Chap. 5 How Securities are Traded Buying and Selling Securities

... investor usually issues an order to buy or sell “at market”. This market order, means the investor will accept the best price available at the time. A certain trade but maybe at an uncertain price. • In contrast, some investors hope to improve the price they accept by placing limit orders. Limit ord ...

... investor usually issues an order to buy or sell “at market”. This market order, means the investor will accept the best price available at the time. A certain trade but maybe at an uncertain price. • In contrast, some investors hope to improve the price they accept by placing limit orders. Limit ord ...

Columbian Exchange PPT

... • Students will have another five minutes to trade their cards. • You can now trade with anyone in either the New World or Old World. ...

... • Students will have another five minutes to trade their cards. • You can now trade with anyone in either the New World or Old World. ...

download

... Using daily data from 1983 to 1993 for the Kuala Lumpur Stock Exchange Composite Index, the day-of-the-week effect is examined. Initial findings indicate that there is a marginally significant negative Monday effect and a significant positive Wednesday and Thursday effect for the whole period. A num ...

... Using daily data from 1983 to 1993 for the Kuala Lumpur Stock Exchange Composite Index, the day-of-the-week effect is examined. Initial findings indicate that there is a marginally significant negative Monday effect and a significant positive Wednesday and Thursday effect for the whole period. A num ...

Generali China - Unit Linked Growth

... In terms of fixed-income, we maintained the portfolio liquidity and kept standard weight. In next 1-3 months , we will adjust the duration of bonds to around 3 year and the holding will be concentrate on AA+ - AAA corporate bonds. ...

... In terms of fixed-income, we maintained the portfolio liquidity and kept standard weight. In next 1-3 months , we will adjust the duration of bonds to around 3 year and the holding will be concentrate on AA+ - AAA corporate bonds. ...

Trading Volumes in Perspective

... Strategy Group (ISG), which analyzes market and economic indicators to develop asset allocation strategies. ISG consists of five investment professionals who consult regularly with portfolio managers and investment officers across the firm. Information is obtained from sources deemed reliable, but t ...

... Strategy Group (ISG), which analyzes market and economic indicators to develop asset allocation strategies. ISG consists of five investment professionals who consult regularly with portfolio managers and investment officers across the firm. Information is obtained from sources deemed reliable, but t ...

Test Your IQ (Investment Quotient)

... 3. Fixed-Income Securities On what basis do we normally distinguish money market securities from fixed-income securities? a. issuer b. interest rate c. maturity d. tax status 4. Fixed-Income Securities Your friend told you she just received her semi-annual coupon payment on a U.S. Treasury note with ...

... 3. Fixed-Income Securities On what basis do we normally distinguish money market securities from fixed-income securities? a. issuer b. interest rate c. maturity d. tax status 4. Fixed-Income Securities Your friend told you she just received her semi-annual coupon payment on a U.S. Treasury note with ...

Portfolio Advisory Council, LLC presents:

... their affiliates. The information herein has been derived from sources believed to be accurate. Please note - investing involves risk, and past performance is no guarantee of future results. Investments will fluctuate and when redeemed may be worth more or less than when originally invested. This in ...

... their affiliates. The information herein has been derived from sources believed to be accurate. Please note - investing involves risk, and past performance is no guarantee of future results. Investments will fluctuate and when redeemed may be worth more or less than when originally invested. This in ...

Weekly roundup - Jesmond Mizzi Financial Advisors

... The result of the continuous positive outcome that the Malta Stock Exchange has been experiencing lately is mainly being achieved by HSBC Bank and FIMBank – the highest two gainers for the week. Both HSBC and FIMBank reached their all time high throughout the week. The best performer for the week w ...

... The result of the continuous positive outcome that the Malta Stock Exchange has been experiencing lately is mainly being achieved by HSBC Bank and FIMBank – the highest two gainers for the week. Both HSBC and FIMBank reached their all time high throughout the week. The best performer for the week w ...

addressing emerging risks in the nigerian

... Mr. Mounir Gwarzo, Director General Securities & Exchange Commission Tuesday, 12th April, 2016 ...

... Mr. Mounir Gwarzo, Director General Securities & Exchange Commission Tuesday, 12th April, 2016 ...

13 characteristics of a successful trader

... At the same time, they’re aware that trends pause and frequently correct. So they’re also attempting to actively take profit and minimize loss at key technical points as the larger trend unfolds. If the environment favors range trading, successful currency traders are able to switch gears and become ...

... At the same time, they’re aware that trends pause and frequently correct. So they’re also attempting to actively take profit and minimize loss at key technical points as the larger trend unfolds. If the environment favors range trading, successful currency traders are able to switch gears and become ...

