1 CHAPTER-1 INTRODUCTION 1.0 INDIAN STOCK MARKET

... Bombay Stock Exchange is located on Dalal street, Mumbai. In terms of market capitalization, BSE is the eleventh largest stock exchange in the world on 31st December, 2012. BSE is the oldest stock exchange in India. In the beginning during 1855, some stock brokers were gathering under Banyan tree. B ...

... Bombay Stock Exchange is located on Dalal street, Mumbai. In terms of market capitalization, BSE is the eleventh largest stock exchange in the world on 31st December, 2012. BSE is the oldest stock exchange in India. In the beginning during 1855, some stock brokers were gathering under Banyan tree. B ...

FORM 10-Q - Piedmont Office Realty Trust, Inc.

... (the “DRP”), such offerings have provided approximately $5.6 billion in total offering proceeds. From these proceeds, Piedmont has paid costs related to the offerings of (1) approximately $171.1 million in acquisition and advisory fees and reimbursements of acquisition expenses; (2) approximately $4 ...

... (the “DRP”), such offerings have provided approximately $5.6 billion in total offering proceeds. From these proceeds, Piedmont has paid costs related to the offerings of (1) approximately $171.1 million in acquisition and advisory fees and reimbursements of acquisition expenses; (2) approximately $4 ...

registration of asset-backed securities

... Hill Company; Moody's Investors Service, Inc.; Fitch Investors Service, Inc. or Duff & Phelps Credit Rating Co. or a successor to any of the foregoing. SECURITY HOLDERS: the PERSONS in whose names the ISSUER'S ASSETBACKED SECURITIES are held and to whom payments pursuant to the terms of the TRUST AG ...

... Hill Company; Moody's Investors Service, Inc.; Fitch Investors Service, Inc. or Duff & Phelps Credit Rating Co. or a successor to any of the foregoing. SECURITY HOLDERS: the PERSONS in whose names the ISSUER'S ASSETBACKED SECURITIES are held and to whom payments pursuant to the terms of the TRUST AG ...

Les faits

... protecting investors and adding efficiency to the capital markets. Exemptions are key to the effective operation of New Brunswick capital market and their abuse can have negative effects on investors and the integrity of the markets. ...

... protecting investors and adding efficiency to the capital markets. Exemptions are key to the effective operation of New Brunswick capital market and their abuse can have negative effects on investors and the integrity of the markets. ...

stock prices and macroeconomic variables in vietnam: an empirical

... and analytical framework in Chapter 3 are: (1) This thesis hypothesizes that the semi-strong efficiency would not exist in the Vietnamese stock market. According to Ross et al. (2006), to be semistrongly efficient, an investor must be skilled at economics and statistics, and steeped in the idiosyncr ...

... and analytical framework in Chapter 3 are: (1) This thesis hypothesizes that the semi-strong efficiency would not exist in the Vietnamese stock market. According to Ross et al. (2006), to be semistrongly efficient, an investor must be skilled at economics and statistics, and steeped in the idiosyncr ...

Informed Trading in Parallel Auction and Dealer Markets

... better able to identify informed traders. Gramming, Schiereck, and Theissen (2001) examine the relation of degree of trader anonymity and the probability of informed trading on the two parallel markets at the Frankfurt Stock Exchange. Both these studies are based on the concept that the non-anonymo ...

... better able to identify informed traders. Gramming, Schiereck, and Theissen (2001) examine the relation of degree of trader anonymity and the probability of informed trading on the two parallel markets at the Frankfurt Stock Exchange. Both these studies are based on the concept that the non-anonymo ...

Lyxor Index Fund December 2014

... States Investment Company Act of 1940, as amended (the “Investment Company Act”). Based on interpretations of the Investment Company Act by the staff of the United States Securities and Exchange Commission (the “SEC”) relating to foreign investment companies, if the Company has more than one hundred ...

... States Investment Company Act of 1940, as amended (the “Investment Company Act”). Based on interpretations of the Investment Company Act by the staff of the United States Securities and Exchange Commission (the “SEC”) relating to foreign investment companies, if the Company has more than one hundred ...

