Top 10 Stock Screening Strategies That Make

... companies in the portfolio. Compounded performances (when stated), were calculated by taking a hypothetical starting equity amount and calculating the total return for the period. Each subsequent period then used the resulting equity balance as its start to calculate that period’s total return. No c ...

... companies in the portfolio. Compounded performances (when stated), were calculated by taking a hypothetical starting equity amount and calculating the total return for the period. Each subsequent period then used the resulting equity balance as its start to calculate that period’s total return. No c ...

PROSPECTUS File Pursuant to Rule 424(b)(1) Registration No. 333

... not independently verified this market data. Similarly, internal company surveys, while believed by Waters to be reliable, have not been verified by any independent sources. Unless otherwise stated or where the context otherwise requires, all information herein assumes the Underwriters' over-allotme ...

... not independently verified this market data. Similarly, internal company surveys, while believed by Waters to be reliable, have not been verified by any independent sources. Unless otherwise stated or where the context otherwise requires, all information herein assumes the Underwriters' over-allotme ...

Reporting Standard ARS 720.5 ABS/RBA Equity Securities Held

... Standard ARS 701.0 ABS/RBA Definitions for the EFS Collection (ARS 701.0) or in this Reporting Standard. All derived fields in the form are shaded in grey and are explained in words as a mathematical expression in these instructions. Examples included under ‘Include’ and ‘Exclude’ are examples and s ...

... Standard ARS 701.0 ABS/RBA Definitions for the EFS Collection (ARS 701.0) or in this Reporting Standard. All derived fields in the form are shaded in grey and are explained in words as a mathematical expression in these instructions. Examples included under ‘Include’ and ‘Exclude’ are examples and s ...

Types of structured equity products

... instrument in isolation from the debt obligations of the transaction originator (assuming it does not guarantee the instrument or provide any on-balance sheet credit support) by reference to the assets of the SPV available to the SPV’s creditors. Structured equity products are also commonly issued d ...

... instrument in isolation from the debt obligations of the transaction originator (assuming it does not guarantee the instrument or provide any on-balance sheet credit support) by reference to the assets of the SPV available to the SPV’s creditors. Structured equity products are also commonly issued d ...

Trial Measures for Overseas Securities Investment by Qualified

... Article 18 When the domestic institutional investor conducts the overseas securities investment business, the banks having the qualifications for custody of securities investment funds shall be responsible for the assets custody business. Article 19 The custodian can entrust the overseas assets cust ...

... Article 18 When the domestic institutional investor conducts the overseas securities investment business, the banks having the qualifications for custody of securities investment funds shall be responsible for the assets custody business. Article 19 The custodian can entrust the overseas assets cust ...

download, ENG - NBI INVESTMENTS Ltd

... Where the Client provides a specific instruction in relation to its entire Order, or any particular aspect of the Order, including an instruction for the order to be executed on a particular venue, the Company will execute the Order according to these instructions. However, in following these specif ...

... Where the Client provides a specific instruction in relation to its entire Order, or any particular aspect of the Order, including an instruction for the order to be executed on a particular venue, the Company will execute the Order according to these instructions. However, in following these specif ...

Chapter Fifteen

... combines the funds of investors who have purchased shares of ownership in the investment company and then invests that money in a diversified portfolio of stocks and bonds issued by other corporations or governments. • Portfolio – consists of a collection of securities and other investment alternati ...

... combines the funds of investors who have purchased shares of ownership in the investment company and then invests that money in a diversified portfolio of stocks and bonds issued by other corporations or governments. • Portfolio – consists of a collection of securities and other investment alternati ...

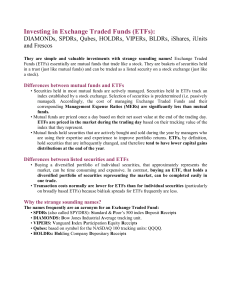

Investing in Exchange Traded Funds (ETFs):

... • All ETFs have redemption features. Holders with large positions in ETFs are allowed to exchange their units for shares that underlie the unit. Net result: units consistently trade at or near their net asset value. • Many ETFs have listed options and LEAPS. • ETFs are marginable. • ETFs can be shor ...

