shares of common stock in the over-the-counter markets. e) None of the above. 9) Which of the ...

A look at trading volumes in the euro

... Monthly averages of daily spot transactions, in billions of US dollars ...

... Monthly averages of daily spot transactions, in billions of US dollars ...

Tips for Investors in Volatile Markets

... deviation of the return of an investment. Standard deviation is a statistical concept that denotes the amount of variation or deviation that might be expected. For example, the S&P 500 has a standard deviation around 15% while a guaranteed investment like a bank account has a standard deviation of z ...

... deviation of the return of an investment. Standard deviation is a statistical concept that denotes the amount of variation or deviation that might be expected. For example, the S&P 500 has a standard deviation around 15% while a guaranteed investment like a bank account has a standard deviation of z ...

Stocks

... • NASDAQ Stock Market- free stock quotes, stock exchange prices, stock market news, and online stock trading tools • AMEX American stock exchange- has about 800 stocks that are generally smaller and less actively traded • Specialists- traders who help to make a market in one or more stocks by taking ...

... • NASDAQ Stock Market- free stock quotes, stock exchange prices, stock market news, and online stock trading tools • AMEX American stock exchange- has about 800 stocks that are generally smaller and less actively traded • Specialists- traders who help to make a market in one or more stocks by taking ...

Abstract

... the price process are extended to this setting. In the case where the price n process is a ∪∞ n=1 R -valued piecewise Itô process, straightforward functionally generated relative arbitrage is found to be less readily available than in n-dimensional Itô process models. In 1999 Robert Fernholz obser ...

... the price process are extended to this setting. In the case where the price n process is a ∪∞ n=1 R -valued piecewise Itô process, straightforward functionally generated relative arbitrage is found to be less readily available than in n-dimensional Itô process models. In 1999 Robert Fernholz obser ...

News as rtf

... Trade Registration Services for the whole derivatives curve, from daily up to yearly maturities. In addition, the exchange offers location spread trading between Spain and France as well as Italy and France. Furthermore, EEX trading participants can trade options on the Baseload Futures (Month, Quar ...

... Trade Registration Services for the whole derivatives curve, from daily up to yearly maturities. In addition, the exchange offers location spread trading between Spain and France as well as Italy and France. Furthermore, EEX trading participants can trade options on the Baseload Futures (Month, Quar ...

Buyside Traders Want SEC to Press Exchanges and Dark Pools for

... disclosure process would certainly help. Comparing and contrasting existing disclosures and then challenging any differences among providers is cumbersome and time consuming. There are a few providers who offer their own standardized ‘checklist’ for wider dissemination; but again, this lack of stand ...

... disclosure process would certainly help. Comparing and contrasting existing disclosures and then challenging any differences among providers is cumbersome and time consuming. There are a few providers who offer their own standardized ‘checklist’ for wider dissemination; but again, this lack of stand ...