Are Executive Stock Option Exercises Driven by Private Information

... 2003 and collected by Thompson Financial, 28.6% of the exercises are associated with no sale of shares within one calendar month. Partitioning options exercises, we find that exercises followed by immediate sale of all shares are associated with negative (future) abnormal returns consistent with pri ...

... 2003 and collected by Thompson Financial, 28.6% of the exercises are associated with no sale of shares within one calendar month. Partitioning options exercises, we find that exercises followed by immediate sale of all shares are associated with negative (future) abnormal returns consistent with pri ...

Scaling Chinese Walls: Insights From Aftra v. JPMorgan Chase

... As purveyors of a variety of financial products, these companies are privy to material nonpublic information (MNPI) relating to their clients’ business operations and future economic outlook, such as when a corporate borrower provides the lending institution with financial statements and future expe ...

... As purveyors of a variety of financial products, these companies are privy to material nonpublic information (MNPI) relating to their clients’ business operations and future economic outlook, such as when a corporate borrower provides the lending institution with financial statements and future expe ...

A Guide to Understanding Opportunities and Risks in Futures Trading

... trading account or by participating in a commodity pool that is similar in concept to a mutual fund. For those individuals who fully understand and can afford the risks that are involved, the allocation of some portion of their investment capital—the portion that is truly risk capital— to futures sp ...

... trading account or by participating in a commodity pool that is similar in concept to a mutual fund. For those individuals who fully understand and can afford the risks that are involved, the allocation of some portion of their investment capital—the portion that is truly risk capital— to futures sp ...

INVESTMENT BANKING

... Stock Ratings: Piper Jaffray ratings are indicators of expected total return (price appreciation plus dividend) within the next 12 months. At times analysts may specify a different investment horizon or may include additional investment time horizons for specific stocks. Stock performance is measure ...

... Stock Ratings: Piper Jaffray ratings are indicators of expected total return (price appreciation plus dividend) within the next 12 months. At times analysts may specify a different investment horizon or may include additional investment time horizons for specific stocks. Stock performance is measure ...

The Relationship between Stock Returns and Macroeconomic

... between inflation (CPI and PPI) and stock returns. As for money supply, stock returns do Granger cause monetary variables (M1, M2, and M2Y) but the reverse causality is not observed in case of money supply and stock returns. However, according to empirical result of the study, it can be inferred tha ...

... between inflation (CPI and PPI) and stock returns. As for money supply, stock returns do Granger cause monetary variables (M1, M2, and M2Y) but the reverse causality is not observed in case of money supply and stock returns. However, according to empirical result of the study, it can be inferred tha ...

Liquidation in the Face of Adversity: Stealth Versus Sunshine Trading

... are made on the temporary nature of the price impact. Interestingly, the impact of stock sales in markets that do not suffer from extreme cash outflows appears to be predominantly permanent, resulting in profitable predatory trading opportunities for insiders. Our research builds on previous work in ...

... are made on the temporary nature of the price impact. Interestingly, the impact of stock sales in markets that do not suffer from extreme cash outflows appears to be predominantly permanent, resulting in profitable predatory trading opportunities for insiders. Our research builds on previous work in ...

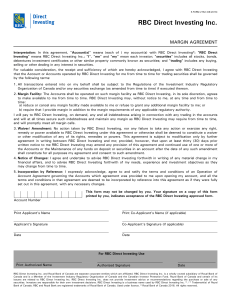

Margin Agreement - RBC Direct Investing

... Interpretation: In this agreement, "Account(s)" means (each of ) my account(s) with RBC Direct Investing®; "RBC Direct Investing" means RBC Direct Investing Inc.; "I", "me" and "my" mean each investor; "securities" includes all stocks, bonds, debentures investment certificates or other similar prope ...

... Interpretation: In this agreement, "Account(s)" means (each of ) my account(s) with RBC Direct Investing®; "RBC Direct Investing" means RBC Direct Investing Inc.; "I", "me" and "my" mean each investor; "securities" includes all stocks, bonds, debentures investment certificates or other similar prope ...

derivatives - Borsa İstanbul

... 2 - Floor: A long position in put option with (X-a) exercise price, maturity at t in the underlying (Buy a Put) 3 - Ceiling: A short position in call option with (X+b) exercise price and maturity at t in the underlying currency (Sell a Call) For example, let’s consider you USD 100,000 in your portfo ...

