Time Variation of Liquidity in the Private Real Estate Market: An

... In considering whether these alternative explanations might carry over to income property markets, it is doubtful that either the behavioral-based downward price rigidity story, with sellers refusing to recognize a drop in house price, or the creditconstrained explanation will completely do so. As n ...

... In considering whether these alternative explanations might carry over to income property markets, it is doubtful that either the behavioral-based downward price rigidity story, with sellers refusing to recognize a drop in house price, or the creditconstrained explanation will completely do so. As n ...

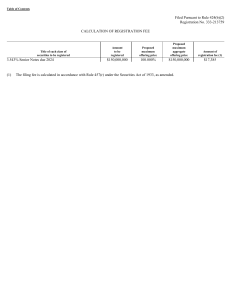

In Millions

... 11-21 In consolidated statements, all the assets and liabilities of the parent and subsidiary are added together in the statements. But the shareholders of the parent do not own all of the combined assets and liabilities, so the interests of the minority owner’s must be subtracted. In contrast, wit ...

... 11-21 In consolidated statements, all the assets and liabilities of the parent and subsidiary are added together in the statements. But the shareholders of the parent do not own all of the combined assets and liabilities, so the interests of the minority owner’s must be subtracted. In contrast, wit ...

Does Supply Curve Inelasticity Explain Abnormal Long

... market repurchases permanently remove supply from the market. The idea that repurchases remove supply and thereby raise equilibrium prices has been used to explain price changes around Dutch auctions (Bagwell (1992)). This is the first paper to explore whether open market repurchases have the same e ...

... market repurchases permanently remove supply from the market. The idea that repurchases remove supply and thereby raise equilibrium prices has been used to explain price changes around Dutch auctions (Bagwell (1992)). This is the first paper to explore whether open market repurchases have the same e ...

The Association between Various Earnings and Cash Flow

... statement ratios leads to a substantial increase in correlation among the ratios of income statement and balance sheet with stock returns. But there is a weaker correlation among the cash flows ratios comparing with ratios of income statement and balance sheet in stock returns. Another research whic ...

... statement ratios leads to a substantial increase in correlation among the ratios of income statement and balance sheet with stock returns. But there is a weaker correlation among the cash flows ratios comparing with ratios of income statement and balance sheet in stock returns. Another research whic ...

Geometric Average Capitalization

... of gravity,” which can help investors understand how market trends (related to capitalization levels) might affect their portfolio. In some cases, geometric average capitalization will be very close in value to median market capitalization. Differences between the two values will be most apparent fo ...

... of gravity,” which can help investors understand how market trends (related to capitalization levels) might affect their portfolio. In some cases, geometric average capitalization will be very close in value to median market capitalization. Differences between the two values will be most apparent fo ...

18-43 18.7 Forward Rate Agreements (FRAs)

... Whether it is a buy or sell order The type of contract (varies between exchanges) Delivery month (expiration) Price restrictions (if any) (e.g. limit order) Time limits on the order (if any) ...

... Whether it is a buy or sell order The type of contract (varies between exchanges) Delivery month (expiration) Price restrictions (if any) (e.g. limit order) Time limits on the order (if any) ...

united states securities and exchange commission

... the cyclical nature of the retail business requires us to carry a significant amount of inventory, especially prior to peak selling seasons. As a result, we typically purchase merchandise from our suppliers well in advance of the applicable selling season, and sometimes before fashion trends are ide ...

... the cyclical nature of the retail business requires us to carry a significant amount of inventory, especially prior to peak selling seasons. As a result, we typically purchase merchandise from our suppliers well in advance of the applicable selling season, and sometimes before fashion trends are ide ...

© 2007 Thomson South

... Evaluating the Market Equilibrium • Three Insights Concerning Market Outcomes • Free markets allocate the supply of goods to the buyers who value them most highly, as measured by their willingness to pay. • Free markets allocate the demand for goods to the sellers who can produce them at least cost ...

... Evaluating the Market Equilibrium • Three Insights Concerning Market Outcomes • Free markets allocate the supply of goods to the buyers who value them most highly, as measured by their willingness to pay. • Free markets allocate the demand for goods to the sellers who can produce them at least cost ...

7. Consumers, Producers and Market Efficiency

... allocation of resources affects economic wellbeing. – Buyers and sellers receive benefits from taking part in the market. – The equilibrium in a market maximizes the total welfare of buyers and sellers. ...

... allocation of resources affects economic wellbeing. – Buyers and sellers receive benefits from taking part in the market. – The equilibrium in a market maximizes the total welfare of buyers and sellers. ...

Agenix Annual Report 2016 - CCP Technologies Limited

... On behalf of the Board of Agenix Limited (“AGX” ‘Company’) I am very pleased to provide shareholders with our 2016 annual report setting out the progress and achievements of the Company since last year. This is my second report as Chair, in a year which saw substantial changes to our Company. During ...

