27 part ii item 5. market for the registrant`s common equity, related

... Our payment of dividends in the future will be determined by Danaher’s Board of Directors and will depend on business conditions, Danaher’s earnings and other factors Danaher’s Board deems relevant. For a description of the distribution of the issued and outstanding common stock of Fortive pursuant ...

... Our payment of dividends in the future will be determined by Danaher’s Board of Directors and will depend on business conditions, Danaher’s earnings and other factors Danaher’s Board deems relevant. For a description of the distribution of the issued and outstanding common stock of Fortive pursuant ...

Investing in Biotechnology

... Number of shares purchased: 500 shares Price per share at purchase: $1.37 ...

... Number of shares purchased: 500 shares Price per share at purchase: $1.37 ...

Warsaw, 3 January 2005

... relating to the Resolution of the Stock Exchange on admitting into stock exchange trade ordinary bearer P, R and O series shares of ComputerLand SA, the Management Board of the Company informs that by virtue of resolution No. 669/04 dated December 29, 2004, the Management Board of the National Depos ...

... relating to the Resolution of the Stock Exchange on admitting into stock exchange trade ordinary bearer P, R and O series shares of ComputerLand SA, the Management Board of the Company informs that by virtue of resolution No. 669/04 dated December 29, 2004, the Management Board of the National Depos ...

TTSE Rule 405 - Price Stabilisation Amended April 19th 2010

... cases of a one sided market with no opposing bids or offers for some securities. As at June 30th 2009, there were three (3) securities with bids or offers at the 10% limit and twenty one (21) securities with a one sided market. ...

... cases of a one sided market with no opposing bids or offers for some securities. As at June 30th 2009, there were three (3) securities with bids or offers at the 10% limit and twenty one (21) securities with a one sided market. ...

Review Sheet - Jefferson Elementary School

... Which stock closed furthest from its 52Week High? ...

... Which stock closed furthest from its 52Week High? ...

Money and Investing - St. John the Baptist Diocesan High School

... banks, pension funds, credit unions, insurance company’s, finance company’s Mutual Funds ...

... banks, pension funds, credit unions, insurance company’s, finance company’s Mutual Funds ...

Sovereign increases stake in UFJ Holdings to 5.11% of total shares

... Sovereign informed the Company in advance of its intention to acquire more than 5% of the outstanding shares. ...

... Sovereign informed the Company in advance of its intention to acquire more than 5% of the outstanding shares. ...

A summary of financial crisis in 2008

... Lehman Brothers declared bankruptcy on September 14th after failing to find a buyer. Bank of America agreed to purchase Merrill Lynch (MER) (美林证 券), and American International Group (AIG) was saved by an $85 million capital injection by the Federal Reserve and the federal government. Followed shortl ...

... Lehman Brothers declared bankruptcy on September 14th after failing to find a buyer. Bank of America agreed to purchase Merrill Lynch (MER) (美林证 券), and American International Group (AIG) was saved by an $85 million capital injection by the Federal Reserve and the federal government. Followed shortl ...

Amendments to the Rules of the Exchange in relation to the

... an aggregate turnover during the preceding 12 months to market capitalisation ratio of not less than 40%; ...

... an aggregate turnover during the preceding 12 months to market capitalisation ratio of not less than 40%; ...

What are stocks? - Buncombe County Schools

... Impact of the Stock Market on the Economy • Bull Market – Stock prices going up or rising – Consumers are optimistic and buy stock hoping to earn more money – Consumers buy goods and businesses prosper • Bear Market – Stock prices are going down or falling – Consumers are pessimistic and reluctant ...

... Impact of the Stock Market on the Economy • Bull Market – Stock prices going up or rising – Consumers are optimistic and buy stock hoping to earn more money – Consumers buy goods and businesses prosper • Bear Market – Stock prices are going down or falling – Consumers are pessimistic and reluctant ...

stocks and shares

... STOCK MARKET – investors or financial institutions buy S_________ of companies listed on the stock exchange S_________ – both stocks and privately held stakes in small firms that are not publicly traded 'Basket' of stocks→ picked by a fund manager and put together into a M__________ FUND (UK - UN ...

... STOCK MARKET – investors or financial institutions buy S_________ of companies listed on the stock exchange S_________ – both stocks and privately held stakes in small firms that are not publicly traded 'Basket' of stocks→ picked by a fund manager and put together into a M__________ FUND (UK - UN ...

pure competition is a situation in which the market for a product is

... perfect competition. Such as agricultural commodities like soybeans, oats and potatoes. In this market structure, price is determined solely by the forces of supply and demand. Monopolistic competition is a market in which many competitors provide similar products which can be distinguished on the b ...

