Cheap Talk, Fraud, and Adverse Selection in Financial Markets

... Theory predicts that the antifraud rule will result in fully efficient outcomes, with all assets trading at appropriate prices. In a sequential equilibrium, the seller makes a potentially vague statement about the asset’s quality. However, the lowest quality stated should be the true quality of the ...

... Theory predicts that the antifraud rule will result in fully efficient outcomes, with all assets trading at appropriate prices. In a sequential equilibrium, the seller makes a potentially vague statement about the asset’s quality. However, the lowest quality stated should be the true quality of the ...

Chapter 6—The Tradeoff Between Risk and Return

... 34. You are analyzing the performance of different asset classes for a foreign economy. You find that over the last 60 years the average annual return for equities was 12% while that of corporate bonds was 10% and the rate of inflation was about 3%. If inflation was projected to be around 1% for the ...

... 34. You are analyzing the performance of different asset classes for a foreign economy. You find that over the last 60 years the average annual return for equities was 12% while that of corporate bonds was 10% and the rate of inflation was about 3%. If inflation was projected to be around 1% for the ...

The Impact of Auctions on Residential Sales Prices in

... Maher (1989) describes the significant change in the proportion of auction versus private-treaty sales from 1959-86 in Melbourne, Australia. His research indicates that the real estate industry has exerted influence to effect a movement towards sale by auction; the purported reason given by industry ...

... Maher (1989) describes the significant change in the proportion of auction versus private-treaty sales from 1959-86 in Melbourne, Australia. His research indicates that the real estate industry has exerted influence to effect a movement towards sale by auction; the purported reason given by industry ...

Preview - American Economic Association

... sector. When more investors choose to become dealers, the price dispersion among interdealer trades is larger (i.e., the dispersion ratio is higher), and customers’ transactions tend to go through more layers of dealers (i.e., the chain is longer). Our model implies that both the dispersion ratio an ...

... sector. When more investors choose to become dealers, the price dispersion among interdealer trades is larger (i.e., the dispersion ratio is higher), and customers’ transactions tend to go through more layers of dealers (i.e., the chain is longer). Our model implies that both the dispersion ratio an ...

For personal use only

... All ordinary shares rank equally with one vote attached to each fully paid ordinary share. Ordinary shares do not have a par value. The Company has agreed to issue KuangChi Science Limited with convertible notes with a face value of A$23,020,000. This provides the Company with further liquidity if r ...

... All ordinary shares rank equally with one vote attached to each fully paid ordinary share. Ordinary shares do not have a par value. The Company has agreed to issue KuangChi Science Limited with convertible notes with a face value of A$23,020,000. This provides the Company with further liquidity if r ...

Seasons Series Trust - Allocation Moderate Growth

... The following Risk/Return Bar Chart and Table illustrate the risks of investing in the Portfolio by showing changes in the Portfolio’s performance from calendar year to calendar year and comparing the Portfolio’s average annual returns to those of the Russell 3000® Index, the MSCI EAFE Index (net), ...

... The following Risk/Return Bar Chart and Table illustrate the risks of investing in the Portfolio by showing changes in the Portfolio’s performance from calendar year to calendar year and comparing the Portfolio’s average annual returns to those of the Russell 3000® Index, the MSCI EAFE Index (net), ...

offering memorandum - Unit Trust Corporation

... The Participating Shares are offered only on the basis of the information contained in this Offering Memorandum. No person has been authorised to give any information or to make any representation in connection with the offering of Participating Shares other than those contained in such documents an ...

... The Participating Shares are offered only on the basis of the information contained in this Offering Memorandum. No person has been authorised to give any information or to make any representation in connection with the offering of Participating Shares other than those contained in such documents an ...

Effects of level of investors confidence and herding behavior on

... the observer choice in two different ways: not only they provide information about the choice (the chosen asset), as current theory assume, but they may also differently affect the investor's level of confidence in her own evaluation of the market and change her demand through that. The distinction ...

... the observer choice in two different ways: not only they provide information about the choice (the chosen asset), as current theory assume, but they may also differently affect the investor's level of confidence in her own evaluation of the market and change her demand through that. The distinction ...

Dilution Factor Calculation for Special Dividends

... A dilution factor provides a means for data users to compare prices over time on a similarly capitalised company and may be applied by users to historical prices retrospectively from the day before the ex-date to the start of the price records. Dilution factors are calculated for corporate actions s ...

... A dilution factor provides a means for data users to compare prices over time on a similarly capitalised company and may be applied by users to historical prices retrospectively from the day before the ex-date to the start of the price records. Dilution factors are calculated for corporate actions s ...

OTC Derivatives Presentation

... – Like a futures contract, an agreement to buy or sell an asset at a specified future time and price – Customized between parties and not exchange traded • Can be for any underlier • Can be for any settlement date ...

... – Like a futures contract, an agreement to buy or sell an asset at a specified future time and price – Customized between parties and not exchange traded • Can be for any underlier • Can be for any settlement date ...

Open Price Agreements: Good Faith Pricing in the Franchise

... have anticipated the addition of provisions change in its cost of crude mutually intended at the oil. Meanwhile, the dealer time the contract was conwould have reaped a windfall selling gasoline at more than summated.25 Relying on the courts’ power to imply terms twice its cost to a market willing t ...

... have anticipated the addition of provisions change in its cost of crude mutually intended at the oil. Meanwhile, the dealer time the contract was conwould have reaped a windfall selling gasoline at more than summated.25 Relying on the courts’ power to imply terms twice its cost to a market willing t ...

SUNTRUST BANKS INC (Form: FWP, Received: 06

... This news release may contain forward-looking statements. Statements regarding our expectations with respect to the Equity Offering and Tender Offer, our expectations with respect to our capital plan, the components and size thereof, and our ability to implement our capital plan are forward-looking ...