... On behalf of the Board of Agenix Limited (“AGX” ‘Company’) I am very pleased to provide shareholders with our 2016 annual report setting out the progress and achievements of the Company since last year. This is my second report as Chair, in a year which saw substantial changes to our Company. During ...

SPIRE INC (Form: 424B2, Received: 02/23/2017 15:27:05)

... We utilize a well-defined, disciplined process based on appropriate returns on invested capital to identify and evaluate acquisition opportunities in the natural gas industry, particularly local distribution companies. Further, we have internal teams that assist in the evaluation of a prospective ac ...

... We utilize a well-defined, disciplined process based on appropriate returns on invested capital to identify and evaluate acquisition opportunities in the natural gas industry, particularly local distribution companies. Further, we have internal teams that assist in the evaluation of a prospective ac ...

What do we know about high-frequency trading?

... While HFT causes better market quality on average, some commentators have argued that HFT could make markets more fragile, increasing the possibility of extreme market moves and episodes of extreme illiquidity. During the May 6, 2010 Flash Crash, for example, S&P futures fell almost 10% within 15 mi ...

... While HFT causes better market quality on average, some commentators have argued that HFT could make markets more fragile, increasing the possibility of extreme market moves and episodes of extreme illiquidity. During the May 6, 2010 Flash Crash, for example, S&P futures fell almost 10% within 15 mi ...

Armour Residential REIT, Inc.

... The accompanying unaudited financial statements have been prepared in accordance with U.S. generally accepted accounting principles (“GAAP”) for interim financial information and with the instructions to Form 10-Q and Rule 10-01 of Regulation S-X. Accordingly, they do not include all of the informat ...

... The accompanying unaudited financial statements have been prepared in accordance with U.S. generally accepted accounting principles (“GAAP”) for interim financial information and with the instructions to Form 10-Q and Rule 10-01 of Regulation S-X. Accordingly, they do not include all of the informat ...

Does Financial Distress Risk Drive the Momentum Anomaly?

... years prior to bankruptcy, and particularly during the last year. This suggests that the market is anticipating, but not fully incorporating (i.e., under reacting to), the deteriorating financial health of a firm. Distressed firms, therefore, experience lower past realized returns. Hong et al. (2000 ...

... years prior to bankruptcy, and particularly during the last year. This suggests that the market is anticipating, but not fully incorporating (i.e., under reacting to), the deteriorating financial health of a firm. Distressed firms, therefore, experience lower past realized returns. Hong et al. (2000 ...

Orders and Positions

... • Account: This panel on the left of the window displays a hierarchical view of your accounts by date, symbol, or trade system. • Filter: This panel on the top of the window provides a way for you to filter orders and positions data. • Orders: This set of tabbed windows provides order status, order ...

... • Account: This panel on the left of the window displays a hierarchical view of your accounts by date, symbol, or trade system. • Filter: This panel on the top of the window provides a way for you to filter orders and positions data. • Orders: This set of tabbed windows provides order status, order ...

Market Signals Associated with Taiwan REIT IPOs

... Supervision Commission will approve the application, which can be regarded as the main reason why interval (0, +1) has more significant abnormal returns than interval (-1, +1) for the filing approval event. Many news reports are issued after the filing is approved, and the maximum number of news rep ...

... Supervision Commission will approve the application, which can be regarded as the main reason why interval (0, +1) has more significant abnormal returns than interval (-1, +1) for the filing approval event. Many news reports are issued after the filing is approved, and the maximum number of news rep ...

Short (finance)

.png?width=300)

In finance, short selling (also known as shorting or going short) is the practice of selling securities or other financial instruments that are not currently owned, and subsequently repurchasing them (""covering""). In the event of an interim price decline, the short seller will profit, since the cost of (re)purchase will be less than the proceeds which were received upon the initial (short) sale. Conversely, the short position will be closed out at a loss in the event that the price of a shorted instrument should rise prior to repurchase. The potential loss on a short sale is theoretically unlimited in the event of an unlimited rise in the price of the instrument, however in practice the short seller will be required to post margin or collateral to cover losses, and any inability to do so on a timely basis would cause its broker or counterparty to liquidate the position. In the securities markets, the seller generally must borrow the securities in order to effect delivery in the short sale. In some cases, the short seller must pay a fee to borrow the securities and must additionally reimburse the lender for cash returns the lender would have received had the securities not been loaned out.Short selling is most commonly done with instruments traded in public securities, futures or currency markets, due to the liquidity and real-time price dissemination characteristic of such markets and because the instruments defined within each class are fungible.In practical terms, going short can be considered the opposite of the conventional practice of ""going long"", whereby an investor profits from an increase in the price of the asset. Mathematically, the return from a short position is equivalent to that of owning (being ""long"") a negative amount of the instrument. A short sale may be motivated by a variety of objectives. Speculators may sell short in the hope of realizing a profit on an instrument which appears to be overvalued, just as long investors or speculators hope to profit from a rise in the price of an instrument which appears undervalued. Traders or fund managers may hedge a long position or a portfolio through one or more short positions.