April 24, 2017 - Portfolio Advisory Council

... their affiliates. The information herein has been derived from sources believed to be accurate. Please note - investing involves risk, and past performance is no guarantee of future results. Investments will fluctuate and when redeemed may be worth more or less than when originally invested. This in ...

... their affiliates. The information herein has been derived from sources believed to be accurate. Please note - investing involves risk, and past performance is no guarantee of future results. Investments will fluctuate and when redeemed may be worth more or less than when originally invested. This in ...

CDS Trading under MiFID II FAQ

... single and competitive market in financial services across all EU member states. The European Commission regards the revision of MiFID as a major part of the continuing structural reforms it considers are needed following the global financial crisis. MiFID II includes requirements for ‘best executio ...

... single and competitive market in financial services across all EU member states. The European Commission regards the revision of MiFID as a major part of the continuing structural reforms it considers are needed following the global financial crisis. MiFID II includes requirements for ‘best executio ...

M.I.T. 15.460 Sloan School of Management Financial Engineering

... Financial Engineering Course Description This course provides an introduction to financial engineering. The course covers the following topics: asset pricing theory and its applications, financial optimization, market equilibrium, market frictions, dynamics trading strategies, risk management, and s ...

... Financial Engineering Course Description This course provides an introduction to financial engineering. The course covers the following topics: asset pricing theory and its applications, financial optimization, market equilibrium, market frictions, dynamics trading strategies, risk management, and s ...

Chapter1

... *If Ingrid at Chase posts a quote of 125.00-.10 and is called by Taka at Sumitomo who wants to “hit her ask” and have her buy his yen for her dollars, she may wonder if Taka knows something she doesn’t *what private information could Taka have? order flow his bank receives from customers early infor ...

... *If Ingrid at Chase posts a quote of 125.00-.10 and is called by Taka at Sumitomo who wants to “hit her ask” and have her buy his yen for her dollars, she may wonder if Taka knows something she doesn’t *what private information could Taka have? order flow his bank receives from customers early infor ...

BusAd 551 - Corporate Financial Decisions

... – Changes in trends result from changes in supply and demand conditions – Old strategy that can be traced back to the late nineteenth century ...

... – Changes in trends result from changes in supply and demand conditions – Old strategy that can be traced back to the late nineteenth century ...

Stock Market

... • Speculation/Margin buying stocks on credit • Margin Calls – Stockbrokers call in the credit and debt that is owed to the stock market • Black Tuesday – October 29, 1929 the stock market system failed, because no one was able to buy and sell stocks ...

... • Speculation/Margin buying stocks on credit • Margin Calls – Stockbrokers call in the credit and debt that is owed to the stock market • Black Tuesday – October 29, 1929 the stock market system failed, because no one was able to buy and sell stocks ...

Portfolio Advisory Council, LLC presents:

... may not be relied on for the purpose of avoiding any Federal tax penalty. This is neither a solicitation nor recommendation to purchase or sell any investment or insurance product or service, and should not be relied upon as such. All market indices discussed are unmanaged and are not illustrative o ...

... may not be relied on for the purpose of avoiding any Federal tax penalty. This is neither a solicitation nor recommendation to purchase or sell any investment or insurance product or service, and should not be relied upon as such. All market indices discussed are unmanaged and are not illustrative o ...

NSE/CMTR/34693 Date

... standardized lot size for SME Exchange/Platform. In view of the guidelines mentioned in the above circular the Exchange has reviewed the lot size of the security Nandani Creation Limited on SME Platform. The change in the market lot for the security is as follows: Symbol NANDANI ...

... standardized lot size for SME Exchange/Platform. In view of the guidelines mentioned in the above circular the Exchange has reviewed the lot size of the security Nandani Creation Limited on SME Platform. The change in the market lot for the security is as follows: Symbol NANDANI ...

During the 10 week period of the stock market simulation, the market

... commitment to keeping interest rates low for “an extended period of time” has provided for investor confidence which contributed to the dramatic spike in investment that has fueled a large portion of the economic recovery. While the economy is rebounding from the recession, improvements are still co ...

... commitment to keeping interest rates low for “an extended period of time” has provided for investor confidence which contributed to the dramatic spike in investment that has fueled a large portion of the economic recovery. While the economy is rebounding from the recession, improvements are still co ...

AN ANALYSIS OF GLOBAL HFT REGULATION Motivations, Market

... Empirical evidence shows that HFT reduces trading costs, provides better investment performance for long-term investors, improves liquidity, and offers more flexibility and options for smaller retail investors. ...

... Empirical evidence shows that HFT reduces trading costs, provides better investment performance for long-term investors, improves liquidity, and offers more flexibility and options for smaller retail investors. ...

Summary Methodology for Manheim Used Vehicle Value Index

... Sample: all Manheim U.S. sales that fall into one of the 20 market classes. (i.e., excludes heavy trucks, motorcycles, etc. Eliminate outliers: calculate average miles and average price for each model year / make / body. For each transaction calculate price and mileage deviation. Outliers are define ...

... Sample: all Manheim U.S. sales that fall into one of the 20 market classes. (i.e., excludes heavy trucks, motorcycles, etc. Eliminate outliers: calculate average miles and average price for each model year / make / body. For each transaction calculate price and mileage deviation. Outliers are define ...

Market Capitalisation– The overall market capitalisation remained

... return by RBG underpinned the increase in STRI value. Dividend will be payable to RBG shareholders on 25th February 2016. Bid-Offer Spread – FMF maintains the narrowest bid-offer margin spread of $0.10 while PBF maintains the widest bidoffer margin with a spread of $3.00. The Bid to Offer ratio stan ...

