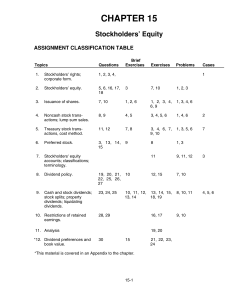

CHAPTER 15 Stockholders` Equity

... Research Bulletin No. 43 specifies that a distribution in excess of 20% to 25% of the number of shares previously outstanding would cause a material decrease in the market value. This is a characteristic of a stock split as opposed to a stock dividend, but, for legal reasons, the term “dividend” mus ...

... Research Bulletin No. 43 specifies that a distribution in excess of 20% to 25% of the number of shares previously outstanding would cause a material decrease in the market value. This is a characteristic of a stock split as opposed to a stock dividend, but, for legal reasons, the term “dividend” mus ...

Barings Developed and Emerging Markets High Yield Bond

... The Fund will invest at least 70% of its assets in a combination of debt and loan securities (including credit linked securities) of corporations and governments (including any agency of government or central bank) of any member state of the Organisation for Economic Co-operation and Development (“O ...

... The Fund will invest at least 70% of its assets in a combination of debt and loan securities (including credit linked securities) of corporations and governments (including any agency of government or central bank) of any member state of the Organisation for Economic Co-operation and Development (“O ...

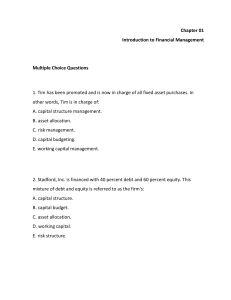

Chapter 01 Introduction to Financial Management

... 24. Maria is the sole proprietor of an antique store which she has operated at the same location for the past 16 years. The store rents the space in which it is located but does own all of the inventory and fixtures. The store has an outstanding loan with the local bank but no other debt obligation ...

... 24. Maria is the sole proprietor of an antique store which she has operated at the same location for the past 16 years. The store rents the space in which it is located but does own all of the inventory and fixtures. The store has an outstanding loan with the local bank but no other debt obligation ...

Dreyfus Variable Investment Fund: International Value Portfolio

... time periods. There is the chance that stock prices overall will decline because stock markets tend to move in cycles, with periods of rising prices and falling prices. The market value of a stock may decline due to general market conditions or because of factors that affect the particular company o ...

... time periods. There is the chance that stock prices overall will decline because stock markets tend to move in cycles, with periods of rising prices and falling prices. The market value of a stock may decline due to general market conditions or because of factors that affect the particular company o ...

EC63-822 Wheat, People and the Plains

... important in foreign trade. This is because most foreign buyers, especially in dollar markets, rely on U.S. grades as measures of quality. They can't actually inspect or test what they're buying, so all they have to go on is grade. A common criticism from foreign buyers concerns milling and baking u ...

... important in foreign trade. This is because most foreign buyers, especially in dollar markets, rely on U.S. grades as measures of quality. They can't actually inspect or test what they're buying, so all they have to go on is grade. A common criticism from foreign buyers concerns milling and baking u ...

Chapter 15: Raising Capital

... Lockup Agreement: The part of the underwriting contract that specifies how long insiders must wait after an IPO before they can sell stock. ...

... Lockup Agreement: The part of the underwriting contract that specifies how long insiders must wait after an IPO before they can sell stock. ...

Learning about Return and Risk from The Historical Record

... P Standard deviation of Portfolio w D Proportion of stock D to the entire portfolio w E Proportion of stock E to the entire portfolio ...

... P Standard deviation of Portfolio w D Proportion of stock D to the entire portfolio w E Proportion of stock E to the entire portfolio ...

Difference of Stock Return Distributions and the Cross

... The sample data include returns from the Center for Research on Security Prices (CRSP) Daily Stock File and book value from the Compustat of all stocks listed in NYSE, Amex, and NASDAQ. ...

... The sample data include returns from the Center for Research on Security Prices (CRSP) Daily Stock File and book value from the Compustat of all stocks listed in NYSE, Amex, and NASDAQ. ...

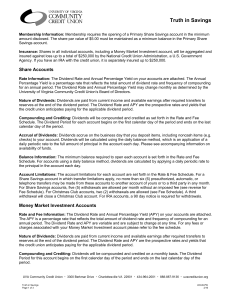

Truth in Savings - UVA Community Credit Union

... Upon opening a money market investment account you are required to maintain this minimum balance to accrue daily dividends. In addition, an account, which continuously remains under this $2,500 minimum for some time, will be subject to closure by the credit union and the funds will be placed into a ...

... Upon opening a money market investment account you are required to maintain this minimum balance to accrue daily dividends. In addition, an account, which continuously remains under this $2,500 minimum for some time, will be subject to closure by the credit union and the funds will be placed into a ...