... perfect competition. Such as agricultural commodities like soybeans, oats and potatoes. In this market structure, price is determined solely by the forces of supply and demand. Monopolistic competition is a market in which many competitors provide similar products which can be distinguished on the b ...

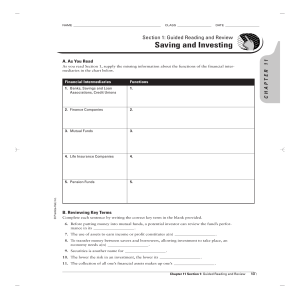

Section 1 - Analy High School Faculty

... bond is issued by the U.S. government. 12. A steady drop in the stock market over time is called a(n) market. 13. An electronic market that trades stock not listed on an organized exchange is termed over-the. 16. Using assets to earn income or profit constitutes a(n) ...

... bond is issued by the U.S. government. 12. A steady drop in the stock market over time is called a(n) market. 13. An electronic market that trades stock not listed on an organized exchange is termed over-the. 16. Using assets to earn income or profit constitutes a(n) ...

Great demand for Hemtex shares. The Offer price set to SEK

... Not for release, publication or distribution in, or into, the United States, Canada, Australia or Japan. ”It is satisfying that we have reached a stock exchange listing of Hemtex, our 24th IPO since the start in 1983. We are impressed by the work the company management has put in during the entire ...

... Not for release, publication or distribution in, or into, the United States, Canada, Australia or Japan. ”It is satisfying that we have reached a stock exchange listing of Hemtex, our 24th IPO since the start in 1983. We are impressed by the work the company management has put in during the entire ...

Celebdaq Academy Lesson Plan

... coverage (in column inches) that the each celebrity gets • On Friday the shares you own pay out a ‘dividend’. The more press coverage a celeb gets, the bigger the dividend • Just like in the real world, the more people want (demand) the share the higher its price becomes ...

... coverage (in column inches) that the each celebrity gets • On Friday the shares you own pay out a ‘dividend’. The more press coverage a celeb gets, the bigger the dividend • Just like in the real world, the more people want (demand) the share the higher its price becomes ...

BsBDH1edchap013WebDisplay

... Issuer sells entire issue to underwriting syndicate The syndicate then resells the issue to the public The underwriter makes money on the spread between the price paid to the issuer and the price received from investors when the stock is sold The syndicate bears the risk of not being able to s ...

... Issuer sells entire issue to underwriting syndicate The syndicate then resells the issue to the public The underwriter makes money on the spread between the price paid to the issuer and the price received from investors when the stock is sold The syndicate bears the risk of not being able to s ...

History of the Stock Market

... • The first reason is psychology. As the price of a stock gets higher and higher, some investors may feel the price is too high for them to buy, or small investors may feel it is unaffordable. Splitting the stock brings the share price down to a more "attractive" level. The effect here is purely ps ...

... • The first reason is psychology. As the price of a stock gets higher and higher, some investors may feel the price is too high for them to buy, or small investors may feel it is unaffordable. Splitting the stock brings the share price down to a more "attractive" level. The effect here is purely ps ...

Short (finance)

.png?width=300)

In finance, short selling (also known as shorting or going short) is the practice of selling securities or other financial instruments that are not currently owned, and subsequently repurchasing them (""covering""). In the event of an interim price decline, the short seller will profit, since the cost of (re)purchase will be less than the proceeds which were received upon the initial (short) sale. Conversely, the short position will be closed out at a loss in the event that the price of a shorted instrument should rise prior to repurchase. The potential loss on a short sale is theoretically unlimited in the event of an unlimited rise in the price of the instrument, however in practice the short seller will be required to post margin or collateral to cover losses, and any inability to do so on a timely basis would cause its broker or counterparty to liquidate the position. In the securities markets, the seller generally must borrow the securities in order to effect delivery in the short sale. In some cases, the short seller must pay a fee to borrow the securities and must additionally reimburse the lender for cash returns the lender would have received had the securities not been loaned out.Short selling is most commonly done with instruments traded in public securities, futures or currency markets, due to the liquidity and real-time price dissemination characteristic of such markets and because the instruments defined within each class are fungible.In practical terms, going short can be considered the opposite of the conventional practice of ""going long"", whereby an investor profits from an increase in the price of the asset. Mathematically, the return from a short position is equivalent to that of owning (being ""long"") a negative amount of the instrument. A short sale may be motivated by a variety of objectives. Speculators may sell short in the hope of realizing a profit on an instrument which appears to be overvalued, just as long investors or speculators hope to profit from a rise in the price of an instrument which appears undervalued. Traders or fund managers may hedge a long position or a portfolio through one or more short positions.