... return by RBG underpinned the increase in STRI value. Dividend will be payable to RBG shareholders on 25th February 2016. Bid-Offer Spread – FMF maintains the narrowest bid-offer margin spread of $0.10 while PBF maintains the widest bidoffer margin with a spread of $3.00. The Bid to Offer ratio stan ...

- SlideBoom

... the broker’s account. Such instruction should reach the DP’s office at least 24 hours before the pay-in, failing which, DP will accept the instruction only at the BO’s risk. ETF An ETF is a basket of securities that is traded on the stock exchange, akin to a stock. So, unlike conventional mutual fun ...

... the broker’s account. Such instruction should reach the DP’s office at least 24 hours before the pay-in, failing which, DP will accept the instruction only at the BO’s risk. ETF An ETF is a basket of securities that is traded on the stock exchange, akin to a stock. So, unlike conventional mutual fun ...

Michael Shulman - AAII

... More and more liquidity in Europe More and more liquidity in China More and more liquidity in Japan Liquidity only serving to prop up assets, not inflation ...

... More and more liquidity in Europe More and more liquidity in China More and more liquidity in Japan Liquidity only serving to prop up assets, not inflation ...

Common Stock: Analysis and Strategy - it

... – Changes in trends result from changes in supply and demand conditions – Old strategy that can be traced back to the late nineteenth century ...

... – Changes in trends result from changes in supply and demand conditions – Old strategy that can be traced back to the late nineteenth century ...

iShares US Treasury Bond 7-10 Year JPY Hedged ETF

... - Because ETFs invest in securities whose prices fluctuate, the market price or base value may decrease due to shifts in the underling index or foreign exchange market, fluctuations in the price of constituent securities, bankruptcy or deterioration in the financial conditions of constituent securit ...

... - Because ETFs invest in securities whose prices fluctuate, the market price or base value may decrease due to shifts in the underling index or foreign exchange market, fluctuations in the price of constituent securities, bankruptcy or deterioration in the financial conditions of constituent securit ...

November 2013 - Dana Investment Advisors

... unemployment, disability and/or food stamps. That is why job creation is so important. Improving job numbers would encourage more people to look for work and make our economy more productive. The Affordable Care Act enters into the employment number also. Employers are wrestling with the consequence ...

... unemployment, disability and/or food stamps. That is why job creation is so important. Improving job numbers would encourage more people to look for work and make our economy more productive. The Affordable Care Act enters into the employment number also. Employers are wrestling with the consequence ...

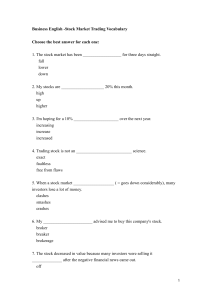

Business English -Stock Market Trading Vocabulary

... Choose the best answer for each one: 1. The stock market has been __________________ for three days straight. fall lower down 2. My stocks are ____________________ 20% this month. high up higher 3. I'm hoping for a 10% _____________________ over the next year. increasing increase increased 4. Tradin ...

... Choose the best answer for each one: 1. The stock market has been __________________ for three days straight. fall lower down 2. My stocks are ____________________ 20% this month. high up higher 3. I'm hoping for a 10% _____________________ over the next year. increasing increase increased 4. Tradin ...

Another Year, Another Stock Market Increase

... indicative of the skill of the advisor. 2. The results portrayed are net of investment advisory fees. A fee of 1.0% per annum was used to calculate the net of fees results. The fee schedule is in Part 2A Form ADV. 3. The results portrayed reflect the reinvestment of dividends and other earnings. ...

... indicative of the skill of the advisor. 2. The results portrayed are net of investment advisory fees. A fee of 1.0% per annum was used to calculate the net of fees results. The fee schedule is in Part 2A Form ADV. 3. The results portrayed reflect the reinvestment of dividends and other earnings. ...

September 2010 - Capital Markets Board of Turkey

... CMB decision dated July 23, 2010 (the “Decision”) was classifying the stocks traded on the ISE into 3 groups (A, B or C). Some trading rules were differentiated based on this classification. For example, Group B and Group C stocks cannot be subject to margin trading and short sale. The Decision was ...

... CMB decision dated July 23, 2010 (the “Decision”) was classifying the stocks traded on the ISE into 3 groups (A, B or C). Some trading rules were differentiated based on this classification. For example, Group B and Group C stocks cannot be subject to margin trading and short sale. The Decision was ...

Lecture 17

... more in-the-know investors realize stock price is higher than in your sell order, they will buy from you at your price. In an expected value sense, your orders can be filled only in this unfortunate case. • Problem is enhanced by decimal trading. When a specialist has the slightest inkling that ther ...

... more in-the-know investors realize stock price is higher than in your sell order, they will buy from you at your price. In an expected value sense, your orders can be filled only in this unfortunate case. • Problem is enhanced by decimal trading. When a specialist has the slightest inkling that ther ...

The OECD Principles as a reference point for good

... challenges with Latin American region • How to get mid-sized companies to list? • How to ensure market conditions with concentrated ownership for effective functioning of cg frameworks? – Balance between regulatory requirements and flexibility to adapt own practices – How to improve board functionin ...

... challenges with Latin American region • How to get mid-sized companies to list? • How to ensure market conditions with concentrated ownership for effective functioning of cg frameworks? – Balance between regulatory requirements and flexibility to adapt own practices – How to improve board functionin ...

Original Document

... • As a type of investment, mutual funds have badly underperform the rest of the market for 20 years. ...

... • As a type of investment, mutual funds have badly underperform the rest of the market for 20 years. ...

Chapter 11

... Changes in trends result from changes in supply and demand conditions Old strategy that can be traced back to the ...

... Changes in trends result from changes in supply and demand conditions Old strategy that can be traced back to the ...