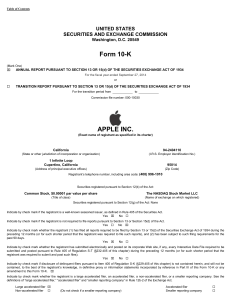

word - Nasdaq`s INTEL Solutions

... The Company is committed to bringing the best user experience to its customers through its innovative hardware, software and services. The Company’s business strategy leverages its unique ability to design and develop its own operating systems, hardware, application software and services to provide ...

... The Company is committed to bringing the best user experience to its customers through its innovative hardware, software and services. The Company’s business strategy leverages its unique ability to design and develop its own operating systems, hardware, application software and services to provide ...

Chapter 07 - Introduction to Risk and Return

... terms of the dollars received. However, the price of the bond fluctuates as interest rates change and the rate at which coupon payments received can be invested also changes as interest rates change. And, of course, the payments are all in nominal dollars, so inflation risk must also be considered. ...

... terms of the dollars received. However, the price of the bond fluctuates as interest rates change and the rate at which coupon payments received can be invested also changes as interest rates change. And, of course, the payments are all in nominal dollars, so inflation risk must also be considered. ...

index of defined terms

... authorised or to any person to whom it is unlawful to make such offer or solicitation, and no action has been taken or will be taken to permit an offering of the Securities or the distribution of this Prospectus in any jurisdiction where any such action is required. Prospects and financial or tradin ...

... authorised or to any person to whom it is unlawful to make such offer or solicitation, and no action has been taken or will be taken to permit an offering of the Securities or the distribution of this Prospectus in any jurisdiction where any such action is required. Prospects and financial or tradin ...

Glossary of Mutual Fund and Other Related Financial Terms

... exchange-traded fund (ETF). An investment company, typically a mutual fund or unit investment trust, whose shares are traded intraday on stock exchanges at market-determined prices. Investors may buy or sell ETF shares on the secondary market through a broker, just as they would the shares of any pu ...

... exchange-traded fund (ETF). An investment company, typically a mutual fund or unit investment trust, whose shares are traded intraday on stock exchanges at market-determined prices. Investors may buy or sell ETF shares on the secondary market through a broker, just as they would the shares of any pu ...

Shorts and Derivatives in Portfolio Statistics

... back at some point in the future. If the price falls after the short sale, the investor will have sold high and can now buy low to close the short position and lock in a profit. However, if the price of the security increases after the short sale, the investor will experience losses by buying it at ...

... back at some point in the future. If the price falls after the short sale, the investor will have sold high and can now buy low to close the short position and lock in a profit. However, if the price of the security increases after the short sale, the investor will experience losses by buying it at ...

Repurchase agreements and the law

... and, where a voidable preference can be shown, forces creditors to return assets collected during the period immediately preceding the bankruptcy filing (Warren 2008, 98). The obvious benefit of the automatic ...

... and, where a voidable preference can be shown, forces creditors to return assets collected during the period immediately preceding the bankruptcy filing (Warren 2008, 98). The obvious benefit of the automatic ...

- Free Documents

... Chapter is designed to be a standard introductory chapter. As such, its purpose is to introduce students to the subject of Investments, explain what Investments is concerned with from a summary viewpoint, and outline what the remainder of the text will cover. It defines important terms such as inves ...

... Chapter is designed to be a standard introductory chapter. As such, its purpose is to introduce students to the subject of Investments, explain what Investments is concerned with from a summary viewpoint, and outline what the remainder of the text will cover. It defines important terms such as inves ...

Short (finance)

.png?width=300)

In finance, short selling (also known as shorting or going short) is the practice of selling securities or other financial instruments that are not currently owned, and subsequently repurchasing them (""covering""). In the event of an interim price decline, the short seller will profit, since the cost of (re)purchase will be less than the proceeds which were received upon the initial (short) sale. Conversely, the short position will be closed out at a loss in the event that the price of a shorted instrument should rise prior to repurchase. The potential loss on a short sale is theoretically unlimited in the event of an unlimited rise in the price of the instrument, however in practice the short seller will be required to post margin or collateral to cover losses, and any inability to do so on a timely basis would cause its broker or counterparty to liquidate the position. In the securities markets, the seller generally must borrow the securities in order to effect delivery in the short sale. In some cases, the short seller must pay a fee to borrow the securities and must additionally reimburse the lender for cash returns the lender would have received had the securities not been loaned out.Short selling is most commonly done with instruments traded in public securities, futures or currency markets, due to the liquidity and real-time price dissemination characteristic of such markets and because the instruments defined within each class are fungible.In practical terms, going short can be considered the opposite of the conventional practice of ""going long"", whereby an investor profits from an increase in the price of the asset. Mathematically, the return from a short position is equivalent to that of owning (being ""long"") a negative amount of the instrument. A short sale may be motivated by a variety of objectives. Speculators may sell short in the hope of realizing a profit on an instrument which appears to be overvalued, just as long investors or speculators hope to profit from a rise in the price of an instrument which appears undervalued. Traders or fund managers may hedge a long position or a portfolio through one or more short positions.