... 2 - Floor: A long position in put option with (X-a) exercise price, maturity at t in the underlying (Buy a Put) 3 - Ceiling: A short position in call option with (X+b) exercise price and maturity at t in the underlying currency (Sell a Call) For example, let’s consider you USD 100,000 in your portfo ...

law, share price accuracy and economic performance: the

... Mandatory disclosure’s effect on efficiency has also been a matter of intense debate among the economics oriented members of the legal academy. As the discussion below indicates, the two questions addressed empirically in this Article – whether an increase in share price accuracy enhances the perfor ...

... Mandatory disclosure’s effect on efficiency has also been a matter of intense debate among the economics oriented members of the legal academy. As the discussion below indicates, the two questions addressed empirically in this Article – whether an increase in share price accuracy enhances the perfor ...

Is There Price Discovery in Equity Options?

... the price disagreement events in our primary sample are potentially profitable opportunities for exchange members. These violations are interesting and informative because they are cases in which it is clear that the option and stock markets disagree about the value of the underlying stock,3 and th ...

... the price disagreement events in our primary sample are potentially profitable opportunities for exchange members. These violations are interesting and informative because they are cases in which it is clear that the option and stock markets disagree about the value of the underlying stock,3 and th ...

2015 10K Final - Auxilio, Inc.

... The aggregate market value of the registrant’s common stock, $0.001 par value per share (“Common Stock”), held by non-affiliates of the registrant on June 30, 2015, the last business day of the registrant’s most recently completed second fiscal quarter, was approximately $21.0 million (based on the ...

... The aggregate market value of the registrant’s common stock, $0.001 par value per share (“Common Stock”), held by non-affiliates of the registrant on June 30, 2015, the last business day of the registrant’s most recently completed second fiscal quarter, was approximately $21.0 million (based on the ...

Cheap Talk, Fraud, and Adverse Selection in Financial Markets

... Theory predicts that the antifraud rule will result in fully efficient outcomes, with all assets trading at appropriate prices. In a sequential equilibrium, the seller makes a potentially vague statement about the asset’s quality. However, the lowest quality stated should be the true quality of the ...

... Theory predicts that the antifraud rule will result in fully efficient outcomes, with all assets trading at appropriate prices. In a sequential equilibrium, the seller makes a potentially vague statement about the asset’s quality. However, the lowest quality stated should be the true quality of the ...

Short (finance)

.png?width=300)

In finance, short selling (also known as shorting or going short) is the practice of selling securities or other financial instruments that are not currently owned, and subsequently repurchasing them (""covering""). In the event of an interim price decline, the short seller will profit, since the cost of (re)purchase will be less than the proceeds which were received upon the initial (short) sale. Conversely, the short position will be closed out at a loss in the event that the price of a shorted instrument should rise prior to repurchase. The potential loss on a short sale is theoretically unlimited in the event of an unlimited rise in the price of the instrument, however in practice the short seller will be required to post margin or collateral to cover losses, and any inability to do so on a timely basis would cause its broker or counterparty to liquidate the position. In the securities markets, the seller generally must borrow the securities in order to effect delivery in the short sale. In some cases, the short seller must pay a fee to borrow the securities and must additionally reimburse the lender for cash returns the lender would have received had the securities not been loaned out.Short selling is most commonly done with instruments traded in public securities, futures or currency markets, due to the liquidity and real-time price dissemination characteristic of such markets and because the instruments defined within each class are fungible.In practical terms, going short can be considered the opposite of the conventional practice of ""going long"", whereby an investor profits from an increase in the price of the asset. Mathematically, the return from a short position is equivalent to that of owning (being ""long"") a negative amount of the instrument. A short sale may be motivated by a variety of objectives. Speculators may sell short in the hope of realizing a profit on an instrument which appears to be overvalued, just as long investors or speculators hope to profit from a rise in the price of an instrument which appears undervalued. Traders or fund managers may hedge a long position or a portfolio through one or more short positions.