Sentiment Analysis and Earnings

... Sentiment Analysis and Earnings This class is a production of Safe Option Strategies © and the content is protected by copyright. Any reproduction or redistribution of this or any Safe Option Strategies © presentation is strictly prohibited by law. The information presented in this class is for educ ...

... Sentiment Analysis and Earnings This class is a production of Safe Option Strategies © and the content is protected by copyright. Any reproduction or redistribution of this or any Safe Option Strategies © presentation is strictly prohibited by law. The information presented in this class is for educ ...

Document

... sale of a currency for spot delivery and purchase of that currency for forward delivery. • Foreign exchange swaps can be used by dealers to manage the maturity structure of their currency positions. ...

... sale of a currency for spot delivery and purchase of that currency for forward delivery. • Foreign exchange swaps can be used by dealers to manage the maturity structure of their currency positions. ...

A Brief History of FE

... accurately. What would happen if this formula was unveiled to the public? ...

... accurately. What would happen if this formula was unveiled to the public? ...

View PDF

... Buried somewhere in the trash can at the manager’s office you might also find thirty of the least attractive securities. If you believe the manager has the skill to identify outperformers, then it stands to reason he or she can identify the underperformers as well. In a hedge fund format, the manage ...

... Buried somewhere in the trash can at the manager’s office you might also find thirty of the least attractive securities. If you believe the manager has the skill to identify outperformers, then it stands to reason he or she can identify the underperformers as well. In a hedge fund format, the manage ...

Capital Market

... Stock exchanges also provide facilities for issue and redemption of securities and other financial instruments, and capital events including the payment of income and dividends. Securities traded on a stock exchange include shares issued by companies, unit trusts, derivatives, pooled investment pro ...

... Stock exchanges also provide facilities for issue and redemption of securities and other financial instruments, and capital events including the payment of income and dividends. Securities traded on a stock exchange include shares issued by companies, unit trusts, derivatives, pooled investment pro ...

Junior Trader

... models and tools that you will implement on the trading desk. Because of the specific nature of the work-environment, we do not expect you to plunge headfirst into your new job. Instead, you will start by following in a three months intensive in-house training program that covers all the intricate d ...

... models and tools that you will implement on the trading desk. Because of the specific nature of the work-environment, we do not expect you to plunge headfirst into your new job. Instead, you will start by following in a three months intensive in-house training program that covers all the intricate d ...

Week10.2 Stocks - B-K

... • Brokerage Firm—financial intermediary that buys and sells securities for individual and institutional investors. • E*trade: An Online Brokerage Firm ...

... • Brokerage Firm—financial intermediary that buys and sells securities for individual and institutional investors. • E*trade: An Online Brokerage Firm ...

SECURITIES OPERATIONS

... Fair bid price; highest price of the well informed trader to buy In an ideal market, all trades occur at fair prices ...

... Fair bid price; highest price of the well informed trader to buy In an ideal market, all trades occur at fair prices ...

Heterogeneous Beliefs under Different Market Architectures

... a finite number of predictors of future price according to the past performance of the predictors. It turns out that when the intensity of choice is high, the price time series may deviate from a fundamental benchmark in a systematic way, become chaotic and exhibit excess volatility and volatility c ...

... a finite number of predictors of future price according to the past performance of the predictors. It turns out that when the intensity of choice is high, the price time series may deviate from a fundamental benchmark in a systematic way, become chaotic and exhibit excess volatility and volatility c ...

FREE Sample Here

... Which of the following statements is not true about the law of one price a. investors prefer more wealth to less b. investments that offer the same return in all states must pay the risk-free rate c. if two investment opportunities offer equivalent outcomes, they must have the same price d. investor ...

... Which of the following statements is not true about the law of one price a. investors prefer more wealth to less b. investments that offer the same return in all states must pay the risk-free rate c. if two investment opportunities offer equivalent outcomes, they must have the same price d. investor ...

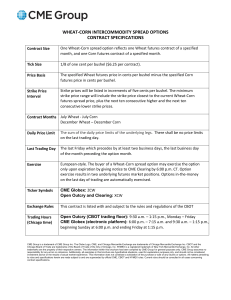

Wheat-Corn Intercommodity Spread Options Contract

... Chicago Board of Trade are trademarks of the Board of Trade of the City of Chicago, Inc. NYMEX is a registered trademark of New York Mercantile Exchange, Inc. All other trademarks are the property of their respective owners. The information within this brochure has been compiled by CME Group for gen ...

... Chicago Board of Trade are trademarks of the Board of Trade of the City of Chicago, Inc. NYMEX is a registered trademark of New York Mercantile Exchange, Inc. All other trademarks are the property of their respective owners. The information within this brochure has been compiled by CME Group for gen ...