... • All ETFs have redemption features. Holders with large positions in ETFs are allowed to exchange their units for shares that underlie the unit. Net result: units consistently trade at or near their net asset value. • Many ETFs have listed options and LEAPS. • ETFs are marginable. • ETFs can be shor ...

Trading Dynamics between Informed and Noise Traders

... says the investors can generally be divided into two lots: one with private information, the other engage in trading for liquidity reasons (e.g. urgent need for cash or reasons other than holding private information). The relative force of these two lots therefore determines the price-setting proces ...

... says the investors can generally be divided into two lots: one with private information, the other engage in trading for liquidity reasons (e.g. urgent need for cash or reasons other than holding private information). The relative force of these two lots therefore determines the price-setting proces ...

SA BlackRock VCP Global Multi Asset Portfolio Summary

... transactional expenses relating to the purchase and sale of portfolio securities, interest, taxes and governmental fees, and other expenses not incurred in the ordinary course of business of SunAmerica Series Trust (the “Trust”) on behalf of the Portfolio. Any waivers and/or reimbursements made by S ...

... transactional expenses relating to the purchase and sale of portfolio securities, interest, taxes and governmental fees, and other expenses not incurred in the ordinary course of business of SunAmerica Series Trust (the “Trust”) on behalf of the Portfolio. Any waivers and/or reimbursements made by S ...

ETF Trading and Execution in the European MarketsPDF

... Premiums/Discounts and Why They Occur In some cases, a differential between the trading price and fair value of an ETF may arise. This discrepancy is known as a premium or discount in the fund. In the example of the ETF above, one variable that may serve as an impediment to keeping an ETF’s market p ...

... Premiums/Discounts and Why They Occur In some cases, a differential between the trading price and fair value of an ETF may arise. This discrepancy is known as a premium or discount in the fund. In the example of the ETF above, one variable that may serve as an impediment to keeping an ETF’s market p ...

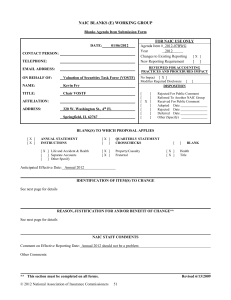

naic blanks (e) working group - National Association of Insurance

... Class One Bond Mutual Funds and Exchange Traded Funds, which are described in the Investment Schedules General Instructions, are to be included in Industrial and Miscellaneous (Unaffiliated). Bonds are to be grouped as listed below and each category arranged alphabetically (securities included in U. ...

... Class One Bond Mutual Funds and Exchange Traded Funds, which are described in the Investment Schedules General Instructions, are to be included in Industrial and Miscellaneous (Unaffiliated). Bonds are to be grouped as listed below and each category arranged alphabetically (securities included in U. ...

March 2004: Initial Public Offerings and Collusion

... core of these bubbles is a compulsive demand by zealous investors who often become subject to price exploitation by opportunistic suppliers. The end result for each bubble is absurdity. Can we imagine how it would feel to save every penny of earnings for seven years to buy a tulip bulb that later wo ...

... core of these bubbles is a compulsive demand by zealous investors who often become subject to price exploitation by opportunistic suppliers. The end result for each bubble is absurdity. Can we imagine how it would feel to save every penny of earnings for seven years to buy a tulip bulb that later wo ...

DOC - Valhi, Inc.

... interim periods ended June 30, 1999 and 2000, have been prepared by the Company, without audit. In the opinion of management, all adjustments, consisting only of normal recurring adjustments, necessary to present fairly the consolidated financial position, results of operations and cash flows have b ...

... interim periods ended June 30, 1999 and 2000, have been prepared by the Company, without audit. In the opinion of management, all adjustments, consisting only of normal recurring adjustments, necessary to present fairly the consolidated financial position, results of operations and cash flows have b ...

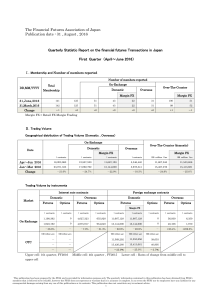

The Financial Futures Association of Japan Publication date : 31

... This publication has been prepared by the FFAJ and is provided for information purpose only. The quarterly information contained in this publication has been obtained from FFAJ's members that is believed to be reliable, however the FFAJ does not represent or warrant that it is accurate or complete. ...