... This news release may contain forward-looking statements. Statements regarding our expectations with respect to the Equity Offering and Tender Offer, our expectations with respect to our capital plan, the components and size thereof, and our ability to implement our capital plan are forward-looking ...

The Role of the Fashion Buyer

... The buying role differs between companies but all fashion buyers are responsible for overseeing the development of a range of products aimed at a specific type of customer and price bracket. There are various levels of seniority within a buying team, ranging from small independent stores, which may ...

... The buying role differs between companies but all fashion buyers are responsible for overseeing the development of a range of products aimed at a specific type of customer and price bracket. There are various levels of seniority within a buying team, ranging from small independent stores, which may ...

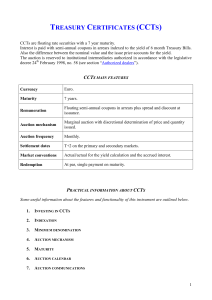

TREASURY CERTIFICATES (CCTS)

... Treasury Certificates are a kind of security very appreciated by families because of their feature to adjust coupons to market rates and therefore guarantee, in case of a negotiation before maturity, a capital amount very similar to that initially invested. CCTs have been issued, since March 1991, w ...

... Treasury Certificates are a kind of security very appreciated by families because of their feature to adjust coupons to market rates and therefore guarantee, in case of a negotiation before maturity, a capital amount very similar to that initially invested. CCTs have been issued, since March 1991, w ...

0001206774-07-000834 - Gentex Investor Relations

... your own name with our transfer agent and you have possession of your stock certificate(s)] or whether you hold your shares in “street name” (that is, if your shares are held for you by a broker or other nominee). ...

... your own name with our transfer agent and you have possession of your stock certificate(s)] or whether you hold your shares in “street name” (that is, if your shares are held for you by a broker or other nominee). ...

share issuance and equity returns in the istanbul stock exchange

... In Turkish markets, capital structure changes occur mostly via rights offerings. A rights offering is a type of issuance of additional shares by a company to raise capital. A rights issue is a special form of shelf offering or shelf registration. With the issued rights, existing shareholders have th ...

... In Turkish markets, capital structure changes occur mostly via rights offerings. A rights offering is a type of issuance of additional shares by a company to raise capital. A rights issue is a special form of shelf offering or shelf registration. With the issued rights, existing shareholders have th ...

FSB Securities Lending and Repos: Market Overview and Financial

... borrow cash unsecured or to borrow securities directly from institutional investors. They therefore rely on prime brokers for financing as well as to locate and borrow the securities they want to sell short. By pooling the supply of lendable securities in the market, prime brokers can also provide h ...

... borrow cash unsecured or to borrow securities directly from institutional investors. They therefore rely on prime brokers for financing as well as to locate and borrow the securities they want to sell short. By pooling the supply of lendable securities in the market, prime brokers can also provide h ...

A Closer Look at the Virtues of Dividend-Paying

... significantly higher than non-dividend payers. For example, in the small-cap universe, dividend payers have compounded money at over 500 basis points higher than nondividend payers, creating more than four times the amount of dollar value. Why are these stocks often overlooked? One reason might be t ...

... significantly higher than non-dividend payers. For example, in the small-cap universe, dividend payers have compounded money at over 500 basis points higher than nondividend payers, creating more than four times the amount of dollar value. Why are these stocks often overlooked? One reason might be t ...

Qualified Small Business Stock: Planning Opportunities

... issuance of QSB stock with a single cost basis. However, planning for the sale of multiple issuances of QSB stock in the same company with separate cost bases is often misunderstood. The most prudent course would be to consult with a tax professional to ensure that potential gain exclusion has been ...

... issuance of QSB stock with a single cost basis. However, planning for the sale of multiple issuances of QSB stock in the same company with separate cost bases is often misunderstood. The most prudent course would be to consult with a tax professional to ensure that potential gain exclusion has been ...

Individual Savings Account Services Guide - Login

... amongst its client base of individuals, building societies, companies and institutions since it was founded in 1993. ...

... amongst its client base of individuals, building societies, companies and institutions since it was founded in 1993. ...

Short (finance)

.png?width=300)

In finance, short selling (also known as shorting or going short) is the practice of selling securities or other financial instruments that are not currently owned, and subsequently repurchasing them (""covering""). In the event of an interim price decline, the short seller will profit, since the cost of (re)purchase will be less than the proceeds which were received upon the initial (short) sale. Conversely, the short position will be closed out at a loss in the event that the price of a shorted instrument should rise prior to repurchase. The potential loss on a short sale is theoretically unlimited in the event of an unlimited rise in the price of the instrument, however in practice the short seller will be required to post margin or collateral to cover losses, and any inability to do so on a timely basis would cause its broker or counterparty to liquidate the position. In the securities markets, the seller generally must borrow the securities in order to effect delivery in the short sale. In some cases, the short seller must pay a fee to borrow the securities and must additionally reimburse the lender for cash returns the lender would have received had the securities not been loaned out.Short selling is most commonly done with instruments traded in public securities, futures or currency markets, due to the liquidity and real-time price dissemination characteristic of such markets and because the instruments defined within each class are fungible.In practical terms, going short can be considered the opposite of the conventional practice of ""going long"", whereby an investor profits from an increase in the price of the asset. Mathematically, the return from a short position is equivalent to that of owning (being ""long"") a negative amount of the instrument. A short sale may be motivated by a variety of objectives. Speculators may sell short in the hope of realizing a profit on an instrument which appears to be overvalued, just as long investors or speculators hope to profit from a rise in the price of an instrument which appears undervalued. Traders or fund managers may hedge a long position or a portfolio through one or more short positions.