... This publication has been prepared by the FFAJ and is provided for information purpose only. The quarterly information contained in this publication has been obtained from FFAJ's members that is believed to be reliable, however the FFAJ does not represent or warrant that it is accurate or complete. ...

Seasons Series Trust - Mid Cap Value Portfolio - Annuities

... The Portfolio may also invest in equity securities of large- and small-capitalization companies, short-term investments (up to 20%), foreign securities (up to 30%), real estate investment trusts and special situations. A special situation arises when, in the opinion of a subadviser, the securities o ...

... The Portfolio may also invest in equity securities of large- and small-capitalization companies, short-term investments (up to 20%), foreign securities (up to 30%), real estate investment trusts and special situations. A special situation arises when, in the opinion of a subadviser, the securities o ...

the right trading strategy for 2017 and beyond

... • InvesAng Risk: Trading securiAes can involve high risk and the loss of any funds invested. Investment informaAon provided may not be appropriate for all investors and is provided without respect to individual investor financial sophisAcaAon, financial situaAon, invesAng Ame horizon, or risk ...

... • InvesAng Risk: Trading securiAes can involve high risk and the loss of any funds invested. Investment informaAon provided may not be appropriate for all investors and is provided without respect to individual investor financial sophisAcaAon, financial situaAon, invesAng Ame horizon, or risk ...

Asset Allocation

... patterns of return and risk There is now a consensus in empirical finance that expected asset returns, and also variances and covariances, are, to some extent, predictable. Pioneering work on the predictability of asset class returns in the U.S. market was carried out by Keim and Stambaugh (1986), C ...

... patterns of return and risk There is now a consensus in empirical finance that expected asset returns, and also variances and covariances, are, to some extent, predictable. Pioneering work on the predictability of asset class returns in the U.S. market was carried out by Keim and Stambaugh (1986), C ...

ch9.slides.4e.MEAPSA.ward

... VIX measures volatility. Why does higher volatility lead to lower stock prices? (HINT: investors must be compensated for bearing risk) ...

... VIX measures volatility. Why does higher volatility lead to lower stock prices? (HINT: investors must be compensated for bearing risk) ...

Liquidity and Market Crashes

... in the form of excessive selling, and why it comes in large magnitudes. In this paper, we show that the same cost that hinders the ex post supply of liquidity also generates the need for liquidity in the first place. Despite the symmetric nature of market participants’ idiosyncratic trading needs, ...

... in the form of excessive selling, and why it comes in large magnitudes. In this paper, we show that the same cost that hinders the ex post supply of liquidity also generates the need for liquidity in the first place. Despite the symmetric nature of market participants’ idiosyncratic trading needs, ...

Short (finance)

.png?width=300)

In finance, short selling (also known as shorting or going short) is the practice of selling securities or other financial instruments that are not currently owned, and subsequently repurchasing them (""covering""). In the event of an interim price decline, the short seller will profit, since the cost of (re)purchase will be less than the proceeds which were received upon the initial (short) sale. Conversely, the short position will be closed out at a loss in the event that the price of a shorted instrument should rise prior to repurchase. The potential loss on a short sale is theoretically unlimited in the event of an unlimited rise in the price of the instrument, however in practice the short seller will be required to post margin or collateral to cover losses, and any inability to do so on a timely basis would cause its broker or counterparty to liquidate the position. In the securities markets, the seller generally must borrow the securities in order to effect delivery in the short sale. In some cases, the short seller must pay a fee to borrow the securities and must additionally reimburse the lender for cash returns the lender would have received had the securities not been loaned out.Short selling is most commonly done with instruments traded in public securities, futures or currency markets, due to the liquidity and real-time price dissemination characteristic of such markets and because the instruments defined within each class are fungible.In practical terms, going short can be considered the opposite of the conventional practice of ""going long"", whereby an investor profits from an increase in the price of the asset. Mathematically, the return from a short position is equivalent to that of owning (being ""long"") a negative amount of the instrument. A short sale may be motivated by a variety of objectives. Speculators may sell short in the hope of realizing a profit on an instrument which appears to be overvalued, just as long investors or speculators hope to profit from a rise in the price of an instrument which appears undervalued. Traders or fund managers may hedge a long position or a portfolio through one or more short positions.